Price supports stabilize farm income by setting minimum prices for agricultural products, ensuring farmers receive fair compensation despite market fluctuations. Direct payments provide fixed financial assistance to farmers regardless of current commodity prices, offering predictable income and encouraging production stability. Both mechanisms aim to protect agricultural livelihoods but differ in market impact and budgetary implications.

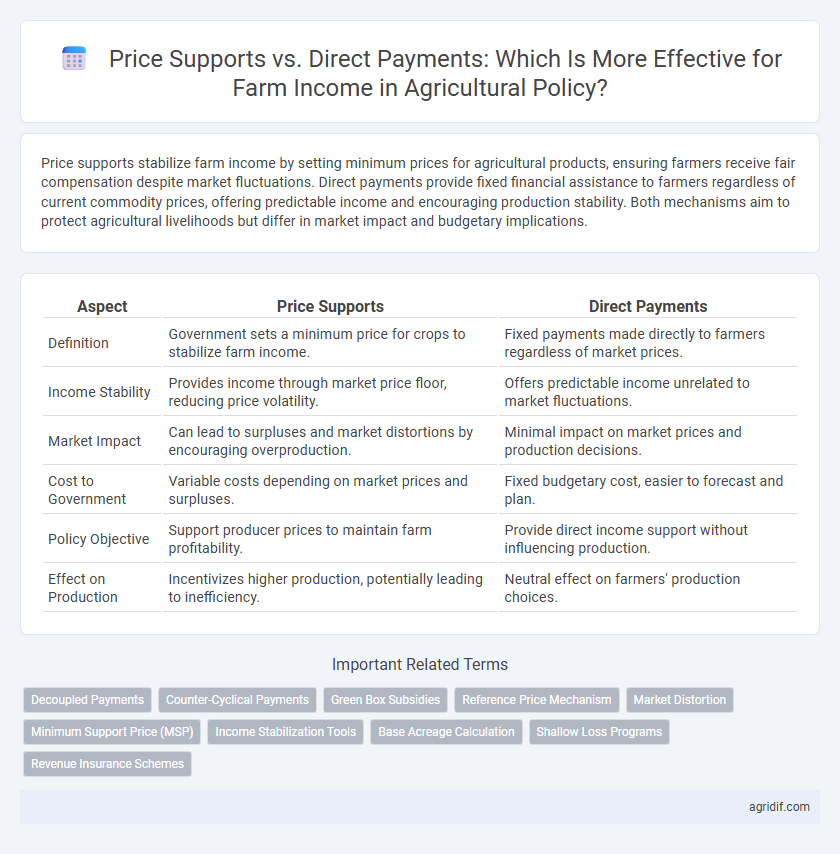

Table of Comparison

| Aspect | Price Supports | Direct Payments |

|---|---|---|

| Definition | Government sets a minimum price for crops to stabilize farm income. | Fixed payments made directly to farmers regardless of market prices. |

| Income Stability | Provides income through market price floor, reducing price volatility. | Offers predictable income unrelated to market fluctuations. |

| Market Impact | Can lead to surpluses and market distortions by encouraging overproduction. | Minimal impact on market prices and production decisions. |

| Cost to Government | Variable costs depending on market prices and surpluses. | Fixed budgetary cost, easier to forecast and plan. |

| Policy Objective | Support producer prices to maintain farm profitability. | Provide direct income support without influencing production. |

| Effect on Production | Incentivizes higher production, potentially leading to inefficiency. | Neutral effect on farmers' production choices. |

Understanding Price Supports in Agricultural Policy

Price supports in agricultural policy involve government interventions that maintain crop and livestock prices above market equilibrium, ensuring stable farm income during market volatility. These supports typically include mechanisms like price floors, government purchases, and supply controls to prevent prices from falling below a certain threshold. By stabilizing prices, price supports protect farmers from price crashes and contribute to food security by ensuring consistent agricultural production.

The Role of Direct Payments in Farm Income Stabilization

Direct payments provide consistent income support to farmers regardless of market fluctuations, stabilizing farm revenues in uncertain economic conditions. Unlike price supports, which intervene by setting minimum prices to influence market supply and demand, direct payments offer predictable financial aid without distorting market prices. This stability helps farmers manage risk, plan investments, and sustain production despite volatile commodity prices.

Comparative Overview: Price Supports vs Direct Payments

Price supports stabilize farm income by maintaining minimum market prices for crops, effectively reducing income volatility in fluctuating commodity markets. Direct payments provide fixed financial assistance to farmers regardless of current market conditions, offering predictable income but potentially encouraging overproduction. Comparing the two, price supports tie assistance to market performance, which can influence supply and demand dynamics, while direct payments deliver consistent revenue regardless of price shifts, impacting budget allocation differently in agricultural policy.

Economic Impacts on Farmers: Which Policy Delivers More Value?

Price supports stabilize farm income by guaranteeing minimum prices, reducing market risk and encouraging production, yet they can lead to market distortions and surplus generation. Direct payments provide farmers with predictable income regardless of market fluctuations, enhancing financial stability without influencing production decisions but may lack responsiveness to price signals. Economically, price supports benefit farmers during price downturns but risk inefficiencies, while direct payments offer consistent value by decoupling income from market volatility, promoting more sustainable agricultural investment.

Market Distortions: Unintended Consequences of Price Supports

Price supports create market distortions by artificially inflating crop prices, leading to overproduction and surplus stockpiles that disrupt supply and demand equilibrium. These unintended consequences can depress global market prices, harming international competitiveness and prompting trade disputes. In contrast, direct payments provide income stability to farmers without incentivizing excess production, reducing market imbalances and promoting more efficient resource allocation.

Direct Payments: Aligning Farm Subsidies with Market Realities

Direct payments provide farmers with fixed income support regardless of market fluctuations, reducing income variability and ensuring financial stability. This approach aligns farm subsidies with market realities by decoupling payments from production levels, discouraging overproduction and promoting sustainable farming practices. By offering predictable revenue streams, direct payments enable farmers to invest in innovation and long-term resource management, enhancing agricultural resilience.

Budgetary Implications for Governments and Taxpayers

Price supports stabilize farm incomes by maintaining minimum market prices, often leading to government expenditure on surplus purchases and storage, thereby increasing budgetary burdens. Direct payments provide fixed income subsidies regardless of market conditions, offering predictable fiscal outlays but potentially encouraging overproduction and market distortion. Governments and taxpayers face trade-offs between fluctuating costs under price supports and steady, though sometimes inefficient, expenditures with direct payments.

International Trade Considerations and WTO Compliance

Price supports raise domestic crop prices by limiting supply or guaranteeing minimum prices, often leading to trade distortions and potential violations of WTO rules on export subsidies and market access. Direct payments, decoupled from production levels, minimize market distortions by providing income support without influencing planting decisions, generally aligning better with WTO commitments under the Agreement on Agriculture. Balancing farm income support with international trade obligations requires designing policies that avoid trade-distorting subsidies while sustaining farmer livelihoods through transparent, non-trade distorting mechanisms.

Effects on Small vs Large-Scale Farmers

Price supports stabilize market prices, benefiting large-scale farmers by maintaining higher income levels through intervention mechanisms such as price floors and supply controls. Direct payments provide fixed subsidies independent of market prices, offering small-scale farmers predictable revenue streams that improve financial stability and farm viability. While price supports can lead to market distortions favoring large agribusinesses, direct payments promote equitable income distribution by targeting smaller operations regardless of production scale.

Future Directions: Reforming Agricultural Income Support Mechanisms

Reforming agricultural income support mechanisms will likely emphasize a shift from traditional price supports to more targeted direct payments that enhance farm resilience and market stability. Future policies may incorporate climate-smart practices and risk management tools to better address the volatility of global commodity markets and environmental challenges. Integrating technology-driven data analytics in subsidy allocation can improve efficiency and promote sustainable agricultural productivity.

Related Important Terms

Decoupled Payments

Decoupled payments provide farmers with income support without influencing production decisions, allowing market signals to guide crop choices and resource allocation. This approach contrasts with price supports, which maintain guaranteed minimum prices but can distort market incentives and lead to overproduction.

Counter-Cyclical Payments

Counter-cyclical payments, a form of price support within agricultural policy, provide farmers with income assistance when market prices fall below target levels, stabilizing farm revenue during downturns. These payments differ from direct payments by activating only in low-price periods, aligning government support with market volatility and enhancing farm income resilience.

Green Box Subsidies

Price supports stabilize farm income by guaranteeing minimum prices for commodities, while Green Box direct payments provide non-distorting financial aid that complies with World Trade Organization rules to promote sustainable agriculture. These Green Box subsidies include environmental protection programs, disaster relief, and rural development, ensuring income support without encouraging overproduction or market distortion.

Reference Price Mechanism

The Reference Price Mechanism stabilizes farm income by setting a baseline price for commodities, triggering government payments when market prices fall below this threshold, ensuring farmers receive consistent revenue. Unlike direct payments, which provide fixed subsidies regardless of market conditions, price supports via reference prices tie financial assistance directly to fluctuating commodity prices, promoting income security while maintaining market responsiveness.

Market Distortion

Price supports create market distortions by artificially inflating crop prices, leading to overproduction and inefficient allocation of resources. Direct payments minimize market interference by providing income support without affecting commodity prices, allowing supply and demand to determine market outcomes more effectively.

Minimum Support Price (MSP)

Minimum Support Price (MSP) guarantees farmers a fixed price for key crops, stabilizing farm income amid market fluctuations, while direct payments provide income support without influencing market prices. MSP acts as a price floor, encouraging production and safeguarding against price crashes, whereas direct payments offer flexible financial aid regardless of output levels.

Income Stabilization Tools

Price supports stabilize farm income by guaranteeing minimum market prices for crops, thereby shielding farmers from volatile commodity prices, while direct payments provide consistent, fixed income regardless of market fluctuations. Both tools are integral to agricultural policy, with price supports influencing market behavior and direct payments offering predictable financial security for farm operators.

Base Acreage Calculation

Base acreage calculation plays a crucial role in determining eligibility and payment levels for both price supports and direct payments in agricultural policy. Accurate assessment of base acreage, reflecting historical production data, ensures fair distribution of subsidies and influences the effectiveness of farm income stabilization programs.

Shallow Loss Programs

Shallow loss programs provide targeted financial support by compensating farmers for small-to-moderate losses in revenue, bridging the gap between price supports and direct payments. These programs enhance farm income stability by offering risk management tools that activate only when losses occur, unlike fixed direct payments or market-distorting price supports.

Revenue Insurance Schemes

Revenue insurance schemes offer farmers protection against income volatility by guaranteeing a minimum level of revenue based on market prices and yield estimates, making them a more market-oriented alternative to traditional price supports and direct payments. These schemes align incentives for risk management, encouraging productivity while reducing reliance on fixed government payments that can distort market signals.

Price Supports vs Direct Payments for Farm Income Infographic

agridif.com

agridif.com