Effective farm business management requires understanding the distinction between cash flow and profitability, as cash flow tracks the actual inflow and outflow of money essential for daily operations, while profitability measures the overall financial success over a period by comparing revenues and expenses. Positive cash flow ensures that farms have liquidity to cover operational costs such as labor, seeds, and equipment maintenance, even when profits may be temporarily low due to seasonal variations or market fluctuations. Balancing cash flow management with profitability analysis enables farmers to make informed decisions on investments, debt management, and long-term sustainability.

Table of Comparison

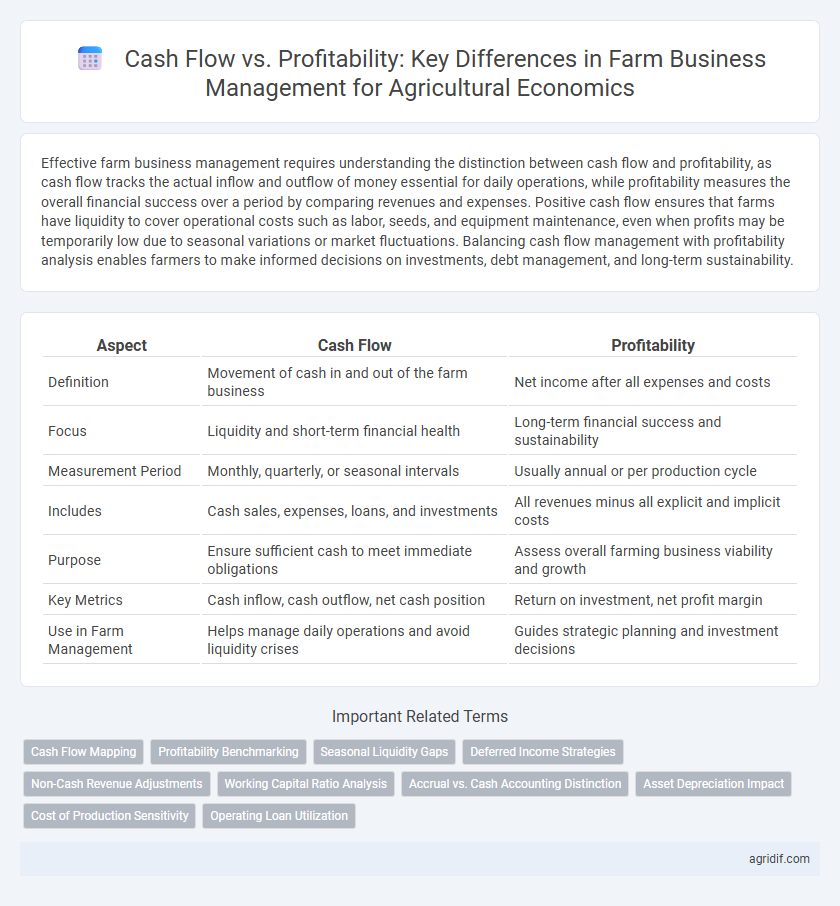

| Aspect | Cash Flow | Profitability |

|---|---|---|

| Definition | Movement of cash in and out of the farm business | Net income after all expenses and costs |

| Focus | Liquidity and short-term financial health | Long-term financial success and sustainability |

| Measurement Period | Monthly, quarterly, or seasonal intervals | Usually annual or per production cycle |

| Includes | Cash sales, expenses, loans, and investments | All revenues minus all explicit and implicit costs |

| Purpose | Ensure sufficient cash to meet immediate obligations | Assess overall farming business viability and growth |

| Key Metrics | Cash inflow, cash outflow, net cash position | Return on investment, net profit margin |

| Use in Farm Management | Helps manage daily operations and avoid liquidity crises | Guides strategic planning and investment decisions |

Understanding Cash Flow in Farm Businesses

Cash flow in farm businesses represents the actual inflow and outflow of cash during a specific period, reflecting the farm's ability to meet immediate financial obligations such as operating expenses and debt payments. It differs from profitability, which measures the farm's overall financial performance based on revenues and expenses over time, including non-cash items like depreciation. Effective cash flow management ensures liquidity for daily operations and investment decisions, critical for sustaining farm business stability despite fluctuating income and seasonal cycles.

Defining Profitability in Agricultural Economics

Profitability in agricultural economics measures the farm's ability to generate returns exceeding costs through efficient resource utilization and optimal production strategies. It reflects the net income after all operating expenses, depreciation, interest, and taxes have been accounted for, highlighting the farm's economic sustainability over time. Understanding profitability enables better decision-making by distinguishing long-term financial health from short-term cash flow fluctuations.

Key Differences Between Cash Flow and Profitability

Cash flow in farm business management refers to the timing of cash inflows and outflows, highlighting liquidity and the farm's ability to meet immediate financial obligations. Profitability measures the overall financial success by comparing total revenues and expenses over a period, reflecting long-term sustainability. Key differences include cash flow's short-term focus on actual cash movements versus profitability's emphasis on accrual accounting and net income generation.

The Importance of Cash Flow Management for Farmers

Effective cash flow management is critical for farmers to ensure timely payment of expenses such as seeds, fertilizers, and labor, preventing disruptions in farm operations. Maintaining positive cash flow enables farmers to invest in equipment upgrades and respond to market fluctuations without compromising profitability. Proper cash flow monitoring supports sustainable farm business management by balancing short-term liquidity needs with long-term financial goals.

Profitability Analysis: Long-term Farm Sustainability

Profitability analysis in farm business management emphasizes long-term sustainability by measuring net income over time, which ensures that revenues consistently exceed expenses, supporting continued investment and growth. Unlike cash flow, which tracks immediate liquidity, profitability analysis assesses the farm's ability to generate surplus returns after covering all costs, including non-cash expenses such as depreciation. Sustainable farm management relies on maintaining positive profitability to withstand market fluctuations, optimize resource allocation, and achieve financial resilience.

Common Cash Flow Challenges in Agriculture

Cash flow challenges in agricultural economics often stem from the seasonal nature of farming income, where expenses must be managed during off-harvest periods despite limited revenue. Unpredictable factors such as weather fluctuations, market price volatility, and delayed payments from buyers exacerbate cash flow constraints in farm business management. Effective liquidity planning is critical to balance cash flow gaps while maintaining profitability and long-term operational sustainability.

Measuring and Monitoring Farm Profitability

Measuring and monitoring farm profitability requires a comprehensive analysis of both cash flow and net income to ensure sustainable agricultural business management. Cash flow provides insight into the timing and availability of liquid resources necessary for daily operations, while profitability reveals overall financial health by accounting for total revenues and expenses, including non-cash items like depreciation. Effective farm business management relies on integrating cash flow statements with profit and loss reports to make informed decisions about investment, expansion, and risk management.

Strategies to Improve Cash Flow on the Farm

Implementing precise cash flow forecasting and maintaining a detailed budget are critical strategies to improve cash flow in farm business management. Utilizing short-term financing options and negotiating favorable payment terms with suppliers help align cash inflows and outflows. Additionally, diversifying income streams through crop rotation and value-added products enhances liquidity and reduces financial risk.

Decision-Making: Balancing Profitability and Cash Flow

Effective farm business management requires balancing cash flow and profitability to ensure sustainable operations. While profitability measures long-term financial success, cash flow determines the farm's ability to meet immediate expenses such as input costs, labor, and debt payments. Strategic decision-making integrates cash flow forecasting with profit analysis to optimize resource allocation, enhance liquidity, and maintain operational stability during variable agricultural cycles.

Tools and Techniques for Farm Financial Management

Effective farm financial management relies on tools such as cash flow forecasting and profitability analysis to ensure sustainable operations. Cash flow tools help track the timing of income and expenses, preventing liquidity shortages, while profitability techniques assess overall farm performance by analyzing revenues against costs. Utilizing software applications and budgeting methods enhances accuracy in decision-making and supports long-term financial planning for farm businesses.

Related Important Terms

Cash Flow Mapping

Cash flow mapping in farm business management provides a detailed visualization of cash inflows and outflows, enabling farmers to anticipate periods of liquidity shortages and manage operational expenses effectively. This focused approach to cash flow analysis supports timely decision-making, ensuring sustainable farm profitability despite seasonal fluctuations and market volatility.

Profitability Benchmarking

Profitability benchmarking in farm business management evaluates financial performance by comparing net farm income to industry standards, helping identify efficiency and cost-effectiveness in operations. Analyzing profitability metrics against peer averages enables farmers to make informed decisions for sustainable growth and resource allocation beyond just monitoring cash flow.

Seasonal Liquidity Gaps

Seasonal liquidity gaps occur when farm expenses peak during planting or harvesting periods but revenues lag, creating cash flow challenges despite overall profitability. Effective farm business management requires aligning cash inflows with outflows through strategies like short-term financing or staggered input purchases to bridge these temporary gaps.

Deferred Income Strategies

Deferred income strategies in farm business management improve cash flow by delaying revenue recognition, enabling better liquidity during off-seasons and reducing financial stress. While profitability reflects overall farm success, managing cash flow through deferred income ensures operational expenses are covered, sustaining farm viability despite fluctuating market conditions.

Non-Cash Revenue Adjustments

Non-cash revenue adjustments such as inventory valuation changes and deferred payments critically influence farm business cash flow without immediately affecting profitability metrics. Understanding these adjustments allows farm managers to accurately assess liquidity positions and make informed decisions regarding operational sustainability and investment timing.

Working Capital Ratio Analysis

Working capital ratio analysis is critical in farm business management for assessing liquidity and operational efficiency, indicating whether current assets sufficiently cover current liabilities to sustain daily farm operations. Maintaining an optimal working capital ratio ensures cash flow stability, supporting profitability by enabling timely payment of expenses and investment in productive resources.

Accrual vs. Cash Accounting Distinction

Cash flow in farm business management reflects the timing of actual cash transactions, highlighting liquidity and the ability to meet short-term expenses, while profitability based on accrual accounting measures economic performance by recognizing revenues and expenses when earned or incurred, regardless of cash movement. Understanding the distinction between cash and accrual accounting is crucial for accurate financial analysis and informed decision-making in agricultural economics.

Asset Depreciation Impact

Asset depreciation significantly affects farm business cash flow by reducing taxable income, enhancing short-term liquidity despite lower reported profitability. Accurate management of depreciation schedules is essential for balancing immediate cash availability with long-term profitability assessments in agricultural economics.

Cost of Production Sensitivity

Cash flow represents the timing of money inflows and outflows crucial for daily farm operations, while profitability measures the overall financial performance accounting for total costs and revenues. Sensitivity to cost of production directly impacts profit margins, as fluctuations in input prices or production efficiency can significantly alter the farm's economic sustainability and decision-making strategies.

Operating Loan Utilization

Effective operating loan utilization enhances farm business cash flow management by providing necessary liquidity for timely input purchases and labor payments, which supports continuous production cycles. While profitability measures long-term financial success, maintaining positive cash flow through strategic loan use ensures operational stability and prevents disruptions in farm management activities.

Cash Flow vs Profitability for Farm Business Management Infographic

agridif.com

agridif.com