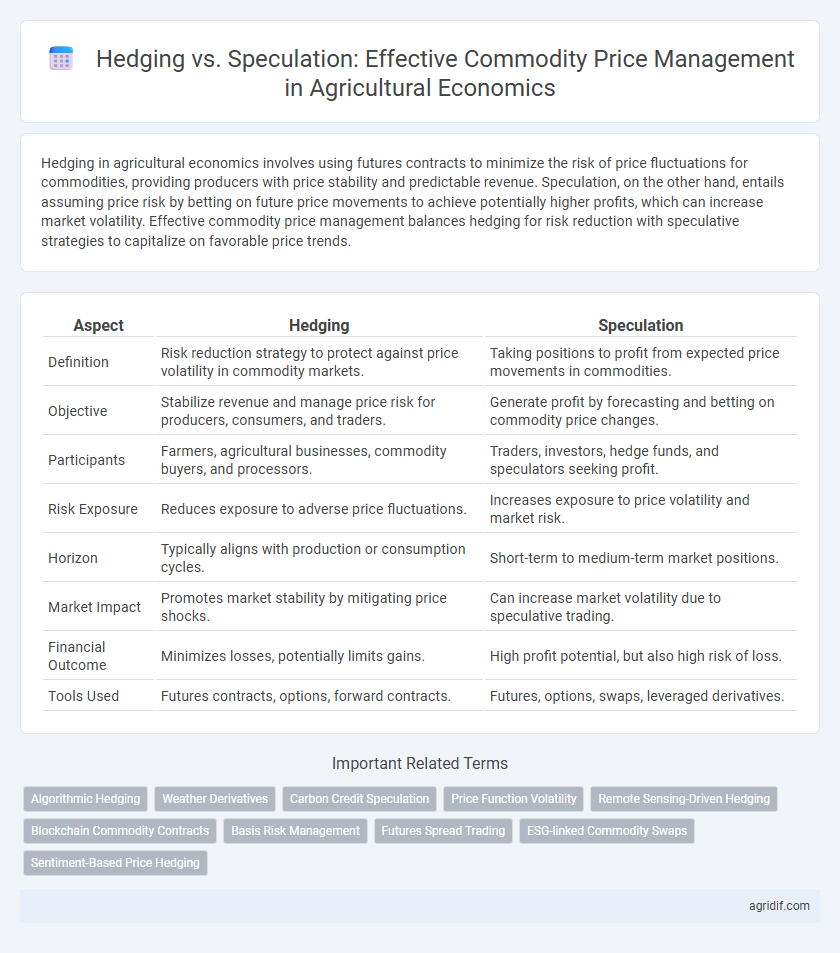

Hedging in agricultural economics involves using futures contracts to minimize the risk of price fluctuations for commodities, providing producers with price stability and predictable revenue. Speculation, on the other hand, entails assuming price risk by betting on future price movements to achieve potentially higher profits, which can increase market volatility. Effective commodity price management balances hedging for risk reduction with speculative strategies to capitalize on favorable price trends.

Table of Comparison

| Aspect | Hedging | Speculation |

|---|---|---|

| Definition | Risk reduction strategy to protect against price volatility in commodity markets. | Taking positions to profit from expected price movements in commodities. |

| Objective | Stabilize revenue and manage price risk for producers, consumers, and traders. | Generate profit by forecasting and betting on commodity price changes. |

| Participants | Farmers, agricultural businesses, commodity buyers, and processors. | Traders, investors, hedge funds, and speculators seeking profit. |

| Risk Exposure | Reduces exposure to adverse price fluctuations. | Increases exposure to price volatility and market risk. |

| Horizon | Typically aligns with production or consumption cycles. | Short-term to medium-term market positions. |

| Market Impact | Promotes market stability by mitigating price shocks. | Can increase market volatility due to speculative trading. |

| Financial Outcome | Minimizes losses, potentially limits gains. | High profit potential, but also high risk of loss. |

| Tools Used | Futures contracts, options, forward contracts. | Futures, options, swaps, leveraged derivatives. |

Understanding Hedging in Agricultural Commodity Markets

Hedging in agricultural commodity markets involves using futures contracts to minimize the risk of price fluctuations, allowing farmers and agribusinesses to lock in prices for crops like wheat, corn, and soybeans. This risk management strategy helps stabilize income and production planning by offsetting potential losses in the physical market with gains in the futures market. Unlike speculation, hedging prioritizes reducing uncertainty rather than seeking profit from price movements, making it a crucial tool for financial resilience in the agricultural sector.

What is Speculation? A Deep Dive for Farmers and Agribusiness

Speculation in agricultural commodity markets involves taking calculated risks by buying or selling futures contracts to profit from price fluctuations without the intent of physical delivery. Farmers and agribusinesses engage in speculation to capitalize on anticipated changes in crop prices, leveraging market trends and economic indicators. While hedging aims to minimize risk, speculation seeks to maximize returns by predicting market movements, which can lead to higher gains or significant losses depending on accuracy and timing.

Key Differences between Hedging and Speculation

Hedging in agricultural economics involves using futures contracts to reduce price risk and protect producers from adverse price fluctuations in commodities like wheat or corn, ensuring stable revenue. Speculation, by contrast, aims to profit from price movements by taking on higher risk without underlying exposure to the physical commodity. The key difference lies in risk management versus risk-taking: hedging minimizes potential losses for farmers and agribusinesses, while speculation introduces higher volatility and potential gains or losses based on market forecasts.

The Role of Hedging in Risk Management for Agri-Producers

Hedging plays a crucial role in risk management for agri-producers by providing price stability against volatile commodity markets. Through futures contracts and options, farmers can lock in prices for crops, reducing uncertainty and protecting profit margins. This strategic use of hedging distinguishes it from speculation, which involves taking on risk for potential financial gain rather than mitigating exposure.

How Speculators Influence Agricultural Commodity Prices

Speculators influence agricultural commodity prices by providing liquidity and facilitating price discovery in futures markets, which helps producers and consumers manage risk effectively. Their trading activity can lead to increased price volatility, as large speculative positions may cause sharp price movements unrelated to fundamental supply and demand factors. Understanding the role of speculators is crucial for agricultural economists to develop policies that balance market efficiency with price stability.

Tools and Strategies for Effective Hedging

Effective hedging in agricultural economics relies on tools such as futures contracts, options, and swaps to mitigate commodity price risks. Strategies include basis risk management, strategic timing of contract execution, and the use of cross-hedging when direct futures are unavailable. Incorporating these tools enhances price stability and reduces exposure to market volatility for producers and traders.

Speculation: Opportunities and Risks for Market Participants

Speculation in agricultural commodity markets involves taking positions based on price expectations to profit from price fluctuations, offering opportunities for high returns amid market volatility. Market participants engaging in speculation face risks such as substantial financial losses if market trends move against their positions and increased exposure to price uncertainty. Speculators contribute to market liquidity and price discovery but must employ robust risk management strategies to mitigate potential adverse impacts on their portfolios.

Impact of Hedging and Speculation on Price Volatility

Hedging in agricultural markets reduces price volatility by allowing producers and consumers to lock in prices, mitigating risks associated with unpredictable commodity price fluctuations. Speculation, while providing market liquidity, can amplify price volatility by driving prices away from fundamental supply and demand factors through excessive trading based on anticipated price movements. Empirical studies indicate that effective hedging stabilizes farm incomes and market prices, whereas high speculative activity correlates with increased short-term price swings in commodities like wheat, corn, and soybeans.

Real-World Case Studies: Hedging vs Speculation in Agriculture

Hedging in agriculture involves farmers using futures contracts to lock in prices, reducing the risk of volatile commodity markets as seen in the 2019 U.S. corn market where producers secured stable income despite price drops. Speculation, by contrast, entails traders betting on price movements to generate profit without physical commodity exchange, which exacerbated wheat price volatility in 2020 due to speculative activity. Real-world case studies highlight that effective hedging stabilizes farm revenues and supports supply chain planning, while speculation can increase price unpredictability and market inefficiencies in agricultural commodities.

Best Practices for Commodity Price Management in Farming

Effective commodity price management in farming relies on hedging strategies to mitigate risks associated with price volatility, protecting profit margins through futures contracts and options. Speculation, while potentially profitable, introduces significant risk and should be approached cautiously by farmers prioritizing stable income. Best practices emphasize robust market analysis, diversification of commodity positions, and employing hedging instruments aligned with farm production cycles to optimize price stability.

Related Important Terms

Algorithmic Hedging

Algorithmic hedging in agricultural economics uses advanced data-driven models and automated trading systems to manage commodity price risks, reducing market volatility exposure for producers and traders. This approach contrasts with speculation by prioritizing price stability and risk mitigation over profit from price fluctuations.

Weather Derivatives

Weather derivatives offer agricultural producers a financial tool to hedge against adverse weather conditions that can impact crop yields and commodity prices, reducing revenue volatility in an unpredictable climate. Unlike speculation, which involves taking on risk for potential profit, hedging with weather derivatives aims to stabilize income by transferring weather-related financial risks to counterparties in financial markets.

Carbon Credit Speculation

Hedging in commodity price management involves using carbon credit futures or options to mitigate the risk of price volatility, ensuring stable costs for agricultural producers. Speculation in carbon credits, driven by traders seeking profit from price fluctuations, can increase market liquidity but also heighten price volatility, impacting the predictability of carbon cost management in agriculture.

Price Function Volatility

Hedging in agricultural commodity markets stabilizes income by reducing price function volatility through contracts like futures and options, effectively managing risk for producers and buyers. Speculation, conversely, embraces price function volatility to achieve potential profit, increasing market liquidity but also contributing to price fluctuations and uncertainty in commodity price management.

Remote Sensing-Driven Hedging

Remote sensing-driven hedging integrates satellite and drone data to enhance commodity price risk management by providing accurate, real-time information on crop conditions and yield forecasts, reducing uncertainty for farmers and traders. This technology-driven approach differs from speculation by focusing on mitigating actual production risks rather than profiting from market price volatility.

Blockchain Commodity Contracts

Blockchain commodity contracts provide enhanced transparency and security in agricultural markets, enabling producers to hedge against price volatility more efficiently than traditional methods. Unlike speculation, which involves taking on price risk to profit from market fluctuations, hedging through blockchain-based contracts stabilizes revenue streams and reduces uncertainty for farmers and traders.

Basis Risk Management

Hedging in agricultural economics minimizes basis risk by locking in prices through futures contracts, ensuring more predictable revenue despite market fluctuations. Speculation, while potentially profitable, exposes producers to higher basis risk due to unpredictable price deviations between spot and futures markets.

Futures Spread Trading

Futures spread trading in agricultural markets allows producers and traders to manage price risk by simultaneously buying and selling related futures contracts, reducing exposure to volatile commodity prices. This technique contrasts with speculation by prioritizing risk mitigation over profit from price fluctuations, optimizing portfolio stability in grain and livestock market cycles.

ESG-linked Commodity Swaps

ESG-linked commodity swaps provide a risk management tool that enables agricultural producers to hedge against volatile commodity prices while aligning with environmental, social, and governance criteria. These financial instruments reduce exposure to price fluctuations and promote sustainable practices by incorporating ESG performance metrics into swap contracts, enhancing market stability and responsible investing in agricultural economics.

Sentiment-Based Price Hedging

Sentiment-based price hedging leverages market sentiment indicators to anticipate price fluctuations and manage risk in agricultural commodity markets more effectively than traditional hedging methods. By integrating emotional market drivers with quantitative data, farmers and traders can optimize hedging strategies to reduce exposure to volatile price movements and improve decision-making under uncertainty.

Hedging vs Speculation for commodity price management Infographic

agridif.com

agridif.com