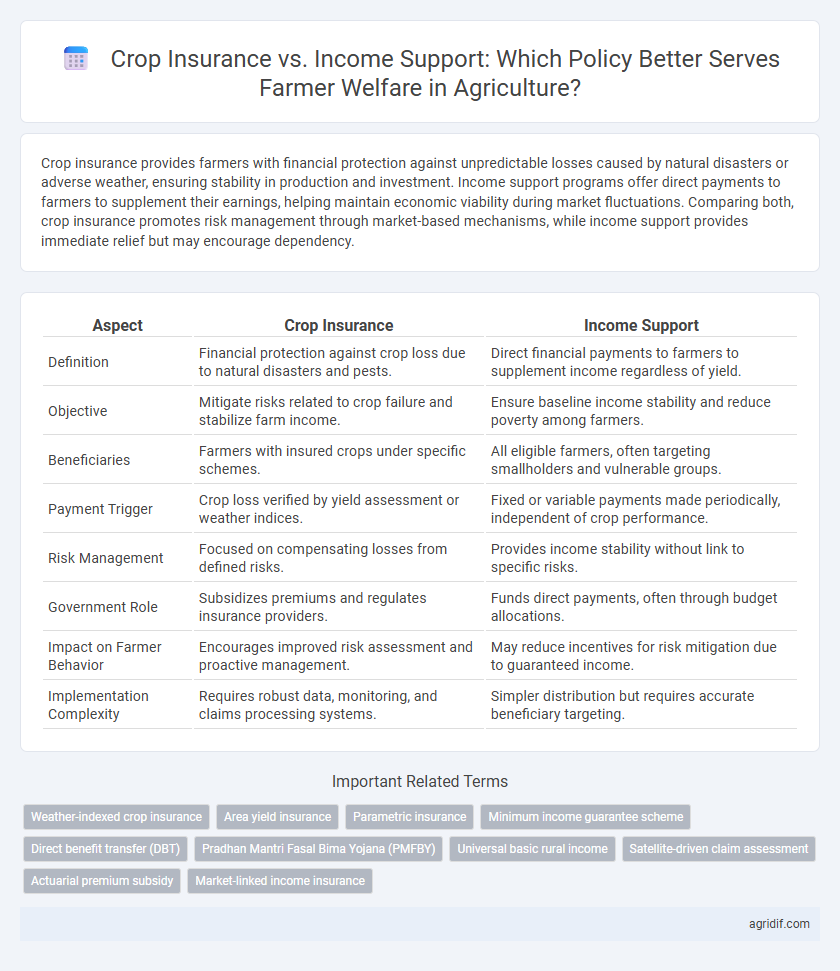

Crop insurance provides farmers with financial protection against unpredictable losses caused by natural disasters or adverse weather, ensuring stability in production and investment. Income support programs offer direct payments to farmers to supplement their earnings, helping maintain economic viability during market fluctuations. Comparing both, crop insurance promotes risk management through market-based mechanisms, while income support provides immediate relief but may encourage dependency.

Table of Comparison

| Aspect | Crop Insurance | Income Support |

|---|---|---|

| Definition | Financial protection against crop loss due to natural disasters and pests. | Direct financial payments to farmers to supplement income regardless of yield. |

| Objective | Mitigate risks related to crop failure and stabilize farm income. | Ensure baseline income stability and reduce poverty among farmers. |

| Beneficiaries | Farmers with insured crops under specific schemes. | All eligible farmers, often targeting smallholders and vulnerable groups. |

| Payment Trigger | Crop loss verified by yield assessment or weather indices. | Fixed or variable payments made periodically, independent of crop performance. |

| Risk Management | Focused on compensating losses from defined risks. | Provides income stability without link to specific risks. |

| Government Role | Subsidizes premiums and regulates insurance providers. | Funds direct payments, often through budget allocations. |

| Impact on Farmer Behavior | Encourages improved risk assessment and proactive management. | May reduce incentives for risk mitigation due to guaranteed income. |

| Implementation Complexity | Requires robust data, monitoring, and claims processing systems. | Simpler distribution but requires accurate beneficiary targeting. |

Overview of Crop Insurance in Agricultural Policy

Crop insurance serves as a risk management tool that safeguards farmers against losses caused by natural disasters, pests, and unpredictable weather, ensuring financial stability and encouraging agricultural investment. It operates by providing indemnity payments based on the extent of crop damage or yield reduction, thereby minimizing the volatility of farm income. This mechanism complements income support schemes by directly linking compensation to crop performance, promoting resilience and sustainability within agricultural policy frameworks.

Understanding Income Support Schemes for Farmers

Income support schemes for farmers provide direct financial assistance to stabilize farm incomes regardless of yield or market fluctuations, ensuring economic security during adverse conditions. Unlike crop insurance, which compensates for specific losses due to natural disasters or crop failure, income support addresses broader income volatility by offering fixed payments or subsidies. These programs enhance farmer welfare by supplementing earnings and reducing dependence on unpredictable agricultural risks, promoting sustainable rural livelihoods.

Key Differences Between Crop Insurance and Income Support

Crop insurance provides financial protection against specific losses due to natural disasters or crop failure, whereas income support offers direct payments to stabilize farmers' overall income regardless of production outcomes. Crop insurance relies on actuarial data and risk assessment to determine premiums and payouts, while income support programs are typically funded through government budgets and aimed at income stabilization. The key difference lies in risk transfer versus income supplementation, influencing policy design and farmer decision-making.

Impact on Farmer Income Stability

Crop insurance provides a direct mechanism to stabilize farmer income by compensating for yield losses due to adverse weather or pests, reducing financial risk and promoting investment in productivity-enhancing technologies. Income support programs offer guaranteed minimum payments irrespective of production outcomes, ensuring baseline income security but potentially reducing incentives for risk management and diversification. Empirical studies indicate that crop insurance more effectively stabilizes income variability, while income support programs contribute to income floor maintenance, highlighting complementary roles in comprehensive agricultural policy frameworks.

Administrative Challenges and Implementation

Crop insurance faces significant administrative challenges including complex claim verification processes and timely premium subsidies, which can delay compensation to farmers. Income support programs simplify implementation by providing direct payments, but risks dependency and may not adequately address localized risk variations. Efficient farmer welfare requires balancing the precise risk coverage of crop insurance with the streamlined delivery of income support schemes.

Cost-Effectiveness for Governments and Farmers

Crop insurance offers targeted financial protection against specific risks such as weather-related crop failures, making it a cost-effective tool for governments by minimizing payout frequencies and incentivizing farmers to adopt risk-reducing practices. Income support programs provide direct payments to farmers regardless of production outcomes, often leading to higher fiscal burdens and potential market distortions without necessarily improving farm resilience. Empirical studies demonstrate that crop insurance schemes can enhance the sustainability of agricultural subsidies by optimizing resource allocation and promoting economic stability for farmers.

Role in Climate Risk and Natural Disaster Management

Crop insurance plays a critical role in managing climate risk and natural disasters by providing farmers with financial protection against yield losses caused by unpredictable weather patterns, droughts, floods, and pest outbreaks. Income support programs offer stable revenue streams that help farmers adapt to long-term climate variability but may lack the direct link to specific climate-induced crop failures that insurance policies address. Together, these mechanisms contribute to agricultural resilience by mitigating economic shocks and promoting sustainable farming practices in the face of climate change.

Socio-Economic Benefits and Drawbacks

Crop insurance provides farmers with risk protection against natural disasters, ensuring stable income and encouraging investment, yet it often requires high premiums and may not cover all losses, potentially excluding smallholders. Income support programs offer direct financial assistance that stabilizes farmer livelihoods during market fluctuations but can lead to dependency and budgetary strains for governments. Both approaches impact socio-economic welfare by balancing financial security and market incentives, with Crop insurance promoting resilience and Income support ensuring immediate relief.

Case Studies: Global Approaches to Farmer Welfare

Global approaches to farmer welfare reveal distinct advantages of crop insurance and income support programs tailored to diverse agricultural economies. In India, crop insurance schemes like the Pradhan Mantri Fasal Bima Yojana mitigate risks of crop failure, enhancing farmer resilience against climate variability. Conversely, the United States employs direct income support payments through the Farm Bill, stabilizing farmer earnings amid market fluctuations and trade uncertainties.

Future Directions in Farmer Welfare Policies

Future directions in farmer welfare policies emphasize integrating crop insurance with robust income support mechanisms to mitigate risks from climate variability and market fluctuations. Combining actuarially sound crop insurance schemes with direct income transfers can enhance financial resilience, ensuring stability in farmer livelihoods. Technological advancements in data analytics and remote sensing are poised to optimize policy targeting and reduce implementation costs, fostering adaptive and sustainable agricultural risk management.

Related Important Terms

Weather-indexed crop insurance

Weather-indexed crop insurance offers farmers direct financial protection against weather-related losses by triggering payouts based on predefined weather parameters, reducing moral hazard and administrative costs compared to traditional crop insurance. Income support programs provide broader economic stability but may lack the precise risk mitigation and incentive alignment that weather-indexed schemes deliver for enhancing farmer welfare under climate variability.

Area yield insurance

Area yield insurance provides farmers with protection against regional crop yield losses due to adverse weather events, offering a risk management tool that directly correlates compensation with aggregate farm performance rather than individual losses. In contrast, income support programs guarantee minimum income levels regardless of production outcomes, potentially reducing incentives for efficient farm management compared to the targeted coverage offered by area yield insurance.

Parametric insurance

Parametric insurance offers farmers streamlined financial protection by triggering payouts based on predefined weather parameters, reducing claim processing times compared to traditional crop insurance. Unlike income support programs that provide direct subsidies, parametric insurance enhances risk management by directly linking compensation to measurable risks such as rainfall deficits or temperature extremes.

Minimum income guarantee scheme

The Minimum Income Guarantee Scheme ensures farmers receive a baseline income regardless of crop yield fluctuations, offering more stable financial security compared to traditional crop insurance, which primarily covers losses from specific risks like weather or pests. By providing consistent income support, this policy effectively reduces rural poverty and encourages sustainable agricultural practices, enhancing overall farmer welfare.

Direct benefit transfer (DBT)

Direct Benefit Transfer (DBT) in agricultural policy enhances farmer welfare by providing timely financial support directly linked to income loss, making crop insurance more efficient and transparent compared to traditional income support schemes. Crop insurance via DBT ensures risk coverage against crop failure, reducing dependency on unpredictable income support and promoting sustainable agricultural practices.

Pradhan Mantri Fasal Bima Yojana (PMFBY)

Pradhan Mantri Fasal Bima Yojana (PMFBY) provides comprehensive crop insurance to mitigate farmer losses due to natural calamities, enhancing financial stability compared to traditional income support schemes. This insurance model emphasizes risk coverage based on crop yield and area, promoting sustainable agricultural practices by directly linking compensation to actual crop damage.

Universal basic rural income

Crop insurance provides targeted risk management by compensating farmers for losses due to adverse weather or pests, while income support schemes, such as Universal Basic Rural Income (UBRI), offer consistent financial stability irrespective of crop outcomes. Implementing UBRI enhances farmer welfare by reducing poverty and ensuring steady cash flow, thereby empowering rural communities beyond the episodic relief provided by crop insurance.

Satellite-driven claim assessment

Satellite-driven claim assessment enhances crop insurance accuracy by providing real-time, data-driven insights on crop health and damage, reducing fraudulent claims and speeding up payouts. Income support schemes lack this precision and timely verification, making satellite technology a critical asset for efficient farmer welfare in agricultural policy.

Actuarial premium subsidy

Actuarial premium subsidies in crop insurance reduce the financial burden on farmers by covering a portion of the risk-based premium, promoting sustainable risk management and crop protection. Income support programs provide direct payments irrespective of loss experience, often lacking the risk pooling benefits that actuarial premium subsidies deliver in enhancing long-term farmer welfare and resilience.

Market-linked income insurance

Market-linked income insurance offers farmers protection against revenue losses by tying payouts to market price fluctuations and yield variations, enhancing risk management compared to traditional crop insurance that covers only specific perils. Compared to direct income support, market-linked insurance incentivizes productivity while stabilizing income through dynamic adjustments aligned with market conditions, promoting sustainable agricultural welfare.

Crop insurance vs Income support for farmer welfare Infographic

agridif.com

agridif.com