Hedging in agriculture involves using futures or options contracts to lock in prices, thereby reducing the risk of price volatility and ensuring income stability for farmers. Speculation, on the other hand, entails taking on price risk with the hope of profiting from market movements, which can lead to significant gains or losses depending on market conditions. Effective risk management in agricultural economics prioritizes hedging to protect against adverse price fluctuations while speculation is considered a higher-risk strategy driven by market predictions.

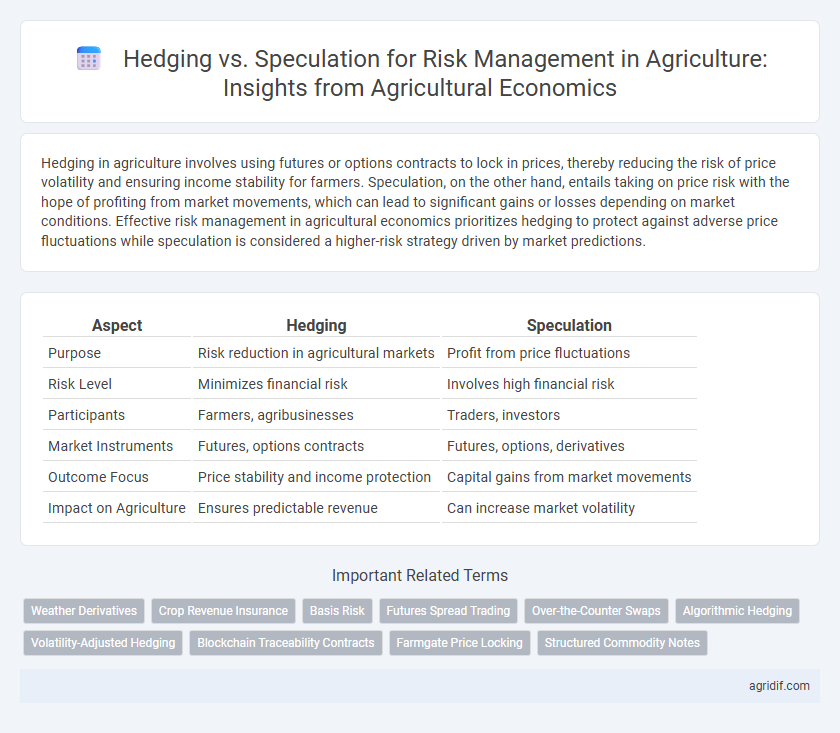

Table of Comparison

| Aspect | Hedging | Speculation |

|---|---|---|

| Purpose | Risk reduction in agricultural markets | Profit from price fluctuations |

| Risk Level | Minimizes financial risk | Involves high financial risk |

| Participants | Farmers, agribusinesses | Traders, investors |

| Market Instruments | Futures, options contracts | Futures, options, derivatives |

| Outcome Focus | Price stability and income protection | Capital gains from market movements |

| Impact on Agriculture | Ensures predictable revenue | Can increase market volatility |

Understanding Hedging and Speculation in Agricultural Markets

Hedging in agricultural markets involves using futures contracts to lock in prices for crops or livestock, mitigating the risk of price volatility and ensuring more predictable revenue for farmers and agribusinesses. Speculation, by contrast, entails taking on price risk by trading futures contracts with the aim of profiting from price fluctuations without underlying physical assets. Understanding the distinction between hedging and speculation is crucial for effective risk management, as hedging protects against adverse price movements while speculation assumes risk to potentially gain financial rewards.

The Importance of Risk Management in Agriculture

Risk management in agriculture is essential to protect farmers from volatile commodity prices, unpredictable weather conditions, and fluctuating input costs. Hedging using futures contracts allows producers to lock in prices and reduce uncertainty, ensuring stable income streams. Speculation, by contrast, involves taking on additional risk for potential profit, which can magnify losses and jeopardize farm financial stability.

How Hedging Works for Farmers and Agribusinesses

Hedging enables farmers and agribusinesses to manage price volatility by locking in future prices through futures contracts, reducing the risk of adverse market fluctuations. By selling or buying commodity contracts on exchanges such as the Chicago Board of Trade, producers secure predictable revenue streams that stabilize cash flow and protect profit margins. This risk management strategy contrasts with speculation by prioritizing price certainty over potential gains from market movements.

Speculation: Role and Impact on Agricultural Prices

Speculation in agricultural markets involves traders taking positions based on anticipated price movements, which can increase market liquidity but also contribute to price volatility. Speculators influence supply and demand signals, sometimes causing price swings that affect farmers' income stability and consumer food prices. Their activities can lead to both opportunities for profit and risks of distorted price signals, complicating risk management strategies in agriculture.

Comparing Objectives: Hedgers vs. Speculators

Hedgers in agricultural markets primarily aim to minimize price risk by locking in prices for crops or livestock to protect against unfavorable market fluctuations, ensuring stable income and financial planning. Speculators seek to profit from price volatility by taking on higher risk positions, anticipating future price movements to capitalize on market inefficiencies. The contrasting objectives highlight hedgers' focus on risk mitigation and stability, while speculators emphasize profit maximization through risk exposure.

Common Hedging Instruments in Agriculture

Futures contracts, options, and forward contracts are common hedging instruments in agriculture used to manage price risks associated with crop production and commodity sales. These financial tools enable farmers and agribusinesses to lock in prices, protect against market volatility, and stabilize income streams. Effective use of hedging instruments can mitigate losses caused by unpredictable factors such as weather conditions, pest outbreaks, and fluctuating global demand.

Risks and Rewards of Speculation in Agricultural Commodities

Speculation in agricultural commodities involves taking on market risks to potentially earn higher returns by predicting price movements, whereas hedging aims to reduce exposure to price volatility for producers and consumers. Speculators face risks such as price unpredictability and market liquidity issues but can benefit from significant profits if their market forecasts are accurate. This role provides market liquidity and price discovery, yet the rewards must be balanced against substantial financial risks inherent in agricultural commodity speculation.

Effectiveness of Hedging Strategies for Price Stability

Hedging strategies in agricultural economics effectively stabilize prices by allowing producers to lock in future prices through futures contracts, reducing exposure to volatile commodity markets. By contrast, speculation involves assuming price risk to profit from market fluctuations, which can increase unpredictability in farm income. Empirical studies show that well-implemented hedging minimizes price risk and enhances financial planning reliability for farmers.

Regulatory Perspectives on Hedging and Speculation

Regulatory frameworks in agricultural markets differentiate hedging as a risk management tool from speculation, often imposing stricter limits on speculative trading to prevent market manipulation and excessive volatility. Commodity Futures Trading Commission (CFTC) regulations enforce position limits and reporting requirements, ensuring hedgers like farmers and agribusinesses can manage price risk effectively without destabilizing markets. These regulatory perspectives prioritize market transparency and stability, balancing the legitimate need for risk mitigation against the potential adverse effects of speculative activities on agricultural commodity prices.

Best Practices for Managing Risk in Agricultural Production

Hedging in agricultural production involves using futures contracts to lock in prices, effectively reducing exposure to volatile commodity markets and stabilizing farm income. Speculation, on the other hand, entails taking on higher risk for potential profit by anticipating price movements without underlying production needs, which can lead to significant financial losses. Best practices for managing risk focus on implementing hedging strategies tailored to crop cycles and market conditions, combined with diversification and use of crop insurance to protect against unforeseen events.

Related Important Terms

Weather Derivatives

Weather derivatives provide farmers with a financial tool to hedge against weather-related risks such as droughts or excessive rainfall, ensuring stable income despite volatile climatic conditions. Unlike speculation, which involves taking on risk to profit from market fluctuations, hedging with weather derivatives focuses on risk mitigation and protecting agricultural yields and revenues.

Crop Revenue Insurance

Crop revenue insurance enhances risk management in agriculture by providing financial protection against losses due to crop yield shortfalls and price fluctuations, effectively hedging against market uncertainties. Unlike speculation, which involves taking on risk to profit from price movements, hedging through crop revenue insurance stabilizes farm income and secures financial resilience for producers.

Basis Risk

Hedging in agricultural economics mitigates price risk by locking in future prices through futures contracts, yet basis risk arises from the imperfect correlation between cash and futures prices, potentially leading to unexpected gains or losses. Speculation involves taking on price risk to profit from market movements but lacks the protective mechanism against adverse price fluctuations that hedging provides, making basis risk a critical factor in evaluating risk management strategies.

Futures Spread Trading

Futures spread trading in agricultural economics mitigates price risk by simultaneously buying and selling related futures contracts, reducing exposure compared to outright hedging or speculation. This strategy leverages price differentials between commodity contracts, enabling farmers and traders to manage volatility while seeking more stable profit margins.

Over-the-Counter Swaps

Over-the-counter (OTC) swaps in agricultural economics serve as tailored financial instruments allowing farmers and agribusinesses to hedge against price volatility of commodities such as corn, soybeans, and wheat, effectively managing revenue risks. Unlike speculation, OTC swaps provide customized risk transfer solutions by locking in prices or cash flows, mitigating exposure to adverse market fluctuations without the goal of profiting from market movements.

Algorithmic Hedging

Algorithmic hedging in agricultural economics leverages advanced data analytics and automated trading strategies to manage price volatility and reduce financial risk for farmers and agribusinesses. By integrating market signals and predictive models, algorithmic hedging enhances decision-making precision compared to traditional speculation, optimizing risk mitigation in commodity markets.

Volatility-Adjusted Hedging

Volatility-adjusted hedging in agricultural economics enhances risk management by dynamically calibrating hedge ratios based on the fluctuating volatility of commodity prices, thereby reducing the basis risk inherent in traditional static hedges. This approach optimizes portfolio performance by aligning hedging strategies with real-time market conditions, offering farmers and agribusinesses a more precise tool to mitigate price uncertainty and improve financial stability.

Blockchain Traceability Contracts

Blockchain traceability contracts enhance risk management in agriculture by enabling transparent hedging strategies that secure commodity prices and reduce exposure to market volatility. These smart contracts automate settlement and verification processes, minimizing speculation risks and ensuring farmers and traders uphold agreed terms with real-time, tamper-proof data.

Farmgate Price Locking

Farmgate price locking through hedging enables farmers to secure stable income by minimizing exposure to volatile commodity prices, thereby protecting profit margins against market fluctuations. Speculation, contrastingly, involves taking on price risk with the goal of profiting from price changes but can lead to significant financial losses in unpredictable agricultural markets.

Structured Commodity Notes

Structured Commodity Notes offer farmers a tailored risk management tool that combines fixed income features with exposure to agricultural commodity prices, effectively balancing hedging strategies and speculative opportunities. By integrating derivative components linked to crop yields or commodity indices, these notes help mitigate price volatility while allowing controlled participation in market upside.

Hedging vs speculation for risk management in agriculture Infographic

agridif.com

agridif.com