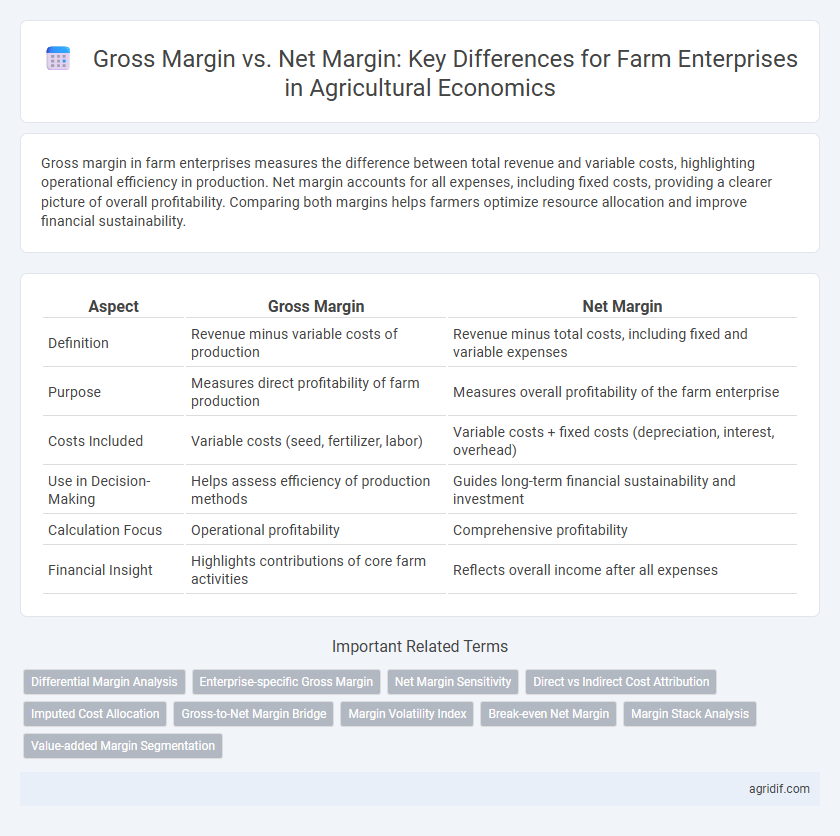

Gross margin in farm enterprises measures the difference between total revenue and variable costs, highlighting operational efficiency in production. Net margin accounts for all expenses, including fixed costs, providing a clearer picture of overall profitability. Comparing both margins helps farmers optimize resource allocation and improve financial sustainability.

Table of Comparison

| Aspect | Gross Margin | Net Margin |

|---|---|---|

| Definition | Revenue minus variable costs of production | Revenue minus total costs, including fixed and variable expenses |

| Purpose | Measures direct profitability of farm production | Measures overall profitability of the farm enterprise |

| Costs Included | Variable costs (seed, fertilizer, labor) | Variable costs + fixed costs (depreciation, interest, overhead) |

| Use in Decision-Making | Helps assess efficiency of production methods | Guides long-term financial sustainability and investment |

| Calculation Focus | Operational profitability | Comprehensive profitability |

| Financial Insight | Highlights contributions of core farm activities | Reflects overall income after all expenses |

Introduction to Gross Margin and Net Margin in Agriculture

Gross margin in agriculture measures the difference between total revenue from farm produce and variable costs directly associated with production, providing insights into profitability before fixed costs are deducted. Net margin represents the actual profit by subtracting both variable and fixed costs from total revenue, reflecting the comprehensive financial performance of farm enterprises. Understanding the distinction between gross margin and net margin is essential for effective farm management, budgeting, and assessing economic sustainability.

Defining Gross Margin for Farm Enterprises

Gross margin for farm enterprises is defined as total revenue from agricultural products minus the variable costs directly associated with production, such as seeds, fertilizers, labor, and fuel. This metric measures the profitability of farm operations before accounting for fixed costs like depreciation, rent, and interest. Understanding gross margin helps farmers evaluate the efficiency of their production processes and make informed decisions on crop or livestock management.

Understanding Net Margin in Agricultural Context

Net margin in agricultural enterprises represents the profit remaining after all variable and fixed costs, including labor, interest, and depreciation, are deducted from total revenue, providing a comprehensive measure of financial performance. Unlike gross margin, which accounts only for variable costs linked directly to production, net margin captures the overall profitability and efficiency of the farm business by incorporating overhead and non-production expenses. Analyzing net margin helps farmers evaluate economic sustainability, make informed investment decisions, and optimize resource allocation within the agricultural sector.

Key Differences Between Gross Margin and Net Margin

Gross margin in farm enterprises measures total revenue minus variable costs such as seeds, labor, and fertilizers, reflecting the profitability of core agricultural activities before fixed expenses. Net margin accounts for all costs, including fixed costs like machinery depreciation, land rent, and administrative expenses, providing a comprehensive view of overall farm profitability. Understanding the key differences between gross margin and net margin is essential for farmers to evaluate operational efficiency versus total financial performance.

Importance of Margin Analysis for Farm Profitability

Gross margin analysis in farm enterprises highlights the direct contribution of crop or livestock sales minus variable costs, offering a clear picture of production efficiency and short-term profitability. Net margin incorporates all expenses, including fixed and overhead costs, providing a comprehensive assessment of overall farm profitability and financial sustainability. Understanding both margins allows farmers to make informed decisions on resource allocation, cost control, and pricing strategies essential for maximizing farm income and long-term economic viability.

Calculating Gross Margin: Step-by-Step Guide

Calculating gross margin for farm enterprises involves subtracting variable costs, such as seeds, fertilizers, labor, and fuel, from total revenue generated by crop or livestock sales, providing insight into operational profitability before fixed costs. Accurate record-keeping of inputs and outputs is essential to ensure precise measurement of gross margin, which informs decision-making on resource allocation and crop selection. Gross margin analysis enables farmers to identify the most profitable enterprises by comparing returns per hectare or per head, optimizing financial performance before accounting for overhead expenses.

Calculating Net Margin: Methods and Considerations

Calculating Net Margin for farm enterprises involves subtracting all variable and fixed costs, including labor, inputs, machinery depreciation, and overhead expenses, from the gross revenue generated by crop or livestock sales. Accurate cost allocation methods, such as activity-based costing or traditional cost accounting, ensure precise identification of expenses, while considerations like seasonal fluctuations, market price volatility, and government subsidies impact the net profitability assessment. Understanding Net Margin provides a realistic measure of financial performance, aiding farm managers in strategic decision-making and resource optimization.

Factors Affecting Margins in Farm Enterprises

Gross margin in farm enterprises is primarily influenced by variable costs such as seed, fertilizer, labor, and fuel, which directly affect the profitability of crops or livestock before fixed costs are considered. Net margin reflects overall profitability by accounting for fixed costs like land rent, machinery depreciation, and interest expenses, highlighting the efficiency of resource management and cost control. Factors such as market prices, weather conditions, input cost fluctuations, and farm management practices critically impact both gross and net margins, determining the financial sustainability of agricultural operations.

Practical Applications: Margin Analysis in Decision Making

Gross margin provides a clear measure of a farm enterprise's profitability by focusing on revenue minus variable costs, helping farmers identify which crops or livestock activities contribute most before fixed costs are considered. Net margin, accounting for all expenses including fixed costs, offers a comprehensive view of overall farm profitability and financial sustainability. Utilizing both margins in decision making enables agricultural managers to allocate resources efficiently, optimize production strategies, and improve long-term economic viability.

Strategies to Improve Gross and Net Margins on the Farm

Improving gross margins on farm enterprises involves increasing total revenue through enhanced crop yields or livestock productivity while managing variable costs such as seeds, fertilizers, and feed efficiently. Strategies to elevate net margins focus on reducing fixed costs, optimizing labor and machinery use, and implementing precision agriculture technologies to minimize waste. Diversification of income streams, value-added products, and effective financial planning support overall farm profitability and sustainable growth.

Related Important Terms

Differential Margin Analysis

Gross margin measures the revenue remaining after variable costs, highlighting farm enterprises' short-term profitability, while net margin accounts for all costs including fixed expenses, reflecting overall financial health. Differential margin analysis compares these margins across farming activities, enabling targeted adjustments to optimize resource allocation and maximize financial returns.

Enterprise-specific Gross Margin

Enterprise-specific Gross Margin quantifies the difference between total revenue and variable costs directly associated with a particular farm enterprise, providing a clear measure of its short-term profitability. It excludes fixed costs, making it a critical tool for comparing the economic efficiency and resource allocation of different enterprises within a farm business.

Net Margin Sensitivity

Net margin sensitivity in farm enterprises reflects how variations in input costs, crop prices, and yield fluctuations directly impact profitability, providing a more precise measure of economic viability than gross margin. Unlike gross margin, which only accounts for the difference between revenue and variable costs, net margin sensitivity incorporates fixed costs and other overheads, enabling farmers to better assess financial risks and operational efficiency.

Direct vs Indirect Cost Attribution

Gross margin in farm enterprises measures revenue minus direct costs such as seeds, fertilizers, and labor directly tied to crop production, highlighting profitability before overhead expenses. Net margin accounts for both direct and indirect costs, including machinery depreciation, land rent, and administrative expenses, offering a more comprehensive view of overall farm financial performance.

Imputed Cost Allocation

Gross margin measures the difference between total revenue and variable costs in farm enterprises, reflecting short-term profitability without accounting for fixed expenses. Net margin incorporates imputed cost allocation, including opportunity costs such as unpaid labor and land rent, providing a more comprehensive assessment of true economic returns in agricultural production.

Gross-to-Net Margin Bridge

Gross margin measures farm enterprise profitability by subtracting variable costs like seeds, fertilizer, and labor from total revenue, providing insight into operational efficiency before fixed costs. The gross-to-net margin bridge highlights how fixed costs, such as machinery depreciation, rent, and interest expenses, reduce gross margin to net margin, revealing the overall financial health and sustainability of the agricultural business.

Margin Volatility Index

Gross margin measures the difference between revenue and variable costs in farm enterprises, reflecting short-term profitability, while net margin accounts for all costs including fixed expenses, indicating overall financial health. The Margin Volatility Index tracks fluctuations in these margins, providing critical insight into risk exposure and financial stability for agricultural producers.

Break-even Net Margin

Break-even Net Margin for farm enterprises represents the minimum profit required to cover all variable and fixed costs, ensuring operational sustainability beyond just covering expenses accounted for in the Gross Margin. While Gross Margin highlights revenue minus variable costs, Net Margin incorporates fixed costs and financial obligations, making the break-even Net Margin a critical threshold for assessing true farm profitability and long-term economic viability.

Margin Stack Analysis

Gross margin in farm enterprises represents total revenue minus variable costs, providing a clear measure of how efficiently resources generate income before fixed expenses; net margin accounts for all costs, including fixed overheads, yielding a comprehensive profit indicator. Margin stack analysis breaks down these layers, highlighting the contribution of each cost component to overall profitability and enabling farmers to identify areas for cost optimization and revenue enhancement.

Value-added Margin Segmentation

Gross margin in farm enterprises represents the difference between total revenue and variable costs, emphasizing immediate profitability from production activities, while net margin accounts for all expenses including fixed costs, reflecting overall financial health. Value-added margin segmentation highlights how efficiently farms convert raw inputs into outputs, distinguishing areas where gross margin can be maximized before fixed cost absorption influences net margin outcomes.

Gross margin vs Net margin for farm enterprises Infographic

agridif.com

agridif.com