Marginal cost represents the additional expense incurred from producing one more unit of a crop, while marginal revenue indicates the additional income generated from selling that unit. Maximizing profit in crop production requires equating marginal cost with marginal revenue, ensuring resources are allocated efficiently. Ignoring this balance can lead to suboptimal decisions, resulting in either wasted input costs or lost revenue opportunities.

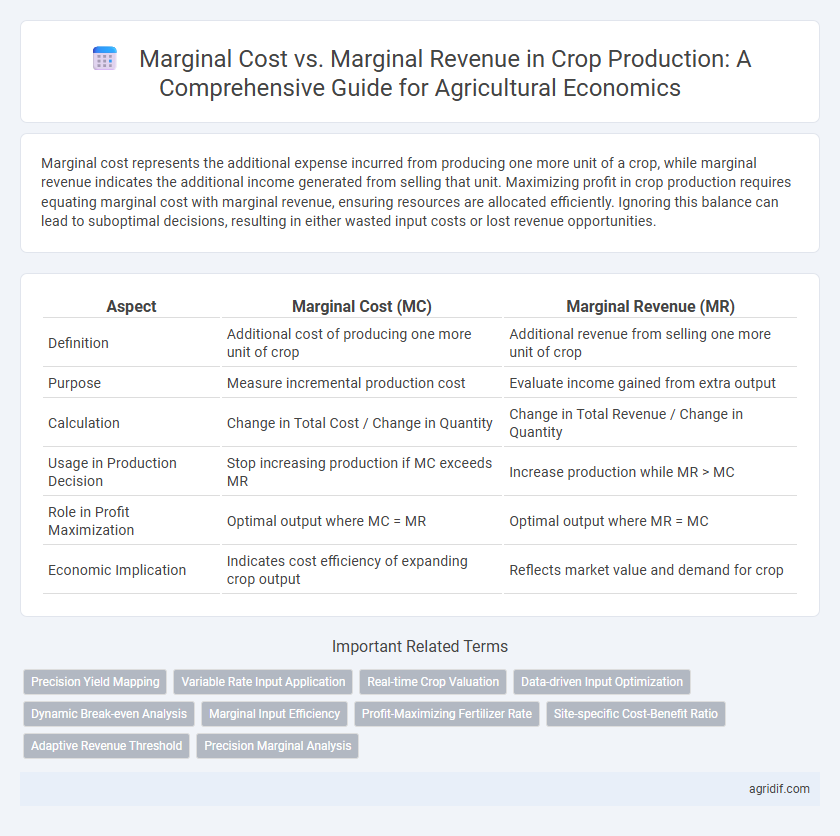

Table of Comparison

| Aspect | Marginal Cost (MC) | Marginal Revenue (MR) |

|---|---|---|

| Definition | Additional cost of producing one more unit of crop | Additional revenue from selling one more unit of crop |

| Purpose | Measure incremental production cost | Evaluate income gained from extra output |

| Calculation | Change in Total Cost / Change in Quantity | Change in Total Revenue / Change in Quantity |

| Usage in Production Decision | Stop increasing production if MC exceeds MR | Increase production while MR > MC |

| Role in Profit Maximization | Optimal output where MC = MR | Optimal output where MR = MC |

| Economic Implication | Indicates cost efficiency of expanding crop output | Reflects market value and demand for crop |

Understanding Marginal Cost in Crop Production

Marginal cost in crop production represents the additional expense incurred by producing one more unit of crop output, including costs such as seeds, fertilizers, labor, and water usage. Understanding marginal cost helps farmers determine the optimal production level where increasing output no longer yields profit gains, ensuring efficient resource allocation. Accurate calculation of marginal cost supports better decision-making by comparing it against marginal revenue to maximize farm profitability.

Defining Marginal Revenue in Agricultural Economics

Marginal revenue in agricultural economics refers to the additional income generated from selling one more unit of crop output, critical for determining optimal production levels. It directly influences farmers' decisions on whether to increase or decrease crop output by comparing marginal revenue to marginal cost. Understanding marginal revenue helps maximize profit by guiding efficient resource allocation in crop production.

The Relationship Between Marginal Cost and Marginal Revenue

Marginal cost (MC) represents the additional expense incurred for producing one more unit of crop output, while marginal revenue (MR) indicates the additional income from selling that extra unit. The optimal production level is achieved when marginal cost equals marginal revenue (MC = MR), ensuring maximum profit for farmers by balancing production costs with revenue gains. If MR exceeds MC, increasing crop output boosts profitability, whereas if MC surpasses MR, reducing production minimizes losses.

Calculating Marginal Cost for Crop Producers

Calculating marginal cost for crop producers involves determining the additional cost incurred from producing one more unit of a crop, typically measured per acre or per bushel. This calculation requires accounting for variable inputs such as seeds, fertilizers, labor, and fuel, excluding fixed costs like land rent or machinery depreciation. Accurate marginal cost assessment enables producers to optimize crop output by comparing marginal cost directly with marginal revenue, guiding decisions on whether to increase or decrease production to maximize profitability.

Determining Marginal Revenue from Crop Sales

Marginal revenue from crop sales is calculated by measuring the change in total revenue resulting from the sale of one additional unit of crop output, which is crucial for optimizing production levels. Understanding marginal cost in relation to marginal revenue helps farmers decide the optimal quantity of crops to produce, ensuring profitability by equating marginal cost to marginal revenue. Accurate estimation of marginal revenue depends on market prices for crops and demand elasticity, influencing decisions in agricultural economics for efficient resource allocation.

Optimizing Crop Yield: Where Marginal Cost Equals Marginal Revenue

Optimizing crop yield in agricultural economics requires analyzing where marginal cost equals marginal revenue, ensuring each additional unit of crop produced generates revenue equal to the cost incurred. When marginal cost exceeds marginal revenue, overproduction leads to losses, while producing less than this equilibrium results in missed profit opportunities. This balance maximizes profit by allocating resources efficiently, guiding farmers in decisions around input use and crop volume.

Impact of Input Prices on Marginal Cost

Marginal cost in crop production rises as input prices such as seeds, fertilizers, and labor increase, directly affecting the cost of producing each additional unit. When input prices escalate, farmers face higher marginal costs, reducing the profitability threshold where marginal revenue equals marginal cost. This shift impacts production decisions, potentially leading to lower output levels or altered crop choices to maintain economic viability.

Price Fluctuations and Marginal Revenue in Crop Markets

Marginal revenue in crop markets often fluctuates due to price volatility caused by changing supply, demand, and external factors like weather conditions and government policies. Marginal cost, which includes inputs such as seeds, labor, and fertilizers, remains relatively stable but can increase during periods of input scarcity or inflation. Farmers maximize profit by producing at the output level where marginal cost equals marginal revenue, balancing production against fluctuating market prices to optimize economic returns.

Practical Examples: Marginal Analysis in Crop Production Decisions

Marginal cost in crop production reflects the additional expense incurred for producing one more unit of crop, such as the extra seed, fertilizer, and labor needed to plant an additional acre of corn or wheat. Marginal revenue represents the income generated from selling that extra unit, for example, the market price obtained from the additional bushel harvested. Farmers use marginal analysis by comparing marginal cost and marginal revenue to determine the optimal level of output, increasing production when marginal revenue exceeds marginal cost and reducing it when the marginal cost surpasses marginal revenue to maximize profit.

Policy Implications for Farmers: Using Marginal Analysis

Farmers optimize crop production by comparing marginal cost and marginal revenue to maximize profit, producing until marginal cost equals marginal revenue. Policies promoting access to accurate price information and cost-effective technologies enable farmers to make informed marginal decisions, enhancing resource allocation efficiency. Supporting extension services and market infrastructure reduces information asymmetry, guiding farmers toward optimal production levels that align with sustainable economic growth.

Related Important Terms

Precision Yield Mapping

Precision yield mapping enhances the accuracy of calculating marginal cost and marginal revenue in crop production by providing detailed spatial data on yield variability across fields. This technology enables farmers to optimize input use, balancing marginal costs with expected marginal revenue to maximize profitability and resource efficiency.

Variable Rate Input Application

Variable rate input application in crop production optimizes marginal cost by adjusting input levels to match soil and crop variability, reducing unnecessary expenses. This precision farming technique enhances marginal revenue by maximizing yield response to inputs, ensuring input costs align closely with the added revenue from increased output.

Real-time Crop Valuation

Marginal cost in crop production represents the expense incurred to produce one additional unit of crop, while marginal revenue denotes the income earned from selling that extra unit; real-time crop valuation integrates market price fluctuations and production costs to optimize planting and harvesting decisions. Leveraging real-time data analytics enables farmers to adjust inputs dynamically, ensuring marginal revenue exceeds marginal cost for maximized profitability in volatile agricultural markets.

Data-driven Input Optimization

Marginal cost in crop production measures the expense of increasing output by one unit, while marginal revenue represents the additional income from selling that unit, crucial for maximizing profit. Data-driven input optimization leverages precise analysis of soil, weather, and crop yield data to adjust inputs like fertilizers and irrigation, ensuring marginal cost aligns with marginal revenue for efficient resource allocation.

Dynamic Break-even Analysis

Dynamic break-even analysis in crop production evaluates the point where marginal cost equals marginal revenue over time, accounting for fluctuations in input prices, crop yields, and market demand. This approach enables farmers to adjust resource allocation and pricing strategies dynamically, optimizing profitability under varying economic and environmental conditions.

Marginal Input Efficiency

Marginal input efficiency in crop production quantifies the increase in output generated by one additional unit of input, serving as a critical factor in determining marginal cost and marginal revenue. Optimizing marginal input efficiency enables farmers to balance input expenses with revenue gains, ensuring production levels where marginal revenue equals marginal cost for maximum profitability.

Profit-Maximizing Fertilizer Rate

Profit-maximizing fertilizer rate is achieved when the marginal cost of applying an additional unit of fertilizer equals the marginal revenue generated from the increased crop yield, ensuring optimal input efficiency. Applying fertilizer beyond this point increases costs faster than revenue, reducing overall profitability in crop production.

Site-specific Cost-Benefit Ratio

Marginal cost in crop production varies significantly with site-specific factors such as soil fertility, water availability, and input accessibility, directly influencing the cost-benefit ratio for each location. Optimizing marginal revenue requires precise adjustments to input levels on a per-site basis to maximize profitability while minimizing excessive expenditure linked to variable marginal costs.

Adaptive Revenue Threshold

Marginal cost in crop production represents the expense incurred for producing one additional unit of output, while marginal revenue reflects the additional income generated from selling that unit. Adaptive revenue thresholds serve as dynamic benchmarks that farmers use to adjust production levels, ensuring that marginal revenue consistently exceeds marginal cost for optimized profitability under varying market and environmental conditions.

Precision Marginal Analysis

Precision Marginal Analysis in agricultural economics quantifies the incremental cost and revenue changes from cultivating additional crop units, enabling farmers to optimize input allocation for maximum profit. By comparing marginal cost and marginal revenue at this fine scale, crop producers can identify the exact point where the cost of growing one more unit equals the revenue it generates, ensuring efficient resource use and enhanced profitability.

Marginal Cost vs Marginal Revenue for crop production Infographic

agridif.com

agridif.com