Primary Agricultural Credit Societies (PACS) provide farmers with credit and basic input supplies, serving primarily as financial cooperatives, whereas Farmer Producer Organizations (FPOs) focus on collective marketing, enabling members to aggregate produce, access better market linkages, and achieve improved price realization. FPOs offer structured support for value addition, branding, and direct negotiation with buyers, which often leads to higher income for farmers compared to the credit-centric PACS. Choosing FPOs over PACS for collective marketing empowers farmers with stronger bargaining power and market intelligence essential for competitive agricultural marketing.

Table of Comparison

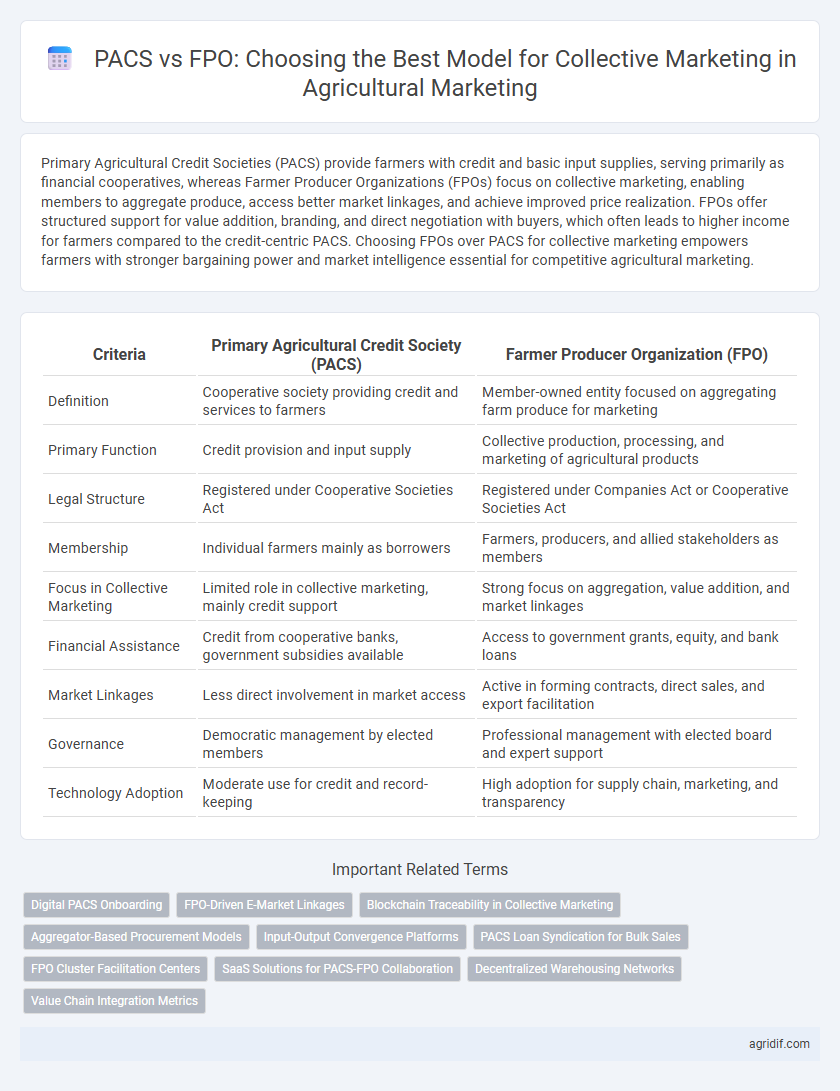

| Criteria | Primary Agricultural Credit Society (PACS) | Farmer Producer Organization (FPO) |

|---|---|---|

| Definition | Cooperative society providing credit and services to farmers | Member-owned entity focused on aggregating farm produce for marketing |

| Primary Function | Credit provision and input supply | Collective production, processing, and marketing of agricultural products |

| Legal Structure | Registered under Cooperative Societies Act | Registered under Companies Act or Cooperative Societies Act |

| Membership | Individual farmers mainly as borrowers | Farmers, producers, and allied stakeholders as members |

| Focus in Collective Marketing | Limited role in collective marketing, mainly credit support | Strong focus on aggregation, value addition, and market linkages |

| Financial Assistance | Credit from cooperative banks, government subsidies available | Access to government grants, equity, and bank loans |

| Market Linkages | Less direct involvement in market access | Active in forming contracts, direct sales, and export facilitation |

| Governance | Democratic management by elected members | Professional management with elected board and expert support |

| Technology Adoption | Moderate use for credit and record-keeping | High adoption for supply chain, marketing, and transparency |

Overview of Primary Agricultural Credit Society (PACS)

Primary Agricultural Credit Societies (PACS) serve as grassroots credit institutions providing short-term agricultural loans to farmers, enabling access to affordable financing for seeds, fertilizers, and other inputs. PACS operate under cooperative principles and play a pivotal role in rural credit delivery, often facilitating the collective marketing of produce by pooling resources and aggregating supply. Their extensive network across villages makes them crucial for enhancing farmers' market access and reducing dependency on informal lenders.

Introduction to Farmer Producer Organizations (FPOs)

Farmer Producer Organizations (FPOs) are member-owned entities that enable small and marginal farmers to collectively market their produce, access inputs, and obtain better price realization through economies of scale. Unlike Primary Agricultural Credit Societies (PACS), which primarily provide credit and basic services, FPOs function as professional business organizations focused on value addition, supply chain management, and market linkages. FPOs leverage collective bargaining power to improve farmers' income and strengthen their position in agricultural marketing ecosystems.

Structure and Governance: PACS vs FPO

Primary Agricultural Credit Societies (PACS) operate as cooperative credit institutions with a democratic governance structure, typically governed by elected farmer members at the village level, focusing on credit and input supply. Farmer Producer Organizations (FPOs) feature a more business-oriented governance model, managed by a Board of Directors elected from among the producer members, emphasizing collective production, marketing, and value addition. Whereas PACS are rooted in cooperative principles with government oversight, FPOs function as autonomous enterprises with greater flexibility in decision-making and market engagement.

Membership and Inclusivity in PACS and FPOs

Primary Agricultural Credit Societies (PACS) primarily serve small and marginal farmers, offering inclusive membership that ensures broad community participation and access to credit and marketing services. Farmer Producer Organizations (FPOs) bring together farmers, including tenants and landless laborers, fostering collective decision-making and economies of scale in marketing agricultural produce. Membership in PACS tends to be more localized and credit-focused, while FPOs emphasize value-chain integration and market linkages, enhancing inclusivity through diversified farmer engagement.

Financial Services and Credit Support

Primary Agricultural Credit Societies (PACS) primarily provide credit support and financial services directly to individual farmers at the grassroots level, facilitating access to affordable loans for agricultural inputs and short-term working capital. Farmer Producer Organizations (FPOs) aggregate farmers to enhance their market power in collective marketing while also offering financial services, including bulk loans, input credit, and access to institutional finance through partnerships with banks and other financial institutions. In terms of financial services and credit support, PACS excel in localized, individual credit delivery, whereas FPOs leverage collective strength for larger-scale credit access and integrated financial solutions tailored for group needs.

Collective Marketing Mechanisms

Primary Agricultural Credit Societies (PACS) primarily provide financial support and credit to farmers, facilitating access to inputs and production resources, but their role in collective marketing remains limited and traditional. Farmer Producer Organizations (FPOs) leverage collective bargaining power, streamlined supply chains, and direct market linkages to enhance farmers' market access, price realization, and value addition. FPOs employ advanced marketing strategies such as bulk procurement, branding, and contract farming, driving efficiency and sustainability in collective agricultural marketing mechanisms.

Market Access and Linkages

Primary Agricultural Credit Societies (PACS) primarily provide credit and input support but have limited capacity in creating extensive market linkages compared to Farmer Producer Organizations (FPOs). FPOs actively facilitate collective marketing by aggregating produce, negotiating better prices, and establishing direct linkages with buyers, agro-processors, and exporters, enhancing market access for members. The institutional strength and market-oriented approach of FPOs make them more effective in integrating small farmers into value chains and formal markets.

Profit Distribution and Member Benefits

Primary Agricultural Credit Societies (PACS) primarily focus on providing credit and basic financial services to farmers, with profits largely reinvested or distributed as dividends based on patronage, ensuring members receive direct financial benefits tied to their usage. Farmer Producer Organizations (FPOs) emphasize collective marketing and value addition, distributing profits among members proportionally to their contribution and facilitating greater bargaining power, market access, and better price realization. FPOs generally offer broader member benefits, including capacity building, input procurement, and stronger market linkage, enhancing overall profitability and sustainability for farmers.

Challenges Faced by PACS and FPOs in Agricultural Marketing

Primary Agricultural Credit Societies (PACS) face challenges such as limited financial resources, inadequate infrastructure, and lack of marketing expertise, hindering their ability to support farmers in collective marketing effectively. Farmer Producer Organizations (FPOs) struggle with issues including limited access to market linkages, regulatory complexities, and capacity-building gaps that restrict their scalability and bargaining power. Both PACS and FPOs require enhanced institutional support, streamlined regulatory frameworks, and improved market integration to overcome these obstacles and boost farmers' collective marketing potential.

Comparative Analysis: Which is Better for Collective Marketing?

Primary Agricultural Credit Societies (PACS) primarily focus on providing credit and basic financial services to farmers, while Farmer Producer Organizations (FPOs) emphasize collective marketing, aggregation, and value addition. FPOs often demonstrate better market access and bargaining power due to their structured approach to production and marketing, leveraging economies of scale and direct linkages with buyers. PACS serve as financial intermediaries but generally lack the marketing expertise and infrastructure that FPOs possess, making FPOs more effective for enhancing farmers' market competitiveness.

Related Important Terms

Digital PACS Onboarding

Primary Agricultural Credit Societies (PACS) serve as grassroots cooperative credit providers enabling small-scale farmers to access financial services, while Farmer Producer Organizations (FPOs) operate as collective enterprises focusing on aggregating produce and enhancing market access. Digital onboarding of PACS streamlines member registration and loan disbursal processes, enhancing credit flow efficiency and strengthening the cooperative's role in integrated agricultural marketing.

FPO-Driven E-Market Linkages

Farmer Producer Organizations (FPOs) leverage e-market linkages to enhance direct access to buyers, optimize price realization, and streamline supply chains, surpassing the traditional Primary Agricultural Credit Society (PACS) model which primarily focuses on credit and limited collective marketing. FPO-driven digital platforms integrate farmers into national and global markets, offering real-time price discovery, transparent transactions, and reduced intermediaries, thus significantly improving agricultural marketing outcomes.

Blockchain Traceability in Collective Marketing

Primary Agricultural Credit Societies (PACS) function as grassroots financial institutions providing credit and inputs, whereas Farmer Producer Organizations (FPOs) facilitate collective marketing and value addition for farmers. Integrating blockchain traceability in FPO-led collective marketing improves transparency, ensures product authenticity, and enhances supply chain efficiency compared to traditional PACS operations.

Aggregator-Based Procurement Models

Primary Agricultural Credit Societies (PACS) primarily provide financial services to farmers, enabling credit access for inputs and production, whereas Farmer Producer Organizations (FPOs) act as aggregators to streamline collective marketing and procurement, enhancing bargaining power and market linkages. FPO-driven aggregator-based procurement models optimize economies of scale, reduce transaction costs, and improve price realization for smallholder farmers through collective negotiation and bulk selling.

Input-Output Convergence Platforms

Primary Agricultural Credit Societies (PACS) primarily offer localized credit and input financing services essential for grassroots farmers, facilitating input procurement through trusted networks, while Farmer Producer Organizations (FPOs) emphasize aggregating produce for collective marketing, leveraging economies of scale and market linkages to enhance farmer income. FPOs function as Input-Output Convergence Platforms by integrating input supply and output marketing under a single organizational framework, optimizing resource use, reducing transaction costs, and ensuring better price realization for members compared to the traditional credit-focused model of PACS.

PACS Loan Syndication for Bulk Sales

Primary Agricultural Credit Societies (PACS) play a crucial role in loan syndication by providing smallholder farmers with access to affordable credit for bulk sales operations, enhancing their bargaining power and reducing transaction costs. Farmer Producer Organizations (FPOs), while effective in aggregating produce for collective marketing, often face challenges in securing large-scale financing compared to the established credit networks of PACS.

FPO Cluster Facilitation Centers

Farmer Producer Organizations (FPOs) provide a stronger platform for collective marketing than Primary Agricultural Credit Societies (PACS), leveraging economies of scale and direct market linkages. FPO Cluster Facilitation Centers play a critical role in strengthening FPOs by offering capacity building, market intelligence, and aggregation support, enhancing farmer access to competitive markets.

SaaS Solutions for PACS-FPO Collaboration

SaaS solutions enable seamless integration between Primary Agricultural Credit Societies (PACS) and Farmer Producer Organizations (FPOs), facilitating efficient collective marketing by streamlining credit access, procurement, and sales processes. These platforms offer real-time data analytics and transparent transaction records, empowering PACS-FPO collaborations to optimize supply chain management and enhance farmers' market reach.

Decentralized Warehousing Networks

Primary Agricultural Credit Societies (PACS) primarily facilitate localized credit and input supply for farmers, whereas Farmer Producer Organizations (FPOs) enhance collective marketing by aggregating produce and accessing decentralized warehousing networks, ensuring better storage, price realization, and reduced post-harvest losses. Decentralized warehousing integrated with FPOs supports efficient supply chain management, enabling direct market access and improved bargaining power for smallholder farmers compared to the more credit-centric PACS model.

Value Chain Integration Metrics

Primary Agricultural Credit Societies (PACS) primarily facilitate credit access and input supply within local farming communities, showing limited integration across value chain activities such as processing and distribution. Farmer Producer Organizations (FPOs) demonstrate higher value chain integration metrics by collectively managing production, processing, marketing, and distribution, thereby enhancing farmers' bargaining power and market linkages.

Primary Agricultural Credit Society (PACS) vs Farmer Producer Organization (FPO) for collective mark Infographic

agridif.com

agridif.com