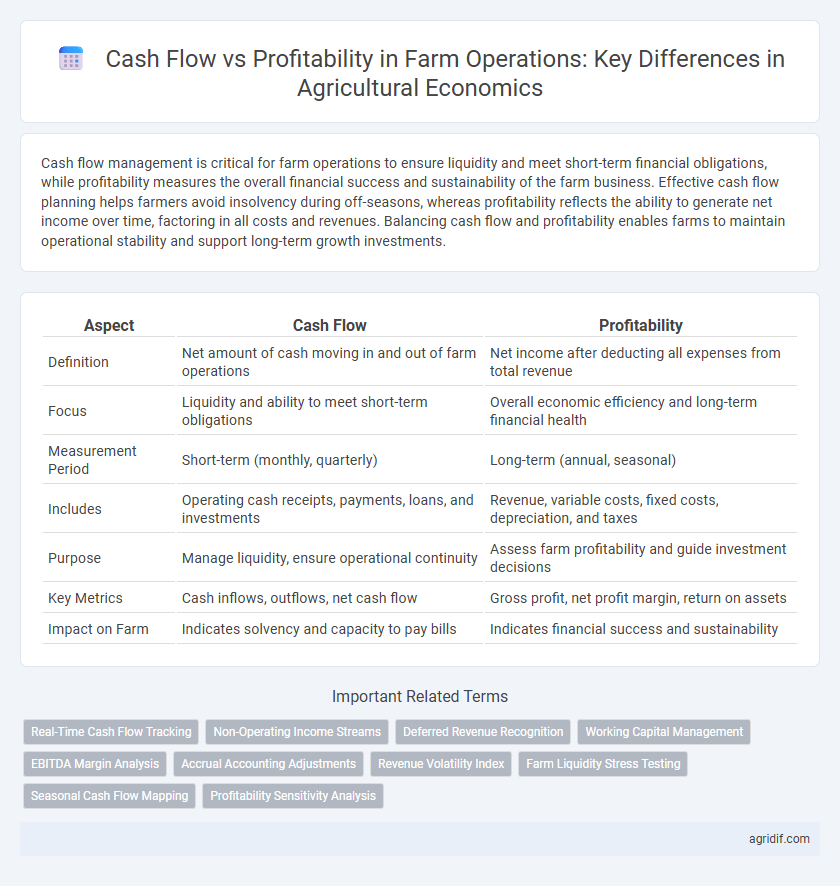

Cash flow management is critical for farm operations to ensure liquidity and meet short-term financial obligations, while profitability measures the overall financial success and sustainability of the farm business. Effective cash flow planning helps farmers avoid insolvency during off-seasons, whereas profitability reflects the ability to generate net income over time, factoring in all costs and revenues. Balancing cash flow and profitability enables farms to maintain operational stability and support long-term growth investments.

Table of Comparison

| Aspect | Cash Flow | Profitability |

|---|---|---|

| Definition | Net amount of cash moving in and out of farm operations | Net income after deducting all expenses from total revenue |

| Focus | Liquidity and ability to meet short-term obligations | Overall economic efficiency and long-term financial health |

| Measurement Period | Short-term (monthly, quarterly) | Long-term (annual, seasonal) |

| Includes | Operating cash receipts, payments, loans, and investments | Revenue, variable costs, fixed costs, depreciation, and taxes |

| Purpose | Manage liquidity, ensure operational continuity | Assess farm profitability and guide investment decisions |

| Key Metrics | Cash inflows, outflows, net cash flow | Gross profit, net profit margin, return on assets |

| Impact on Farm | Indicates solvency and capacity to pay bills | Indicates financial success and sustainability |

Understanding Cash Flow in Farm Operations

Understanding cash flow in farm operations is crucial for managing day-to-day expenses such as seeds, labor, and equipment maintenance, ensuring liquidity throughout the growing season. Unlike profitability, which measures overall financial success by comparing total revenues and costs, cash flow focuses on the timing and availability of cash to meet immediate operational needs. Effective cash flow management helps farmers avoid debt, maintain solvency, and plan for seasonal fluctuations common in agricultural production.

Defining Profitability in Agriculture

Profitability in agriculture measures the difference between total farm revenue and total costs, reflecting the economic gain from agricultural operations. It incorporates both explicit costs like seeds and labor, and implicit costs such as opportunity costs of owned resources. Understanding profitability helps farmers assess long-term sustainability beyond short-term cash flow variations.

Key Differences: Cash Flow vs Profitability

Cash flow in farm operations measures the timing of cash inflows and outflows, reflecting the liquidity needed to cover immediate expenses such as seeds, labor, and equipment maintenance. Profitability evaluates the overall financial performance by calculating net income from revenues minus total costs, including non-cash items like depreciation and accrued expenses. Key differences include cash flow's emphasis on short-term financial health and operational liquidity, while profitability focuses on long-term economic viability and return on investment.

The Role of Cash Flow in Sustainable Farming

Cash flow is critical for sustainable farming as it ensures farmers can cover immediate operational costs such as seeds, labor, and equipment maintenance, preventing disruptions in production cycles. While profitability measures long-term financial success, positive cash flow provides the liquidity needed to respond to unexpected expenses and invest in soil health and technology advancements. Maintaining strong cash flow supports resilience against market volatility and climatic challenges, fostering continuous farm growth and sustainability.

Profitability Metrics for Farm Businesses

Profitability metrics for farm businesses, such as net profit margin, return on assets (ROA), and return on equity (ROE), provide critical insights into the financial health and sustainability of farm operations. Unlike cash flow, which tracks the timing of cash inflows and outflows, profitability metrics focus on long-term economic performance by measuring income relative to costs and asset utilization. Assessing profitability enables farmers to make informed decisions on resource allocation, investment strategies, and risk management to enhance overall farm enterprise value.

Seasonal Impacts on Cash Flow and Profitability

Seasonal fluctuations significantly influence cash flow and profitability in farm operations, as income often peaks during harvest while expenses occur year-round. Managing working capital is crucial to bridge periods of low revenue, ensuring funds are available for inputs like seeds, fertilizers, and labor. Strategic planning and financial tools help mitigate risks associated with these seasonal cash flow constraints, ultimately stabilizing overall farm profitability.

Common Pitfalls: Confusing Cash Flow with Profit

Farm operations often face challenges by confusing cash flow with profitability, leading to mismanagement of resources and financial planning errors. Cash flow reflects the actual movement of money in and out of the farm business, while profitability measures the overall financial performance over a period, incorporating non-cash items like depreciation. Ignoring this distinction can result in overlooking long-term sustainability despite positive cash flow or underestimating potential liquidity issues despite reported profits.

Cash Flow Planning Strategies for Farmers

Effective cash flow planning strategies for farmers involve detailed forecasting of income and expenses to ensure liquidity during critical periods such as planting and harvest. Utilizing tools like cash flow budgets and seasonal loans helps manage timing gaps between cash inflows and outflows, reducing financial stress. Prioritizing the alignment of operational expenses with revenue cycles enhances farm sustainability and profitability.

Improving Profitability in Modern Agriculture

Effective farm operations prioritize cash flow management to ensure liquidity for daily activities and input purchases while strategically enhancing profitability through yield optimization, cost reduction, and sustainable resource use. Utilizing data-driven decision-making tools and precision agriculture technologies enables farmers to maximize revenue streams and minimize expenses, aligning short-term cash needs with long-term financial health. Integrating crop diversification and value-added products further strengthens profitability by mitigating market risks and exploiting emerging market opportunities.

Balancing Cash Flow and Profitability for Farm Success

Balancing cash flow and profitability is critical for sustainable farm operations, as positive cash flow ensures daily expenses and operational continuity while profitability reflects long-term financial health. Effective cash flow management involves scheduling expenses and optimizing revenue cycles to avoid liquidity shortages, whereas profitability assessment requires analyzing income against total costs to gauge farm efficiency. Integrating cash flow strategies with profitability goals enables farmers to maintain solvency, invest in growth, and achieve economic resilience in fluctuating agricultural markets.

Related Important Terms

Real-Time Cash Flow Tracking

Real-time cash flow tracking enables farm operations to monitor incoming and outgoing funds instantly, providing critical insights for managing operational expenses and seasonal revenues. This dynamic monitoring contrasts with profitability metrics that reflect longer-term financial health, allowing farmers to make timely decisions to sustain liquidity and avoid cash shortages.

Non-Operating Income Streams

Non-operating income streams such as government subsidies, asset sales, and investment dividends significantly enhance farm cash flow without directly affecting operational profitability, enabling better liquidity management. These income sources provide essential financial buffers that support farm operations during low production periods, yet they do not reflect the core farm business efficiency or profitability metrics.

Deferred Revenue Recognition

Deferred revenue recognition impacts farm operations by delaying the recording of income until the related goods or services are delivered, which can create discrepancies between cash flow and profitability metrics. Understanding this timing difference is essential for accurate financial analysis and effective management of agricultural cash flows and long-term profitability.

Working Capital Management

Effective working capital management in farm operations ensures sufficient cash flow to cover short-term liabilities, directly impacting the farm's operational liquidity and ability to invest in inputs. While profitability measures long-term financial success, maintaining optimal cash flow through timely management of receivables, payables, and inventory is critical to sustain day-to-day agricultural activities and avoid solvency risks.

EBITDA Margin Analysis

EBITDA margin analysis in farm operations provides a clear measurement of cash flow efficiency by excluding non-cash expenses like depreciation and amortization, offering a more accurate indication of operational profitability than net income. This metric enables farmers to assess financial health and sustainability by focusing on earnings generated from core agricultural activities before interest, taxes, and accounting adjustments.

Accrual Accounting Adjustments

Accrual accounting adjustments in agricultural economics reconcile cash flow and profitability by recording revenues and expenses when they are earned or incurred, not when cash is exchanged, providing a more accurate financial picture of farm operations. These adjustments ensure that inventory changes, prepaid inputs, and deferred expenses are accounted for, enabling farmers to assess true economic performance beyond cash liquidity.

Revenue Volatility Index

Revenue Volatility Index measures fluctuations in farm revenues, directly impacting cash flow stability and the ability to cover operational expenses in agricultural businesses. Understanding this index helps farmers manage risk, ensuring liquidity while maintaining profitability despite market and climate variability.

Farm Liquidity Stress Testing

Farm liquidity stress testing evaluates cash flow dynamics by simulating adverse conditions to ensure farms maintain solvency and operational viability despite fluctuating income and expenses. Emphasizing cash flow management over profitability metrics highlights the critical importance of liquidity in sustaining farm operations during periods of financial stress.

Seasonal Cash Flow Mapping

Seasonal cash flow mapping is essential for farm operations to align inflows and outflows with planting and harvesting cycles, ensuring liquidity during peak expense periods despite variable profitability. Accurate forecasting of cash flow supports timely loan repayments and investment decisions, reflecting the farm's operational health beyond mere profitability metrics.

Profitability Sensitivity Analysis

Profitability sensitivity analysis in farm operations evaluates how changes in key variables such as crop prices, input costs, and yield levels impact net farm income, providing critical insights for decision-making and risk management. By modeling scenarios of revenue fluctuations and expense variations, farmers can identify thresholds that affect cash flow stability and long-term profitability, enhancing financial resilience in volatile agricultural markets.

Cash flow vs Profitability for farm operations Infographic

agridif.com

agridif.com