The quota system limits the quantity of agricultural imports, directly controlling market supply and protecting domestic farmers from foreign competition. Tariff systems impose taxes on imported goods, raising prices to discourage imports while generating government revenue without fixed quantity restrictions. Evaluating the balance between market protection, consumer prices, and trade relations is crucial for effective agricultural import control policies.

Table of Comparison

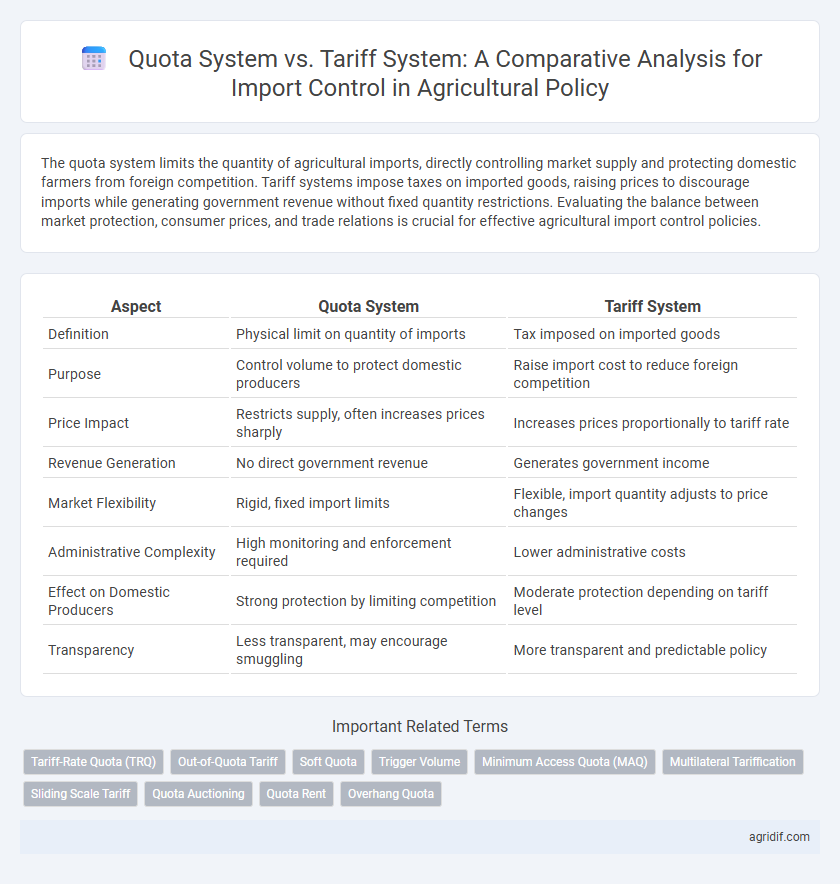

| Aspect | Quota System | Tariff System |

|---|---|---|

| Definition | Physical limit on quantity of imports | Tax imposed on imported goods |

| Purpose | Control volume to protect domestic producers | Raise import cost to reduce foreign competition |

| Price Impact | Restricts supply, often increases prices sharply | Increases prices proportionally to tariff rate |

| Revenue Generation | No direct government revenue | Generates government income |

| Market Flexibility | Rigid, fixed import limits | Flexible, import quantity adjusts to price changes |

| Administrative Complexity | High monitoring and enforcement required | Lower administrative costs |

| Effect on Domestic Producers | Strong protection by limiting competition | Moderate protection depending on tariff level |

| Transparency | Less transparent, may encourage smuggling | More transparent and predictable policy |

Introduction to Import Control in Agriculture

Import control in agriculture utilizes quota systems and tariff systems to regulate the volume and cost of imported goods. Quota systems set a physical limit on the quantity of agricultural products entering a country, ensuring domestic producers maintain market share and price stability. Tariff systems impose taxes on imports, increasing their price to protect local farmers while generating revenue for the government.

Understanding the Quota System in Agricultural Imports

The quota system in agricultural imports restricts the quantity of specific products allowed into a country, directly controlling market supply to protect domestic farmers and stabilize prices. Unlike tariffs, which increase the cost of imported goods, quotas impose physical limits, creating scarcity that can raise market prices and secure local producers' markets. Effective quota management involves precise allocation to balance domestic interest with international trade commitments and consumer welfare.

How Tariff System Regulates Agricultural Imports

The tariff system regulates agricultural imports by imposing specific taxes on foreign agricultural products, making them more expensive and less competitive compared to domestic goods. This method provides flexibility in adjusting rates according to market conditions and trade goals, influencing supply and demand without setting quantitative limits. Tariff revenues also contribute to government funds, supporting agricultural subsidies and rural development programs.

Comparative Effectiveness: Quotas vs Tariffs

Quotas impose a strict physical limit on the quantity of agricultural imports, providing precise control over market supply but often leading to higher prices and restricted consumer choice. Tariffs levy a tax on imported goods, allowing quantities to fluctuate with market demand while generating government revenue and potentially encouraging domestic production efficiency. Tariffs offer greater flexibility and economic efficiency, whereas quotas deliver more predictable protection levels but can provoke trade disputes and market distortions.

Impact on Domestic Agricultural Producers

The quota system limits the quantity of imported agricultural products, providing domestic producers with guaranteed market share and stable prices by restricting foreign competition. The tariff system imposes taxes on imports, increasing their cost, which can protect domestic farmers but may expose them to fluctuating market conditions and less certainty. Quotas tend to create more predictable environments for domestic producers, while tariffs offer flexible protection that varies with international price changes.

Consumer Price Implications of Quotas and Tariffs

Quotas restrict the quantity of agricultural imports, often resulting in higher prices for consumers due to limited supply and increased domestic producer power. Tariffs impose a tax on imported goods, which raises consumer prices but allows market flexibility as import volumes can adjust based on demand and tariff levels. Both systems protect domestic agriculture but quotas tend to create more significant price increases and reduce consumer choice compared to tariffs.

Compliance with International Trade Agreements

Quota systems limit the quantity of agricultural imports, often causing trade distortions that can violate World Trade Organization (WTO) agreements. Tariff systems impose taxes on imports, allowing price adjustments while generally maintaining compliance with WTO rules by adhering to bound tariff rates. Countries prefer tariffs over quotas to avoid disputes under the Agreement on Agriculture, ensuring smoother international trade relations.

Administrative Challenges: Quota vs Tariff Management

Quota systems impose strict limits on the quantity of agricultural imports, requiring complex monitoring and enforcement mechanisms to prevent smuggling and quota breaches. Tariff systems allow imports at varying tax rates, simplifying enforcement but necessitating accurate tariff classification and payment collection. Managing quotas demands extensive administrative resources for licensing and compliance verification, while tariffs rely more on efficient customs infrastructure and revenue tracking.

Economic Consequences for Developing Countries

The quota system limits the quantity of agricultural imports, often leading to higher domestic prices and reduced market access for developing countries, which can stifle their export growth and economic diversification. In contrast, tariff systems impose taxes on imports, providing predictable revenue for governments but potentially increasing costs for consumers and producers reliant on imported inputs. Developing countries may face trade distortions under quotas, while tariffs offer more flexibility but can still hinder competitive integration into global agricultural value chains.

Policy Recommendations for Sustainable Import Control

Implementing a quota system limits the quantity of agricultural imports, providing direct control over market supply and protecting domestic producers from price volatility. In contrast, tariff systems impose taxes on imported goods, encouraging market efficiency by allowing import volumes to adjust based on price signals while generating government revenue. Sustainable import control policy should balance quotas to prevent market distortions with tariffs to incentivize competitive pricing, ensuring food security and domestic industry resilience.

Related Important Terms

Tariff-Rate Quota (TRQ)

The Tariff-Rate Quota (TRQ) system combines quantitative import limits with variable tariff rates, allowing a set volume of goods to enter at lower tariffs while imposing higher duties on excess imports, effectively balancing market protection and trade liberalization. TRQs provide flexibility compared to strict quota systems by permitting controlled market access, supporting domestic producers while enabling consumer access to imported agricultural products at competitive prices.

Out-of-Quota Tariff

Out-of-quota tariffs impose higher duties on imports that exceed predetermined quota limits, effectively controlling supply while allowing limited access to foreign goods. This system combines quantity restrictions with price adjustments, protecting domestic agriculture by discouraging excessive imports beyond quota allocations.

Soft Quota

Soft quota systems in agricultural policy allow imports up to a specified limit with lower tariffs applied below the quota and higher tariffs above, blending quantity control with price protection. This mechanism offers flexibility compared to hard quotas, promoting market stability while shielding domestic producers from excessive foreign competition.

Trigger Volume

The quota system enforces a strict limit on the Trigger Volume of agricultural imports, ensuring supply control by capping the exact quantity allowed into the market. In contrast, the tariff system permits flexible import volumes but imposes costs through taxes once the Trigger Volume threshold is exceeded, influencing import behavior based on price sensitivity.

Minimum Access Quota (MAQ)

The Minimum Access Quota (MAQ) ensures a guaranteed import volume under the quota system, balancing domestic agricultural protection with international trade obligations. Unlike tariff systems that impose variable taxes on imports, MAQ provides predictable market access while maintaining price stability for local producers.

Multilateral Tariffication

Multilateral tariffication in agricultural import control replaces non-tariff barriers, such as quota systems, by converting quotas into tariffs with agreed maximum rates under WTO frameworks, enhancing transparency and predictability in market access. This shift promotes fair competition and reduces trade distortions by allowing importing countries to implement tariff-rate quotas that balance domestic producer protection with consumer interests.

Sliding Scale Tariff

Sliding scale tariffs adjust import duties based on the volume of agricultural imports, increasing tariffs as imports rise to protect domestic farmers from market fluctuations while allowing some flexibility in trade. This system provides a more dynamic control compared to fixed quotas, balancing market access with safeguarding local agricultural production and price stability.

Quota Auctioning

Quota auctioning in agricultural import control allocates limited import rights through competitive bidding, ensuring efficient resource allocation and generating government revenue while protecting domestic farmers. This system contrasts with tariffs by providing price certainty and potentially higher fiscal gains, reducing market distortions inherent in fixed quotas and improving transparency in quota distribution.

Quota Rent

Quota systems restrict import quantities, creating quota rent by enabling importers to earn profits from limited supply, while tariff systems generate government revenue through taxes on imports but do not produce quota rent for private entities. Quota rent represents the economic surplus captured by those holding import licenses under a quota, influencing market prices and trade efficiency in agricultural policy.

Overhang Quota

Overhang quotas in agricultural policy create a backlog of unused import rights, leading to market distortions and reduced import flexibility compared to tariff systems, which allow for predictable revenue and price stability through fixed duties. The quota system's overhang effect often results in supply uncertainties and trade disputes, whereas tariff mechanisms provide transparent protection aligning with World Trade Organization (WTO) commitments.

Quota System vs Tariff System for import control Infographic

agridif.com

agridif.com