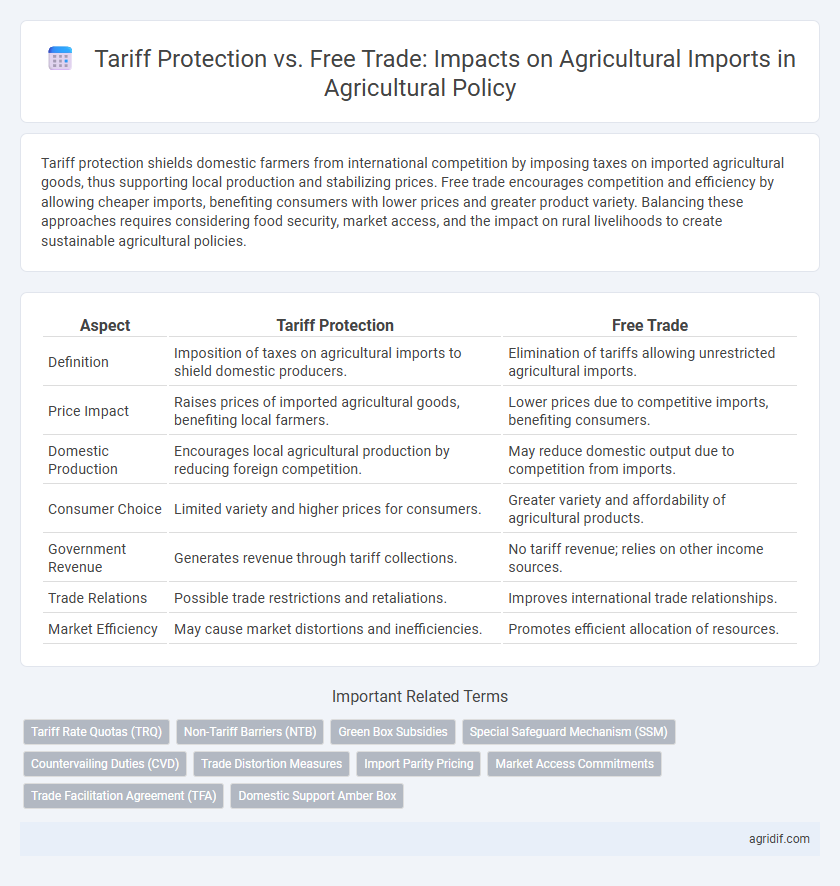

Tariff protection shields domestic farmers from international competition by imposing taxes on imported agricultural goods, thus supporting local production and stabilizing prices. Free trade encourages competition and efficiency by allowing cheaper imports, benefiting consumers with lower prices and greater product variety. Balancing these approaches requires considering food security, market access, and the impact on rural livelihoods to create sustainable agricultural policies.

Table of Comparison

| Aspect | Tariff Protection | Free Trade |

|---|---|---|

| Definition | Imposition of taxes on agricultural imports to shield domestic producers. | Elimination of tariffs allowing unrestricted agricultural imports. |

| Price Impact | Raises prices of imported agricultural goods, benefiting local farmers. | Lower prices due to competitive imports, benefiting consumers. |

| Domestic Production | Encourages local agricultural production by reducing foreign competition. | May reduce domestic output due to competition from imports. |

| Consumer Choice | Limited variety and higher prices for consumers. | Greater variety and affordability of agricultural products. |

| Government Revenue | Generates revenue through tariff collections. | No tariff revenue; relies on other income sources. |

| Trade Relations | Possible trade restrictions and retaliations. | Improves international trade relationships. |

| Market Efficiency | May cause market distortions and inefficiencies. | Promotes efficient allocation of resources. |

Understanding Tariff Protection in Agricultural Imports

Tariff protection in agricultural imports involves imposing taxes on foreign agricultural goods to shield domestic farmers from international competition and stabilize local markets. This policy aims to maintain food security, support rural livelihoods, and reduce reliance on volatile global prices by making imported products more expensive. While tariffs can protect domestic agriculture, they may also lead to higher consumer prices and retaliatory trade measures that impact export opportunities.

The Principles of Free Trade in Agriculture

The principles of free trade in agriculture emphasize reducing tariffs and trade barriers to enhance market efficiency and promote global food security. Tariff protection often leads to inefficiencies, higher consumer prices, and trade distortions, whereas free trade encourages competition, innovation, and resource allocation based on comparative advantage. Empirical studies show that countries adopting liberalized agricultural trade policies tend to experience increased agricultural productivity and diversified export markets.

Comparative Impacts on Domestic Farmers

Tariff protection on agricultural imports shields domestic farmers from international competition by increasing the prices of imported goods, potentially boosting local production and farm incomes. Free trade, on the other hand, exposes domestic agriculture to global market forces, promoting efficiency but risking income instability for farmers unable to compete with lower-cost imports. Empirical studies reveal that while tariffs can temporarily sustain farm livelihoods, long-term reliance on protectionism may hinder innovation and reduce export competitiveness.

Price Stability and Consumer Costs

Tariff protection in agricultural imports helps stabilize domestic prices by shielding local farmers from volatile international markets, ensuring predictable income and food supply. Free trade, conversely, often lowers consumer costs by increasing market competition and product availability, though it may lead to price fluctuations and exposure to global market shocks. Policymakers must balance the benefits of price stability against the advantages of reduced consumer prices when designing agricultural trade policies.

Economic Benefits and Drawbacks of Tariffs

Tariff protection on agricultural imports can safeguard domestic farmers by ensuring higher prices and stable incomes, promoting rural development and food security. However, tariffs often lead to higher consumer prices, reduced market efficiency, and retaliatory trade measures that disrupt global supply chains. Free trade encourages competitive pricing, innovation, and resource allocation based on comparative advantage but may expose local agriculture to volatility and unfair competition from subsidized foreign producers.

International Trade Agreements and Agriculture

International trade agreements such as the World Trade Organization's Agreement on Agriculture aim to reduce tariff protection on agricultural imports, promoting free trade and market access. Tariff protection often distorts global agricultural markets by inflating prices and limiting competition, whereas free trade encourages efficiency, diversification, and technology transfer among participating countries. Balancing tariff rates within trade agreements is critical to safeguarding domestic farmers while enabling competitive participation in international agriculture markets.

Food Security Considerations

Tariff protection on agricultural imports can enhance food security by stabilizing domestic prices and shielding local farmers from volatile global markets. Free trade encourages competition and efficiency, potentially lowering consumer costs but may expose domestic agriculture to risks from price fluctuations and foreign subsidies. Balancing tariff policies with strategic stockpiles and diversification ensures resilient food systems against external shocks.

Trade Wars and Retaliatory Tariffs

Tariff protection in agriculture often leads to trade wars, where countries impose retaliatory tariffs that disrupt global supply chains and increase costs for farmers and consumers. Free trade policies promote market efficiency and competitive pricing but can expose domestic agricultural sectors to price volatility and import surges. Economic models show that prolonged tariff disputes reduce export earnings and hinder food security by limiting access to diverse agricultural products.

Agricultural Innovation and Market Competitiveness

Tariff protection on agricultural imports often limits market competitiveness by reducing incentives for domestic producers to innovate and improve productivity. Free trade policies encourage agricultural innovation by exposing local farmers to international competition, fostering the adoption of advanced technologies and efficient farming practices. Enhanced market competitiveness driven by open trade can lead to greater agricultural sustainability and food security through diversified supply chains.

Long-Term Policy Recommendations

Long-term agricultural policy should balance tariff protection to safeguard domestic farmers with free trade principles to enhance market efficiency and consumer choice. Implementing targeted tariffs can stabilize local agricultural markets during periods of volatility while gradually reducing them incentivizes innovation and competitiveness. Sustainable policy frameworks emphasize investment in technology, infrastructure, and fair international trade agreements to support resilient agricultural sectors.

Related Important Terms

Tariff Rate Quotas (TRQ)

Tariff Rate Quotas (TRQs) balance tariff protection and free trade by allowing a set quantity of agricultural imports at lower tariffs while imposing higher tariffs on volumes exceeding the quota, thus protecting domestic producers without fully restricting market access. This mechanism supports price stability and farmer income in sensitive agricultural sectors while promoting limited competition and consumer choice through controlled import liberalization.

Non-Tariff Barriers (NTB)

Non-Tariff Barriers (NTBs) such as quotas, import licensing, and stringent sanitary and phytosanitary standards often serve as covert tariff protection in agricultural imports, impacting market access and trade flows more than explicit tariffs. These measures can distort competition, increase costs for exporters, and complicate compliance, influencing the balance between protectionism and free trade in agricultural policy frameworks.

Green Box Subsidies

Green Box subsidies under the WTO framework support agricultural production without distorting trade, providing a tariff-free mechanism to protect domestic farmers while promoting compliance with free trade principles. These subsidies enable countries to maintain agricultural stability and environmental sustainability without triggering retaliatory tariffs on imports.

Special Safeguard Mechanism (SSM)

The Special Safeguard Mechanism (SSM) allows countries to impose temporary tariff increases on agricultural imports to protect domestic farmers from sudden surges or price depressions, balancing tariff protection with free trade commitments. Implementing the SSM helps safeguard vulnerable agricultural sectors while promoting market stability and complying with World Trade Organization (WTO) rules.

Countervailing Duties (CVD)

Countervailing Duties (CVD) serve as a critical tool in agricultural policy to counteract subsidized imports that distort market prices and harm domestic producers, effectively balancing tariff protection with free trade commitments. By imposing CVD on unfairly subsidized agricultural imports, governments protect local farmers from price undercutting while maintaining compliance with World Trade Organization (WTO) regulations and promoting equitable trade practices.

Trade Distortion Measures

Tariff protection in agricultural imports imposes taxes on foreign goods, leading to trade distortion measures that inflate domestic prices and reduce market efficiency. Free trade eliminates such barriers, promoting competitive pricing, enhancing resource allocation, and fostering global agricultural supply chain integration.

Import Parity Pricing

Tariff protection in agricultural imports raises import parity pricing, increasing domestic market prices and shielding local producers from cheaper international competition. Free trade lowers import parity pricing by eliminating tariffs, fostering competitive pricing that benefits consumers while pressuring domestic agriculture to enhance efficiency and productivity.

Market Access Commitments

Market access commitments in agricultural policy significantly influence tariff protection levels and free trade dynamics by determining the extent of border measures applied to imports. Reducing tariffs under these commitments facilitates freer trade, enhancing competitive access for agricultural imports and promoting more efficient global supply chains.

Trade Facilitation Agreement (TFA)

The Trade Facilitation Agreement (TFA) enhances agricultural import efficiency by reducing tariffs and streamlining customs procedures, promoting smoother cross-border trade. Tariff protection limits market access and raises costs for exporters, whereas TFA implementation supports free trade by lowering trade barriers and improving regulatory transparency.

Domestic Support Amber Box

Domestic Support Amber Box measures represent trade-distorting agricultural subsidies that directly impact market prices and production levels, often triggering disputes under World Trade Organization (WTO) rules. Tariff protections shield domestic farmers by imposing import barriers, but free trade encourages market efficiency and competitiveness, reducing the reliance on Amber Box subsidies while promoting global agricultural trade liberalization.

Tariff protection vs free trade for agricultural imports Infographic

agridif.com

agridif.com