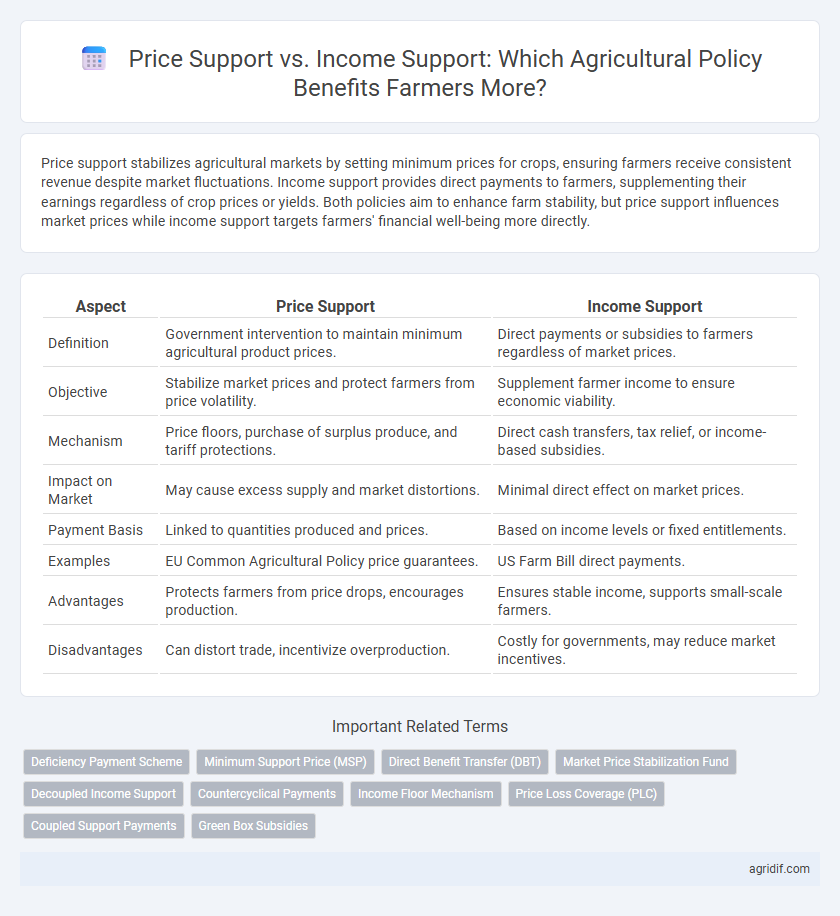

Price support stabilizes agricultural markets by setting minimum prices for crops, ensuring farmers receive consistent revenue despite market fluctuations. Income support provides direct payments to farmers, supplementing their earnings regardless of crop prices or yields. Both policies aim to enhance farm stability, but price support influences market prices while income support targets farmers' financial well-being more directly.

Table of Comparison

| Aspect | Price Support | Income Support |

|---|---|---|

| Definition | Government intervention to maintain minimum agricultural product prices. | Direct payments or subsidies to farmers regardless of market prices. |

| Objective | Stabilize market prices and protect farmers from price volatility. | Supplement farmer income to ensure economic viability. |

| Mechanism | Price floors, purchase of surplus produce, and tariff protections. | Direct cash transfers, tax relief, or income-based subsidies. |

| Impact on Market | May cause excess supply and market distortions. | Minimal direct effect on market prices. |

| Payment Basis | Linked to quantities produced and prices. | Based on income levels or fixed entitlements. |

| Examples | EU Common Agricultural Policy price guarantees. | US Farm Bill direct payments. |

| Advantages | Protects farmers from price drops, encourages production. | Ensures stable income, supports small-scale farmers. |

| Disadvantages | Can distort trade, incentivize overproduction. | Costly for governments, may reduce market incentives. |

Introduction to Price Support and Income Support

Price support programs stabilize agricultural markets by setting minimum prices for crops, ensuring farmers receive a guaranteed price regardless of market fluctuations. Income support compensates farmers directly through subsidies or payments based on farm income, aiming to maintain farm profitability without distorting market prices. Both mechanisms address financial risks but differ in targeting price stability versus farm income security.

Historical Overview of Agricultural Support Policies

Price support mechanisms, historically dominant since the New Deal era, stabilize market prices through interventions such as price floors and supply controls, ensuring farmers receive a minimum income for staple crops like wheat and corn. Income support policies, emerging prominently in the late 20th century, provide direct payments or subsidies independent of market prices, aiming to secure farm household income amid volatile markets and policy reforms. The shift from price support to income support reflects changes in trade agreements, market liberalization, and efforts to reduce market distortions while maintaining farmer welfare.

Mechanisms of Price Support: How It Works

Price support mechanisms stabilize agricultural markets by setting minimum prices for crops, ensuring farmers receive a guaranteed income regardless of market fluctuations. Governments implement tools such as price floors, purchase programs, and import tariffs to maintain these minimum prices, thereby reducing price volatility. This approach incentivizes production but can lead to surplus stockpiles and distortions in supply and demand balance.

Mechanisms of Income Support: Direct Payments Explained

Income support for farmers primarily operates through direct payments, which are cash transfers provided by governments to stabilize farm income regardless of market fluctuations. These payments are often decoupled from production levels, allowing farmers to retain decision-making autonomy while ensuring financial security. Direct payments help mitigate risks associated with price volatility and yield uncertainty, providing a reliable income base compared to price support mechanisms that intervene in market prices.

Impact on Farmer Income Stability

Price support mechanisms stabilize farmer income by guaranteeing minimum prices, reducing market volatility effects. Income support programs provide direct payments, cushioning farmers against unpredictable income fluctuations and ensuring consistent financial resources. Both approaches enhance income stability, but income support offers more targeted and flexible protection against market risks.

Market Distortions and Unintended Consequences

Price support mechanisms often lead to market distortions by artificially inflating agricultural commodity prices, resulting in overproduction and surplus stockpiles that disrupt global trade balance. In contrast, income support programs provide targeted financial aid to farmers without directly affecting market prices, minimizing supply-side inefficiencies and reducing unintended consequences such as resource misallocation. Both approaches influence farmer behavior, but income support tends to maintain market stability while price supports may provoke retaliatory trade measures and exacerbate volatility.

Fiscal Costs and Budgetary Implications

Price support mechanisms often lead to higher government expenditures due to market distortions and surplus stock management, increasing fiscal costs significantly. In contrast, income support programs can deliver targeted assistance with relatively stable budgetary implications by decoupling payments from production levels. Evaluating the trade-offs between these approaches is essential for designing sustainable agricultural policies that balance farmer welfare and public finance efficiency.

Effects on Smallholder vs. Large-Scale Farmers

Price support mechanisms often benefit large-scale farmers more significantly by stabilizing market prices and allowing them to leverage economies of scale, while smallholder farmers may struggle with limited access to subsidized inputs and market fluctuations. Income support schemes, such as direct cash transfers or payments based on land size, tend to provide more equitable assistance by targeting individual farm households regardless of market conditions, thus offering better financial stability for smallholder farmers. Empirical studies indicate that income support enhances smallholder resilience and encourages sustainable practices, whereas price supports primarily drive production expansion among large agribusinesses.

International Trade and Policy Implications

Price support measures, such as minimum price guarantees and tariffs, can distort international trade by creating market imbalances and triggering retaliatory protectionism among trading partners. Income support policies, including direct payments and subsidies, tend to be less trade-distorting as they provide financial assistance without influencing market prices, aligning better with World Trade Organization (WTO) agreements. Policymakers must balance domestic agricultural stability with compliance to global trade rules to avoid trade disputes and ensure sustainable market access.

Future Directions for Farm Support Policy Reform

Future directions for farm support policy reform emphasize shifting from price support mechanisms to direct income support to enhance market efficiency and reduce distortionary effects. Income support programs provide targeted assistance that stabilizes farmer earnings amid price volatility, fostering sustainability and resilience. Integrating environmental and climate-related incentives within income support frameworks aligns agricultural policy with broader goals of sustainability and rural development.

Related Important Terms

Deficiency Payment Scheme

The Deficiency Payment Scheme compensates farmers by covering the gap between market prices and a predetermined target price, ensuring stable income without inflating market prices. This price support mechanism contrasts with direct income support payments, as it maintains market-driven pricing while mitigating income volatility for farmers.

Minimum Support Price (MSP)

Minimum Support Price (MSP) acts as a critical price support mechanism that guarantees a fixed price for farmers' crops, ensuring market stability and protecting against price fluctuations. Income support schemes complement MSP by providing direct financial aid, but MSP remains central to safeguarding farmers' revenue through assured procurement and price assurance.

Direct Benefit Transfer (DBT)

Price support mechanisms stabilize market prices by purchasing surplus crops or setting minimum support prices, while income support through Direct Benefit Transfer (DBT) provides targeted financial assistance directly to farmers' bank accounts, ensuring timely and efficient subsidy delivery. DBT reduces leakages and enhances transparency by bypassing intermediaries, promoting equitable resource distribution and improving farmers' purchasing power.

Market Price Stabilization Fund

Price support mechanisms maintain fixed minimum prices for agricultural products through interventions like the Market Price Stabilization Fund, which buys surplus crops to prevent price collapse and ensure market stability. Income support, by contrast, provides direct payments or subsidies to farmers regardless of market prices, aiming to enhance farmer earnings without distorting market pricing signals.

Decoupled Income Support

Decoupled income support provides farmers with financial assistance independent of current production levels or market prices, promoting planting decisions based on market signals rather than subsidies. Unlike price support mechanisms, which directly influence commodity prices by setting minimum thresholds, decoupled payments enhance farm income stability without distorting production incentives.

Countercyclical Payments

Countercyclical payments provide income support to farmers by offering financial aid when market prices fall below a predetermined target, stabilizing farm revenue without directly influencing commodity prices. Unlike price support mechanisms that intervene in market pricing, countercyclical payments adjust for income shortfalls, enabling more flexible and market-oriented agricultural policies.

Income Floor Mechanism

Income floor mechanisms in agricultural policy provide farmers with a guaranteed minimum income, stabilizing earnings regardless of market price fluctuations. This approach contrasts with price support systems by directly ensuring financial security, thereby promoting sustainable farm operations and rural development.

Price Loss Coverage (PLC)

Price Loss Coverage (PLC) provides targeted price support by compensating farmers when market prices fall below a predetermined reference price, ensuring stable revenue streams. Unlike direct income support, PLC focuses specifically on mitigating price risk in commodity markets, thereby promoting agricultural market stability and encouraging production sustainability.

Coupled Support Payments

Coupled support payments directly link financial aid to the production levels of specific crops or livestock, incentivizing farmers to maintain or increase output of targeted commodities. This contrasts with income support, which provides unconditional payments to stabilize farmers' income regardless of production decisions, influencing agricultural supply dynamics differently.

Green Box Subsidies

Green Box subsidies under the WTO framework provide income support to farmers without distorting market prices, distinguishing them from price support mechanisms that can lead to market imbalances. These payments, including direct income support and environmental programs, promote sustainable agriculture by decoupling financial aid from production levels or prices.

Price Support vs Income Support for Farmers Infographic

agridif.com

agridif.com