Yield risk and price risk are two primary factors influencing farm income volatility in agricultural economics. Yield risk arises from unpredictable variables such as weather, pests, and diseases that directly impact the volume of crop production. Price risk stems from fluctuations in market demand, supply conditions, and global trade policies, affecting the revenue per unit of output regardless of yield levels.

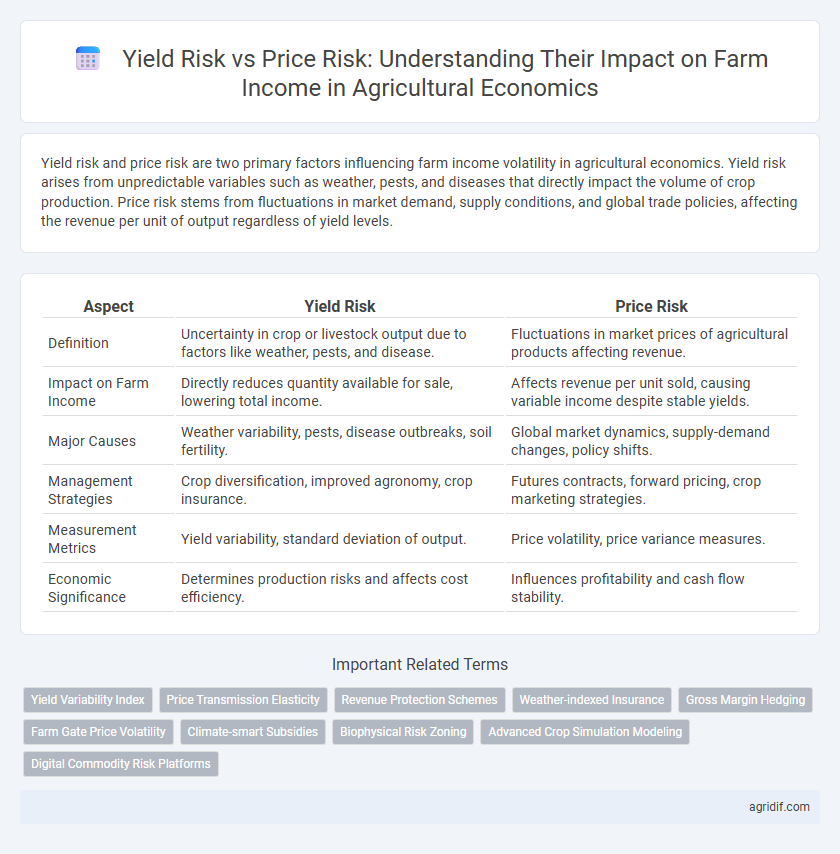

Table of Comparison

| Aspect | Yield Risk | Price Risk |

|---|---|---|

| Definition | Uncertainty in crop or livestock output due to factors like weather, pests, and disease. | Fluctuations in market prices of agricultural products affecting revenue. |

| Impact on Farm Income | Directly reduces quantity available for sale, lowering total income. | Affects revenue per unit sold, causing variable income despite stable yields. |

| Major Causes | Weather variability, pests, disease outbreaks, soil fertility. | Global market dynamics, supply-demand changes, policy shifts. |

| Management Strategies | Crop diversification, improved agronomy, crop insurance. | Futures contracts, forward pricing, crop marketing strategies. |

| Measurement Metrics | Yield variability, standard deviation of output. | Price volatility, price variance measures. |

| Economic Significance | Determines production risks and affects cost efficiency. | Influences profitability and cash flow stability. |

Understanding Yield Risk in Agricultural Production

Yield risk in agricultural production directly affects farm income by causing variability in the quantity of crops harvested due to factors like weather, pests, and soil conditions. Understanding yield risk enables farmers to implement risk management strategies such as crop diversification, insurance, and improved agronomic practices to stabilize production levels. Effective yield risk assessment supports better decision-making and financial planning, reducing income volatility in farming operations.

Exploring Price Risk and Market Volatility

Price risk in agricultural economics refers to the uncertainty of fluctuations in commodity prices that directly impact farm income, with market volatility driven by factors such as global demand shifts, weather events, and policy changes. Unlike yield risk, which is primarily associated with production variability, price risk can lead to significant income instability even when yields are stable, necessitating strategic risk management tools like futures contracts and crop insurance. Understanding market volatility patterns enables farmers to make informed selling decisions and adopt hedging strategies that mitigate the adverse effects of unpredictable price swings.

Comparative Impact of Yield and Price Risks on Farm Income

Yield risk and price risk both significantly influence farm income stability, with yield risk often causing more variability due to unpredictable weather, pests, and disease affecting crop output. Price risk stems from market fluctuations driven by supply-demand dynamics, trade policies, and global economic trends, impacting the profitability of harvested crops. Comparative studies reveal that yield risk generally exerts a more immediate and severe effect on income variability, while price risk influences overall revenue, making risk management strategies critical in agricultural economics.

Measuring Yield Risk: Methods and Models

Measuring yield risk in agricultural economics involves statistical models such as stochastic frontier analysis and variance decomposition techniques to quantify the variability in crop output due to environmental and biological factors. Simulation models, including Monte Carlo simulations, provide probabilistic distributions of yield under varying climatic and management scenarios, enhancing risk assessment. These methods enable farmers and economists to isolate yield uncertainty from price volatility, informing risk management strategies and decision-making for farm income stability.

Analyzing Price Risk: Factors and Forecasting

Price risk in agricultural economics significantly impacts farm income, driven by factors such as market volatility, supply-demand imbalances, and global trade policies. Accurate forecasting models incorporate historical price trends, seasonal patterns, and real-time market data to predict price fluctuations effectively. Risk management strategies leverage these forecasts to optimize crop selling decisions, hedge against adverse price movements, and stabilize farm revenue.

Strategies for Managing Yield Risk

Managing yield risk in agricultural economics involves adopting practices such as crop diversification, improved irrigation techniques, and the use of resilient seed varieties to stabilize production levels. Implementing precision agriculture technologies enables farmers to monitor soil health and optimize inputs, reducing variability in crop yields. Crop insurance programs and government safety nets provide financial protection against unpredictable yield fluctuations, enhancing farm income stability.

Price Risk Management Tools for Farmers

Price risk management tools for farmers include futures contracts, options, and crop insurance, which help stabilize farm income amidst volatile market prices. Utilizing hedging strategies through commodity exchanges allows producers to lock in prices and reduce the uncertainty of future revenue. Government programs and private sector solutions, such as revenue protection insurance, further mitigate financial losses caused by adverse price fluctuations.

Role of Government Policies in Risk Mitigation

Government policies play a crucial role in mitigating yield risk and price risk for farm income through tools such as crop insurance, price support programs, and disaster relief initiatives. These interventions stabilize farm revenues by providing financial safety nets that compensate for adverse weather events and market fluctuations. Strategic government involvement enhances rural economic resilience and encourages sustainable agricultural production.

Diversification as a Buffer Against Yield and Price Fluctuations

Diversification in agricultural production reduces yield risk by spreading exposure across multiple crops with varying growth conditions and harvest times, thereby stabilizing overall farm output. It also mitigates price risk by allowing farmers to sell a range of products, lessening dependence on volatile market prices of a single commodity. Efficient portfolio diversification enhances resilience against simultaneous adverse yield declines and price drops, supporting more stable farm incomes.

Integrating Yield and Price Risk Management for Sustainable Farm Incomes

Effective farm income stability requires integrating yield and price risk management strategies to address the inherent volatility in agricultural production and market dynamics. Yield risk involves uncertainties in crop production due to weather, pests, and soil conditions, while price risk stems from fluctuating commodity prices driven by supply-demand imbalances and global trade policies. Combining approaches such as crop insurance, futures contracts, and diversification enhances resilience against these risks, promoting sustainable farm incomes and long-term economic viability in agriculture.

Related Important Terms

Yield Variability Index

The Yield Variability Index quantifies the fluctuation in crop yields, offering a precise measure of yield risk that directly impacts farm income stability. While price risk involves market fluctuations, yield variability presents a more inherent uncertainty, often exerting a greater influence on agricultural profitability due to environmental and agronomic factors.

Price Transmission Elasticity

Yield risk affects farm income by directly influencing the quantity of output, while price risk stems from fluctuations in market prices. Price Transmission Elasticity measures how sensitively farm gate prices respond to changes in upstream or downstream market prices, critically determining the degree to which price risk is passed through to farmers.

Revenue Protection Schemes

Revenue Protection Schemes mitigate farm income volatility by covering losses from both yield reductions and price declines, ensuring consistent revenue despite fluctuating market conditions and adverse weather events. These insurance programs integrate yield risk and price risk management, stabilizing farm profitability and supporting financial resilience in agricultural operations.

Weather-indexed Insurance

Weather-indexed insurance mitigates yield risk by providing payouts based on measurable weather parameters, reducing farmers' dependence on unpredictable crop yields caused by climate variability. This risk transfer mechanism complements price risk management tools, enhancing overall farm income stability amid volatile market prices and adverse weather conditions.

Gross Margin Hedging

Gross Margin Hedging strategically manages farm income fluctuations by simultaneously addressing yield risk and price risk, stabilizing revenue through futures contracts that lock in both crop prices and production costs. Effective gross margin hedging leverages commodity derivatives to protect against adverse yield variations and volatile market prices, ensuring more predictable farm profitability and enhanced financial resilience.

Farm Gate Price Volatility

Farm gate price volatility significantly impacts farm income by causing unpredictable revenue fluctuations even when yield remains stable. Managing price risk through market instruments and contract arrangements is essential to stabilize income in the face of unpredictable agricultural commodity prices.

Climate-smart Subsidies

Climate-smart subsidies mitigate yield risk by promoting drought-resistant crops and advanced irrigation technologies, stabilizing farm income amid climate variability. These policies also address price risk through market support mechanisms, ensuring economic resilience for farmers facing volatile commodity prices.

Biophysical Risk Zoning

Biophysical Risk Zoning segments agricultural areas based on environmental factors influencing yield variability, directly impacting yield risk by identifying zones prone to drought, pests, or soil degradation. Price risk remains influenced by market fluctuations, but integrating yield risk analysis through Biophysical Risk Zoning enhances farm income stability by enabling targeted risk management strategies tailored to specific agro-ecological conditions.

Advanced Crop Simulation Modeling

Advanced crop simulation modeling quantifies yield risk by predicting crop growth under varying environmental conditions, enabling more accurate assessments of production variability. Integrating these models with price risk analysis improves farm income management by balancing expected yield fluctuations against market price volatility.

Digital Commodity Risk Platforms

Digital commodity risk platforms enhance farm income stability by integrating yield risk and price risk data through advanced analytics and real-time market monitoring. These platforms enable farmers to optimize decision-making by providing precise hedging options and predictive models tailored to fluctuating crop yields and commodity prices.

Yield risk vs price risk for farm income Infographic

agridif.com

agridif.com