Domestic marketing of high-value crops emphasizes local consumer preferences, regulatory compliance, and shorter supply chains, ensuring fresher produce and reduced transportation costs. Export marketing requires adherence to international standards, effective logistics management, and strategic positioning to access global markets with higher profit margins. Understanding distinct market dynamics enables producers to optimize pricing, distribution, and promotional strategies for domestic and export channels.

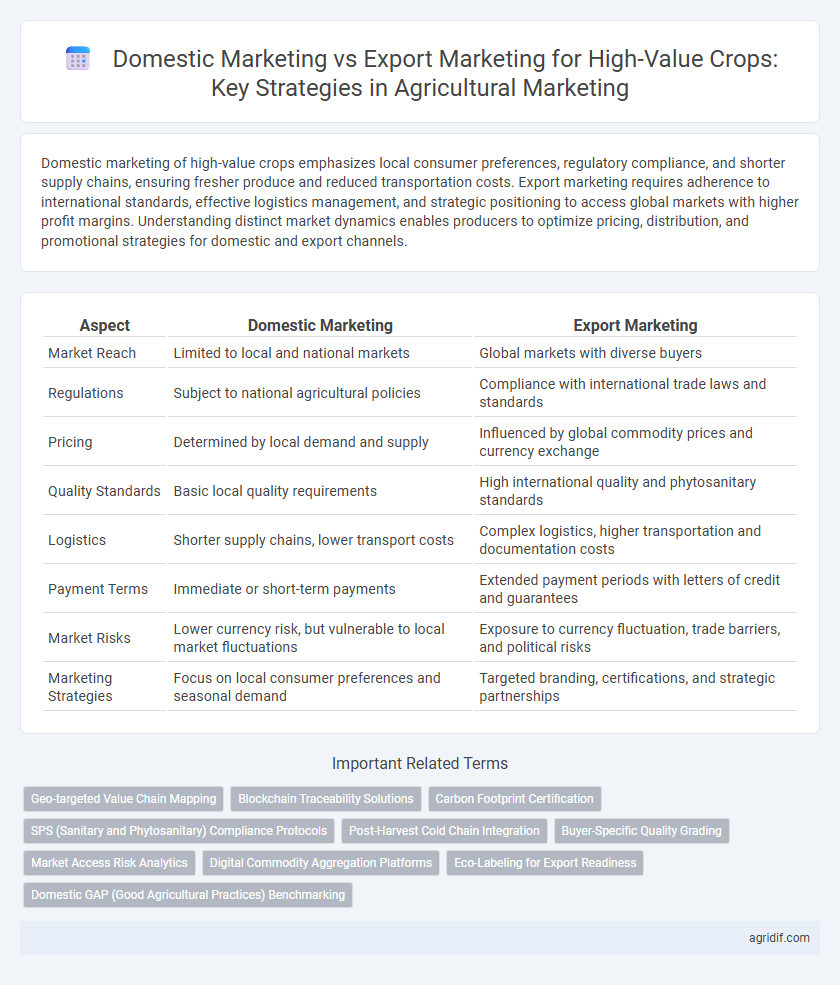

Table of Comparison

| Aspect | Domestic Marketing | Export Marketing |

|---|---|---|

| Market Reach | Limited to local and national markets | Global markets with diverse buyers |

| Regulations | Subject to national agricultural policies | Compliance with international trade laws and standards |

| Pricing | Determined by local demand and supply | Influenced by global commodity prices and currency exchange |

| Quality Standards | Basic local quality requirements | High international quality and phytosanitary standards |

| Logistics | Shorter supply chains, lower transport costs | Complex logistics, higher transportation and documentation costs |

| Payment Terms | Immediate or short-term payments | Extended payment periods with letters of credit and guarantees |

| Market Risks | Lower currency risk, but vulnerable to local market fluctuations | Exposure to currency fluctuation, trade barriers, and political risks |

| Marketing Strategies | Focus on local consumer preferences and seasonal demand | Targeted branding, certifications, and strategic partnerships |

Overview of Domestic vs Export Marketing in High-Value Crop Agriculture

Domestic marketing in high-value crop agriculture prioritizes local consumer preferences, regulatory standards, and supply chain efficiencies to ensure timely and cost-effective distribution. Export marketing involves navigating international trade regulations, quality certifications, and foreign market demands to maximize profitability and market reach. Both strategies require tailored marketing approaches to optimize revenue, with domestic markets offering stability and export markets providing growth potential.

Key Differences in Market Requirements

Domestic marketing of high-value crops emphasizes compliance with local regulatory standards, consumer preferences for freshness, and established distribution networks tailored to regional demand. Export marketing demands adherence to stringent international quality certifications, phytosanitary regulations, and packaging requirements to withstand long transit times and diverse market standards. Pricing strategies also differ, with export markets often requiring premium pricing due to higher logistics costs and value addition.

Quality Standards and Certification Demands

High-value crops in domestic marketing often face lower quality standards compared to export marketing, where stringent certification demands like GlobalGAP and organic certifications are mandatory to access international markets. Export marketing requires adherence to precise traceability, pesticide residue limits, and quality grading to meet global buyer expectations. Domestic markets prioritize freshness and local preferences but lack uniform certification, making export marketing more demanding in quality assurance and compliance costs.

Pricing Structures: Local vs International Markets

Pricing structures for high-value crops in domestic marketing typically reflect local production costs, supply-demand dynamics, and government regulations, leading to more stable but often lower price points compared to export markets. Export marketing prices incorporate international market trends, currency fluctuations, and tariff structures, resulting in higher price volatility but greater profit potential. Understanding these pricing differences is essential for farmers aiming to optimize revenue by balancing risk and market opportunities.

Supply Chain Logistics and Infrastructure

Domestic marketing for high-value crops relies heavily on well-established supply chain logistics and infrastructure, including efficient road networks, cold storage facilities, and local distribution channels to maintain product quality and meet consumer demand. Export marketing demands advanced logistics solutions such as temperature-controlled shipping containers, compliance with international quality standards, and streamlined customs processes to ensure timely delivery and minimize losses. Investment in modern infrastructure and technology integration enhances the competitiveness of both domestic and export supply chains, reducing costs and improving market access.

Regulatory and Policy Considerations

Domestic marketing of high-value crops is often governed by national food safety standards, quality certifications, and local agricultural policies that prioritize consumer protection and supply chain transparency. Export marketing requires adherence to international trade regulations, phytosanitary certifications, and import country-specific standards such as the EU's Global GAP or the USDA Organic certification, which influence market access and competitiveness. Regulatory frameworks for exports tend to be more stringent, demanding comprehensive documentation and compliance with global trade agreements like the WTO Sanitary and Phytosanitary Measures Agreement.

Market Access and Consumer Preferences

Domestic marketing of high-value crops offers easier market access due to established distribution channels and familiarity with local consumer preferences, enabling targeted product differentiation. Export marketing demands adherence to stringent international standards, compliance with phytosanitary regulations, and adaptation to diverse consumer preferences across global markets. Understanding regional demand variations and leveraging trade agreements are crucial for competitive positioning in both domestic and export markets.

Opportunities and Risks for Farmers

Domestic marketing of high-value crops offers farmers stable demand, easier logistics, and lower compliance costs, enhancing profitability and consistent cash flow. Export marketing provides access to larger international markets and higher price premiums, but exposes farmers to currency fluctuations, stringent quality standards, and complex regulatory barriers. Balancing these opportunities and risks enables farmers to diversify income sources and optimize returns in the agricultural marketing landscape.

Strategies for Successful Market Entry

Effective strategies for successful market entry of high-value crops in domestic marketing emphasize understanding local consumer preferences, leveraging regional supply chains, and complying with national agricultural standards. Export marketing requires in-depth analysis of international demand, adherence to foreign regulatory requirements, and strategic partnerships with global distributors to navigate complex trade barriers. Tailoring pricing, quality certifications, and promotion efforts to distinct market segments enhances competitive advantage in both domestic and export markets.

Future Trends in High-Value Crop Marketing

Domestic marketing of high-value crops increasingly leverages advanced digital platforms and precision agriculture data to meet growing consumer demand for traceability and sustainability. Export marketing emphasizes compliance with stringent international standards, leveraging blockchain technology for transparent supply chains and adopting geo-certification to enhance product differentiation. Future trends indicate a convergence of smart agriculture innovations and eco-certifications driving competitive advantage in both domestic and global markets.

Related Important Terms

Geo-targeted Value Chain Mapping

Domestic marketing of high-value crops emphasizes geo-targeted value chain mapping to optimize regional demand fulfillment and reduce transportation costs, ensuring fresh produce reaches local consumers efficiently. Export marketing leverages geo-targeted value chain mapping to identify international market hotspots, streamline cross-border logistics, and comply with diverse regulatory standards, maximizing global market penetration and profitability.

Blockchain Traceability Solutions

Blockchain traceability solutions enhance domestic marketing by providing transparent supply chain data, ensuring product authenticity and consumer trust for high-value crops. In export marketing, blockchain facilitates compliance with international standards, streamlines customs processes, and verifies origin, boosting market access and premium pricing opportunities.

Carbon Footprint Certification

Domestic marketing of high-value crops often benefits from shorter supply chains, resulting in reduced carbon footprints and easier compliance with Carbon Footprint Certification standards, which appeal to environmentally conscious consumers. Export marketing, while expanding market reach, faces challenges in maintaining low carbon emissions due to transportation logistics, making certification more complex but crucial for accessing eco-sensitive international markets.

SPS (Sanitary and Phytosanitary) Compliance Protocols

Domestic marketing of high-value crops primarily centers on meeting national Sanitary and Phytosanitary (SPS) standards, which often differ in strictness and scope compared to export marketing requirements. Export marketing demands rigorous adherence to international SPS compliance protocols, including certifications and traceability systems, to ensure access to global markets and avoid trade barriers.

Post-Harvest Cold Chain Integration

Domestic marketing of high-value crops emphasizes minimizing post-harvest losses through efficient cold chain integration tailored to local distribution networks and consumer preferences. Export marketing demands advanced cold chain logistics and stringent quality control to maintain freshness and meet international standards, ensuring crop competitiveness in global markets.

Buyer-Specific Quality Grading

Domestic marketing of high-value crops emphasizes buyer-specific quality grading tailored to local consumer preferences and regulatory standards, ensuring freshness and varietal attributes are maintained. Export marketing requires stringent adherence to international quality grades, certifications, and phytosanitary measures to meet diverse global buyer specifications and enhance market competitiveness.

Market Access Risk Analytics

Domestic marketing of high-value crops offers more predictable regulatory environments and shorter supply chains, minimizing market access risks related to compliance and logistics. Export marketing involves complex international regulations, tariff uncertainties, and varying quality standards, requiring advanced market access risk analytics to optimize pricing strategies and ensure timely delivery.

Digital Commodity Aggregation Platforms

Domestic marketing of high-value crops leverages digital commodity aggregation platforms to streamline supply chains, enhance price transparency, and connect small-scale farmers with local buyers efficiently. Export marketing benefits from these platforms by enabling real-time access to international demand data, facilitating compliance with global standards, and optimizing logistics to meet export timelines and quality requirements.

Eco-Labeling for Export Readiness

Eco-labeling enhances export readiness for high-value crops by verifying sustainable practices, thereby increasing market access and consumer trust in international markets. Domestic marketing often prioritizes price and volume, while export marketing leverages eco-labels to meet stringent environmental standards and command premium prices abroad.

Domestic GAP (Good Agricultural Practices) Benchmarking

Domestic marketing for high-value crops emphasizes adherence to Domestic GAP (Good Agricultural Practices) benchmarking to ensure quality, safety, and sustainability, aligning with local consumer preferences and regulatory standards. Export marketing, while also reliant on GAP, requires compliance with international certifications and stricter quality controls to meet diverse global market demands and enhance competitive advantage.

Domestic marketing vs Export marketing for high-value crops Infographic

agridif.com

agridif.com