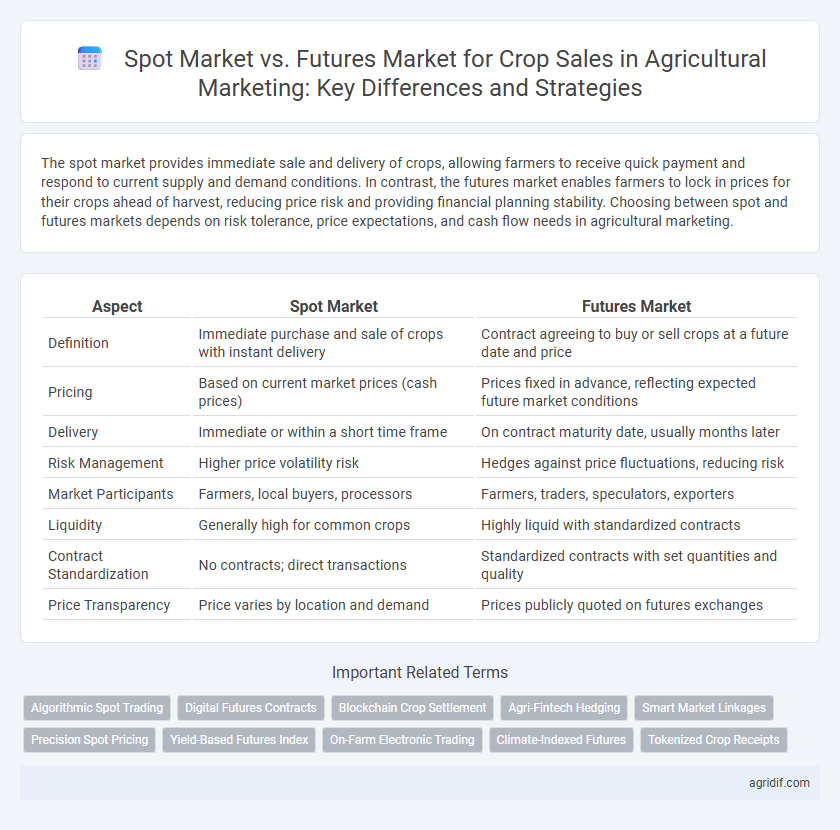

The spot market provides immediate sale and delivery of crops, allowing farmers to receive quick payment and respond to current supply and demand conditions. In contrast, the futures market enables farmers to lock in prices for their crops ahead of harvest, reducing price risk and providing financial planning stability. Choosing between spot and futures markets depends on risk tolerance, price expectations, and cash flow needs in agricultural marketing.

Table of Comparison

| Aspect | Spot Market | Futures Market |

|---|---|---|

| Definition | Immediate purchase and sale of crops with instant delivery | Contract agreeing to buy or sell crops at a future date and price |

| Pricing | Based on current market prices (cash prices) | Prices fixed in advance, reflecting expected future market conditions |

| Delivery | Immediate or within a short time frame | On contract maturity date, usually months later |

| Risk Management | Higher price volatility risk | Hedges against price fluctuations, reducing risk |

| Market Participants | Farmers, local buyers, processors | Farmers, traders, speculators, exporters |

| Liquidity | Generally high for common crops | Highly liquid with standardized contracts |

| Contract Standardization | No contracts; direct transactions | Standardized contracts with set quantities and quality |

| Price Transparency | Price varies by location and demand | Prices publicly quoted on futures exchanges |

Understanding Spot Markets in Crop Sales

Spot markets in crop sales involve the immediate exchange of agricultural commodities at current market prices, enabling farmers to receive instant payment upon delivery. Prices in spot markets reflect real-time supply and demand dynamics, often influenced by seasonal factors, local conditions, and crop quality. Understanding spot markets helps producers capitalize on favorable market conditions without the complexities of contract obligations inherent in futures trading.

What Are Futures Markets in Agriculture?

Futures markets in agriculture enable farmers and buyers to contract the sale and purchase of crops at predetermined prices and delivery dates, reducing the risk of price volatility. These markets provide standardized contracts traded on exchanges, offering liquidity and transparent price discovery for commodities like wheat, corn, and soybeans. By using futures contracts, agricultural producers can hedge against adverse price movements, ensuring predictable revenue streams and stabilizing farm income.

Key Differences Between Spot and Futures Markets

Spot markets involve the immediate exchange of agricultural products at current prices, enabling farmers to sell crops like wheat or corn for instant delivery and payment. Futures markets, on the other hand, allow producers and buyers to agree on a price for crops to be delivered at a later date, providing a hedge against price volatility in commodities such as soybeans or rice. The key differences lie in timing of delivery, price certainty, and risk management mechanisms used to stabilize income in agricultural marketing.

Price Volatility in Spot vs Futures Crop Sales

Price volatility in spot markets for crop sales tends to be higher due to immediate supply and demand fluctuations, weather conditions, and seasonal factors affecting availability. Futures markets provide price stability by allowing farmers and buyers to lock in prices in advance, thereby reducing uncertainty and risk associated with unpredictable market swings. Hedging through futures contracts minimizes exposure to spot market volatility, promoting more predictable income and cost planning.

Risk Management for Farmers: Spot vs Futures

Spot markets allow farmers to sell crops immediately at current prices, offering quick liquidity but exposing them to price volatility and unpredictable income. Futures markets enable farmers to lock in prices ahead of harvest, reducing financial risk by hedging against adverse price movements and ensuring more stable revenue. Utilizing futures contracts effectively safeguards farmers from market fluctuations, enhancing overall risk management in agricultural marketing.

Impact on Farmer Revenue: Comparing Market Types

Spot markets provide immediate cash transactions for crops, enabling farmers to quickly convert produce into revenue at prevailing local prices. Futures markets offer price stability by allowing farmers to lock in prices ahead of harvest, reducing the risk of price fluctuations but potentially limiting profit if market prices rise. Comparing impacts on farmer revenue, spot markets favor flexibility and immediate income, while futures markets emphasize risk management and predictable earnings.

Role of Spot and Futures Markets in Price Discovery

Spot markets provide immediate price signals based on current supply and demand conditions, enabling farmers to sell crops at prevailing market prices. Futures markets offer a mechanism for price discovery by aggregating information and expectations about future supply, demand, and risks, helping producers and buyers hedge against price volatility. The interaction between spot and futures markets enhances transparency and market efficiency, facilitating better-informed decisions in agricultural commodity trading.

Accessibility and Participation: Spot vs Futures

The spot market offers immediate sale and delivery of crops, providing high accessibility for small-scale farmers and local buyers due to its straightforward, cash-based transactions. In contrast, the futures market involves standardized contracts traded on exchanges, requiring participants to meet margin requirements and understand complex price movements, which favors larger producers and institutional investors. Limited accessibility and higher participation barriers in futures markets restrict small farmers, while spot markets enable broader participation in agricultural trade.

Storage and Delivery Considerations in Both Markets

Spot markets require immediate delivery and payment for crops, eliminating the need for storage but exposing sellers to price volatility at harvest time. Futures markets allow producers to lock in prices ahead of the delivery period, necessitating storage or arranging timely logistics to meet contract delivery dates. Efficient storage facilities and reliable transportation infrastructure are critical to managing risks and ensuring compliance with delivery obligations in futures trading.

Choosing the Right Market for Your Crop Sales

Selecting the appropriate market for crop sales depends on factors such as price volatility, risk tolerance, and delivery timing. Spot markets offer immediate transactions with current prices, ideal for farmers needing quick sales and cash flow. Futures markets provide price certainty and risk management through contracts, enabling producers to hedge against price fluctuations before harvest.

Related Important Terms

Algorithmic Spot Trading

Algorithmic spot trading in agricultural markets enables real-time crop sales by leveraging data-driven models to optimize pricing and inventory decisions on the spot market, providing immediate liquidity compared to the futures market's contract-based transactions. Advanced algorithms analyze weather patterns, supply-demand dynamics, and market trends to execute precise spot trades, minimizing risk and enhancing profitability for farmers and traders in volatile agricultural environments.

Digital Futures Contracts

Digital futures contracts in agricultural marketing enable farmers and traders to lock in crop prices on spot markets while leveraging real-time data and advanced analytics for better risk management. These contracts enhance price transparency and liquidity, reducing exposure to market volatility and streamlining crop sales through secure, blockchain-based platforms.

Blockchain Crop Settlement

Blockchain crop settlement enhances transparency and security in both spot and futures markets by providing immutable transaction records and real-time verification for crop sales. This technology reduces fraud and settlement delays, facilitating efficient price discovery and risk management for agricultural producers and traders.

Agri-Fintech Hedging

Spot markets enable farmers to sell crops immediately at current prices, offering quick liquidity but exposing them to price volatility risks. Futures markets, supported by Agri-Fintech hedging platforms, allow producers to lock in prices in advance, reducing uncertainty and stabilizing income through digital contract management and real-time risk analytics.

Smart Market Linkages

Spot markets facilitate immediate crop sales at current prices, enabling farmers to quickly access cash and reduce storage risks, while futures markets allow producers to hedge against price volatility by locking in prices for future delivery, promoting financial stability. Smart market linkages integrate digital platforms and real-time data analytics to connect farmers directly with buyers, optimizing price discovery and streamlining transactions in both spot and futures markets.

Precision Spot Pricing

Precision spot pricing in agricultural marketing enables real-time determination of crop values based on immediate supply and demand factors, enhancing transparency and efficiency in the spot market. Unlike futures markets that rely on contract-based pricing forecasts, spot market prices reflect actual current conditions, allowing farmers and buyers to make swift, informed decisions on crop sales.

Yield-Based Futures Index

Yield-based futures indexes offer farmers a risk management tool by allowing crop sales to be hedged against yield fluctuations, contrasting with the spot market where prices are fixed at the time of sale. These indexes provide a standardized, transparent benchmark for crop performance, facilitating more accurate price discovery and reducing exposure to adverse yield outcomes in agricultural marketing.

On-Farm Electronic Trading

On-farm electronic trading platforms enhance crop sales by facilitating instant transactions in the spot market, allowing farmers to capitalize on real-time local demand and prices. In contrast, futures markets enable price risk management through standardized contracts traded on commodity exchanges, providing farmers with hedging opportunities to stabilize income against market volatility.

Climate-Indexed Futures

Climate-indexed futures in agricultural marketing offer farmers a risk management tool by linking contract payouts to specific climate data such as rainfall or temperature, mitigating uncertainties in spot market prices caused by weather variability. This innovative approach complements traditional spot market transactions by providing a financial hedge against adverse climate conditions, stabilizing income and improving crop sales predictability.

Tokenized Crop Receipts

Spot markets facilitate immediate buying and selling of crops based on current prices, while futures markets allow participants to hedge against price volatility by locking in prices for future delivery. Tokenized crop receipts enhance transparency and liquidity by digitizing ownership and enabling swift, secure transactions across both spot and futures markets.

Spot Market vs Futures Market for crop sales Infographic

agridif.com

agridif.com