Net present value (NPV) provides a direct measure of the expected profitability of farm investments by discounting future cash flows to their present value, helping farmers determine if a project adds value to their operation. Internal rate of return (IRR) calculates the discount rate that makes the net present value of cash flows equal to zero, offering a percentage return that can be easily compared across different investments. While NPV focuses on absolute value creation, IRR emphasizes the efficiency of investment, and using both metrics together enhances decision-making in agricultural economics.

Table of Comparison

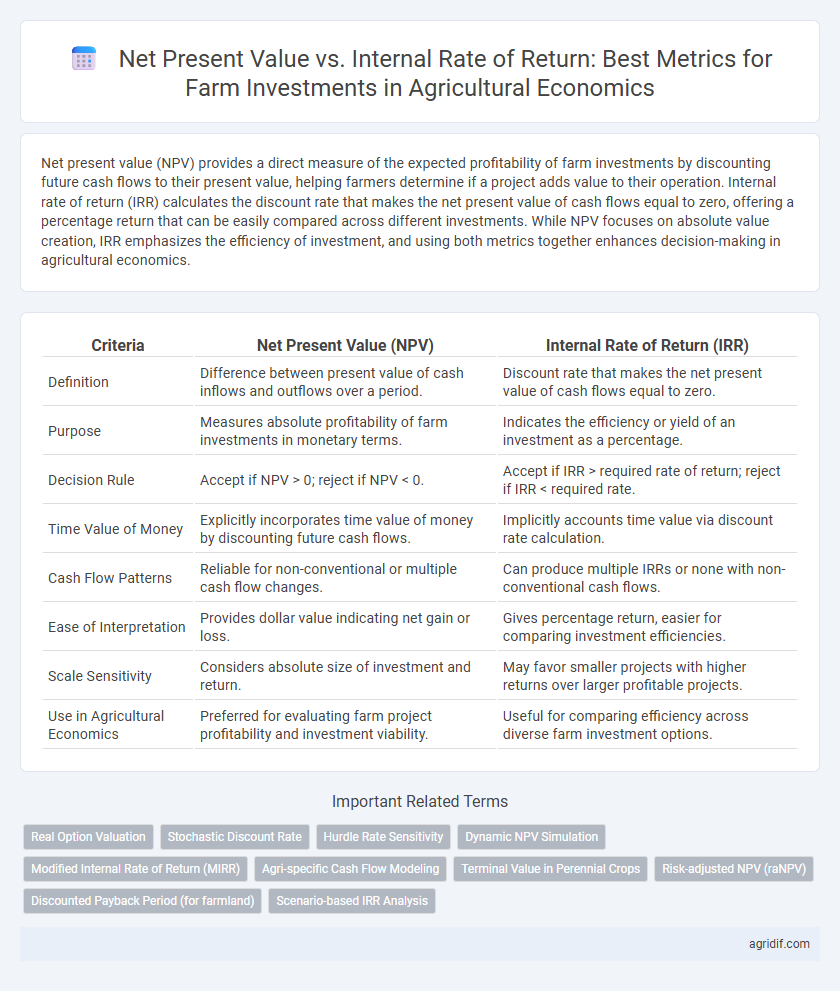

| Criteria | Net Present Value (NPV) | Internal Rate of Return (IRR) |

|---|---|---|

| Definition | Difference between present value of cash inflows and outflows over a period. | Discount rate that makes the net present value of cash flows equal to zero. |

| Purpose | Measures absolute profitability of farm investments in monetary terms. | Indicates the efficiency or yield of an investment as a percentage. |

| Decision Rule | Accept if NPV > 0; reject if NPV < 0. | Accept if IRR > required rate of return; reject if IRR < required rate. |

| Time Value of Money | Explicitly incorporates time value of money by discounting future cash flows. | Implicitly accounts time value via discount rate calculation. |

| Cash Flow Patterns | Reliable for non-conventional or multiple cash flow changes. | Can produce multiple IRRs or none with non-conventional cash flows. |

| Ease of Interpretation | Provides dollar value indicating net gain or loss. | Gives percentage return, easier for comparing investment efficiencies. |

| Scale Sensitivity | Considers absolute size of investment and return. | May favor smaller projects with higher returns over larger profitable projects. |

| Use in Agricultural Economics | Preferred for evaluating farm project profitability and investment viability. | Useful for comparing efficiency across diverse farm investment options. |

Introduction to Investment Appraisal in Agriculture

Net Present Value (NPV) measures the profitability of farm investments by calculating the difference between the present value of cash inflows and outflows over time, providing a clear indication of expected monetary gain. Internal Rate of Return (IRR) identifies the discount rate at which the NPV equals zero, representing the efficiency or yield of agricultural projects. Both NPV and IRR are fundamental tools in investment appraisal, enabling farmers to evaluate financial viability and make informed decisions on resource allocation in agriculture.

Defining Net Present Value (NPV) in Farm Economics

Net Present Value (NPV) in farm economics represents the difference between the present value of cash inflows and outflows over a farm investment's lifetime, discounted at a specified rate reflecting opportunity cost. It quantifies the profitability of agricultural projects by incorporating time value of money, making it a critical tool for evaluating long-term farm investments like equipment, land improvements, or crop production systems. A positive NPV indicates expected profitability, guiding farmers to select investments that maximize wealth and resource efficiency in a volatile agricultural market.

Understanding Internal Rate of Return (IRR) for Agricultural Projects

Internal Rate of Return (IRR) for agricultural projects measures the discount rate at which the net present value (NPV) of farm investment cash flows equals zero, providing a clear indicator of profitability relative to the cost of capital. IRR is crucial for comparing multiple farm projects with varying cash flow patterns and investment durations, helping farmers prioritize investments that maximize economic returns. Unlike NPV, IRR offers a percentage rate that simplifies decision-making under uncertain market conditions typical in agricultural economics.

Key Differences Between NPV and IRR in Farming Investments

Net present value (NPV) measures the absolute profitability of farm investments by discounting future cash flows to their present value, aiding farmers in assessing dollar-value gains. Internal rate of return (IRR) calculates the discount rate that sets the NPV of all cash flows to zero, providing the percentage yield expected from the investment. Key differences include NPV's direct measurement of value addition, while IRR offers a rate of return metric that can be misleading with non-conventional cash flows or multiple IRRs common in agricultural projects.

Advantages of Using NPV in Agricultural Decision-Making

Net present value (NPV) offers a precise measure of the profitability of farm investments by calculating the absolute value of expected cash flows discounted at a specific rate, providing clear insight into wealth creation. NPV accounts for the time value of money and adjusts for varying cash inflows and outflows, making it particularly useful for agricultural projects with fluctuating seasonal revenues and costs. Unlike Internal Rate of Return (IRR), NPV can handle multiple discount rates, reducing ambiguity and enhancing decision-making accuracy in complex farm investment scenarios.

Benefits of IRR Analysis for Farm Enterprises

Internal Rate of Return (IRR) analysis offers farm enterprises a clear metric to evaluate investment profitability by identifying the discount rate that sets the net present value (NPV) of cash flows to zero. IRR aids in comparing diverse farm projects with varying scales and durations, enabling decision-makers to prioritize options that maximize long-term returns. This method also captures the time value of money and reinvestment potential, making it a robust tool for strategic capital allocation in agricultural investments.

Limitations of NPV and IRR Methods in Agriculture

Net Present Value (NPV) and Internal Rate of Return (IRR) methods often face limitations in agricultural investments due to the sector's inherent uncertainties such as fluctuating commodity prices, weather variability, and long project horizons. NPV may undervalue future benefits during periods of high inflation or discounting, while IRR can produce multiple or misleading rates when cash flows are non-conventional or irregular, common in farming cycles. These constraints highlight the need for complementary evaluation tools that incorporate risk analysis and adaptive management in agricultural economics.

Practical Examples: NPV vs IRR in Real-World Farm Investments

In farm investments, Net Present Value (NPV) provides a dollar amount reflecting the profitability of a project by discounting future cash flows to their present value, making it easier to compare multiple projects on an absolute scale. Internal Rate of Return (IRR) indicates the discount rate at which the NPV of all cash flows equals zero, helping investors assess the efficiency of an investment relative to the cost of capital, but it can be misleading when projects have non-conventional cash flows or different durations. For example, choosing between a long-term orchard with steady cash inflows and a short-term crop rotation, NPV favors the project with greater total wealth creation, while IRR highlights the project with the highest percentage return, guiding farmers depending on their risk tolerance and investment timeline.

Choosing the Right Method: Factors for Farmers to Consider

Net present value (NPV) provides a clear dollar-value measure of farm investment profitability by discounting future cash flows to present terms, making it suitable for farmers prioritizing absolute returns. Internal rate of return (IRR) expresses the profitability as a percentage, facilitating comparison across investments but can be misleading with non-conventional cash flows or multiple sign changes. Farmers should consider the cash flow pattern, project scale, risk tolerance, and ease of interpretation when selecting between NPV and IRR to make optimal investment decisions.

Conclusion: Optimizing Farm Investment Decisions with NPV and IRR

Net Present Value (NPV) and Internal Rate of Return (IRR) are critical metrics for evaluating farm investments, with NPV providing a dollar value estimate of profitability and IRR representing the investment's expected rate of return. Prioritizing NPV offers a clearer indication of absolute financial benefit, while IRR facilitates comparison across different projects with varying scales and timeframes. Combining NPV's precision with IRR's relative efficiency enables farmers to optimize investment decisions, maximizing economic returns and resource allocation.

Related Important Terms

Real Option Valuation

Net present value (NPV) provides a static measure of a farm investment's profitability by discounting expected cash flows to present value, while internal rate of return (IRR) identifies the discount rate that sets NPV to zero, reflecting investment yield. Real option valuation enhances these traditional metrics by incorporating the value of managerial flexibility and future decision-making opportunities under uncertainty, offering a dynamic framework for evaluating investment timing and scale in agricultural projects.

Stochastic Discount Rate

Net Present Value (NPV) provides a clear monetary measure of farm investment profitability by discounting expected cash flows at a stochastic discount rate that captures market uncertainty and risk variability. Internal Rate of Return (IRR), while indicating investment efficiency, can be less reliable under stochastic discount rates due to its sensitivity to cash flow timing and the difficulty in accommodating fluctuating risk premiums inherent in agricultural markets.

Hurdle Rate Sensitivity

Net Present Value (NPV) provides a direct measure of a farm investment's profitability by discounting future cash flows at a specific hurdle rate, making it highly sensitive to changes in this rate, which can significantly alter project viability conclusions. In contrast, Internal Rate of Return (IRR) represents the discount rate that sets NPV to zero but can yield multiple or misleading values when cash flow patterns are irregular, thus complicating hurdle rate sensitivity assessment in agricultural investments.

Dynamic NPV Simulation

Dynamic NPV simulation provides a more robust assessment of farm investments by accounting for variable cash flows, inflation, and risk factors over time, delivering a realistic portrayal of project profitability compared to static Net Present Value (NPV) models. Unlike the Internal Rate of Return (IRR), which can produce multiple or misleading discount rates in non-conventional cash flows, Dynamic NPV simulation captures the temporal financial dynamics essential for optimizing investment decisions in agricultural economics.

Modified Internal Rate of Return (MIRR)

The Modified Internal Rate of Return (MIRR) provides a more accurate assessment of farm investments by incorporating the cost of capital and reinvestment rate, overcoming the limitations of traditional Internal Rate of Return (IRR) which can give multiple or misleading values. In agricultural economics, MIRR enhances decision-making by offering a clearer comparison with Net Present Value (NPV), ensuring investment projects are evaluated based on realistic cash flow assumptions and profitability timelines.

Agri-specific Cash Flow Modeling

Net Present Value (NPV) offers a precise valuation of farm investments by discounting projected cash flows using an appropriate agricultural discount rate, capturing the time value of money in crop cycles and livestock production. Internal Rate of Return (IRR) provides a percentage measure of profitability but may misrepresent agri-specific cash flow patterns due to seasonal variability and irregular investment timings inherent in farming operations.

Terminal Value in Perennial Crops

Net Present Value (NPV) provides a clear measure of the absolute profitability of farm investments by discounting all future cash flows, including Terminal Value, to present terms, which is critical for evaluating perennial crops with long lifecycle horizons. Internal Rate of Return (IRR) offers the rate at which an investment breaks even, but often undervalues Terminal Value in perennial crop investments due to reinvestment rate assumptions, making NPV a more reliable indicator for long-term agricultural economic decisions.

Risk-adjusted NPV (raNPV)

Risk-adjusted Net Present Value (raNPV) provides a more comprehensive evaluation of farm investments by incorporating uncertainty and variability in cash flows, offering a more realistic assessment than Internal Rate of Return (IRR), which can be misleading due to its assumption of reinvestment at the same rate. By adjusting for risk, raNPV enhances decision-making in agricultural economics, particularly when comparing projects with differing risk profiles and cash flow timings.

Discounted Payback Period (for farmland)

Net Present Value (NPV) offers a comprehensive measure of profitability for farm investments by calculating the present value of cash inflows minus outflows, while Internal Rate of Return (IRR) identifies the discount rate that equates these cash flows to zero, reflecting investment efficiency. The Discounted Payback Period specifically accounts for the time required to recover initial farmland investment costs in present value terms, emphasizing liquidity and risk management within agricultural economics.

Scenario-based IRR Analysis

Scenario-based IRR analysis provides a dynamic approach to evaluating farm investments by assessing internal rate of return under varying market prices, yields, and cost structures, capturing the inherent uncertainties in agricultural economics. Net present value offers a static snapshot by discounting future cash flows, but integrating scenario-based IRR enhances decision-making through sensitivity to different economic conditions, improving risk management in farm investment planning.

Net present value vs Internal rate of return for farm investments Infographic

agridif.com

agridif.com