Target prices and loan rates are pivotal tools in agricultural policy for stabilizing farm income and market prices. Target prices guarantee farmers a minimum payment by compensating the difference between the market price and the pre-set target, while loan rates provide a nonrecourse loan using crops as collateral, effectively setting a price floor. These mechanisms work synergistically to reduce price volatility, support farm revenue, and ensure a stable supply chain in the agricultural sector.

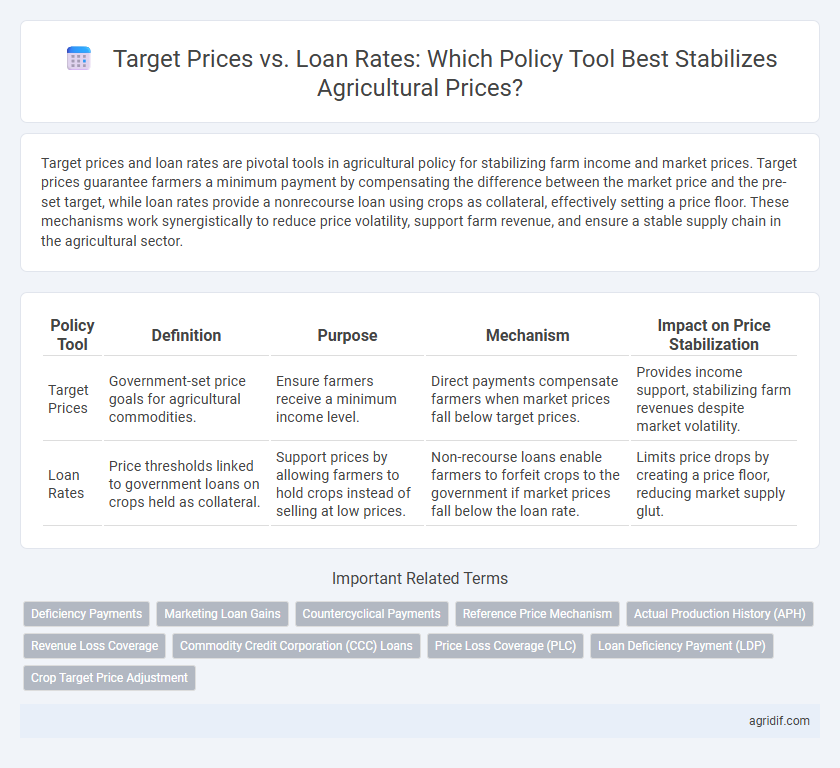

Table of Comparison

| Policy Tool | Definition | Purpose | Mechanism | Impact on Price Stabilization |

|---|---|---|---|---|

| Target Prices | Government-set price goals for agricultural commodities. | Ensure farmers receive a minimum income level. | Direct payments compensate farmers when market prices fall below target prices. | Provides income support, stabilizing farm revenues despite market volatility. |

| Loan Rates | Price thresholds linked to government loans on crops held as collateral. | Support prices by allowing farmers to hold crops instead of selling at low prices. | Non-recourse loans enable farmers to forfeit crops to the government if market prices fall below the loan rate. | Limits price drops by creating a price floor, reducing market supply glut. |

Introduction to Price Stabilization in Agriculture

Target prices and loan rates serve as critical mechanisms in agricultural price stabilization by providing farmers with financial security amid market fluctuations. Target prices set a guaranteed income level for crops, while loan rates function as collateral loans where farmers can store their produce and repay loans later, ensuring minimum revenue. These tools collectively help mitigate risks of price volatility, support stable farm incomes, and promote sustainable agricultural production.

Defining Target Prices and Loan Rates

Target prices serve as predetermined price levels set by agricultural policymakers toBao Zhang farmers' income by compensating the difference between market prices and these target benchmarks. Loan rates are government-established minimum prices for certain commodities, functioning as collateral values for non-recourse loans that provide farmers with a safety net if market prices fall below the loan rate. Together, target prices and loan rates form crucial mechanisms within agricultural policy designed to stabilize farm income and buffer against volatile market conditions.

Mechanisms of Target Prices

Target prices function as a government-guaranteed floor price ensuring farmers receive a minimum payment for their crops, stabilizing income despite market fluctuations. These mechanisms involve direct payments to farmers when market prices fall below the target, effectively bridging revenue gaps caused by volatile commodity prices. Target price programs differ from loan rates by providing payment adjustments without requiring the forfeiture of collateral, optimizing price support and reducing market distortions.

Functioning of Loan Rates in Agriculture

Loan rates in agriculture function as a price support mechanism by establishing a minimum price for crops, preventing market prices from falling below a certain level. Unlike target prices, which provide direct payments to bridge the gap between market prices and desired revenue, loan rates allow farmers to use harvested crops as collateral to secure non-recourse loans, stabilizing income during price volatility. This system maintains market balance by offering price floors, reducing the risk of drastic income fluctuations for farmers.

Comparative Effectiveness: Target Prices vs Loan Rates

Target prices provide farmers with a guaranteed minimum income by compensating the difference between market prices and predetermined target levels, promoting income stability and production planning. Loan rates serve as collateral-based price supports that offer non-recourse loans at set rates, enabling farmers to hold crops when market prices fall, thus reducing immediate market supply fluctuations. Comparative effectiveness studies reveal that target prices more effectively stabilize farm incomes and production decisions, whereas loan rates primarily influence short-term market interventions and inventory management.

Impacts on Farmer Income Stability

Target prices provide a guaranteed minimum income by setting a benchmark price that triggers government payments when market prices fall below this level, ensuring farmer income stability. Loan rates act as a price floor by allowing farmers to use crops as collateral for non-recourse loans, preventing sales below the loan rate and thereby supporting market prices. Both mechanisms stabilize farmer incomes by mitigating the effects of volatile commodity prices, but target prices offer more direct income support compared to the indirect price floor effect of loan rates.

Government Budget Implications

Target prices set by the government establish a guaranteed price floor for farmers, influencing market stability and income predictability. Loan rates function as collateral-based price supports, reducing immediate market intervention but potentially increasing government expenditures through forfeitures. The choice between target prices and loan rates directly impacts government budget allocations, with target prices often requiring higher direct payments, while loan rates may lead to variable costs depending on market conditions and repayment rates.

Market Distortion and Efficiency Concerns

Target prices and loan rates play critical roles in agricultural price stabilization, but each mechanism creates distinct market distortions that affect efficiency. Target prices guarantee farmers a minimum income by setting a floor above market prices, often leading to overproduction and resource misallocation, while loan rates offer non-recourse loans to temporarily support prices, resulting in stockpiling and market imbalances. These interventions can disrupt supply-demand signals, reducing overall market efficiency and potentially encouraging dependency on government support rather than responsive market behavior.

Historical Case Studies and Global Examples

Target prices and loan rates have historically served as crucial mechanisms for price stabilization in agricultural policy, with the U.S. implementing target prices during the 1930s Great Depression to support farmer incomes by guaranteeing minimum prices for commodities like wheat and corn. In contrast, loan rates have been widely used in countries such as Canada and India, providing farmers with non-recourse loans that act as price floors while allowing market sales above the loan rate, effectively stabilizing prices without direct market intervention. Global examples reveal that combining target prices with loan rate schemes can mitigate price volatility, ensuring both income security and market efficiency in volatile agricultural markets.

Policy Recommendations for Future Agricultural Price Stabilization

Target prices should be set above loan rates to provide farmers with a more reliable income floor and reduce market volatility. Implementing flexible target pricing mechanisms based on real-time market data enhances responsiveness to price fluctuations and minimizes government fiscal burdens. Policy recommendations emphasize combining target prices with loan rates to stabilize prices while encouraging sustainable agricultural production and market competitiveness.

Related Important Terms

Deficiency Payments

Target prices set a benchmark for crop prices, ensuring farmers receive a minimum income by compensating the difference when market prices fall below this level; loan rates function as a price floor by allowing farmers to secure government loans using their crops as collateral. Deficiency payments bridge the gap between the target price and the market price, providing direct financial support to stabilize farm incomes without distorting market supply.

Marketing Loan Gains

Target prices provide farmers with a guaranteed minimum income, ensuring price stabilization by compensating when market prices fall below set levels, while loan rates facilitate marketing loan gains by allowing producers to repay nonrecourse loans at lower market prices and benefit from the difference. Marketing loan gains serve as a direct economic incentive that helps stabilize farm income and control surplus by encouraging timely commodity marketing aligned with current market conditions.

Countercyclical Payments

Target prices set a benchmark for farmers' income, triggering countercyclical payments when market prices fall below this threshold, while loan rates provide a safety net through government-backed loans to stabilize income. Countercyclical payments effectively bridge the gap between declining market prices and target prices, ensuring farmers receive consistent financial support despite fluctuations in commodity prices.

Reference Price Mechanism

The Reference Price Mechanism stabilizes agricultural incomes by setting target prices that guarantee farmers a minimum payment when market prices fall below a predefined threshold, contrasting with loan rates which provide non-recourse loans using crops as collateral. Target prices ensure predictable revenue streams, while loan rates act as temporary price floors, both integral to mitigating market volatility in agricultural policy.

Actual Production History (APH)

Target prices provide farmers with a guaranteed minimum income by setting a benchmark price for crops, while loan rates serve as a safety net through non-recourse loans that support crop prices during market downturns. Actual Production History (APH) data is critical in this system, as it determines eligibility and the calculation of payments, ensuring price stabilization aligns with individual farm productivity and risk levels.

Revenue Loss Coverage

Target prices provide direct revenue loss coverage by guaranteeing a minimum income level to farmers, while loan rates serve as collateral values that help stabilize market prices without direct payments. Revenue Loss Coverage programs rely on target prices to compensate producers when market prices fall below predetermined thresholds, ensuring income stability beyond what loan rates can offer.

Commodity Credit Corporation (CCC) Loans

Target prices establish a benchmark for supporting farmers' income by ensuring they receive a minimum price for their crops, while Commodity Credit Corporation (CCC) loans provide nonrecourse loan rates that act as price floors, allowing farmers to use harvested commodities as collateral. Price stabilization is achieved when loan rates set by CCC align closely with target prices, reducing market volatility and protecting producers from sharp price declines.

Price Loss Coverage (PLC)

Target prices set in agricultural policy serve as benchmarks to trigger Price Loss Coverage (PLC) payments when market prices fall below these levels, ensuring income stability for farmers. Unlike loan rates that provide direct market price support through non-recourse loans, PLC leverages target prices to compensate for price deficits, enhancing effective price stabilization.

Loan Deficiency Payment (LDP)

Target prices serve as a benchmark for supporting farmers' income by compensating for the difference between market prices and predetermined levels, while loan rates act as a minimum price guarantee through nonrecourse loans, enabling producers to store crops during price downturns. The Loan Deficiency Payment (LDP) program complements these mechanisms by providing direct payments to farmers who forgo nonrecourse loans when market prices fall below loan rates, stabilizing income without requiring collateral forfeiture.

Crop Target Price Adjustment

Crop target price adjustment serves as a critical mechanism in agricultural policy to stabilize market prices by setting a benchmark that ensures farmers receive fair compensation regardless of market fluctuations. This adjustment complements loan rates by providing a flexible support level; while loan rates offer minimum price guarantees through government-backed loans, target prices are periodically revised based on production costs and market conditions to maintain economic viability for crop producers.

Target prices vs loan rates for price stabilization Infographic

agridif.com

agridif.com