Price floors set a minimum allowable price to protect producers from prices that are too low, ensuring stable income and preventing market prices from crashing. Price ceilings impose a maximum price limit to keep essential goods affordable for consumers, preventing prices from soaring during shortages. Both mechanisms aim to stabilize markets but can lead to surpluses in the case of price floors or shortages with price ceilings if set improperly.

Table of Comparison

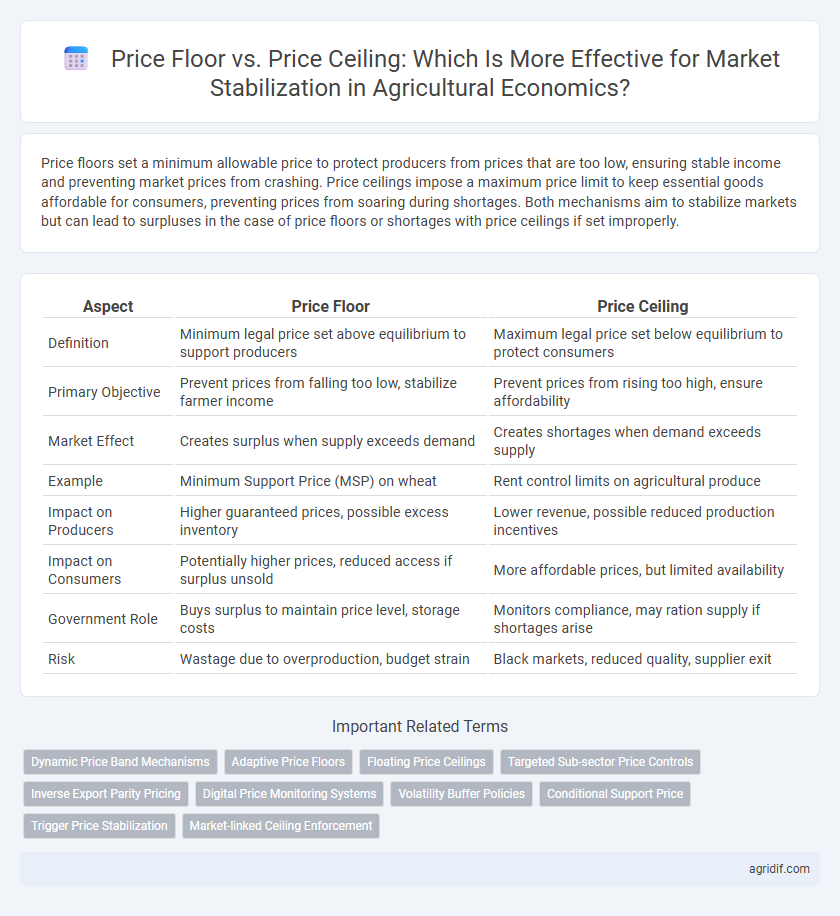

| Aspect | Price Floor | Price Ceiling |

|---|---|---|

| Definition | Minimum legal price set above equilibrium to support producers | Maximum legal price set below equilibrium to protect consumers |

| Primary Objective | Prevent prices from falling too low, stabilize farmer income | Prevent prices from rising too high, ensure affordability |

| Market Effect | Creates surplus when supply exceeds demand | Creates shortages when demand exceeds supply |

| Example | Minimum Support Price (MSP) on wheat | Rent control limits on agricultural produce |

| Impact on Producers | Higher guaranteed prices, possible excess inventory | Lower revenue, possible reduced production incentives |

| Impact on Consumers | Potentially higher prices, reduced access if surplus unsold | More affordable prices, but limited availability |

| Government Role | Buys surplus to maintain price level, storage costs | Monitors compliance, may ration supply if shortages arise |

| Risk | Wastage due to overproduction, budget strain | Black markets, reduced quality, supplier exit |

Introduction to Price Controls in Agricultural Markets

Price floors set a minimum price to protect farmers from prices that are too low, ensuring stable income and preventing market collapse. Price ceilings impose a maximum price to keep essential agricultural products affordable and guard consumers against exorbitant costs. Both mechanisms aim to stabilize agricultural markets but must be carefully balanced to avoid surpluses or shortages.

Defining Price Floors and Price Ceilings

Price floors are government-imposed minimum prices set above the equilibrium to prevent prices from falling too low, commonly used in agriculture to protect farmers' incomes. Price ceilings establish maximum allowable prices below equilibrium to make essential goods affordable, often applied to staple food products to benefit consumers. Both mechanisms aim to stabilize markets but can lead to surpluses or shortages if misaligned with supply and demand.

Objectives of Market Stabilization Policies

Price floor policies aim to prevent prices from falling below a certain level, ensuring farmers receive minimum income and promoting agricultural production stability. Price ceilings seek to protect consumers by capping prices to prevent excessive costs, maintaining affordability and controlling inflation in food markets. Both mechanisms stabilize markets by reducing price volatility and ensuring a balanced supply-demand equilibrium.

Economic Rationale Behind Price Floors

Price floors in agricultural markets establish a minimum price to protect farmers from prices that fall below production costs, ensuring stable incomes and encouraging continued production. They prevent market prices from dropping to levels that could cause supply shortages by discouraging excessive production cutbacks. By supporting farmers' revenue, price floors aim to maintain market stability and secure food supply chains.

Economic Impacts of Price Ceilings

Price ceilings in agricultural markets are designed to prevent prices from exceeding a certain level, protecting consumers from exorbitant costs but often leading to shortages as supply diminishes. These artificially low prices can discourage farmers from producing enough crops, causing market distortions and reducing overall agricultural output. Economically, price ceilings may stabilize short-term prices but create inefficiencies and long-term supply constraints in agricultural production.

Case Studies: Price Controls in Agricultural History

Price floors in agriculture, such as the U.S. Agricultural Adjustment Act of the 1930s, aimed to stabilize farm incomes by setting minimum prices, preventing market prices from falling below production costs and reducing supply gluts. In contrast, price ceilings, like those implemented in India on staple crops, intended to protect consumers from soaring food prices but often led to shortages and black markets. Historical case studies reveal that while price floors can help maintain farmer livelihoods, price ceilings risk supply distortions and unintended economic inefficiencies in agricultural markets.

Effects on Producers and Consumers

Price floors in agricultural markets guarantee producers a minimum income by setting a legally mandated minimum price, often leading to surplus supply and higher storage costs. Price ceilings protect consumers by capping prices below equilibrium, which can result in shortages and reduced producers' revenue. Both mechanisms impact market stability, with price floors benefiting producers at the expense of consumers, while price ceilings prioritize consumer affordability but risk supply constraints.

Unintended Consequences of Price Interventions

Price floors in agricultural markets often lead to surplus production, causing inefficient resource allocation and increased government expenditure on stockpiling. Price ceilings can result in shortages, reducing farmer income and potentially harming long-term supply stability. Both interventions distort market signals, leading to unintended consequences such as black markets, reduced investment, and decreased product quality.

Policy Alternatives for Market Stabilization

Price floors, set above equilibrium prices, aim to protect producers by ensuring minimum income levels, often used in agricultural markets to stabilize farm revenues. Price ceilings, established below equilibrium prices, are designed to keep essential goods affordable for consumers, preventing price gouging during shortages. Policymakers must balance these tools by considering market disequilibrium effects, such as surpluses from price floors and shortages from price ceilings, while exploring complementary measures like subsidies or rationing to achieve effective market stabilization.

Conclusion: Balancing Stability and Market Efficiency

Price floors and price ceilings serve as crucial tools in agricultural economics to stabilize markets by preventing extreme price fluctuations. While price floors protect producers by setting a minimum acceptable price, price ceilings safeguard consumers by capping maximum prices, each addressing different sides of the market imbalance. Effective market stabilization requires a balanced approach that considers both producer incentives and consumer welfare to maintain overall market efficiency and sustainable agricultural production.

Related Important Terms

Dynamic Price Band Mechanisms

Dynamic Price Band Mechanisms in agricultural economics adjust price floors and ceilings based on market conditions, preventing extreme price volatility while ensuring fair compensation for producers and affordability for consumers. These mechanisms stabilize markets by allowing flexibility within predetermined limits, balancing supply-demand fluctuations without causing market distortions typical of fixed price controls.

Adaptive Price Floors

Adaptive price floors in agricultural markets adjust minimum prices based on supply fluctuations and production costs, ensuring farmer incomes remain stable during volatility. Unlike rigid price ceilings that limit maximum prices and risk shortages, adaptive floors promote market equilibrium by preventing price collapses without distorting consumer demand.

Floating Price Ceilings

Floating price ceilings allow prices to adjust within a set maximum limit, enhancing market stability by preventing drastic price spikes while enabling supply and demand to find equilibrium. This mechanism helps protect consumers from inflationary shocks without causing persistent shortages typical of fixed price ceilings.

Targeted Sub-sector Price Controls

Targeted sub-sector price controls, such as price floors and price ceilings, are essential tools in agricultural economics for market stabilization by preventing extreme price volatility in specific commodity segments like grains and dairy. Price floors protect producers' incomes by setting minimum prices above equilibrium, whereas price ceilings ensure affordability for consumers by capping prices below equilibrium, balancing supply-demand dynamics in volatile agricultural markets.

Inverse Export Parity Pricing

Price floors set a minimum price above equilibrium, protecting farmers by guaranteeing higher incomes but risking surplus and inefficiencies, while price ceilings cap prices to protect consumers yet may discourage production. Inverse Export Parity Pricing uses international price disparities to establish domestic price limits, helping stabilize agricultural markets by preventing export prices from diverging excessively from local prices, thus balancing producer and consumer interests.

Digital Price Monitoring Systems

Price floors and price ceilings are regulatory tools used to stabilize agricultural markets by preventing prices from falling below or rising above certain thresholds, ensuring fair income for farmers and affordable prices for consumers. Digital Price Monitoring Systems enhance market stabilization by providing real-time data analytics and transparent pricing information, enabling swift adjustments and minimizing market distortions caused by artificially imposed price limits.

Volatility Buffer Policies

Price floors in agricultural markets set minimum prices to protect farmers' incomes during periods of low demand, creating a volatility buffer by preventing prices from falling below production costs. Conversely, price ceilings limit maximum prices to ensure consumer affordability but may reduce producer incentives, thus offering a different form of market stabilization that addresses demand-side price spikes.

Conditional Support Price

Price floors, such as Conditional Support Prices, protect farmers by guaranteeing a minimum income and preventing market prices from falling below production costs, thereby stabilizing agricultural markets. Price ceilings limit consumer costs but can cause supply shortages; Conditional Support Prices strategically set minimum prices to balance producer sustainability with market equilibrium.

Trigger Price Stabilization

Trigger price stabilization employs a predetermined price floor to prevent market prices from falling below a level that jeopardizes farmers' income, ensuring stability in agricultural markets. Unlike price ceilings, which limit maximum prices to protect consumers, price floors support producers by maintaining minimum price thresholds during periods of volatility.

Market-linked Ceiling Enforcement

Price floor policies guarantee minimum prices, protecting producers from market volatility, while price ceilings prevent prices from exceeding a set limit, safeguarding consumer affordability. Market-linked ceiling enforcement dynamically adjusts price caps based on real-time supply and demand data to stabilize volatile agricultural markets effectively.

Price floor vs price ceiling for market stabilization Infographic

agridif.com

agridif.com