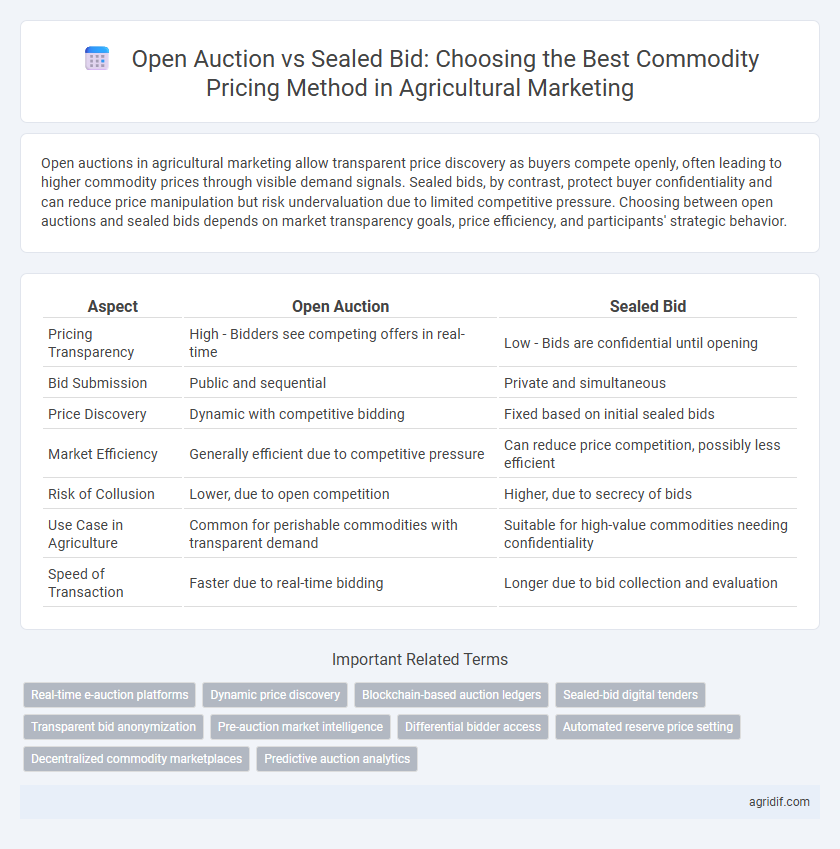

Open auctions in agricultural marketing allow transparent price discovery as buyers compete openly, often leading to higher commodity prices through visible demand signals. Sealed bids, by contrast, protect buyer confidentiality and can reduce price manipulation but risk undervaluation due to limited competitive pressure. Choosing between open auctions and sealed bids depends on market transparency goals, price efficiency, and participants' strategic behavior.

Table of Comparison

| Aspect | Open Auction | Sealed Bid |

|---|---|---|

| Pricing Transparency | High - Bidders see competing offers in real-time | Low - Bids are confidential until opening |

| Bid Submission | Public and sequential | Private and simultaneous |

| Price Discovery | Dynamic with competitive bidding | Fixed based on initial sealed bids |

| Market Efficiency | Generally efficient due to competitive pressure | Can reduce price competition, possibly less efficient |

| Risk of Collusion | Lower, due to open competition | Higher, due to secrecy of bids |

| Use Case in Agriculture | Common for perishable commodities with transparent demand | Suitable for high-value commodities needing confidentiality |

| Speed of Transaction | Faster due to real-time bidding | Longer due to bid collection and evaluation |

Introduction to Commodity Pricing in Agriculture

Open auction in agricultural commodity pricing facilitates transparent price discovery through competitive bidding, allowing farmers and buyers to gauge real-time market value. Sealed bid auctions involve confidential offers submitted by buyers, promoting price competition while reducing potential collusion but limiting real-time price adjustments. Both methods impact commodity pricing efficiency, market transparency, and farmer revenue in distinct ways within agricultural markets.

Overview of Open Auction Systems

Open auction systems in agricultural marketing facilitate transparent commodity pricing by allowing multiple buyers to place competitive bids publicly, ensuring real-time price discovery based on demand. This method encourages price competition, often resulting in higher prices for sellers compared to sealed bid auctions where bids are confidential and submitted simultaneously. Open auctions are widely used for perishable goods like fruits and vegetables due to their capacity for quick price adjustments and efficient market clearing.

Exploring Sealed Bid Mechanisms

Sealed bid mechanisms in agricultural commodity pricing provide sellers with confidential offers, promoting competitive and fair market value without revealing competitors' bids. This approach reduces price manipulation and encourages genuine valuation, enhancing transparency in supply chain transactions. Sealed bids often result in more accurate price discovery compared to open auctions, particularly in volatile markets.

Transparency and Market Efficiency Compared

Open auction in agricultural commodity pricing ensures higher transparency by allowing all participants to observe bids in real time, fostering competitive pricing and reducing information asymmetry. Sealed bid auctions limit visibility into competitors' offers, which can result in less market efficiency due to potential strategic underbidding or overbidding. Transparency in open auctions promotes fair price discovery and greater market liquidity, whereas sealed bids may protect confidentiality but often at the cost of optimal price signals and efficiency.

Price Discovery: Open Auction vs Sealed Bid

Open auctions in agricultural marketing enable transparent price discovery by allowing multiple buyers to openly compete, often driving prices closer to true market value through dynamic bidding. Sealed bid auctions conceal bids until submission, leading to less price transparency and potentially lower final prices due to limited competitive information. Open auctions typically encourage better price discovery compared to sealed bids, benefiting sellers by maximizing commodity pricing efficiency.

Farmer Participation and Accessibility

Open auction formats enhance farmer participation by providing transparent pricing mechanisms and real-time bidding, allowing growers to gauge demand and adjust offers accordingly. Sealed bid systems limit accessibility due to their opaque nature and stringent submission requirements, potentially excluding small-scale farmers unfamiliar with complex bidding procedures. Consequently, open auctions often result in broader farmer inclusivity and more competitive commodity pricing in agricultural markets.

Impact on Producer Revenue

Open auction pricing often leads to higher producer revenue by fostering competitive bidding among buyers, which can drive prices upward based on real-time demand signals. In contrast, sealed bid auctions may limit price discovery since bids are confidential, potentially resulting in lower revenues due to the absence of price competition awareness. Empirical studies in agricultural markets show that open auctions enhance transparency and can increase revenue volatility but generally yield better price realization for producers compared to sealed bid methods.

Risks of Collusion and Manipulation

Open auctions in agricultural marketing expose commodities to higher risks of collusion among bidders, as transparent bidding sequences allow participants to signal and coordinate prices. Sealed bid auctions reduce manipulation opportunities by keeping bids confidential, limiting the ability to form cartels or fix prices. However, sealed bids may result in less price discovery efficiency compared to open auctions, potentially impacting fair market value for agricultural commodities.

Technological Integration in Auction Processes

Open auctions facilitate real-time bidding transparency and price discovery, leveraging digital platforms that allow participants to monitor bids and adjust strategies instantly. Sealed bid auctions benefit from secure, encrypted technologies ensuring bid confidentiality, which enhances trust and reduces collusion in commodity pricing. Advanced data analytics and blockchain integration improve accuracy and fairness in both auction types, optimizing agricultural commodity market efficiency.

Policy Implications and Recommendations

Open auction mechanisms promote transparency and competitive pricing, driving fair market value for agricultural commodities, which supports policy goals of market efficiency and farmer empowerment. Sealed bid systems, while potentially reducing price collusion, may limit price discovery and market transparency, posing challenges for regulatory oversight. Policymakers should encourage open auctions for commodities with active markets and implement stringent monitoring in sealed bid scenarios to balance transparency with anti-collusion measures.

Related Important Terms

Real-time e-auction platforms

Open auction platforms provide real-time price transparency and competitive bidding dynamics for agricultural commodities, enabling farmers and buyers to respond instantly to market fluctuations. Sealed bid formats on e-auction platforms limit immediate market feedback, often resulting in less price discovery and reduced efficiency compared to the dynamic pricing mechanisms of open auctions.

Dynamic price discovery

Open auctions facilitate dynamic price discovery by allowing real-time bidding that reflects current market demand for agricultural commodities, leading to transparent and competitive pricing. Sealed bids limit this responsiveness, as prices are determined without immediate feedback, potentially resulting in less accurate market valuations.

Blockchain-based auction ledgers

Blockchain-based auction ledgers enhance transparency and trust in agricultural commodity pricing by providing immutable records for open auctions, where bidders openly compete, and sealed bids, where bids remain confidential until revealed. These decentralized ledgers reduce fraud and manipulation risks, ensuring fair market value discovery through verifiable transaction histories and real-time auditability.

Sealed-bid digital tenders

Sealed-bid digital tenders enhance commodity pricing transparency and efficiency by allowing farmers and buyers to submit confidential bids simultaneously, reducing price manipulation and bidding wars common in open auctions. This method leverages secure digital platforms to streamline transactions, ensuring fair market value and timely settlement in agricultural marketing.

Transparent bid anonymization

Open auction facilitates transparent commodity pricing through public bids, enabling real-time market-driven price discovery but may expose bidders to competitive influence. Sealed bid auctions enhance bid anonymization by keeping offers confidential until the deadline, reducing strategic manipulation and promoting fair valuation in agricultural markets.

Pre-auction market intelligence

Open auctions provide transparent price discovery by allowing real-time bidding information to influence buyers, enhancing market efficiency through visible competitive dynamics. Sealed bids rely heavily on pre-auction market intelligence, where accurate data on supply, demand, and competitor strategies becomes crucial for bidders to submit optimal offers without price feedback during the auction.

Differential bidder access

Open auction allows transparent price discovery through competitive bidding visible to all participants, enhancing market efficiency for agricultural commodities. Sealed bid restricts bidder access to private offers, which can limit price competition but protect strategic bidding and sensitive pricing information.

Automated reserve price setting

Open auction systems in agricultural marketing allow dynamic price discovery through transparent bidding, while sealed bid auctions rely on confidential offers, often limiting competitive price revelation. Automated reserve price setting leverages market data analytics and machine learning algorithms to optimize reserve prices in both formats, enhancing price efficiency and minimizing the risk of undervaluation for commodities.

Decentralized commodity marketplaces

Open auctions in decentralized commodity marketplaces promote transparent price discovery through real-time bidding, enhancing market efficiency and farmer empowerment. Sealed bids, while preserving price confidentiality, may limit competitive pricing dynamics and reduce market liquidity in agricultural trading.

Predictive auction analytics

Open auctions enable dynamic price discovery by allowing real-time bidding, providing rich data sets for predictive auction analytics that help forecast price trends and buyer behavior. Sealed bid auctions, while less transparent, generate discrete bid data that can be analyzed to predict competitive pricing patterns and optimize commodity marketing strategies.

Open auction vs Sealed bid for commodity pricing Infographic

agridif.com

agridif.com