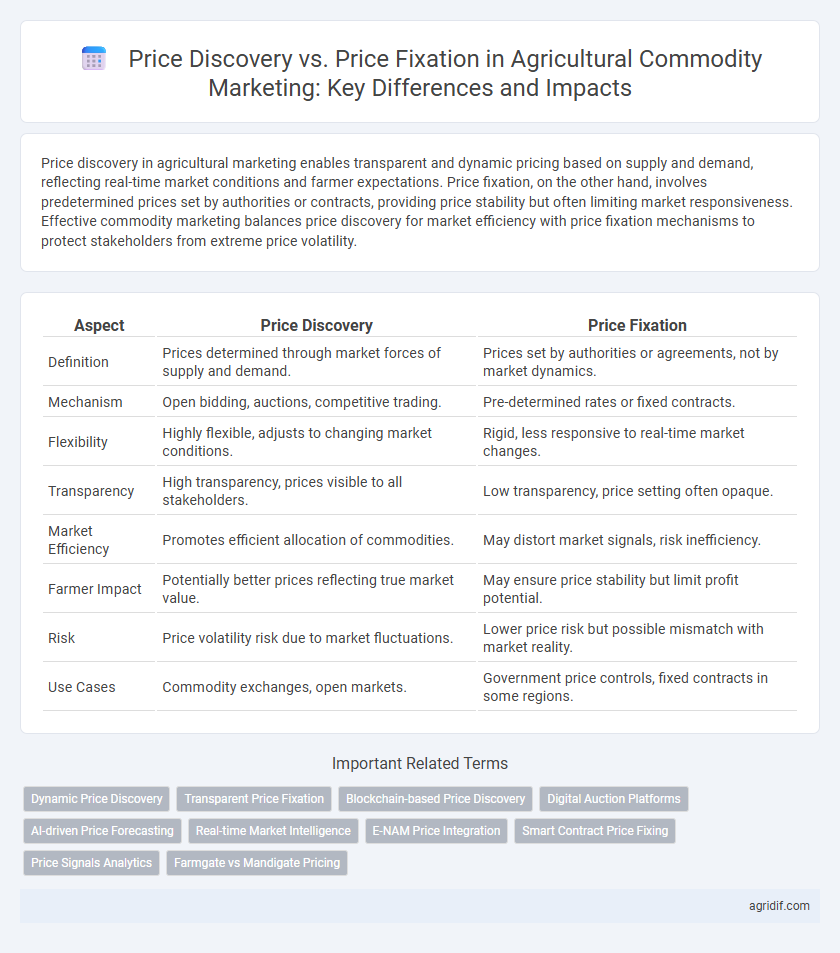

Price discovery in agricultural marketing enables transparent and dynamic pricing based on supply and demand, reflecting real-time market conditions and farmer expectations. Price fixation, on the other hand, involves predetermined prices set by authorities or contracts, providing price stability but often limiting market responsiveness. Effective commodity marketing balances price discovery for market efficiency with price fixation mechanisms to protect stakeholders from extreme price volatility.

Table of Comparison

| Aspect | Price Discovery | Price Fixation |

|---|---|---|

| Definition | Prices determined through market forces of supply and demand. | Prices set by authorities or agreements, not by market dynamics. |

| Mechanism | Open bidding, auctions, competitive trading. | Pre-determined rates or fixed contracts. |

| Flexibility | Highly flexible, adjusts to changing market conditions. | Rigid, less responsive to real-time market changes. |

| Transparency | High transparency, prices visible to all stakeholders. | Low transparency, price setting often opaque. |

| Market Efficiency | Promotes efficient allocation of commodities. | May distort market signals, risk inefficiency. |

| Farmer Impact | Potentially better prices reflecting true market value. | May ensure price stability but limit profit potential. |

| Risk | Price volatility risk due to market fluctuations. | Lower price risk but possible mismatch with market reality. |

| Use Cases | Commodity exchanges, open markets. | Government price controls, fixed contracts in some regions. |

Understanding Price Discovery in Agricultural Markets

Price discovery in agricultural markets refers to the dynamic process where buyers and sellers interact to determine the market price for commodities based on supply, demand, and market conditions. This mechanism reflects real-time information, including weather impacts, crop yields, and global trade flows, enhancing price transparency and aiding farmers in decision-making. Unlike price fixation, which sets prices through regulatory or contractual agreements, price discovery ensures prices are responsive to market signals, promoting efficiency and competitiveness in agricultural commodity marketing.

The Role of Price Fixation in Commodity Marketing

Price fixation in commodity marketing establishes a predetermined price that helps stabilize market expectations and reduces volatility for producers and consumers. This mechanism supports efficient supply chain planning and protects stakeholders from unpredictable market fluctuations. Price fixation also facilitates government intervention to ensure fair pricing and prevent exploitation in essential agricultural markets.

Key Differences: Price Discovery vs Price Fixation

Price discovery in agricultural marketing involves the dynamic process where market forces of supply and demand determine the commodity price through continuous interaction among buyers and sellers, reflecting real-time market conditions. In contrast, price fixation is a predetermined price set by regulatory authorities or market agencies, often aimed at stabilizing markets or protecting producers, which may not immediately respond to changing market dynamics. The key difference lies in price discovery's market-driven price formation versus price fixation's externally imposed pricing mechanism.

Market Mechanisms Facilitating Price Discovery

Market mechanisms facilitating price discovery in agricultural marketing include open outcry auctions, electronic trading platforms, and spot markets, which reflect real-time supply and demand dynamics. Price discovery enables transparent valuation of commodities based on current market conditions, leading to efficient resource allocation and risk management for farmers and traders. These mechanisms counteract price fixation, where prices are pre-determined and may not reflect true market value, potentially causing inefficiencies and distortions in commodity marketing.

Government Intervention and Price Fixation Policies

Government intervention in agricultural marketing often leads to price fixation policies designed to stabilize commodity prices and protect farmers' incomes. These policies can distort the natural price discovery mechanism, where market forces of supply and demand determine prices, resulting in potential inefficiencies and reduced market competitiveness. Price fixation may provide short-term security but often inhibits accurate reflection of market conditions, affecting overall commodity market dynamics.

Advantages of Price Discovery for Farmers and Traders

Price discovery in commodity marketing empowers farmers and traders by reflecting real-time supply and demand dynamics, leading to fair market values. It enhances market transparency and reduces information asymmetry, enabling better decision-making and risk management. This dynamic mechanism promotes competitive pricing, resulting in improved income stability for farmers and optimized trading strategies for market participants.

Limitations and Risks of Price Fixation in Agriculture

Price fixation in agricultural marketing poses significant limitations, including reduced market flexibility and the potential for price distortions that do not reflect true supply and demand dynamics. Fixed prices can discourage farmers from responding to market signals, leading to inefficiencies and potential oversupply or shortages. This approach also increases risks of government intervention failures and market manipulation, ultimately harming both producers and consumers by limiting competitive price discovery mechanisms.

Impact on Smallholder Farmers: Discovery vs Fixation

Price discovery enables smallholder farmers to benefit from transparent market price signals, improving their bargaining power and income by aligning prices with real-time supply and demand. Price fixation, often set by government or cooperatives, can offer short-term price stability but risks suppressing farmers' earnings below market value, potentially limiting investment in production. Empowering smallholders through efficient price discovery mechanisms fosters more equitable and responsive commodity marketing systems that enhance rural livelihoods.

Technological Innovations Boosting Price Transparency

Technological innovations such as blockchain, AI-powered analytics, and digital trading platforms have significantly enhanced price transparency in agricultural commodity markets by enabling real-time data sharing and decentralized price discovery mechanisms. These tools facilitate dynamic price discovery by aggregating vast amounts of market information, reducing information asymmetry, and allowing stakeholders to make more informed decisions based on current supply-demand dynamics. Improved price transparency driven by technology helps prevent price fixation, promotes fair competition, and supports efficient market functioning in agricultural marketing.

Future Trends in Agricultural Price Formation

Price discovery in agricultural marketing leverages real-time data and market signals to reflect supply-demand dynamics accurately, enhancing transparency and efficiency in commodity pricing. Price fixation relies on predetermined benchmarks or government interventions, often limiting responsiveness to volatile market conditions and impacting farmers' income stability. Future trends emphasize integrating advanced analytics, blockchain technology, and decentralized platforms to enable dynamic price discovery, supporting fairer and more resilient agricultural price formation systems.

Related Important Terms

Dynamic Price Discovery

Dynamic price discovery in agricultural marketing enables real-time adjustments of commodity prices based on supply-demand fluctuations, market signals, and buyer-seller interactions, promoting transparency and efficiency. Unlike price fixation, which sets predetermined prices, dynamic discovery enhances market responsiveness, reduces price distortions, and supports fair valuation in volatile commodity markets.

Transparent Price Fixation

Transparent price fixation in commodity marketing enhances trust by providing clear, accessible information on price determinants, enabling farmers and buyers to make informed decisions. This approach reduces market volatility and asymmetry, improving overall efficiency compared to traditional price discovery processes that often lack transparency.

Blockchain-based Price Discovery

Blockchain-based price discovery in agricultural marketing enhances transparency and trust by recording real-time commodity transactions on a decentralized ledger, enabling accurate and tamper-proof market price signals. Unlike price fixation, which sets static prices, blockchain-driven price discovery reflects dynamic supply and demand, reducing information asymmetry and inefficiencies in commodity trading.

Digital Auction Platforms

Digital auction platforms enhance price discovery in commodity marketing by enabling transparent, real-time bidding that reflects true market demand and supply dynamics. This contrasts with price fixation methods, which often rely on predetermined rates, limiting market efficiency and potentially distorting fair commodity values.

AI-driven Price Forecasting

AI-driven price forecasting leverages machine learning algorithms and vast datasets to enhance price discovery by predicting commodity price fluctuations with higher accuracy in agricultural markets. This dynamic approach contrasts with traditional price fixation methods, enabling stakeholders to make informed decisions based on real-time market signals and reduce risks associated with price volatility.

Real-time Market Intelligence

Real-time market intelligence enhances price discovery by providing farmers and traders with up-to-the-minute data on supply, demand, and transaction prices, enabling more accurate and transparent commodity valuation. In contrast, price fixation relies on predetermined or regulated prices that may not reflect current market conditions, often leading to inefficiencies and reduced market responsiveness.

E-NAM Price Integration

E-NAM (Electronic National Agriculture Market) facilitates price discovery by aggregating real-time bidding data from multiple mandis, enhancing transparency and competitiveness in commodity marketing. Price fixation, in contrast, relies on predetermined rates that can limit market efficiency and distort true demand-supply dynamics.

Smart Contract Price Fixing

Smart contract price fixing in agricultural commodity marketing automates transparent and tamper-proof price determination based on real-time market data, reducing the risks associated with traditional price discovery methods. This blockchain-enabled process enhances efficiency by enforcing pre-agreed terms without human intervention, resulting in faster settlements and minimized disputes.

Price Signals Analytics

Price discovery in agricultural marketing leverages market-driven price signals to reflect real-time supply and demand dynamics, enhancing transparency and efficiency. Price fixation, conversely, relies on predetermined benchmarks, limiting responsiveness to fluctuating market conditions and potentially distorting commodity valuations.

Farmgate vs Mandigate Pricing

Farmgate pricing reflects the initial price set by farmers based on production costs and local demand, while mandigate pricing involves fixed prices determined by market authorities or cooperatives, often influenced by broader market trends and regulatory policies. Understanding the dynamics between farmgate and mandigate pricing is essential for optimizing commodity marketing strategies and ensuring fair income distribution within agricultural supply chains.

Price Discovery vs Price Fixation for commodity marketing Infographic

agridif.com

agridif.com