Price discovery in agricultural marketing allows market participants to determine the equilibrium price of commodities through supply and demand interactions, ensuring transparency and efficiency. Price fixation, however, involves setting predetermined prices by regulatory bodies or cooperatives, which can stabilize markets but may reduce market responsiveness. Balancing price discovery with appropriate price fixation mechanisms helps protect farmers' interests while promoting fair trading environments.

Table of Comparison

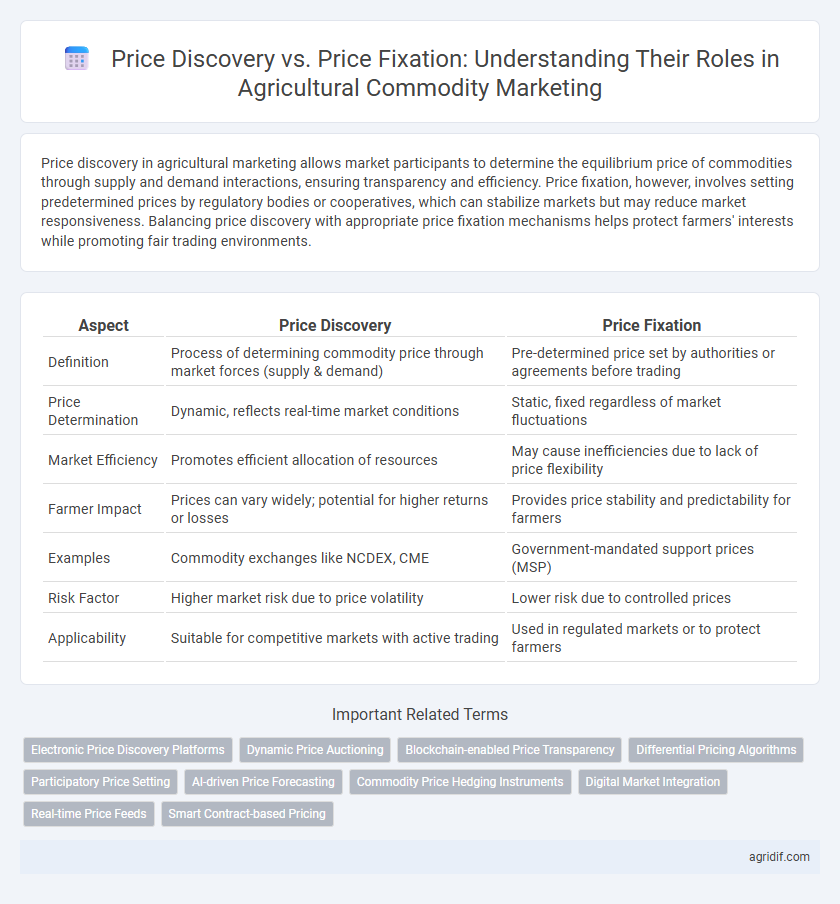

| Aspect | Price Discovery | Price Fixation |

|---|---|---|

| Definition | Process of determining commodity price through market forces (supply & demand) | Pre-determined price set by authorities or agreements before trading |

| Price Determination | Dynamic, reflects real-time market conditions | Static, fixed regardless of market fluctuations |

| Market Efficiency | Promotes efficient allocation of resources | May cause inefficiencies due to lack of price flexibility |

| Farmer Impact | Prices can vary widely; potential for higher returns or losses | Provides price stability and predictability for farmers |

| Examples | Commodity exchanges like NCDEX, CME | Government-mandated support prices (MSP) |

| Risk Factor | Higher market risk due to price volatility | Lower risk due to controlled prices |

| Applicability | Suitable for competitive markets with active trading | Used in regulated markets or to protect farmers |

Introduction to Agricultural Price Mechanisms

Price discovery in agricultural marketing allows market participants to determine commodity prices based on real-time supply and demand dynamics, reflecting localized conditions and seasonal variations. Price fixation, conversely, involves setting prices through regulatory bodies or agreements to stabilize markets and protect stakeholders from extreme volatility. Understanding these price mechanisms is crucial for balancing farmers' income stability with efficient market functioning and consumer affordability.

Understanding Price Discovery in Agriculture

Price discovery in agricultural marketing refers to the dynamic process where buyers and sellers interact to determine the market price of commodities based on supply, demand, and prevailing market conditions. This mechanism reflects real-time information, including weather patterns, crop yields, and global trade influences, enabling transparent and efficient transactions. Understanding price discovery helps stakeholders make informed decisions, adapt to market fluctuations, and optimize profitability in agricultural commodity trading.

The Role of Market Forces in Price Discovery

Market forces play a crucial role in price discovery for agricultural commodities by facilitating the interaction between supply and demand, which determines market-clearing prices. This dynamic process allows for real-time adjustments based on factors such as weather conditions, crop yields, and consumer preferences, ensuring prices reflect actual market conditions. In contrast to price fixation, where prices are set by administrative decisions, market-driven price discovery enhances transparency and efficiency in agricultural marketing.

What is Price Fixation in Agricultural Commodities?

Price fixation in agricultural commodities refers to the predetermined setting of prices by regulatory bodies, government agencies, or cooperatives, rather than allowing market forces of supply and demand to determine prices. This approach aims to stabilize farmers' incomes, protect consumers from price volatility, and ensure fair compensation for producers, especially in volatile markets like grains, fruits, and vegetables. Price fixation often involves minimum support prices (MSP) or price controls that seek to balance market equilibrium while addressing economic and social objectives in the agricultural sector.

Key Differences Between Price Discovery and Price Fixation

Price discovery in agricultural marketing involves real-time determination of commodity prices through market interactions between buyers and sellers, reflecting supply-demand dynamics and external factors like weather and policy changes. In contrast, price fixation refers to predetermined prices set by regulatory bodies or industry agreements, often aimed at stabilizing farmer income and market prices. Key differences include the flexibility and responsiveness of price discovery versus the predictability and control inherent in price fixation systems.

Advantages and Disadvantages of Price Discovery

Price discovery in agricultural commodities allows market-driven pricing that reflects real-time supply and demand, promoting transparency and efficiency for farmers and buyers. It encourages competitive pricing and can lead to better market signals, helping producers adjust production according to market trends. However, price discovery can result in volatility and unpredictability, exposing farmers to risks from sudden price fluctuations influenced by external factors like weather or policy changes.

Pros and Cons of Price Fixation Methods

Price fixation in agricultural commodities ensures price stability, protecting farmers from market volatility and providing predictable income, which can support long-term planning and investment. However, fixed prices may distort true market signals, leading to inefficiencies such as surplus production or shortages and reduced incentives for quality improvement and innovation. Moreover, government intervention for price fixation can result in fiscal burdens and may discourage competitive market dynamics essential for efficient resource allocation.

Impact of Price Policies on Farmers and Markets

Price discovery in agricultural markets enables transparent reflection of supply and demand dynamics, empowering farmers with real-time signals to make informed production decisions. Price fixation, often through government intervention, can provide short-term stability but may distort market incentives, leading to inefficient resource allocation and reduced farmer income over time. Effective price policies must balance market signals with support mechanisms to enhance farmer welfare while ensuring market efficiency and sustainability.

Case Studies: Price Discovery vs Price Fixation in Practice

Case studies in agricultural marketing reveal distinct outcomes between price discovery and price fixation for commodities such as wheat and soybeans. In markets where price discovery mechanisms operate, real-time trading data and open auctions facilitate transparent price signals, adapting swiftly to supply-demand fluctuations. Conversely, price fixation systems, often government-mandated, create fixed price points that can stabilize farmer income but may reduce market responsiveness and distort supply incentives.

The Future of Pricing Mechanisms in Agricultural Marketing

Price discovery in agricultural marketing relies on dynamic market interactions, enabling real-time reflection of supply and demand, while price fixation often involves predetermined governmental or institutional controls that may not adapt swiftly to market fluctuations. Advances in digital platforms and blockchain technology are enhancing transparency and efficiency in price discovery systems, empowering farmers and buyers with timely and accurate information. The future of pricing mechanisms in agricultural commodities will likely emphasize hybrid models combining algorithmic price discovery with regulatory oversight to balance market freedom and price stability.

Related Important Terms

Electronic Price Discovery Platforms

Electronic price discovery platforms enhance transparency and efficiency in agricultural marketing by facilitating real-time price formation based on supply and demand dynamics for commodities such as wheat, corn, and soybeans. These digital systems reduce information asymmetry and price manipulation risks inherent in traditional price fixation methods, empowering farmers and traders with accurate market signals.

Dynamic Price Auctioning

Dynamic price auctioning enhances price discovery for agricultural commodities by reflecting real-time supply and demand fluctuations, enabling market participants to reveal true valuation signals. Unlike price fixation, which sets static prices irrespective of market conditions, dynamic auctions foster transparency and efficiency, reducing arbitrage opportunities and optimizing resource allocation across the agricultural value chain.

Blockchain-enabled Price Transparency

Blockchain-enabled price transparency revolutionizes agricultural marketing by facilitating real-time price discovery through decentralized ledgers that record transactions securely and transparently. This technology reduces information asymmetry between farmers, traders, and buyers, preventing price fixation and promoting fair market valuation of agricultural commodities.

Differential Pricing Algorithms

Differential pricing algorithms enhance price discovery for agricultural commodities by analyzing real-time market signals, supply fluctuations, and demand patterns to establish dynamic prices reflecting actual conditions. These algorithms reduce reliance on fixed price systems, promoting transparency and efficiency in agricultural marketing through adaptive valuation based on granular data inputs.

Participatory Price Setting

Participatory price setting in agricultural commodities enhances price discovery by involving farmers, traders, and other stakeholders directly in determining market prices, reflecting real-time supply and demand conditions. This collaborative approach contrasts with price fixation, which often leads to market distortions and inefficiencies by imposing predetermined prices disconnected from actual market dynamics.

AI-driven Price Forecasting

AI-driven price forecasting enhances price discovery in agricultural commodities by analyzing vast datasets and market signals to predict real-time price fluctuations with high accuracy. This dynamic approach contrasts with traditional price fixation methods, which often rely on static or delayed information, limiting market responsiveness and farmer profitability.

Commodity Price Hedging Instruments

Price discovery for agricultural commodities involves market-driven mechanisms reflecting real-time supply and demand dynamics, while price fixation relies on predetermined prices often set by regulatory bodies. Commodity price hedging instruments, such as futures contracts and options, enable producers and traders to mitigate risks by locking in prices ahead of market fluctuations, thus enhancing price stability and predictability in agricultural marketing.

Digital Market Integration

Digital market integration enhances price discovery for agricultural commodities by providing real-time data on supply, demand, and market trends, leading to more transparent and efficient pricing mechanisms. In contrast, price fixation often limits market responsiveness and can result in misaligned prices that do not reflect current market conditions or farmer incentives.

Real-time Price Feeds

Real-time price feeds enhance price discovery in agricultural commodities by reflecting current market supply and demand conditions, enabling farmers and traders to make informed decisions quickly. Unlike price fixation, which sets static prices often disconnected from market fluctuations, dynamic price discovery supported by live data increases transparency and market efficiency.

Smart Contract-based Pricing

Smart contract-based pricing enhances price discovery in agricultural commodities by automating transparent, real-time market data integration and eliminating intermediaries, which reduces price manipulation risks. This technology enables dynamic price adjustments reflecting supply-demand fluctuations, contrasting with fixed pricing that often leads to market inefficiencies and reduced farmer profitability.

Price Discovery vs Price Fixation for Agricultural Commodities Infographic

agridif.com

agridif.com