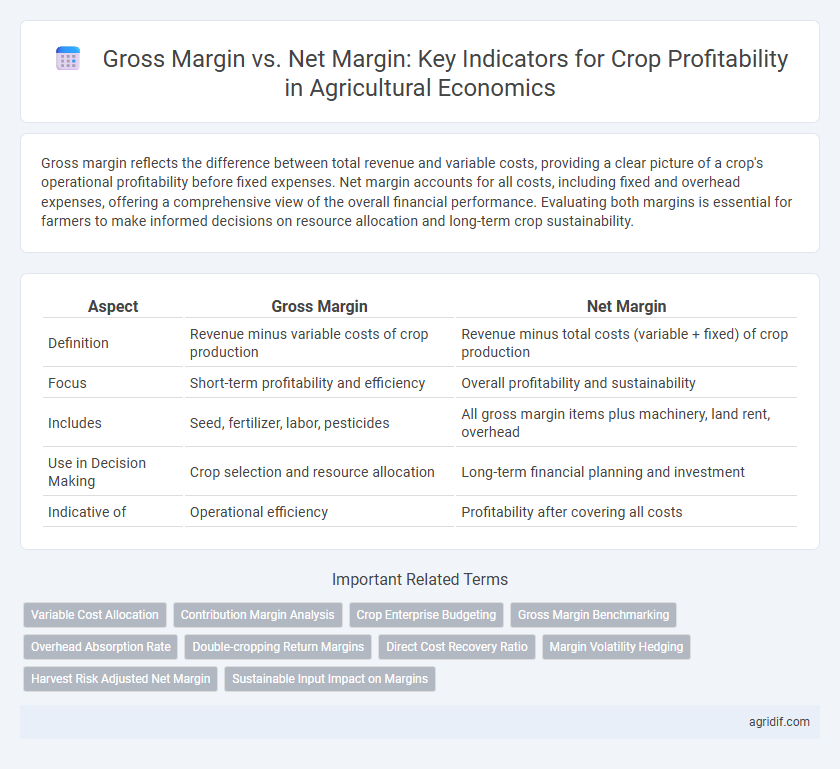

Gross margin reflects the difference between total revenue and variable costs, providing a clear picture of a crop's operational profitability before fixed expenses. Net margin accounts for all costs, including fixed and overhead expenses, offering a comprehensive view of the overall financial performance. Evaluating both margins is essential for farmers to make informed decisions on resource allocation and long-term crop sustainability.

Table of Comparison

| Aspect | Gross Margin | Net Margin |

|---|---|---|

| Definition | Revenue minus variable costs of crop production | Revenue minus total costs (variable + fixed) of crop production |

| Focus | Short-term profitability and efficiency | Overall profitability and sustainability |

| Includes | Seed, fertilizer, labor, pesticides | All gross margin items plus machinery, land rent, overhead |

| Use in Decision Making | Crop selection and resource allocation | Long-term financial planning and investment |

| Indicative of | Operational efficiency | Profitability after covering all costs |

Understanding Gross Margin in Crop Production

Gross margin in crop production represents the difference between total crop revenue and variable costs, serving as a crucial indicator of short-term profitability and efficiency in resource allocation. It allows farmers to assess the financial viability of individual crops by isolating costs directly tied to production, such as seeds, fertilizers, and labor, excluding fixed costs like land or equipment depreciation. Understanding gross margin helps optimize cropping decisions and improves cash flow management, providing a clear measure of operational performance before accounting for overhead expenses.

Defining Net Margin for Agricultural Enterprises

Net margin for agricultural enterprises represents the percentage of revenue remaining after all operating expenses, including variable and fixed costs, have been deducted from total crop sales. Unlike gross margin, which only accounts for direct production costs such as seed, fertilizer, and labor, net margin provides a comprehensive measure of overall profitability by factoring in overhead, depreciation, and interest expenses. This metric is critical for evaluating long-term financial sustainability and making informed decisions on resource allocation in crop production.

Key Differences Between Gross Margin and Net Margin

Gross margin in crop profitability measures the total revenue minus variable costs like seeds, fertilizers, and labor, reflecting the efficiency of crop production. Net margin accounts for all expenses, including fixed costs such as machinery depreciation, land rent, and interest, providing a comprehensive view of overall profitability. Understanding these key differences helps farmers optimize resource allocation and financial planning for sustainable agricultural operations.

Components of Crop Revenue and Cost Structure

Gross margin in crop profitability measures the difference between total crop revenue and variable costs, highlighting the efficiency of production without fixed costs consideration. Net margin accounts for total costs, including fixed expenses like equipment depreciation and land rent, offering a comprehensive view of profit. Key components of crop revenue include yield per acre and market price, while cost structure involves seeds, fertilizers, labor, machinery, and overheads.

Importance of Calculating Gross Margin in Crop Profitability

Calculating gross margin is essential in crop profitability analysis as it provides a clear measure of revenue minus variable costs, reflecting the direct profitability of crop production before fixed costs. Understanding gross margin allows farmers and agronomists to assess the financial efficiency of different crops, optimize resource allocation, and make informed decisions on input levels and crop selection. This metric serves as a foundational indicator for managing operational risk and improving overall farm profitability in agricultural economics.

The Role of Overhead Costs in Net Margin Analysis

Gross margin reflects the difference between total crop revenue and variable costs, highlighting immediate profitability before fixed expenses. Net margin incorporates overhead costs such as equipment depreciation, land rent, and administrative expenses, offering a comprehensive view of true crop profitability. Ignoring overhead costs in analysis can overstate financial performance and misguide management decisions in agricultural economics.

Practical Examples: Gross vs Net Margin in Major Crops

Gross margin represents the difference between the revenue from crop sales and variable costs such as seeds, fertilizers, and labor, providing a clear indicator of the short-term profitability for crops like corn, wheat, and soybeans. Net margin accounts for both variable and fixed costs, including machinery depreciation and land rent, offering a comprehensive view of overall profitability. For instance, while corn may show a high gross margin due to strong market prices and low variable costs, its net margin can be significantly lower after factoring in high fixed expenses, unlike wheat which often has a more balanced gross to net margin ratio.

Strategic Decision-Making Using Margin Analysis

Gross margin provides insight into crop profitability by measuring the difference between revenue and variable costs, serving as a critical indicator for short-term production decisions in agricultural economics. Net margin accounts for all costs, including fixed expenses, offering a comprehensive view of overall profitability and informing long-term strategic planning for crop enterprises. Analyzing both margins enables farmers and agribusinesses to optimize resource allocation, enhance cost efficiency, and improve financial sustainability in crop production.

Common Pitfalls in Margin Calculations for Farmers

Gross margin and net margin are critical metrics for assessing crop profitability, yet farmers often miscalculate these by overlooking indirect costs such as labor, machinery depreciation, and interest expenses. Ignoring these hidden expenses leads to an inflated gross margin, providing a misleading picture of true profitability and financial health. Accurate margin calculations require detailed accounting of all variable and fixed costs, enabling informed decisions on crop management and investment strategies.

Enhancing Crop Profitability Through Margin Optimization

Gross margin represents the revenue remaining after subtracting variable costs directly tied to crop production, serving as a crucial indicator of short-term profitability. Net margin accounts for both variable and fixed costs, offering a comprehensive view of overall financial health and sustainability in crop farming. Enhancing crop profitability hinges on optimizing gross margin through efficient input management and maximizing net margin by reducing fixed costs and improving operational efficiency.

Related Important Terms

Variable Cost Allocation

Gross margin measures crop profitability by subtracting variable costs such as seeds, fertilizers, and labor from total revenue, highlighting the immediate cost-efficiency of production decisions. In contrast, net margin accounts for both variable and fixed costs, offering a comprehensive view of overall farm profitability and resource allocation efficiency.

Contribution Margin Analysis

Gross margin measures the revenue from crop sales minus variable production costs, providing insight into the direct profitability of crop production, while net margin accounts for all costs including fixed expenses, reflecting overall farm profitability. Contribution margin analysis helps identify the extent to which each crop contributes to covering fixed costs and generating profit, pivotal for informed decision-making in agricultural economics.

Crop Enterprise Budgeting

Gross margin in crop enterprise budgeting represents total revenue minus variable costs, providing a clear indicator of the crop's contribution to fixed costs and profitability. Net margin, calculated by subtracting total costs (both fixed and variable) from total revenue, delivers a comprehensive measure of overall crop profitability and financial sustainability.

Gross Margin Benchmarking

Gross margin benchmarking in crop profitability highlights the difference between revenues and variable costs, offering a clear measure of production efficiency before fixed costs and overheads are considered. Focusing on gross margin enables farmers to identify high-performing crops and optimize resource allocation, while net margin provides insight into overall profitability after accounting for all expenses.

Overhead Absorption Rate

Gross margin measures crop profitability by subtracting variable costs from total revenue, while net margin accounts for both variable and fixed costs, including overheads absorbed through the Overhead Absorption Rate (OAR). Accurate application of the OAR ensures fixed costs are fairly allocated to crops, providing a realistic assessment of net profitability and guiding better financial decisions in agricultural enterprises.

Double-cropping Return Margins

Gross margin for double-cropping return margins highlights the direct revenue minus variable costs from both crops, offering a clear snapshot of immediate profitability per acre. Net margin accounts for all fixed and overhead expenses, revealing the true economic return and sustainability of intensive double-cropping systems in agricultural economics.

Direct Cost Recovery Ratio

Gross margin in crop profitability measures total revenue minus variable costs, reflecting the financial efficiency before fixed costs are considered, while net margin accounts for all operating expenses, providing a comprehensive profitability overview. The Direct Cost Recovery Ratio, a key metric in agricultural economics, indicates the proportion of direct costs covered by gross margin, offering insight into short-term sustainability and operational efficiency of crop production systems.

Margin Volatility Hedging

Gross margin measures crop revenue minus variable costs, providing a clear snapshot of immediate profitability, while net margin accounts for all expenses including fixed costs, offering a comprehensive view of long-term financial health. Margin volatility hedging strategies such as futures contracts and options help stabilize gross margins by minimizing price fluctuations, thereby protecting crop profitability against unpredictable market conditions.

Harvest Risk Adjusted Net Margin

Harvest Risk Adjusted Net Margin accounts for variability in crop yields and market prices, providing a more realistic profitability measure than Gross Margin, which only considers direct costs and revenues. This risk-adjusted metric allows farmers to better evaluate crop choices under uncertain conditions by incorporating potential losses from harvest variability into the Net Margin calculation.

Sustainable Input Impact on Margins

Gross margin highlights the revenue remaining after variable costs, emphasizing the direct profitability of crop production, while net margin accounts for all expenses, including fixed costs and overhead, providing a comprehensive profitability measure. Sustainable inputs like organic fertilizers and integrated pest management can reduce variable costs and enhance soil health, leading to improved gross margins and potentially higher net margins by lowering long-term expenditures and increasing yield stability.

Gross margin vs net margin for crop profitability Infographic

agridif.com

agridif.com