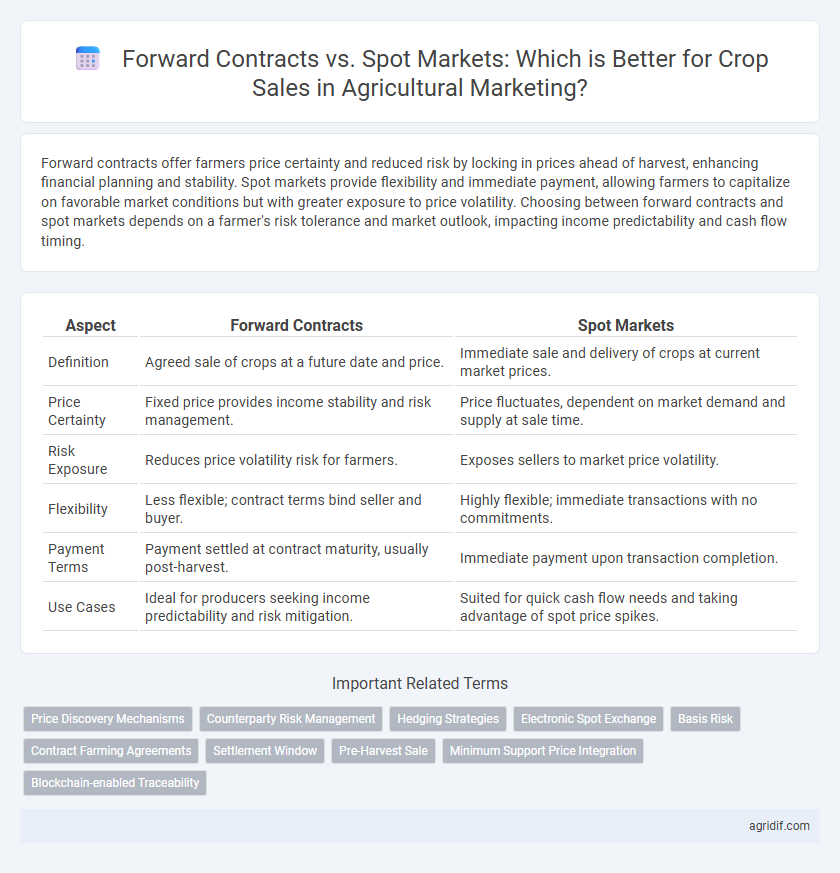

Forward contracts offer farmers price certainty and reduced risk by locking in prices ahead of harvest, enhancing financial planning and stability. Spot markets provide flexibility and immediate payment, allowing farmers to capitalize on favorable market conditions but with greater exposure to price volatility. Choosing between forward contracts and spot markets depends on a farmer's risk tolerance and market outlook, impacting income predictability and cash flow timing.

Table of Comparison

| Aspect | Forward Contracts | Spot Markets |

|---|---|---|

| Definition | Agreed sale of crops at a future date and price. | Immediate sale and delivery of crops at current market prices. |

| Price Certainty | Fixed price provides income stability and risk management. | Price fluctuates, dependent on market demand and supply at sale time. |

| Risk Exposure | Reduces price volatility risk for farmers. | Exposes sellers to market price volatility. |

| Flexibility | Less flexible; contract terms bind seller and buyer. | Highly flexible; immediate transactions with no commitments. |

| Payment Terms | Payment settled at contract maturity, usually post-harvest. | Immediate payment upon transaction completion. |

| Use Cases | Ideal for producers seeking income predictability and risk mitigation. | Suited for quick cash flow needs and taking advantage of spot price spikes. |

Overview of Forward Contracts and Spot Markets in Agriculture

Forward contracts in agricultural marketing involve an agreement between farmers and buyers to sell and purchase crops at a predetermined price and date, providing price certainty and risk management against market volatility. Spot markets enable the immediate sale and purchase of crops at current market prices, allowing flexibility but exposing producers to price fluctuations. Understanding the trade-offs between price stability with forward contracts and market responsiveness in spot markets is crucial for effective crop sales strategies.

Key Differences Between Forward Contracts and Spot Markets

Forward contracts in agricultural marketing guarantee a fixed price and delivery date for crops, reducing price volatility risk for farmers and buyers. Spot markets involve the immediate sale and purchase of crops at current market prices, which can fluctuate based on supply, demand, and weather conditions. Forward contracts provide price stability and planning certainty, while spot markets offer flexibility and potentially higher returns depending on market trends.

Benefits of Using Forward Contracts for Crop Sales

Forward contracts in agricultural marketing provide farmers with price certainty by locking in rates before harvest, protecting against market volatility and fluctuating spot prices. These agreements enable better financial planning and risk management, facilitating access to credit and investment in farm operations. By securing guaranteed sales, forward contracts reduce marketing costs and help stabilize farm income compared to unpredictable spot market transactions.

Advantages and Risks of Spot Market Transactions

Spot market transactions for crop sales offer immediate payment and quick turnover, providing farmers with essential liquidity and flexibility to respond to market changes. However, spot markets carry price volatility risks due to fluctuating supply and demand, which can result in unpredictable revenues for producers. The lack of price certainty in spot markets contrasts with forward contracts, making risk management a crucial consideration for agricultural marketing strategies.

Price Stability: Forward Contracts vs Spot Markets

Forward contracts in agricultural marketing provide price stability by allowing farmers to lock in crop prices before harvest, reducing exposure to volatile market fluctuations. Spot markets, conversely, offer prices based on immediate supply and demand, which can lead to unpredictable revenue and increased financial risk. Utilizing forward contracts enables more predictable cash flow management and improved financial planning for crop sales compared to spot market transactions.

Managing Market Volatility for Farmers

Forward contracts provide farmers with price certainty by locking in sales agreements before harvest, reducing exposure to unpredictable market fluctuations. Spot markets offer flexibility with immediate transactions but expose farmers to price volatility influenced by supply, demand, and weather conditions. Strategically balancing forward contracts and spot market sales helps farmers manage risk and stabilize income in volatile agricultural markets.

Impact on Farmer Income and Financial Planning

Forward contracts provide farmers with price certainty and risk mitigation by locking in prices before harvest, enhancing income stability and facilitating more accurate financial planning. In contrast, spot markets offer potential for higher returns when prices rise but expose farmers to income volatility due to market fluctuations at the time of sale. Choosing between forward contracts and spot markets significantly affects cash flow predictability and the ability to manage operational expenses during the crop cycle.

Role in Supply Chain and Market Access

Forward contracts in agricultural marketing provide farmers with price certainty and guaranteed market access by locking in sales before harvest, facilitating better supply chain planning and reducing price volatility risks. Spot markets offer flexibility and immediate sales opportunities but expose producers to fluctuating prices and uncertain demand, impacting supply chain stability. Both methods influence market access and supply chain efficiency, with forward contracts enhancing predictability and spot markets enabling responsiveness to real-time market conditions.

Legal and Institutional Framework for Crop Contracts

Forward contracts in agricultural marketing provide legally binding agreements between farmers and buyers, ensuring price certainty and delivery terms under established institutional frameworks, which enhance contract enforcement and dispute resolution. Spot markets offer immediate transactions but lack formal legal structures, increasing price volatility and buyer-seller risk exposure in crop sales. Effective legal and institutional frameworks for forward contracts protect stakeholders, reduce transaction costs, and support market stability in crop marketing systems.

Choosing the Right Sales Strategy for Agricultural Producers

Forward contracts in agricultural marketing provide producers with price certainty and risk management by locking in prices before harvest, which helps stabilize income during volatile market conditions. Spot markets offer flexibility and the potential for premium prices when supply is tight or demand surges, but expose producers to price fluctuations and market unpredictability. Choosing the right sales strategy depends on the producer's risk tolerance, cash flow needs, and market outlook, balancing the security of forward contracts with the opportunity-driven nature of spot market sales.

Related Important Terms

Price Discovery Mechanisms

Forward contracts offer farmers price certainty by locking in rates before harvest, reducing exposure to volatile market fluctuations. Spot markets enable immediate price discovery based on current supply and demand conditions, reflecting real-time market dynamics for crop sales.

Counterparty Risk Management

Forward contracts in agricultural marketing offer farmers price certainty and reduce exposure to spot price volatility but introduce counterparty risk requiring careful credit assessment and contract enforcement mechanisms. Spot markets provide immediate payment and eliminate long-term credit risk, yet expose sellers to unpredictable market fluctuations and price uncertainty at the time of sale.

Hedging Strategies

Forward contracts in agricultural marketing allow farmers to lock in crop prices ahead of harvest, providing price certainty and a hedge against market volatility, while spot markets offer immediate sale opportunities but expose producers to fluctuating prices and higher risk. Effective hedging strategies combine forward contracting to secure revenue with timely spot market transactions to capitalize on favorable price movements, optimizing income stability for crop producers.

Electronic Spot Exchange

Forward contracts in agricultural marketing allow farmers to secure prices ahead of harvest, reducing income uncertainty, while electronic spot exchanges facilitate immediate crop sales by providing transparent, real-time market pricing and increased liquidity. The use of electronic spot exchanges enhances price discovery and market accessibility for producers, contrasting with the fixed-price certainty offered by forward contracts in volatile commodity markets.

Basis Risk

Forward contracts in agricultural marketing mitigate price volatility by locking in sales prices before harvest, reducing exposure to market fluctuations but exposing farmers to basis risk--the risk that the local cash price may diverge from the futures price used in the contract. Spot markets offer immediate cash transactions at prevailing prices, eliminating basis risk but increasing vulnerability to unpredictable price drops at the time of sale.

Contract Farming Agreements

Forward contracts in agricultural marketing secure a fixed price for crops before harvest, reducing price volatility risk for farmers and buyers, while spot markets involve immediate sale of produce at current market prices, often exposing parties to unpredictable fluctuations. Contract farming agreements formalize forward contracts by establishing clear terms on production, quality, and delivery schedules, enhancing supply chain stability and encouraging investment in crop production.

Settlement Window

Forward contracts in agricultural marketing allow farmers and buyers to agree on crop prices and quantities ahead of harvest, providing a flexible settlement window that can extend from planting to post-harvest, reducing price uncertainty and cash flow volatility. Spot markets require immediate settlement at harvest, offering quick transaction closure but exposing farmers to price fluctuations and limited negotiation opportunities during the selling period.

Pre-Harvest Sale

Forward contracts enable farmers to lock in prices before harvest, providing price certainty and reducing financial risk in agricultural marketing. Spot markets offer immediate sale based on current prices, exposing farmers to market volatility but allowing potential gains from favorable price fluctuations.

Minimum Support Price Integration

Forward contracts in agricultural marketing provide farmers price certainty by locking in rates before harvest, which helps stabilize income when integrated with government Minimum Support Price (MSP) schemes. In contrast, spot markets offer immediate cash flow but expose farmers to price volatility, often fluctuating below the MSP, thereby underscoring the importance of MSP integration to protect farmers' earnings.

Blockchain-enabled Traceability

Forward contracts in agricultural marketing leverage blockchain-enabled traceability to ensure transparent, tamper-proof recording of crop sales agreements, enhancing trust and reducing disputes between farmers and buyers. Spot markets benefit from blockchain by providing real-time verification of crop quality and origin, facilitating immediate, secure transactions with verified provenance for buyers seeking fresh produce.

Forward contracts vs Spot markets for crop sales Infographic

agridif.com

agridif.com