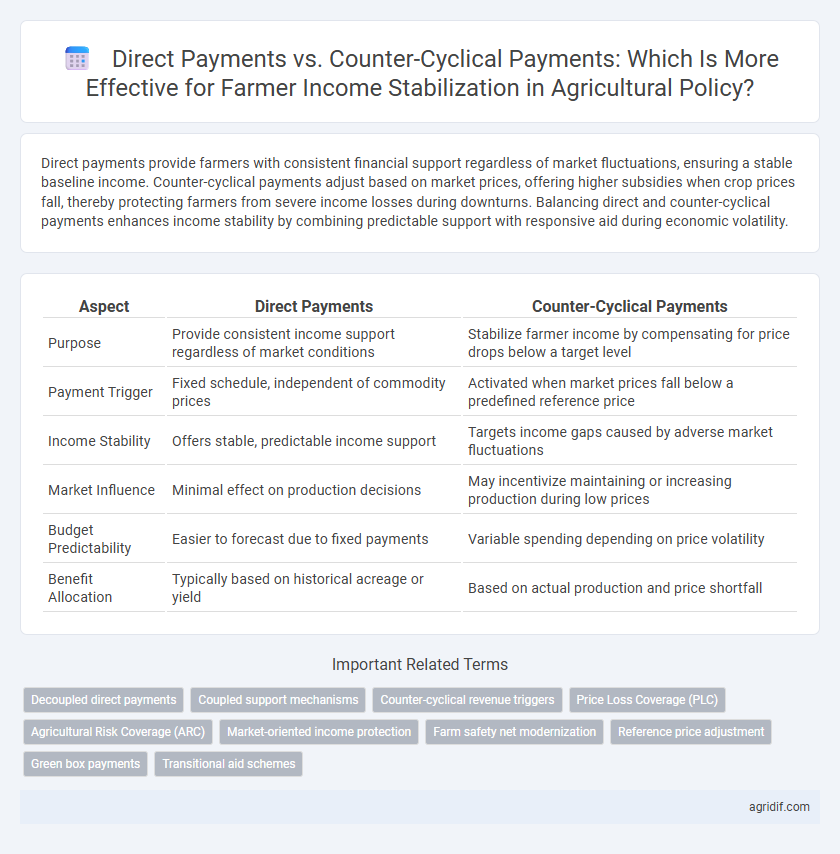

Direct payments provide farmers with consistent financial support regardless of market fluctuations, ensuring a stable baseline income. Counter-cyclical payments adjust based on market prices, offering higher subsidies when crop prices fall, thereby protecting farmers from severe income losses during downturns. Balancing direct and counter-cyclical payments enhances income stability by combining predictable support with responsive aid during economic volatility.

Table of Comparison

| Aspect | Direct Payments | Counter-Cyclical Payments |

|---|---|---|

| Purpose | Provide consistent income support regardless of market conditions | Stabilize farmer income by compensating for price drops below a target level |

| Payment Trigger | Fixed schedule, independent of commodity prices | Activated when market prices fall below a predefined reference price |

| Income Stability | Offers stable, predictable income support | Targets income gaps caused by adverse market fluctuations |

| Market Influence | Minimal effect on production decisions | May incentivize maintaining or increasing production during low prices |

| Budget Predictability | Easier to forecast due to fixed payments | Variable spending depending on price volatility |

| Benefit Allocation | Typically based on historical acreage or yield | Based on actual production and price shortfall |

Overview of Agricultural Income Stabilization Policies

Direct payments provide farmers with a predictable income stream regardless of market fluctuations, helping to stabilize farm revenue in times of low prices. Counter-cyclical payments adjust according to market prices, offering financial support when commodity prices fall below a predetermined target level. Both payment types aim to reduce income volatility but differ in their responsiveness to price changes and budget predictability.

Defining Direct Payments in Agriculture

Direct payments in agriculture are fixed subsidies provided to farmers regardless of current market prices or production levels, ensuring a stable income base. These payments help buffer farmers against price volatility by offering predictable financial support tied to historical acreage or yields rather than current output. Unlike counter-cyclical payments, which activate only when market prices fall below a certain threshold, direct payments deliver consistent income stabilization throughout varying economic conditions.

Understanding Counter-Cyclical Payment Mechanisms

Counter-cyclical payment mechanisms provide farmers with financial support during periods of low market prices by compensating for revenue losses, enhancing income stability compared to direct payments, which offer fixed sums regardless of market fluctuations. These payments adjust dynamically based on market conditions, ensuring targeted assistance during downturns and reducing exposure to price volatility. Understanding the calculation components, such as reference prices and actual market prices, is critical for optimizing counter-cyclical support and improving farm income resilience.

Historical Evolution of Agricultural Support Programs

Direct payments emerged as a key agricultural support mechanism in the 1990s, providing fixed subsidies to farmers regardless of market conditions, simplifying income stabilization. Counter-cyclical payments were introduced later to provide farmers with income support during periods of low commodity prices, targeting financial risk more effectively. The historical evolution of these programs reflects a shift from fixed income support toward more market-responsive tools aimed at enhancing farm income stability and risk management.

Comparative Analysis: Direct vs. Counter-Cyclical Payments

Direct payments provide farmers with fixed income support regardless of market fluctuations, ensuring steady cash flow and simplifying administrative processes. Counter-cyclical payments offer targeted income stabilization by compensating farmers during periods of low commodity prices, thereby addressing revenue volatility more effectively. Comparative analysis indicates that direct payments favor income predictability, while counter-cyclical payments enhance market responsiveness and risk mitigation in agricultural income stabilization.

Impact on Farmer Income Security

Direct payments provide farmers with consistent income support irrespective of market fluctuations, enhancing income stability and reducing financial uncertainty. Counter-cyclical payments trigger only when commodity prices fall below predetermined levels, offering targeted relief during downturns but exposing farmers to income volatility during stable or rising markets. Empirical studies indicate that combining both payment types can balance steady baseline income with responsive support, optimizing farmer income security in volatile agricultural markets.

Market Effects of Different Payment Systems

Direct payments provide consistent income support to farmers regardless of market fluctuations, stabilizing revenues but potentially encouraging overproduction and market distortion. Counter-cyclical payments adjust based on market prices, offering income support during low-price periods which helps to reduce income volatility without significantly impacting production decisions. These differing payment systems influence supply levels and commodity prices, with direct payments potentially leading to surplus supply and suppressed market prices, while counter-cyclical payments aim to balance income stability with market equilibrium.

Administrative Complexity and Policy Implementation

Direct payments offer a simpler administrative structure by providing fixed income support regardless of market fluctuations, reducing the burden on government agencies. Counter-cyclical payments require complex monitoring of market prices and yield data, increasing implementation costs and the risk of delays in disbursement. Efficient policy design minimizes bureaucratic overhead while ensuring timely income stabilization for farmers through accurate market condition assessments.

International Perspectives on Income Stabilization Approaches

Direct payments provide farmers with consistent financial support regardless of market fluctuations, enhancing income stability across diverse international agricultural systems. Counter-cyclical payments adjust to market prices, offering targeted relief during low-price periods, which can stabilize income but introduce variability. Countries like the United States emphasize counter-cyclical measures, while the European Union primarily relies on direct payments, reflecting differing policy priorities in global income stabilization strategies.

Future Directions in Agricultural Income Support Policy

Direct payments provide steady income support regardless of market fluctuations, ensuring baseline financial security for farmers, while counter-cyclical payments activate only during price downturns, targeting income stabilization more precisely. Future agricultural income support policies may increasingly integrate data-driven risk assessments and adaptive mechanisms to balance budget efficiency with effective income stabilization. Emphasizing sustainability and climate resilience, evolving frameworks could prioritize payments that incentivize environmentally responsible practices alongside economic stability.

Related Important Terms

Decoupled direct payments

Decoupled direct payments provide farmers with income support independent of current production levels or market prices, promoting income stability without influencing planting decisions. Counter-cyclical payments, triggered by market price drops, offer targeted financial relief during periods of low commodity prices but may lead to production distortion.

Coupled support mechanisms

Coupled support mechanisms in agricultural policy, such as direct payments linked to current production levels or specific outputs, provide immediate income stabilization by directly incentivizing farmers to maintain or increase production. In contrast, counter-cyclical payments offer income support based on market price fluctuations, but coupled payments more effectively stabilize income by aligning financial aid with actual agricultural activity and regional production conditions.

Counter-cyclical revenue triggers

Counter-cyclical payments for farmer income stabilization are activated when market prices or revenues fall below predefined benchmarks, effectively targeting support during periods of economic downturn in agriculture. Unlike direct payments, these revenue triggers provide a safety net that adjusts with market volatility, helping farmers manage income risks linked to unpredictable commodity prices and yield fluctuations.

Price Loss Coverage (PLC)

Direct payments provide consistent income support to farmers regardless of market fluctuations, while counter-cyclical payments, such as Price Loss Coverage (PLC), activate when market prices fall below predetermined reference levels, effectively stabilizing farmer income during price downturns. PLC targets specific commodity price declines, offering tailored compensation that mitigates revenue losses and enhances financial resilience within volatile agricultural markets.

Agricultural Risk Coverage (ARC)

Agricultural Risk Coverage (ARC) provides counter-cyclical payments to farmers when actual crop revenues fall below a specified benchmark, enhancing income stabilization by targeting revenue shortfalls rather than fixed direct payments. Unlike traditional direct payments, ARC adjusts support based on market conditions and yield fluctuations, offering a more responsive risk management tool in agricultural policy.

Market-oriented income protection

Direct payments provide stable, predictable income to farmers regardless of market fluctuations, while counter-cyclical payments activate only during low-price periods, offering targeted support tied to market conditions. Market-oriented income protection emphasizes counter-cyclical payments to align subsidies with price signals, encouraging farmers to respond to market demands while buffering revenue volatility.

Farm safety net modernization

Direct payments provide fixed income support regardless of market fluctuations, ensuring baseline financial stability for farmers, while counter-cyclical payments adjust based on commodity prices, offering targeted relief during downturns to better stabilize revenue streams. Modernizing the farm safety net emphasizes integrating both mechanisms with advanced risk management tools, enhancing resilience against price volatility and climate-related uncertainties.

Reference price adjustment

Direct payments provide farmers with fixed income support independent of market fluctuations, whereas counter-cyclical payments trigger income support only when market prices fall below a predetermined reference price. Adjusting the reference price in counter-cyclical payment schemes effectively stabilizes farmer income by aligning subsidies with current market conditions, reducing income volatility during price downturns.

Green box payments

Green Box payments under agricultural policy provide direct payments to farmers that are decoupled from production levels and market prices, thereby promoting income stabilization without distorting trade. In contrast, counter-cyclical payments target income stabilization by compensating farmers when market prices fall below a predetermined threshold, but they may influence production decisions and market dynamics.

Transitional aid schemes

Direct payments provide consistent financial support to farmers regardless of market conditions, while counter-cyclical payments activate during low commodity prices to stabilize income. Transitional aid schemes often blend both mechanisms to ensure gradual adjustment and income reliance during policy shifts in agricultural subsidy frameworks.

Direct payments vs counter-cyclical payments for farmer income stabilization Infographic

agridif.com

agridif.com