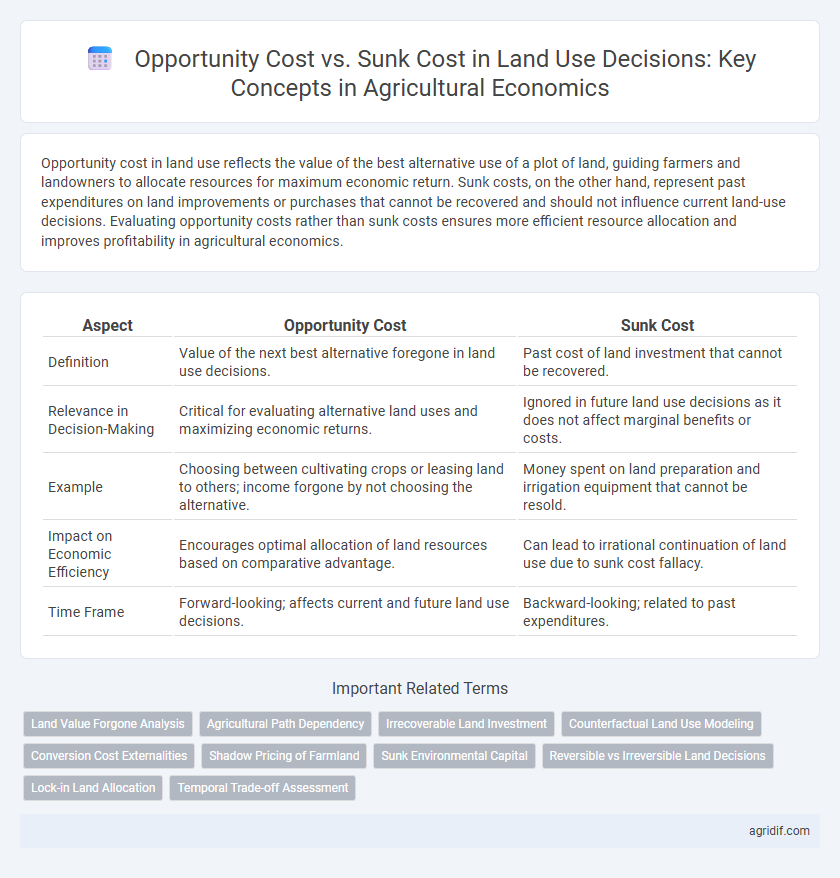

Opportunity cost in land use reflects the value of the best alternative use of a plot of land, guiding farmers and landowners to allocate resources for maximum economic return. Sunk costs, on the other hand, represent past expenditures on land improvements or purchases that cannot be recovered and should not influence current land-use decisions. Evaluating opportunity costs rather than sunk costs ensures more efficient resource allocation and improves profitability in agricultural economics.

Table of Comparison

| Aspect | Opportunity Cost | Sunk Cost |

|---|---|---|

| Definition | Value of the next best alternative foregone in land use decisions. | Past cost of land investment that cannot be recovered. |

| Relevance in Decision-Making | Critical for evaluating alternative land uses and maximizing economic returns. | Ignored in future land use decisions as it does not affect marginal benefits or costs. |

| Example | Choosing between cultivating crops or leasing land to others; income forgone by not choosing the alternative. | Money spent on land preparation and irrigation equipment that cannot be resold. |

| Impact on Economic Efficiency | Encourages optimal allocation of land resources based on comparative advantage. | Can lead to irrational continuation of land use due to sunk cost fallacy. |

| Time Frame | Forward-looking; affects current and future land use decisions. | Backward-looking; related to past expenditures. |

Understanding Opportunity Cost in Agricultural Land Use

Opportunity cost in agricultural land use represents the value of the best alternative use of the land, such as converting cropland to pasture or setting it aside for conservation, which directly informs decision-making for maximizing farm profitability. Unlike sunk costs, which are past investments in land improvements or equipment that cannot be recovered, opportunity costs emphasize future returns forgone by choosing one land use over another. Understanding opportunity cost aids farmers and economists in evaluating trade-offs between crop production, livestock grazing, and sustainable practices to optimize land allocation under varying economic and environmental conditions.

Defining Sunk Cost in Agricultural Economics

Sunk cost in agricultural economics refers to past expenditures on land or resources that cannot be recovered, such as initial investments in soil preparation or irrigation systems. Unlike opportunity cost, which measures the potential benefits of alternative land uses forgone, sunk costs should not influence current or future production decisions because they remain unchanged regardless of outcomes. Understanding sunk costs helps farmers avoid irrational commitments to unprofitable land use by focusing on marginal costs and benefits.

Key Differences: Opportunity Cost vs Sunk Cost for Farmers

Opportunity cost in agricultural economics refers to the potential benefits farmers forgo by allocating land to a particular crop instead of the next best alternative, highlighting the value of missed opportunities in land use decisions. Sunk cost represents expenses already incurred, such as past investments in soil improvement or irrigation infrastructure, which should not influence current land use choices because these costs cannot be recovered. Understanding these key differences enables farmers to make more efficient land allocation decisions by focusing on future benefits rather than irrecoverable past expenditures.

Land Allocation Decisions: Weighing Future Gains and Past Investments

Opportunity cost in land allocation highlights the potential benefits forgone when choosing one land use over another, emphasizing the value of future gains in agricultural economics. Sunk cost refers to past investments in land that should not influence current or future land use decisions, as these expenditures cannot be recovered. Effective land allocation decisions prioritize opportunity costs to maximize long-term agricultural productivity and economic returns, disregarding sunk costs to avoid inefficient resource use.

Opportunity Cost in Crop Selection and Rotation

Opportunity cost in crop selection and rotation refers to the potential benefits foregone by choosing one crop over another on the same land, affecting revenue and soil health. Considering opportunity cost ensures optimal land use by aligning crop choices with market demand, input costs, and long-term sustainability. Ignoring sunk costs, such as past investments in soil amendments or irrigation, allows farmers to make economically rational decisions based on current and future profitability rather than irreversible expenditures.

Sunk Cost Fallacy: Avoiding Irreversible Land Investments

Sunk costs in land use, such as initial clearing or infrastructure expenses, should not influence current agricultural decisions since these investments are irreversible and unrecoverable. Opportunity cost evaluates alternative uses of the land, emphasizing potential benefits from crop rotation, conservation, or leasing options that generate higher economic returns. Avoiding the sunk cost fallacy prevents farmers from persisting with unprofitable land investments, optimizing resource allocation and long-term sustainability.

Maximizing Land Value: Economic Principles in Farm Planning

Opportunity cost in land use represents the potential income from the next best alternative use of farmland, crucial for maximizing land value in farm planning. Sunk costs, such as previous investments in land improvements, should not influence current economic decisions as they cannot be recovered. Prioritizing opportunity cost analysis ensures resource allocation optimizes profitability and long-term economic sustainability in agricultural operations.

Case Studies: Real-World Examples from Agriculture

Case studies in agricultural economics highlight the critical distinction between opportunity cost and sunk cost in land use decisions, where opportunity cost represents the forgone benefits from alternative crops or land uses, such as switching from wheat to livestock grazing. Real-world examples include farmers in the Midwest allocating fields to corn production, assessing the opportunity cost of not planting soybeans, while sunk costs like prior investments in irrigation systems are irrecoverable regardless of land use changes. These examples emphasize that rational agricultural land management depends on evaluating future opportunity costs rather than past sunk costs to optimize profitability.

Policy Implications for Land Use and Resource Allocation

Opportunity cost in land use reflects the value of the next best alternative foregone, guiding policymakers to allocate land resources efficiently for maximum economic return and sustainability. Sunk costs, which are irreversible investments in land development, should not influence future land use decisions but often do, leading to suboptimal resource allocation and inefficient policy measures. Recognizing the distinction helps design land use policies that prioritize dynamic economic incentives and adaptive resource management, fostering sustainable agricultural growth and environmental conservation.

Strategic Recommendations for Optimizing Land Use Choices

Evaluating opportunity cost in land use prioritizes the potential returns from the best alternative crop or land activity, guiding resource allocation toward higher-value options. Ignoring sunk costs, such as prior investments in soil improvement or irrigation, prevents biased decisions that could hinder profitability and sustainability in agricultural economics. Strategic recommendations emphasize dynamic land-use models incorporating opportunity cost to optimize crop rotation, maximize yield, and enhance long-term farm income.

Related Important Terms

Land Value Forgone Analysis

Opportunity cost in agricultural land use represents the potential income lost when land is allocated to a particular crop instead of its best alternative use, directly influencing land value forgone analysis. Sunk costs, by contrast, are past investments in land improvements or purchases that do not affect current land value decisions, emphasizing the importance of focusing on opportunity costs for effective land use planning and resource allocation.

Agricultural Path Dependency

Opportunity cost in agricultural land use represents the potential benefits forgone by choosing one crop or land use over another, directly influencing farmers' decisions and reinforcing agricultural path dependency. Sunk costs, such as past investments in irrigation or machinery, do not affect current land use choices but contribute to the inertia that perpetuates established farming practices despite changing market or environmental conditions.

Irrecoverable Land Investment

Irrecoverable land investment represents sunk costs that cannot be recovered once spent, while opportunity cost reflects the value of the next best alternative land use foregone. In agricultural economics, understanding the distinction is crucial as sunk costs should not influence current land-use decisions, whereas opportunity costs guide optimal allocation to maximize economic returns.

Counterfactual Land Use Modeling

Opportunity cost in agricultural land use quantifies the potential yield or revenue lost when allocating land to one crop instead of the next best alternative, a critical factor in counterfactual land use modeling to optimize resource allocation. Sunk cost, by contrast, represents past investments in land improvements or inputs that do not influence future land-use decisions, emphasizing the importance of ignoring these costs when evaluating alternative agricultural scenarios.

Conversion Cost Externalities

Opportunity cost in land use reflects the value of the next best alternative foregone when converting land, emphasizing the importance of evaluating externalities such as changes in ecosystem services or biodiversity loss. Sunk costs are past investments in agriculture infrastructure or soil improvement that do not influence current land-use decisions, but failure to consider opportunity costs can lead to inefficient allocation, exacerbating negative externalities like soil degradation or water pollution.

Shadow Pricing of Farmland

Shadow pricing of farmland quantifies the opportunity cost by assigning a hypothetical market value to land in the absence of direct transactions, reflecting potential income from alternative uses. This contrasts with sunk costs, which are unrecoverable past investments in land improvements that do not influence current land use decisions or marginal economic value.

Sunk Environmental Capital

Sunk environmental capital refers to irreversible degradation or loss of natural resources in agricultural land, making recovery impossible or economically unjustifiable. Opportunity cost involves evaluating potential gains from alternative land uses, whereas sunk costs represent past environmental damages that should not influence current land-use decisions.

Reversible vs Irreversible Land Decisions

Opportunity cost in agricultural land use refers to the value of the next best alternative, emphasizing reversible decisions like crop rotation or fallowing that allow flexibility in land management. Sunk cost involves irreversible investments such as permanent land conversion or soil degradation, where past expenditures cannot be recovered and should not influence future land use choices.

Lock-in Land Allocation

Opportunity cost in land use represents the value of the best alternative agricultural activity forgone, influencing decisions to avoid lock-in land allocation that restricts future flexibility and profitability. Sunk costs, such as past investments in irrigation or soil improvement, should not dictate current land use choices, as they do not affect the marginal cost-benefit analysis critical for optimizing resource allocation and preventing inefficient land lock-in.

Temporal Trade-off Assessment

Opportunity cost in land use reflects the future benefits foregone by choosing one agricultural practice over another, guiding temporal trade-off assessments for maximizing land productivity. Sunk costs, such as past investments in land improvement, do not influence current or future land use decisions since they cannot be recovered or changed.

Opportunity cost vs sunk cost for land use Infographic

agridif.com

agridif.com