Market integration facilitates efficient regional price transmission by allowing information and goods to flow freely across markets, leading to price convergence and reduced volatility. In contrast, market isolation hinders price transmission, causing significant price disparities that can disadvantage producers and consumers in isolated regions. Strengthening market integration enhances resource allocation and promotes stable agricultural development across diverse geographic areas.

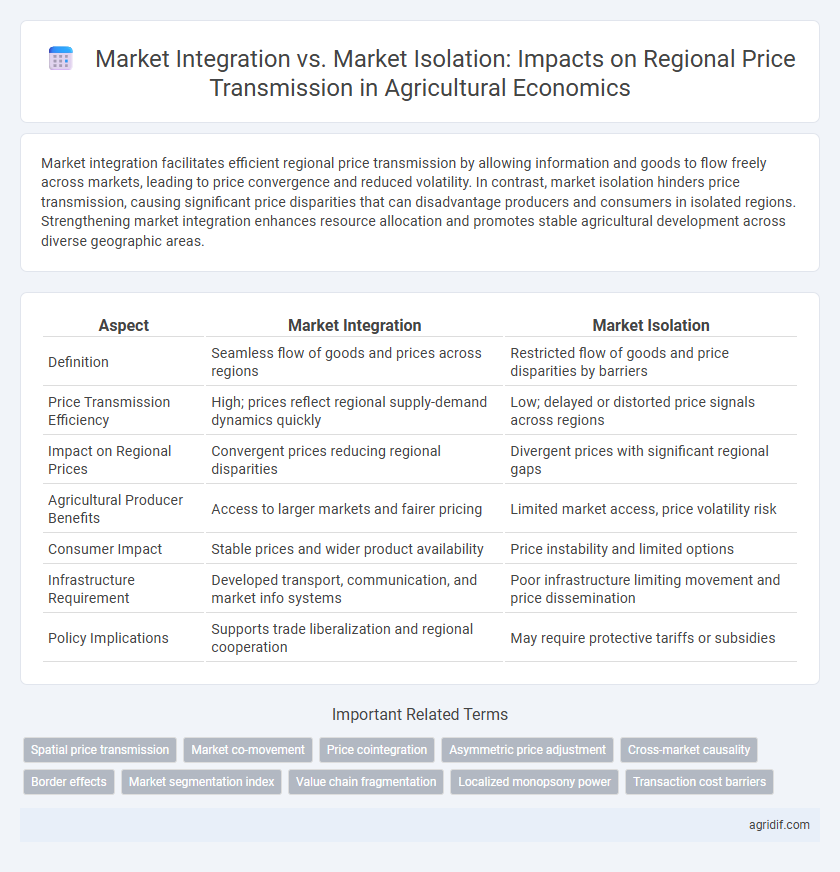

Table of Comparison

| Aspect | Market Integration | Market Isolation |

|---|---|---|

| Definition | Seamless flow of goods and prices across regions | Restricted flow of goods and price disparities by barriers |

| Price Transmission Efficiency | High; prices reflect regional supply-demand dynamics quickly | Low; delayed or distorted price signals across regions |

| Impact on Regional Prices | Convergent prices reducing regional disparities | Divergent prices with significant regional gaps |

| Agricultural Producer Benefits | Access to larger markets and fairer pricing | Limited market access, price volatility risk |

| Consumer Impact | Stable prices and wider product availability | Price instability and limited options |

| Infrastructure Requirement | Developed transport, communication, and market info systems | Poor infrastructure limiting movement and price dissemination |

| Policy Implications | Supports trade liberalization and regional cooperation | May require protective tariffs or subsidies |

Defining Market Integration and Market Isolation in Agriculture

Market integration in agriculture refers to the extent to which prices of agricultural commodities in different regions move together, indicating efficient information flow and minimal trade barriers. Market isolation occurs when regional markets exhibit price discrepancies due to limited connectivity, high transportation costs, or restrictive policies that hinder the transmission of price signals. Understanding the degree of integration or isolation helps in assessing the efficiency of regional price transmission and the potential for improving market access for farmers.

Mechanisms of Regional Price Transmission

Market integration facilitates efficient regional price transmission through interconnected supply chains and transparent information flows, enabling prices to adjust quickly in response to demand and supply changes. In contrast, market isolation disrupts these mechanisms, resulting in price disparities and inefficiencies caused by limited transportation infrastructure, poor market access, and fragmented communication networks. Understanding spatial arbitrage, transportation costs, and market power dynamics is crucial for analyzing the degree of price transmission across agricultural markets.

Factors Influencing Market Integration in Agricultural Sectors

Market integration in agricultural sectors is primarily influenced by factors such as transportation infrastructure quality, information flow efficiency, and market access. High transportation costs and poor infrastructure contribute significantly to market isolation, leading to price disparities across regions. Furthermore, policy regulations, market competition levels, and the presence of intermediaries play critical roles in determining the degree of price transmission between agricultural markets.

Barriers Leading to Market Isolation and Segmentation

Barriers such as poor infrastructure, trade restrictions, and information asymmetry significantly contribute to market isolation and segmentation in regional agricultural markets. These constraints hinder efficient price transmission by limiting the flow of goods and market signals between regions, resulting in price disparities and reduced market efficiency. Addressing these barriers through investments in transportation networks, policy harmonization, and improved market information systems enhances integration and promotes equitable price distribution across agricultural markets.

Effects of Market Integration on Agricultural Price Volatility

Market integration enhances regional price transmission by linking local agricultural markets with broader networks, reducing price volatility through improved supply chain responsiveness. Greater interconnectivity allows for efficient allocation of resources and stabilization of prices against localized shocks. In contrast, market isolation amplifies price fluctuations by limiting access to external markets, hindering farmers' ability to adjust production and consumption based on wider price signals.

Impact of Market Isolation on Farmer Incomes and Consumer Prices

Market isolation disrupts efficient price transmission by limiting farmers' access to broader markets, leading to reduced income opportunities due to lower demand and price volatility. Consumers face higher prices and limited product variety as isolated markets prevent competitive supply chains and economies of scale. Regional disparities intensify as isolated areas suffer from inefficiencies in agricultural supply and distribution systems, directly impacting economic welfare.

Policy Interventions: Promoting Regional Market Synergies

Policy interventions that promote regional market synergies enhance price transmission efficiency by facilitating better coordination among agricultural markets. Strengthening infrastructure, harmonizing trade regulations, and supporting information exchange reduce market isolation and enable seamless flow of goods and price signals across regions. Effective policies increase market integration, leading to stabilized prices, reduced volatility, and improved farmer incomes through expanded access to larger, interconnected markets.

Case Studies: Successes and Failures in Regional Price Transmission

Regional price transmission in agricultural markets demonstrates that market integration enhances price stability and efficiency, as seen in successful case studies from East African maize markets where improved infrastructure enabled better price synchronization. Conversely, market isolation, evidenced by remote Himalayan agricultural zones, often results in price distortions and volatility due to high transportation costs and limited information flow. Analyzing these case studies reveals that market integration fosters improved resource allocation and farmer income, while isolation perpetuates inefficiencies and price disparities.

Infrastructure and Technology in Enhancing Market Linkages

Improved infrastructure such as roads, storage facilities, and transport networks significantly enhances market integration by reducing transaction costs and facilitating efficient price transmission across regions. Advanced technology, including digital platforms and mobile communication, enables real-time market information flow, strengthening price convergence and reducing regional price disparities. Regions with weak infrastructure and limited technology suffer from market isolation, leading to inefficient price signals and reduced competitiveness in agricultural markets.

Future Prospects for Regional Agricultural Market Integration

Future prospects for regional agricultural market integration emphasize enhanced price transmission mechanisms driven by improved infrastructure and digital technologies. Greater market integration reduces price volatility and spatial price disparities, fostering efficiency and benefiting producers and consumers across regions. Policies promoting trade facilitation and harmonization of standards remain critical for achieving seamless regional market connectivity.

Related Important Terms

Spatial price transmission

Spatial price transmission analysis reveals that market integration enhances regional price efficiency by facilitating the flow of price signals across geographically dispersed markets, reducing price disparities and promoting resource allocation. Market isolation, conversely, leads to weak spatial price transmission, resulting in higher regional price volatility and distorted incentives for producers and consumers.

Market co-movement

Market integration enhances regional price transmission by promoting synchronized price movements across connected markets, which increases market co-movement and efficiency. In contrast, market isolation disrupts price signals, resulting in weak co-movement and reduced ability to respond to supply and demand shocks.

Price cointegration

Price cointegration in agricultural markets indicates strong market integration, where regional price transmission reflects efficient information flow and arbitrage opportunities across markets; in contrast, market isolation disrupts this cointegration, leading to price discrepancies that reduce economic efficiency and limit farmers' market access. Empirical studies show that higher degrees of price cointegration correlate with improved price stability and income predictability for agricultural producers in integrated regional markets.

Asymmetric price adjustment

Asymmetric price adjustment in agricultural markets highlights inefficiencies in regional price transmission where market integration allows faster and more balanced price responses to supply and demand shocks compared to market isolation, which often results in delayed and unequal price changes. Empirical studies demonstrate that integrated markets facilitate more efficient resource allocation and reduce price volatility, while isolated markets suffer from persistent price asymmetries harming farmers' income stability.

Cross-market causality

Cross-market causality in agricultural economics highlights how price signals in integrated markets transmit efficiently across regions, reducing price volatility and improving resource allocation. Market isolation disrupts this causal flow, leading to fragmented price discovery, higher transaction costs, and welfare losses for producers and consumers.

Border effects

Border effects significantly influence regional price transmission by creating price disparities that hinder market integration across agricultural regions. These effects arise due to trade barriers, transportation costs, and regulatory differences, resulting in fragmented markets and reduced efficiency in agricultural commodity flows.

Market segmentation index

The Market Segmentation Index (MSI) quantifies the degree of price transmission efficiency between regional agricultural markets, with higher MSI values indicating greater market isolation and reduced integration. Efficient market integration leads to synchronized price movements across regions, enhancing resource allocation and income stabilization for farmers.

Value chain fragmentation

Market integration enhances regional price transmission by reducing value chain fragmentation through improved linkages among producers, processors, and markets, facilitating efficient information flow and cost reduction. In contrast, market isolation leads to fragmented value chains characterized by limited connectivity, higher transaction costs, and price disparities, undermining regional economic efficiency and agricultural development.

Localized monopsony power

Localized monopsony power in agricultural markets disrupts regional price transmission by limiting competitive buying options and suppressing farmgate prices, thereby reducing market integration. This market isolation intensifies price disparities across regions, weakening efficiency and distorting signals needed for optimal resource allocation in agricultural supply chains.

Transaction cost barriers

High transaction cost barriers impede market integration by increasing expenses associated with transportation, information asymmetry, and contract enforcement, leading to fragmented regional price transmission and inefficiencies in agricultural markets. Reducing these costs enhances market connectivity, allowing prices to reflect supply and demand conditions more accurately across regions, thereby promoting equitable economic outcomes and resource allocation.

Market integration vs market isolation for regional price transmission Infographic

agridif.com

agridif.com