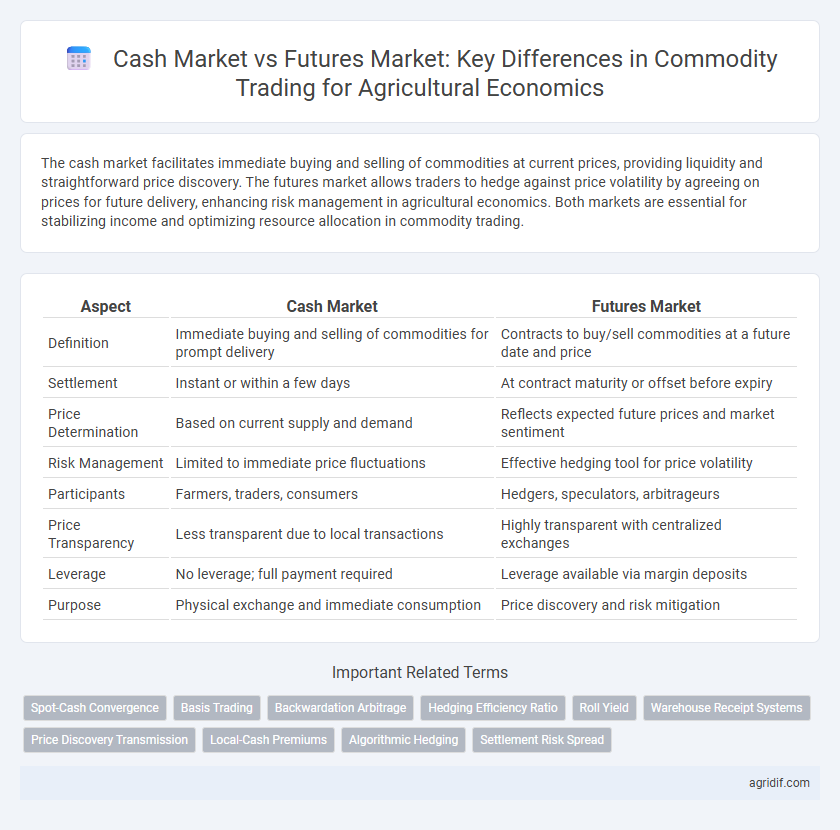

The cash market facilitates immediate buying and selling of commodities at current prices, providing liquidity and straightforward price discovery. The futures market allows traders to hedge against price volatility by agreeing on prices for future delivery, enhancing risk management in agricultural economics. Both markets are essential for stabilizing income and optimizing resource allocation in commodity trading.

Table of Comparison

| Aspect | Cash Market | Futures Market |

|---|---|---|

| Definition | Immediate buying and selling of commodities for prompt delivery | Contracts to buy/sell commodities at a future date and price |

| Settlement | Instant or within a few days | At contract maturity or offset before expiry |

| Price Determination | Based on current supply and demand | Reflects expected future prices and market sentiment |

| Risk Management | Limited to immediate price fluctuations | Effective hedging tool for price volatility |

| Participants | Farmers, traders, consumers | Hedgers, speculators, arbitrageurs |

| Price Transparency | Less transparent due to local transactions | Highly transparent with centralized exchanges |

| Leverage | No leverage; full payment required | Leverage available via margin deposits |

| Purpose | Physical exchange and immediate consumption | Price discovery and risk mitigation |

Overview of Cash and Futures Markets in Agriculture

The cash market in agriculture involves the immediate buying and selling of physical commodities such as grains, livestock, and produce, with transactions settled on the spot. In contrast, the futures market allows producers and buyers to enter standardized contracts trading agricultural commodities like wheat, corn, and soybeans for delivery at a future date, providing price risk management and hedging opportunities. Cash markets reflect current supply and demand conditions, while futures markets offer price discovery and risk transfer mechanisms essential for stabilizing farm incomes and managing price volatility.

Key Differences Between Cash and Futures Markets

Cash markets involve immediate commodity transactions with physical delivery and payment, reflecting current supply and demand conditions. Futures markets trade standardized contracts for commodities to be delivered at a specified future date, allowing price hedging and speculation. Key differences include timing of delivery, price determination mechanisms, and risk management functions.

Price Discovery Mechanisms in Cash vs Futures Trading

Price discovery in cash markets relies on real-time physical supply and demand conditions, reflecting immediate transactions and local market sentiments. Futures markets aggregate expectations about future prices, incorporating factors like weather forecasts, policy changes, and global supply trends to establish forward-looking price signals. The interaction between both markets enhances overall price efficiency by balancing actual spot prices with anticipated market developments in agricultural commodity trading.

Risk Management Strategies for Farmers

Farmers use cash markets to sell commodities immediately, securing current prices but facing risks from price volatility and weather unpredictability. Futures markets allow locking in prices for future delivery, providing a hedge against adverse price fluctuations and stabilizing income. Employing futures contracts as a risk management strategy helps farmers plan production and financial operations more effectively.

Role of Speculation in Commodity Markets

Speculation plays a crucial role in both cash markets and futures markets by providing liquidity and enabling price discovery for commodities such as grains, livestock, and metals. In futures markets, speculators assume risk by buying and selling contracts, which helps stabilize prices and reduces volatility for producers and consumers in the cash market. The effective functioning of these markets relies on speculators' willingness to anticipate future price movements, facilitating efficient allocation of resources in agricultural economics.

Impact on Agricultural Supply Chains

Cash markets in agricultural commodity trading enable immediate transaction and delivery, providing real-time price signals that help farmers and suppliers make swift production and distribution decisions. Futures markets facilitate price risk management through contracts, allowing producers and buyers to hedge against price volatility, enhancing supply chain stability and planning. Together, these markets improve liquidity, reduce uncertainty, and optimize resource allocation across agricultural supply chains.

Hedging Agricultural Commodities: Cash vs Futures

Hedging agricultural commodities involves using the cash market for immediate purchase and sale of physical goods, providing price certainty at the time of transaction, while the futures market allows producers and buyers to lock in prices for delivery at a future date, reducing exposure to price volatility. Cash market transactions reflect current supply and demand conditions, whereas futures contracts serve as financial instruments to manage risk against uncertain future price fluctuations. Effective hedging strategies combine both markets to stabilize income and costs in volatile agricultural economies.

Liquidity and Accessibility of Each Market

Cash markets offer immediate liquidity and straightforward transactions for commodity trading, making them accessible to local farmers and small-scale traders who require quick cash flow. Futures markets provide higher liquidity through standardized contracts traded on exchanges, attracting large-scale producers and financial investors seeking risk management and price discovery. Accessibility in futures markets is enhanced by electronic trading platforms, although margin requirements and contract specifications may limit entry for some participants compared to the more flexible cash markets.

Regulatory Frameworks Governing Commodity Trading

Regulatory frameworks governing commodity trading differ significantly between cash markets and futures markets, with futures markets subject to rigorous oversight by agencies such as the Commodity Futures Trading Commission (CFTC) to ensure transparency and prevent market manipulation. Cash markets often fall under less stringent regulations, focusing primarily on quality standards and immediate settlement procedures. Compliance with these regulatory requirements impacts market liquidity, pricing accuracy, and risk management strategies for agricultural commodities.

Choosing the Right Market for Agricultural Producers

Agricultural producers must evaluate price volatility, risk tolerance, and cash flow needs when choosing between cash and futures markets for commodity trading. The cash market offers immediate payment and delivery, suitable for managing current production, while the futures market provides a mechanism for hedging price risks and locking in future prices. Optimal market selection hinges on balancing short-term liquidity demands with long-term price risk management strategies.

Related Important Terms

Spot-Cash Convergence

Spot-cash convergence in agricultural commodity trading refers to the alignment of futures prices and spot market prices as the contract nears its expiration, ensuring accurate price signals for producers and traders. This convergence mechanism is crucial for mitigating basis risk and enhancing market efficiency in cash markets where actual commodity delivery occurs.

Basis Trading

Basis trading in agricultural economics involves exploiting the difference between the cash market price and the futures market price of commodities like corn, wheat, or soybeans. Traders monitor basis levels to hedge price risk, optimize selling strategies, and enhance profit margins by capitalizing on predictable fluctuations between spot and futures prices.

Backwardation Arbitrage

Backwardation arbitrage in agricultural commodity trading exploits the price difference where spot prices exceed futures prices, enabling traders to profit by simultaneously selling the commodity in the cash market and buying futures contracts. This strategy reduces storage costs risk and capitalizes on market inefficiencies inherent in cash and futures price convergence during the contract's lifecycle.

Hedging Efficiency Ratio

The Hedging Efficiency Ratio measures the effectiveness of risk reduction when using futures contracts compared to cash market transactions for commodities, indicating how well price volatility is mitigated. A higher ratio reflects better risk management by minimizing losses in the cash market through offsetting positions in the futures market, crucial for producers and consumers in agricultural economics.

Roll Yield

Roll yield in commodity trading arises when investors in futures markets continuously roll over expiring contracts to maintain positions, often capturing gains or losses due to the shape of the futures curve; cash markets lack this mechanism as they involve physical delivery and spot pricing. This difference impacts agricultural economics by influencing price signals and risk management strategies, where futures market participants may benefit or incur costs from contango or backwardation, unlike cash market traders.

Warehouse Receipt Systems

Warehouse receipt systems facilitate the transfer of ownership in both cash and futures markets by providing a secure, standardized proof of commodity storage, enhancing liquidity and price discovery. These systems enable farmers and traders to leverage stored commodities as collateral for futures contracts, mitigating risks and improving access to credit in agricultural commodity trading.

Price Discovery Transmission

The cash market serves as the immediate trading platform where prices reflect current supply and demand conditions, providing a baseline for price discovery in agricultural commodities. Futures markets facilitate price discovery by incorporating expectations about future supply, demand, and risks, transmitting these signals back to the cash market to influence spot prices and improve market efficiency.

Local-Cash Premiums

Local-cash premiums in agricultural commodity trading represent the price difference between the cash market and futures market, reflecting factors like transportation costs, storage availability, and regional supply-demand imbalances. These premiums play a crucial role in pricing strategies for farmers and traders by providing real-time signals for local market conditions beyond standardized futures prices.

Algorithmic Hedging

Algorithmic hedging in agricultural commodity trading optimizes risk management by systematically executing trades in both cash and futures markets, minimizing price volatility exposure. Utilizing real-time data and predictive analytics, these algorithms enhance decision-making efficiency, ensuring accurate alignment of physical commodity positions with futures contracts.

Settlement Risk Spread

Settlement risk in cash markets arises from immediate payment and delivery obligations, increasing the exposure to counterparty default and liquidity shortages, whereas futures markets mitigate this risk through standardized contracts, margin requirements, and daily mark-to-market settlements, reducing the settlement risk spread significantly. The futures market's centralized clearinghouse guarantees contract performance, which contrasts with the decentralized and bilateral nature of cash market transactions that often leads to wider settlement risk spreads and higher transactional uncertainty.

Cash market vs Futures market for commodity trading Infographic

agridif.com

agridif.com