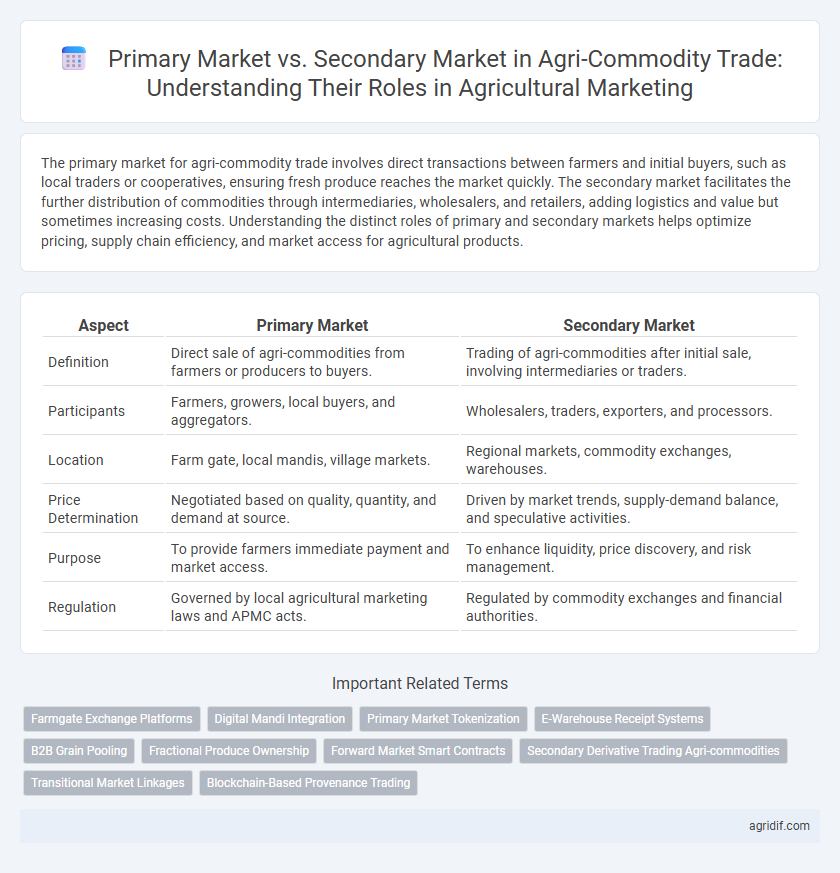

The primary market for agri-commodity trade involves direct transactions between farmers and initial buyers, such as local traders or cooperatives, ensuring fresh produce reaches the market quickly. The secondary market facilitates the further distribution of commodities through intermediaries, wholesalers, and retailers, adding logistics and value but sometimes increasing costs. Understanding the distinct roles of primary and secondary markets helps optimize pricing, supply chain efficiency, and market access for agricultural products.

Table of Comparison

| Aspect | Primary Market | Secondary Market |

|---|---|---|

| Definition | Direct sale of agri-commodities from farmers or producers to buyers. | Trading of agri-commodities after initial sale, involving intermediaries or traders. |

| Participants | Farmers, growers, local buyers, and aggregators. | Wholesalers, traders, exporters, and processors. |

| Location | Farm gate, local mandis, village markets. | Regional markets, commodity exchanges, warehouses. |

| Price Determination | Negotiated based on quality, quantity, and demand at source. | Driven by market trends, supply-demand balance, and speculative activities. |

| Purpose | To provide farmers immediate payment and market access. | To enhance liquidity, price discovery, and risk management. |

| Regulation | Governed by local agricultural marketing laws and APMC acts. | Regulated by commodity exchanges and financial authorities. |

Understanding Primary Markets in Agri-Commodity Trade

Primary markets in agri-commodity trade serve as the initial point where farmers sell their produce directly to traders, aggregators, or cooperatives, ensuring a transparent price discovery process based on supply and demand. These markets are critical for maintaining the quality and perishability standards of fresh agricultural products, offering farmers immediate access to cash flow and reducing post-harvest losses. Efficient primary markets enable better price realization for producers and form the foundation for subsequent transactions in secondary markets, which deal primarily in processed or bulk commodities.

Overview of Secondary Markets for Agricultural Products

Secondary markets for agricultural products facilitate the trading of agri-commodities after their initial sale in primary markets, providing farmers, traders, and processors with increased liquidity and price discovery opportunities. These markets include commodity exchanges, wholesale markets, and digital platforms where standardized contracts and bulk quantities are exchanged, enabling improved market access and risk management. The efficiency of secondary markets helps stabilize prices and enhances supply chain integration for key crops like wheat, rice, and cotton.

Key Differences: Primary vs Secondary Agricultural Markets

Primary agricultural markets facilitate direct transactions between farmers and buyers, offering fresh produce at farm gate or local mandis with minimal intermediaries. Secondary agricultural markets involve the resale of commodities by wholesalers, retailers, or processors, providing value addition, storage, and broader market reach. Key differences include the commodity flow stage, price determination mechanisms, and the level of market linkages, where primary markets emphasize immediate sales with limited price negotiation, and secondary markets focus on aggregation, grading, and distribution.

Role of Farmers in Primary Agri-Markets

Farmers play a crucial role in primary agricultural markets by directly supplying raw agri-commodities such as grains, fruits, and vegetables, ensuring the initial point of sale and price discovery. These markets facilitate the aggregation of produce from multiple small-scale farmers, enabling efficient transactions and quality control before goods move to secondary markets like wholesalers or retailers. Effective functioning of primary markets supports farmers' income stability and provides transparency in price mechanisms essential for agri-commodity trade.

Functions of Intermediaries in Secondary Markets

Intermediaries in secondary markets for agri-commodity trade play a crucial role in price discovery, risk management, and efficient distribution of agricultural products. They facilitate liquidity by aggregating supply from multiple primary market sources and connecting it with a broader network of buyers, enhancing market accessibility and reducing transaction costs. These intermediaries also provide essential services such as grading, packaging, storage, and transportation, which improve product quality and shelf-life, enabling smoother trade flows and higher market efficiency.

Pricing Mechanisms in Primary and Secondary Agricultural Markets

Pricing mechanisms in primary agricultural markets are typically determined through direct interactions between farmers and buyers, relying on local supply and demand conditions, often influenced by government-mandated minimum support prices (MSP) and auction systems. Secondary agricultural markets involve intermediaries and traders who set prices based on broader market trends, commodity quality, storage conditions, and external factors such as export demand and input costs. The distinction in pricing mechanisms impacts price discovery, transparency, and the efficiency of value transmission from farm gate to end consumers.

Market Infrastructure: Primary vs Secondary Agri-Markets

Primary agri-markets feature direct farmer-to-buyer transactions with minimal intermediaries, supported by basic infrastructure such as auction sheds, weighing scales, and storage facilities tailored for fresh produce. Secondary agri-markets involve more complex infrastructure, including warehousing, processing units, and advanced logistics networks, enabling value addition and extended shelf life for commodities. Efficient market infrastructure in primary markets ensures timely price discovery, while robust secondary market infrastructure facilitates broader distribution and better market access for agricultural produce.

Impact on Farmer Income: Primary and Secondary Markets

Primary markets allow farmers to sell agri-commodities directly to traders or consumers, often resulting in better price realization and immediate cash flow, which positively impacts farmer income. Secondary markets facilitate the resale of commodities through intermediaries, sometimes leading to price dilution and delayed payments that can reduce the financial benefits for farmers. Efficient integration between primary and secondary markets is essential to stabilize prices and enhance overall farmer income in agri-commodity trade.

Government Regulations Affecting Agri-Commodity Markets

Government regulations in agricultural marketing distinctly impact the primary and secondary markets for agri-commodity trade by setting standards for quality, pricing, and trade practices at the farmgate level while influencing storage, transportation, and wholesale operations downstream. Primary markets are affected by regulations such as Minimum Support Prices (MSP), registration requirements, and direct sale mandates aimed at protecting farmers' interests. In contrast, secondary markets face regulations regarding licensing of traders, quality inspections, and market fees that govern the aggregation, processing, and distribution stages of agri-commodities.

Challenges and Opportunities in Primary and Secondary Market Systems

Primary markets for agri-commodity trade face challenges such as limited infrastructure, price volatility, and low farmer bargaining power, yet offer opportunities for direct farmer engagement and improved price discovery. Secondary markets encounter issues like market fragmentation, information asymmetry, and regulatory hurdles, but provide scalability, increased trading volumes, and better access to diverse buyers. Strengthening digital platforms and supply chain integration can mitigate challenges and unlock value across both primary and secondary agricultural market systems.

Related Important Terms

Farmgate Exchange Platforms

Farmgate exchange platforms streamline agricultural marketing by facilitating direct transactions between farmers and buyers within the primary market, reducing intermediaries and ensuring better price realization for producers. In contrast, the secondary market involves resale and redistribution of agri-commodities, where prices are often influenced by market speculation and supply chain complexities.

Digital Mandi Integration

Primary markets serve as the initial point of sale where farmers directly sell agri-commodities, while secondary markets involve further trading and distribution to wholesalers and retailers; digital mandi integration enhances transparency, price discovery, and market access across both tiers by leveraging online platforms and real-time data analytics. This digital transformation optimizes supply chain efficiency and empowers farmers with better pricing information and reduced intermediaries in agri-commodity trade.

Primary Market Tokenization

Primary market tokenization in agricultural commodity trade enables direct digitization of assets at the initial point of sale, improving transparency and liquidity for farmers by converting physical commodities into tradable digital tokens. This innovation enhances price discovery and reduces intermediaries compared to secondary markets, where tokens are exchanged post-initial sale, often reflecting speculative values rather than the actual commodity's real-time market condition.

E-Warehouse Receipt Systems

Primary markets facilitate direct transactions between farmers and buyers, enabling initial sales of agri-commodities, while secondary markets involve trading of warehouse receipts representing stored goods, enhancing liquidity and price discovery. E-Warehouse Receipt Systems digitize these receipts, ensuring secure, transparent, and efficient transactions that reduce transaction costs and improve access to finance for farmers and traders.

B2B Grain Pooling

Primary markets for agri-commodity trade involve direct transactions between producers and buyers, facilitating initial grain sales through B2B grain pooling, which aggregates supply to enhance bargaining power and reduce transaction costs. Secondary markets enable the trading of pooled grain contracts among intermediaries and end-users, providing liquidity and price discovery for agribusiness firms engaged in large-scale grain distribution.

Fractional Produce Ownership

Primary markets in agricultural commodity trade involve direct transactions between farmers and buyers, enabling fractional produce ownership that allows multiple stakeholders to invest in specific crop portions. Secondary markets facilitate the trading of these fractional shares, enhancing liquidity and price discovery while providing farmers with broader access to capital and risk diversification.

Forward Market Smart Contracts

Primary markets in agricultural commodity trade involve the initial sale of products directly from producers to buyers, establishing price discovery and supply agreements, while secondary markets facilitate further trading of these contracts among investors and traders to provide liquidity and risk management. Forward market smart contracts enhance both markets by enabling transparent, secure, and automated execution of terms, reducing counterparty risk and improving efficiency in price hedging for agri-commodities.

Secondary Derivative Trading Agri-commodities

Secondary derivative trading in agricultural commodities involves financial contracts like futures and options, enabling traders to hedge risks and speculate on price fluctuations beyond the primary market's physical exchange. This market enhances liquidity and price discovery, allowing participants to manage volatility linked to factors such as weather, supply chain disruptions, and global demand shifts.

Transitional Market Linkages

Primary markets facilitate direct transactions between farmers and buyers, allowing immediate pricing and sale of agri-commodities at farmgate or local markets. Secondary markets enable aggregation, processing, and distribution, linking regional buyers and exporters through transitional market linkages that improve supply chain efficiency and price discovery.

Blockchain-Based Provenance Trading

Blockchain-based provenance trading enhances transparency and trust in both primary and secondary agricultural commodity markets by securely recording the origin, quality, and transaction history of products. This technology reduces fraud, enables traceability from farm to consumer, and streamlines trust among stakeholders across different market stages.

Primary Market vs Secondary Market for agri-commodity trade Infographic

agridif.com

agridif.com