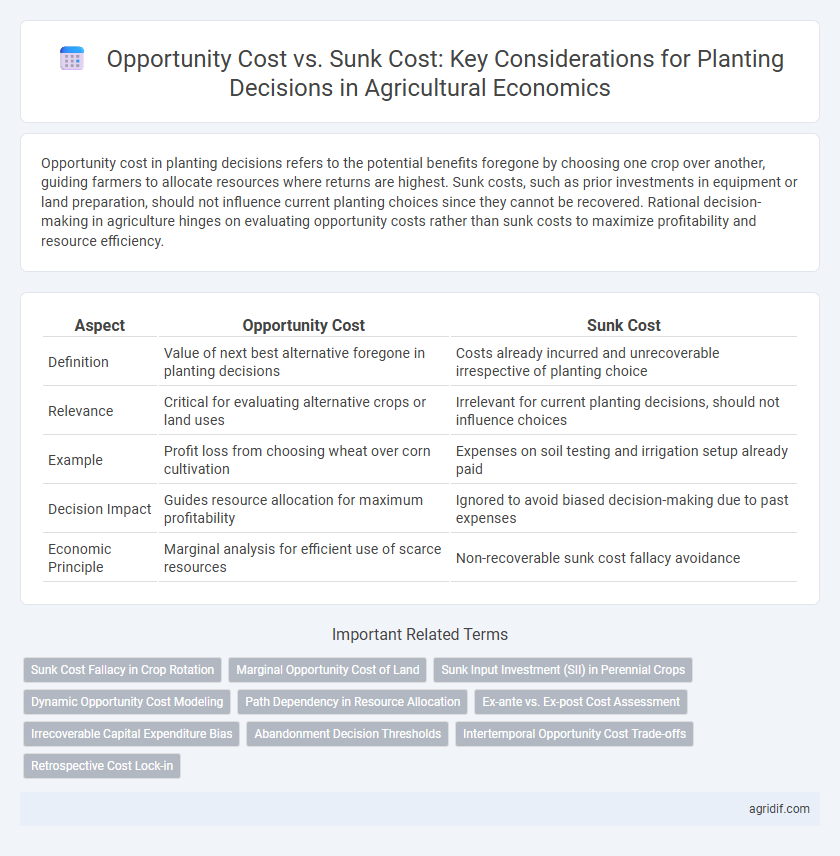

Opportunity cost in planting decisions refers to the potential benefits foregone by choosing one crop over another, guiding farmers to allocate resources where returns are highest. Sunk costs, such as prior investments in equipment or land preparation, should not influence current planting choices since they cannot be recovered. Rational decision-making in agriculture hinges on evaluating opportunity costs rather than sunk costs to maximize profitability and resource efficiency.

Table of Comparison

| Aspect | Opportunity Cost | Sunk Cost |

|---|---|---|

| Definition | Value of next best alternative foregone in planting decisions | Costs already incurred and unrecoverable irrespective of planting choice |

| Relevance | Critical for evaluating alternative crops or land uses | Irrelevant for current planting decisions, should not influence choices |

| Example | Profit loss from choosing wheat over corn cultivation | Expenses on soil testing and irrigation setup already paid |

| Decision Impact | Guides resource allocation for maximum profitability | Ignored to avoid biased decision-making due to past expenses |

| Economic Principle | Marginal analysis for efficient use of scarce resources | Non-recoverable sunk cost fallacy avoidance |

Introduction to Opportunity Cost and Sunk Cost in Agriculture

Opportunity cost in agricultural economics represents the value of the next best alternative foregone when resources, such as land and labor, are allocated to a specific crop planting decision. Sunk costs are past expenses, like soil preparation or seed purchase, that cannot be recovered and should not influence current planting choices. Understanding the distinction between opportunity cost and sunk cost enables farmers to make efficient resource allocation decisions that maximize profitability and long-term sustainability.

Defining Opportunity Cost in Planting Decisions

Opportunity cost in planting decisions refers to the value of the next best alternative crop or land use that must be forgone when choosing a particular crop to plant. It quantifies potential profit or yield lost by not selecting an alternative planting option with higher returns or better resource utilization. Understanding opportunity cost ensures farmers allocate land, labor, and capital efficiently to maximize overall farm profitability and sustainability.

Understanding Sunk Costs on the Farm

Sunk costs on the farm include past investments in equipment, seeds, or land preparation that cannot be recovered regardless of current planting choices. Farmers should ignore these irreversible expenses when deciding which crops to plant, instead emphasizing opportunity costs, such as potential revenue from alternative crops or uses of the land. This approach maximizes profit by focusing on future returns rather than non-recoverable past expenditures.

Key Differences Between Opportunity Cost and Sunk Cost

Opportunity cost in agricultural economics represents the value of the next best alternative foregone when choosing to plant a particular crop, directly influencing resource allocation and profitability. Sunk cost refers to expenses already incurred in previous planting decisions, which should not affect current or future planting choices as they cannot be recovered. The key difference lies in opportunity cost guiding rational decision-making by considering potential benefits, while sunk cost often leads to irrational commitment due to past investments.

Opportunity Cost in Crop Selection Strategy

Opportunity cost in crop selection represents the potential yield or profit forgone by choosing one crop over another, guiding farmers toward the most economically efficient planting decisions. By evaluating the opportunity cost of different crops, agricultural economists help optimize resource allocation, maximizing overall farm income. Ignoring sunk costs, which are irrelevant for future planting decisions, ensures that farmers focus solely on potential returns and opportunity costs for strategic crop selection.

Sunk Cost Considerations in Capital Investment

Sunk costs in agricultural capital investments, such as the purchase of machinery or irrigation systems, should not influence current planting decisions since these expenses cannot be recovered. Opportunity cost analysis requires focusing on future benefits and alternative uses of resources rather than past expenditures. Understanding that sunk costs are irrelevant to marginal decision-making enables more efficient allocation of inputs for maximizing crop yields and profitability.

Real-World Examples: Opportunity Cost in Planting Choices

Farmers face opportunity costs when deciding between planting crops like corn or soybeans, as choosing one crop means forgoing potential profits from the other. For instance, if a farmer plants corn on 100 acres with an expected profit of $500 per acre, but soybeans could yield $600 per acre, the opportunity cost of planting corn is $10,000. Understanding opportunity costs helps optimize land use and maximize farm profitability by prioritizing crops with the highest net returns.

Avoiding the Sunk Cost Fallacy in Farm Management

Farmers must evaluate planting decisions by comparing the opportunity cost--the foregone benefits of the next best alternative--with sunk costs, which are unrecoverable past investments. Avoiding the sunk cost fallacy prevents managers from irrationally investing more resources into crops or methods that no longer offer economic benefits. Efficient farm management relies on directing resources toward options with the highest marginal returns, ignoring irretrievable expenses.

Impact on Profitability: Opportunity vs Sunk Cost

Opportunity cost directly impacts profitability by representing the foregone returns from alternative crop choices, guiding farmers to allocate resources toward the most profitable options. Sunk costs, which are past expenditures that cannot be recovered, do not affect future planting decisions and should be disregarded to avoid reducing potential profits. Emphasizing opportunity cost ensures optimal resource use in agricultural economics, enhancing long-term financial performance.

Best Practices for Farmers: Economic Decision-Making

Farmers maximize profitability by evaluating opportunity costs, which represent the potential returns from the next best alternative crop or land use, rather than sunk costs that are irrecoverable expenses such as prior investments in equipment or seeds. Accurate assessment of opportunity costs enables allocation of resources to crops with the highest expected economic returns, ensuring efficient land use and input deployment. Ignoring sunk costs prevents financial bias and supports rational planting decisions that align with market conditions and crop price fluctuations.

Related Important Terms

Sunk Cost Fallacy in Crop Rotation

Farmers often fall into the sunk cost fallacy by continuing to plant the same crop despite declining yields, ignoring opportunity costs associated with alternative crops that could enhance soil health and profitability. Recognizing and avoiding sunk costs in crop rotation decisions enables more efficient resource allocation and long-term agricultural sustainability.

Marginal Opportunity Cost of Land

The marginal opportunity cost of land in agricultural economics refers to the value of the best alternative use of land resources when making planting decisions, highlighting the trade-offs farmers face in allocating land to different crops. Unlike sunk costs, which are past expenditures that cannot be recovered, marginal opportunity cost directly impacts current decision-making by measuring potential foregone returns from alternative crop choices.

Sunk Input Investment (SII) in Perennial Crops

Sunk Input Investment (SII) in perennial crops represents irreversible costs such as soil preparation and initial planting that cannot be recovered once made, influencing planting decisions by emphasizing the importance of future opportunity costs over past expenditures. Understanding SII helps farmers evaluate alternative land uses and crop rotations without being biased by non-recoverable historical investments, optimizing long-term profitability in agricultural economics.

Dynamic Opportunity Cost Modeling

Dynamic Opportunity Cost Modeling in agricultural economics quantifies the evolving trade-offs between current planting decisions and potential future returns, incorporating factors like crop price volatility, seasonality, and resource constraints. Unlike sunk costs, which are irrecoverable past expenses, dynamic opportunity costs emphasize forward-looking economic impacts, guiding farmers to optimize crop selection for maximizing long-term profitability.

Path Dependency in Resource Allocation

Opportunity cost in agricultural economics reflects the foregone benefits of the next best alternative use of land and resources, guiding efficient planting decisions by emphasizing future returns rather than past expenses. Sunk costs, being irrecoverable, induce path dependency in resource allocation as farmers may continue planting suboptimal crops to justify previous investments, potentially leading to inefficient economic outcomes and reduced farm productivity.

Ex-ante vs. Ex-post Cost Assessment

Opportunity cost in agricultural economics refers to the ex-ante assessment of potential benefits from alternative planting decisions, guiding resource allocation before the planting season begins. Sunk costs represent ex-post expenditures already incurred and irrecoverable, which should not influence future planting decisions to avoid inefficient resource use.

Irrecoverable Capital Expenditure Bias

Opportunity cost plays a crucial role in planting decisions by emphasizing the value of foregone alternatives, whereas sunk cost reflects past, irrecoverable expenditures that should not influence current choices. The irrecoverable capital expenditure bias occurs when farmers irrationally consider sunk costs as relevant, leading to inefficient resource allocation and suboptimal crop selection.

Abandonment Decision Thresholds

Opportunity cost represents the potential gains foregone by choosing one crop over another in planting decisions, guiding farmers to allocate resources where returns exceed alternative uses. Sunk costs are past investments in land preparation or inputs that should not influence abandonment decision thresholds, which are determined by current and expected profitability rather than irrecoverable expenditures.

Intertemporal Opportunity Cost Trade-offs

Intertemporal opportunity cost trade-offs in planting decisions involve comparing the potential benefits of current crop choices against future planting opportunities, where resources allocated today cannot be recovered or redirected later. Understanding sunk costs, such as irreversible investments in land preparation, helps farmers avoid biased decisions by focusing on marginal returns from alternative crops rather than past expenditures.

Retrospective Cost Lock-in

Opportunity cost in planting decisions represents the potential profits foregone by choosing one crop over another, essential for evaluating alternative uses of land and resources. Sunk cost, a retrospective cost lock-in from previous investments in specific crops or technologies, should not influence current decisions since it cannot be recovered and may lead to economically inefficient farming practices.

Opportunity Cost vs Sunk Cost for planting decisions Infographic

agridif.com

agridif.com