Tariff-rate quotas offer a flexible approach by allowing a set quantity of imports at a lower tariff rate, promoting controlled market access while protecting domestic producers. Outright tariffs impose a fixed tax on all imports, creating stronger barriers but potentially leading to higher consumer prices and trade tensions. Balancing these tools can optimize import control by supporting domestic agriculture while maintaining fair market conditions.

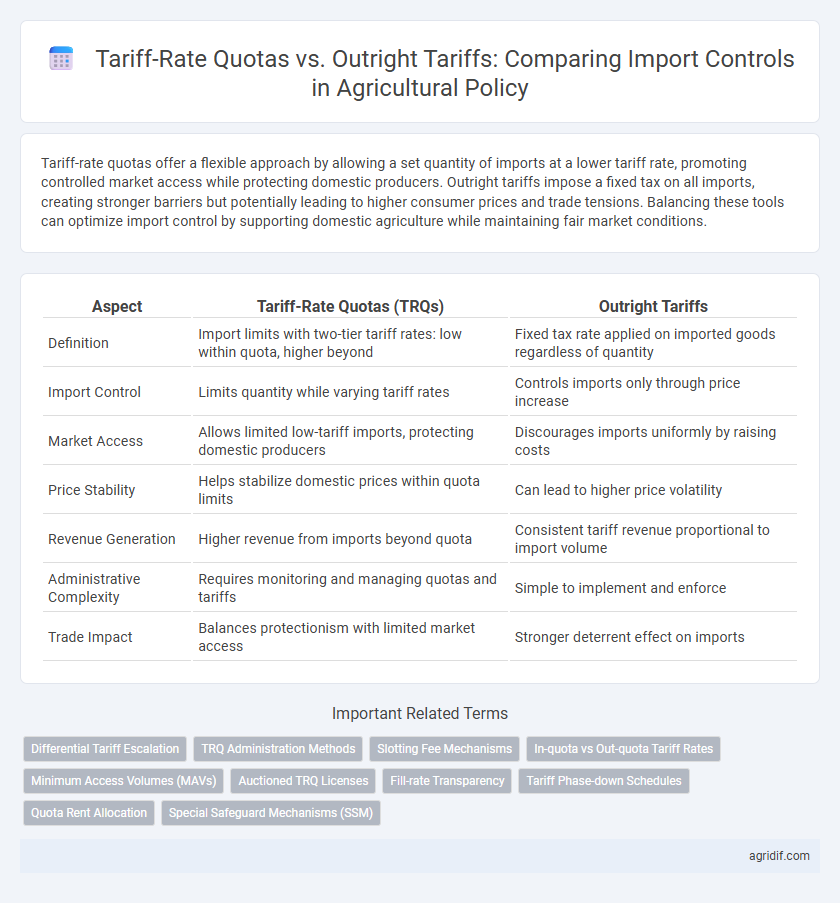

Table of Comparison

| Aspect | Tariff-Rate Quotas (TRQs) | Outright Tariffs |

|---|---|---|

| Definition | Import limits with two-tier tariff rates: low within quota, higher beyond | Fixed tax rate applied on imported goods regardless of quantity |

| Import Control | Limits quantity while varying tariff rates | Controls imports only through price increase |

| Market Access | Allows limited low-tariff imports, protecting domestic producers | Discourages imports uniformly by raising costs |

| Price Stability | Helps stabilize domestic prices within quota limits | Can lead to higher price volatility |

| Revenue Generation | Higher revenue from imports beyond quota | Consistent tariff revenue proportional to import volume |

| Administrative Complexity | Requires monitoring and managing quotas and tariffs | Simple to implement and enforce |

| Trade Impact | Balances protectionism with limited market access | Stronger deterrent effect on imports |

Understanding Tariff-Rate Quotas in Agricultural Policy

Tariff-rate quotas (TRQs) in agricultural policy combine quantity limits with tariff rates, allowing a set amount of imports at a lower tariff while applying higher tariffs to quantities exceeding the quota. This mechanism balances market access and domestic protection by controlling import volumes without fully restricting trade. TRQs offer more flexibility than outright tariffs by mitigating price volatility and supporting the stability of domestic agricultural markets.

Outright Tariffs: Definition and Application in Agriculture

Outright tariffs in agriculture refer to fixed taxes imposed on imported agricultural goods to protect domestic producers and regulate market supply. These tariffs directly increase the cost of foreign products, making local goods more competitive without setting quantity limits. Governments apply outright tariffs to stabilize prices, support farmer incomes, and control import volumes in key sectors like grains, dairy, and meat.

Key Differences Between Tariff-Rate Quotas and Outright Tariffs

Tariff-rate quotas (TRQs) combine quantity limits with variable tariff rates, allowing a specified volume of imports at a lower tariff rate while applying higher tariffs beyond that quota, balancing market protection and trade liberalization. Outright tariffs impose a single fixed tax rate on all imports regardless of quantity, providing straightforward revenue generation but potentially limiting import volumes more rigidly. TRQs offer flexibility and targeted protection to domestic producers, whereas outright tariffs prioritize simplicity and consistent tariff application across import quantities.

Economic Impacts on Domestic Agricultural Producers

Tariff-rate quotas (TRQs) offer a hybrid approach by allowing a specific quantity of imports at a lower tariff rate while imposing higher tariffs on amounts exceeding the quota, effectively moderating market access. Domestic agricultural producers benefit from TRQs as these quotas provide a buffer against import surges, helping stabilize prices and protect farm incomes without completely isolating the market. In contrast, outright tariffs can lead to higher prices for consumers but may provoke retaliatory trade measures, potentially reducing export opportunities for domestic producers and disrupting long-term market stability.

Effects on Agricultural Import Levels and Market Access

Tariff-rate quotas (TRQs) allow a specified quantity of agricultural imports at a lower tariff rate, promoting moderate market access while controlling import volume. Outright tariffs impose a fixed duty on all imports, often restricting market access and significantly reducing agricultural import levels. TRQs balance import control with access, whereas outright tariffs tend to create sharper barriers that limit trade and affect domestic market prices.

Consumer Prices: Tariff-Rate Quotas vs Outright Tariffs

Tariff-rate quotas (TRQs) allow a specified quantity of imports at lower tariff rates, reducing price volatility and helping stabilize consumer prices compared to outright tariffs, which impose a uniform tax on all imports. TRQs protect domestic producers while mitigating sharp increases in consumer prices by permitting limited low-tariff imports that ease supply constraints. Outright tariffs often lead to higher consumer prices due to restricted import volumes and less flexible market adjustments in agricultural commodities.

WTO Regulations and Legal Considerations

Tariff-rate quotas (TRQs) offer a flexible mechanism for agricultural import control by combining lower tariffs within a set quota and higher tariffs beyond it, aligning with WTO regulations that permit such measures under specific conditions to protect domestic markets while maintaining trade balance. Outright tariffs impose a fixed duty on imports regardless of quantity, often triggering stricter scrutiny under WTO rules due to potential trade distortion and compliance issues with the Agreement on Agriculture. Legal considerations under the WTO emphasize transparency, non-discrimination, and adherence to bound tariff rates, making TRQs a preferred approach for managing agricultural imports within international trade obligations.

Case Studies: Successful Implementation in Agriculture

Tariff-rate quotas (TRQs) have shown greater effectiveness than outright tariffs in controlling agricultural imports by allowing controlled access to markets while protecting domestic producers. Case studies from countries like Canada and Australia demonstrate that TRQs maintain market stability and promote fair competition without causing significant price distortions. These implementations align with World Trade Organization guidelines and support sustainable agricultural trade policies.

Policy Recommendations for Import Control in Agriculture

Tariff-rate quotas (TRQs) offer a balanced approach to import control by allowing limited quantities of agricultural products at lower tariff rates, promoting market access while protecting domestic producers from global price shocks. Outright tariffs impose a uniform tax on all imports, which can lead to trade distortions and higher consumer prices, reducing overall market efficiency. Policy recommendations emphasize prioritizing TRQs for their flexibility in managing supply, supporting domestic agriculture, and aligning with international trade commitments under WTO agreements.

Future Trends in Agricultural Import Control Mechanisms

Tariff-rate quotas (TRQs) increasingly replace outright tariffs as a preferred agricultural import control mechanism, balancing protection with market access by allowing a set volume of imports at low tariffs before higher rates apply. Future trends indicate a shift towards more nuanced, volume-contingent measures that accommodate international trade commitments while safeguarding domestic producers amid global supply chain fluctuations. Data from WTO and FAO highlight growing reliance on TRQs to maintain trade equilibrium and promote sustainable agricultural development.

Related Important Terms

Differential Tariff Escalation

Tariff-rate quotas (TRQs) impose lower tariffs on imports within a set quantity and higher tariffs beyond that limit, enabling targeted import control while reducing market disruption. Differential tariff escalation applies higher tariffs to processed goods than raw materials, encouraging domestic processing but complicating trade by affecting the effectiveness of outright tariffs compared to TRQs.

TRQ Administration Methods

Tariff-rate quotas (TRQs) combine quantity limits with tariff rates, allowing a specific import volume at a lower tariff while imposing higher tariffs on quantities beyond the quota, effectively balancing trade protection and market access. TRQ administration methods include licensing systems, first-come first-served allocation, historical import rights, or auction mechanisms, each influencing transparency, efficiency, and distribution of import privileges.

Slotting Fee Mechanisms

Tariff-rate quotas (TRQs) limit agricultural imports by allowing a specified quantity at a lower tariff rate, with higher tariffs applied beyond that limit, effectively controlling market access while minimizing trade disruption. Slotting fee mechanisms complement TRQs by requiring importers to pay fees for access to limited quota slots, incentivizing efficient allocation and reducing rent-seeking behaviors compared to outright tariffs that impose uniform rates without quantity restrictions.

In-quota vs Out-quota Tariff Rates

Tariff-rate quotas (TRQs) impose lower in-quota tariff rates on agricultural imports up to a specified quantity, promoting controlled market access, while applying significantly higher out-quota tariffs on imports exceeding that quota to protect domestic producers. This dual-rate system balances trade liberalization with safeguard measures, contrasting outright tariffs that maintain a uniform rate regardless of import volume.

Minimum Access Volumes (MAVs)

Tariff-rate quotas (TRQs) impose a lower tariff within a specified Minimum Access Volume (MAV), allowing controlled import quantities at favorable rates while applying higher tariffs beyond that threshold to restrict excess imports. MAVs ensure a guaranteed minimum market access under TRQs, balancing protection for domestic producers with compliance to international trade agreements, contrasting with outright tariffs that impose a constant rate regardless of import volume.

Auctioned TRQ Licenses

Auctioned tariff-rate quota (TRQ) licenses efficiently regulate agricultural imports by allocating limited access through competitive bidding, ensuring market-driven pricing and minimizing rent-seeking behavior compared to outright tariffs. This system promotes transparency and revenue generation while maintaining import volume controls, supporting domestic producers without distorting trade as heavily as fixed tariffs.

Fill-rate Transparency

Tariff-rate quotas provide greater fill-rate transparency by explicitly limiting the quantity of imports subject to lower tariffs before higher rates apply, enabling clearer monitoring of import volumes and market impact. Outright tariffs lack this layer of quantity control, making it harder to assess trade flow and policy effectiveness in agricultural import management.

Tariff Phase-down Schedules

Tariff-rate quotas (TRQs) provide a flexible approach by allowing a specific quantity of imports at lower tariff rates before higher tariffs apply, making them more adaptable during tariff phase-down schedules. Outright tariffs impose a fixed duty regardless of quantity, which can lead to sharper market distortions compared to the graduated reductions offered by TRQs in agricultural trade liberalization.

Quota Rent Allocation

Tariff-rate quotas (TRQs) generate quota rents by allowing imports at lower tariff rates up to a specified quota, benefiting importers or domestic quota holders, whereas outright tariffs do not create rents but uniformly increase import costs. Quota rent allocation under TRQs influences market efficiency and distributional outcomes, often requiring transparent mechanisms to prevent rent-seeking and ensure equitable benefits across stakeholders.

Special Safeguard Mechanisms (SSM)

Tariff-rate quotas (TRQs) provide a flexible import control by allowing a set quantity of goods to enter at a lower tariff, with higher rates applying beyond that threshold, effectively protecting domestic markets while meeting trade commitments. Special Safeguard Mechanisms (SSM) offer countries the ability to temporarily increase tariffs in response to import surges or price falls, serving as a targeted tool distinct from outright tariffs by addressing emergency market disruptions without long-term trade restrictions.

Tariff-rate quotas vs outright tariffs for import control Infographic

agridif.com

agridif.com