Farmers with high risk aversion prefer crop insurance to protect against financial losses due to unpredictable weather or pest damage, ensuring income stability despite uncertainties. In contrast, risk-tolerant farmers may opt for minimal insurance coverage, accepting potential losses for the chance of higher profits by reducing premium expenses. Understanding these behavioral differences is crucial in designing effective crop insurance policies that balance affordability with adequate risk protection.

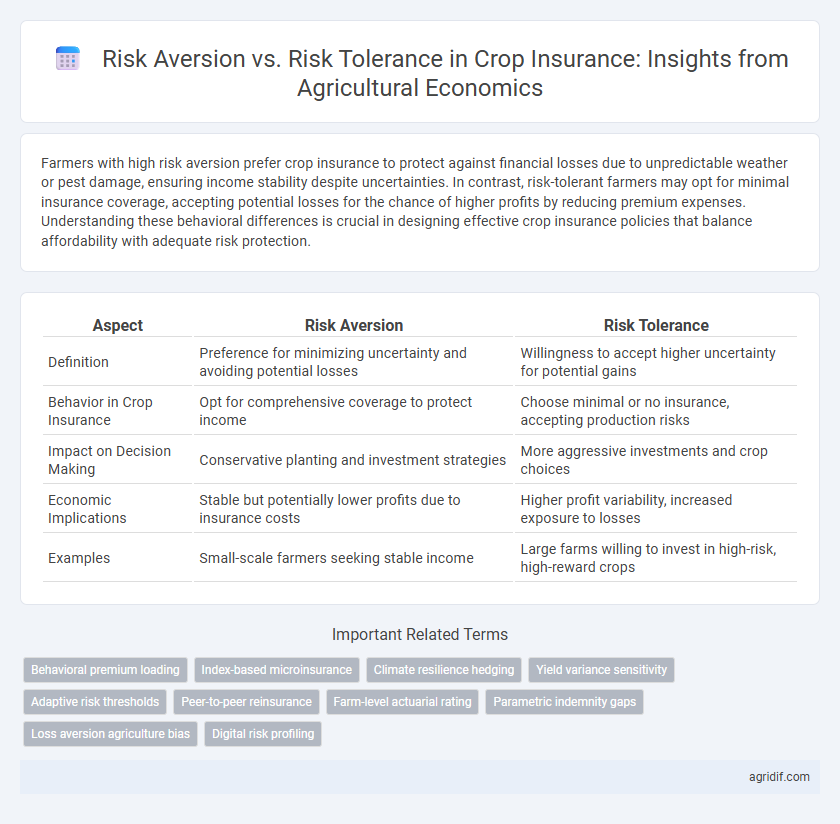

Table of Comparison

| Aspect | Risk Aversion | Risk Tolerance |

|---|---|---|

| Definition | Preference for minimizing uncertainty and avoiding potential losses | Willingness to accept higher uncertainty for potential gains |

| Behavior in Crop Insurance | Opt for comprehensive coverage to protect income | Choose minimal or no insurance, accepting production risks |

| Impact on Decision Making | Conservative planting and investment strategies | More aggressive investments and crop choices |

| Economic Implications | Stable but potentially lower profits due to insurance costs | Higher profit variability, increased exposure to losses |

| Examples | Small-scale farmers seeking stable income | Large farms willing to invest in high-risk, high-reward crops |

Understanding Risk Aversion and Risk Tolerance in Agriculture

Farmers exhibiting high risk aversion prefer crop insurance to protect against potential yield losses and price fluctuations, prioritizing stable income over high-risk, high-reward opportunities. Risk-tolerant farmers may opt for minimal or no insurance coverage, willing to face variability in returns for a chance at greater profit. Understanding these behavioral economics concepts helps tailor insurance products that align with farmers' risk profiles, improving adoption rates and financial resilience in agricultural communities.

The Role of Crop Insurance in Managing Farm Risks

Crop insurance plays a critical role in managing farm risks by providing a financial safety net that mitigates the impact of unpredictable events such as droughts, floods, or pest infestations. Risk-averse farmers are more likely to invest in crop insurance to protect their income stability and ensure long-term sustainability, while risk-tolerant farmers might opt for lower coverage or alternative risk management strategies. The effectiveness of crop insurance in agricultural economics hinges on balancing premium costs with potential losses, influencing farmers' decisions based on their individual risk preferences and market conditions.

Behavioral Economics: Farmers’ Choices Under Uncertainty

Farmers exhibiting risk aversion often opt for comprehensive crop insurance to secure predictable income despite uncertain weather conditions and market prices. Those with higher risk tolerance may prefer partial coverage or alternative risk management strategies, leveraging potential higher returns despite exposure to potential losses. Behavioral economics reveals that farmers' decisions under uncertainty are influenced by cognitive biases and varying perceptions of probability, shaping their preference for insurance products that align with their individual risk profiles.

Factors Influencing Risk Preferences Among Farmers

Farmers' risk preferences in crop insurance are influenced by factors such as farm size, income stability, and access to financial resources. Experience with past crop losses and varying exposure to weather volatility also shape risk aversion or tolerance levels. Socioeconomic characteristics, including education and family responsibilities, critically determine willingness to adopt insurance products.

Measuring Risk Aversion in Agricultural Decision-Making

Measuring risk aversion in agricultural decision-making involves quantifying farmers' preferences under uncertainty to determine their willingness to pay for crop insurance. Techniques such as utility theory, certainty equivalents, and experimental auctions provide empirical data on farmers' risk attitudes essential for designing effective insurance products. Accurately assessing risk aversion helps optimize premium pricing, coverage levels, and policy adoption rates, ultimately improving financial resilience in agriculture.

Impact of Risk Tolerance on Crop Insurance Adoption

Farmers with high risk tolerance often delay or avoid purchasing crop insurance, favoring potential higher returns over guaranteed payouts, which influences overall adoption rates. Research shows that increased risk tolerance correlates with lower insurance uptake, as these farmers rely more on self-insurance strategies such as diversified cropping or savings. Crop insurance providers must tailor policies and outreach to address varying risk preferences, enhancing adoption among moderately risk-tolerant producers.

Policy Implications: Designing Effective Crop Insurance Schemes

Understanding farmers' varying degrees of risk aversion and risk tolerance is crucial for designing effective crop insurance schemes that enhance participation and financial stability. Crop insurance policies should incorporate flexible coverage options and premium variations to accommodate diverse risk profiles, encouraging both highly risk-averse and moderately risk-tolerant farmers to engage with the programs. Policy frameworks that integrate behavioral economics insights and localized risk assessments improve the alignment of insurance products with actual farmer needs, reducing adverse selection and moral hazard.

Balancing Profitability and Security on the Farm

Balancing profitability and security on the farm requires understanding the trade-off between risk aversion and risk tolerance in crop insurance decisions. Farmers with high risk aversion prioritize premium costs and coverage limits to minimize potential losses from adverse weather or market fluctuations. Conversely, risk-tolerant farmers may opt for lower coverage and higher potential returns, leveraging market conditions to maximize profitability while accepting uncertain yields.

Socioeconomic Determinants of Insurance Participation

Farmers with higher income levels and greater access to credit exhibit increased risk tolerance, leading to more frequent participation in crop insurance programs. Educational attainment and farm size significantly influence risk aversion, with more educated and larger-scale farmers showing a preference for insurance as a risk management tool. Socioeconomic factors such as age, gender, and regional market access further shape decisions on insurance uptake, impacting overall agricultural risk management strategies.

Future Trends in Risk Management for Sustainable Agriculture

Future trends in risk management for sustainable agriculture emphasize integrating advanced data analytics and precision farming technologies to enhance crop insurance models tailored for varying levels of risk aversion and risk tolerance among farmers. Innovations such as satellite monitoring, blockchain-based transparency, and machine learning algorithms enable more accurate risk assessments and adaptive insurance products that support resilience against climate variability. These developments promote sustainable agricultural practices by aligning financial protections with individual risk profiles, thereby encouraging investment in long-term environmental stewardship.

Related Important Terms

Behavioral premium loading

Risk-averse farmers tend to pay higher behavioral premium loading for crop insurance due to their preference for minimizing potential losses, whereas risk-tolerant farmers often opt for lower coverage levels reflecting their willingness to accept higher variability in crop yields. Empirical studies in agricultural economics show that behavioral premium loading significantly influences insurance uptake rates and affects the overall stability of farm income under uncertain weather and market conditions.

Index-based microinsurance

Farmers exhibiting risk aversion are more likely to adopt index-based microinsurance for crop protection as it offers predictable payouts tied to measurable indices like rainfall or temperature, minimizing uncertainty. In contrast, risk-tolerant farmers may opt for traditional insurance or self-insurance strategies, given their higher willingness to absorb potential losses without guaranteed compensation.

Climate resilience hedging

Farmers with high risk aversion prioritize crop insurance as a climate resilience strategy to hedge against extreme weather impacts and fluctuating yields, ensuring financial stability. Conversely, risk-tolerant farmers may opt for reduced insurance coverage, relying on adaptive practices and diversified cropping systems to manage climate-related uncertainties.

Yield variance sensitivity

Farmers exhibiting high risk aversion prioritize crop insurance to mitigate yield variance sensitivity, reducing potential financial losses from unpredictable climatic conditions or pest infestations. Conversely, risk-tolerant farmers may opt for minimal insurance coverage, accepting higher yield variance fluctuations while capitalizing on potential yield gains during optimal growing seasons.

Adaptive risk thresholds

Adaptive risk thresholds in crop insurance enable farmers to dynamically adjust coverage levels based on changing environmental and economic conditions, aligning with varying degrees of risk aversion and tolerance. This approach optimizes financial protection by calibrating insurance premiums and deductibles to individual risk profiles, enhancing decision-making under uncertainty in agricultural economics.

Peer-to-peer reinsurance

Peer-to-peer reinsurance in agricultural economics leverages farmers' varying levels of risk aversion and risk tolerance to create customized crop insurance pools, reducing traditional insurer costs and enhancing payout efficiency. This decentralized approach aligns premiums with individual risk profiles, promoting more adaptive risk-sharing among participants and incentivizing sustainable farming practices.

Farm-level actuarial rating

Farm-level actuarial rating in crop insurance quantifies individual risk profiles by integrating farm-specific data on yield variability and loss history, enabling precise premium adjustments reflecting risk aversion levels. Risk-averse farmers benefit from tailored coverage that mitigates potential losses, while risk-tolerant producers may opt for lower premiums accepting higher exposure, optimizing financial resilience and resource allocation in agricultural economics.

Parametric indemnity gaps

Risk-averse farmers often prefer traditional crop insurance with full indemnity to avoid shortfalls in coverage, while risk-tolerant farmers might opt for parametric insurance despite indemnity gaps due to lower costs and quicker payouts. Parametric indemnity gaps arise when payouts are triggered by predefined parameters rather than actual loss, potentially leaving uncovered losses that risk-averse producers find less acceptable.

Loss aversion agriculture bias

Farmers exhibiting loss aversion demonstrate a stronger preference for crop insurance due to the disproportionate weighting of potential losses over equivalent gains, influencing their risk-averse behavior in agricultural decision-making. This bias leads to higher demand for insurance products that mitigate downside risks, shaping the design and pricing strategies in crop insurance markets.

Digital risk profiling

Digital risk profiling enhances the accuracy of assessing farmers' risk aversion and risk tolerance, enabling tailored crop insurance solutions that minimize financial losses and optimize coverage. By leveraging big data and machine learning, insurers can better predict individual risk behaviors and customize policies, improving adoption rates and reducing claim costs.

Risk aversion vs risk tolerance for crop insurance Infographic

agridif.com

agridif.com