Seed suppliers operating in a perfectly competitive market face intense competition, which drives prices down to the marginal cost and limits their ability to earn economic profits. In contrast, suppliers with monopoly power can influence seed prices and output levels, often resulting in higher prices and reduced choices for farmers. This market power can impact agricultural productivity and input costs, shaping the overall efficiency and sustainability of the agricultural sector.

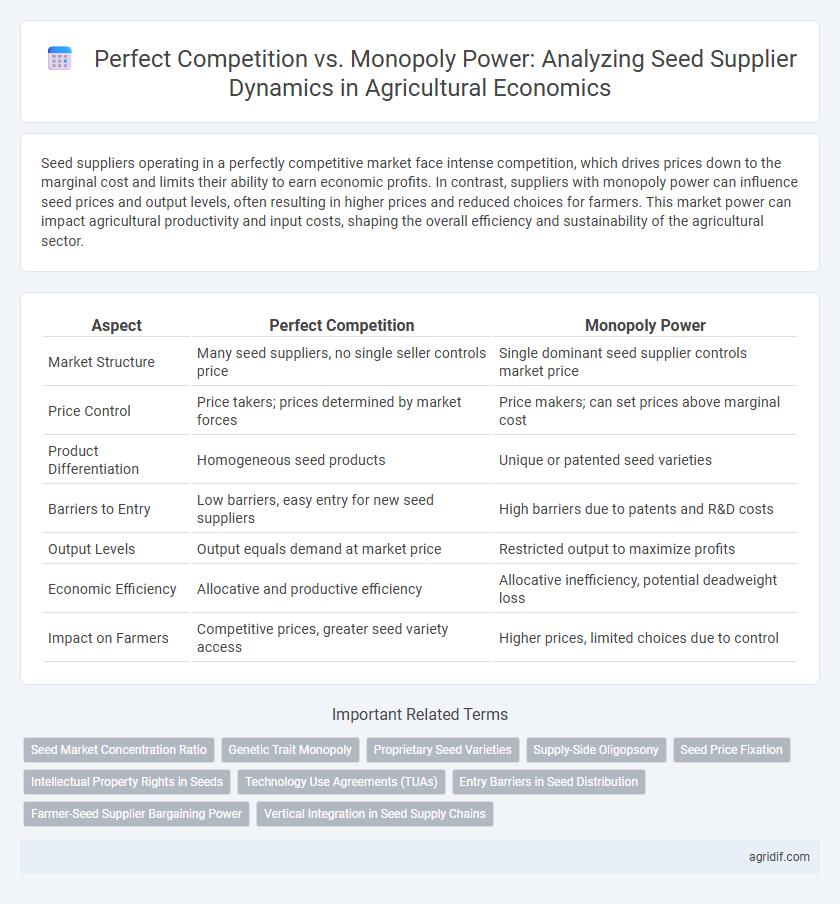

Table of Comparison

| Aspect | Perfect Competition | Monopoly Power |

|---|---|---|

| Market Structure | Many seed suppliers, no single seller controls price | Single dominant seed supplier controls market price |

| Price Control | Price takers; prices determined by market forces | Price makers; can set prices above marginal cost |

| Product Differentiation | Homogeneous seed products | Unique or patented seed varieties |

| Barriers to Entry | Low barriers, easy entry for new seed suppliers | High barriers due to patents and R&D costs |

| Output Levels | Output equals demand at market price | Restricted output to maximize profits |

| Economic Efficiency | Allocative and productive efficiency | Allocative inefficiency, potential deadweight loss |

| Impact on Farmers | Competitive prices, greater seed variety access | Higher prices, limited choices due to control |

Overview of Seed Supply Markets in Agriculture

Seed supply markets in agriculture exhibit distinct characteristics under perfect competition and monopoly power regimes. Perfect competition features numerous suppliers offering identical seeds, leading to price-taking behavior and efficient market outcomes. In contrast, monopoly power emerges when few firms dominate seed production, enabling price-setting and reduced market competitiveness, often impacting farmers' input costs and seed availability.

Defining Perfect Competition in Agricultural Seed Supply

Perfect competition in agricultural seed supply is characterized by numerous small suppliers offering homogeneous seed varieties, resulting in no single supplier having control over market prices. Seed prices are determined by the intersection of aggregate supply and demand, ensuring farmers purchase seeds at competitive, market-driven rates. This market structure promotes efficiency, innovation diffusion, and prevents monopolistic pricing that can restrict access and increase costs for farmers.

Characteristics of Monopoly Power Among Seed Suppliers

Monopoly power among seed suppliers is characterized by a single or few firms dominating the market, enabling them to control prices and restrict output to maximize profits. These firms benefit from high barriers to entry, such as patented seed genetics and substantial research and development costs, which limit competition. Unlike perfect competition, where numerous suppliers offer homogeneous products, monopolistic seed suppliers can differentiate their seeds through proprietary technology, resulting in reduced consumer choice and higher market concentration.

Market Structure and Seed Pricing Strategies

In agricultural economics, seed suppliers operating under perfect competition face numerous competitors, ensuring prices reflect true production costs without excess profit, promoting efficiency and accessibility. Conversely, monopolistic seed suppliers leverage market power to set higher prices by controlling supply and product differentiation, often resulting in reduced market output and higher prices for farmers. This contrast in market structure profoundly influences seed pricing strategies, with competitive markets driving cost-based pricing and monopolies utilizing strategic pricing to maximize profits.

Impact on Farmer Choice and Access to Seeds

In agricultural economics, perfect competition among seed suppliers ensures farmers have diverse seed options at competitive prices, enhancing access and fostering innovation tailored to local needs. Conversely, monopoly power limits seed variety and inflates prices, reducing farmers' ability to choose seeds suited for their specific crops and conditions. Restricted access under monopoly conditions often leads to dependency on a single supplier, adversely affecting farm productivity and sustainability.

Innovation and R&D: Competition vs Monopoly Dynamics

In agricultural economics, seed suppliers under perfect competition tend to innovate through incremental improvements due to thinner profit margins, driving moderate R&D investments. Monopoly power enables firms to allocate substantial resources towards breakthrough innovations and proprietary technologies, leveraging higher profits and market control. However, monopolistic dominance may reduce the incentive for continuous innovation compared to competitive markets where multiple firms race to improve seed quality and yield efficiency.

Barriers to Entry in Seed Markets

Barriers to entry in seed markets include high research and development costs, stringent regulatory approvals, and intellectual property protections such as patents and plant variety rights. These obstacles limit the number of suppliers, enabling companies with monopoly power to control seed prices and market access. In contrast, perfect competition is rare due to the significant capital investment and innovation-driven nature of the seed industry.

Regulatory Frameworks Governing Seed Market Competition

Regulatory frameworks governing seed market competition aim to balance the benefits of perfect competition, such as lower prices and increased innovation, with the risks posed by monopoly power held by dominant seed suppliers. Antitrust laws and intellectual property rights regulations are designed to prevent market abuses and encourage fair access to seeds while protecting investments in research and development. Effective policy enforcement ensures competitive seed markets, promoting agricultural productivity and food security.

Economic Efficiency: Welfare Implications for Farmers

Perfect competition among seed suppliers leads to allocative and productive efficiency, ensuring farmers access seeds at prices reflecting true production costs, maximizing consumer and producer surplus. Conversely, monopoly power allows a single supplier to set higher prices, reducing farmers' surplus and causing deadweight loss through underproduction and restricted seed availability. This welfare loss diminishes overall economic efficiency in agricultural markets, adversely impacting farm profitability and food security.

Policy Recommendations for Enhancing Competitive Seed Markets

Policymakers should promote transparent pricing and enforce antitrust laws to prevent monopolistic practices by dominant seed suppliers. Encouraging entry of new firms through subsidies or reduced regulatory barriers can increase competition and lower seed prices for farmers. Investing in open-access breeding programs and supporting farmer cooperatives further diversifies seed sources and enhances market efficiency.

Related Important Terms

Seed Market Concentration Ratio

Seed market concentration ratio reveals dominance levels of leading firms, with perfect competition characterized by low concentration and many suppliers driving innovation and price stability. Monopoly power emerges when high concentration ratios signal few seed suppliers controlling significant market share, leading to reduced competition and potential price increases.

Genetic Trait Monopoly

In agricultural economics, seed suppliers with genetic trait monopoly possess exclusive control over patented seed varieties, enabling them to set higher prices and restrict market entry than in perfect competition scenarios where numerous suppliers offer similar seeds with no single firm dominating. This monopoly power limits farmer choices and can reduce overall market efficiency while driving innovation incentives tied closely to intellectual property rights on genetic traits.

Proprietary Seed Varieties

Proprietary seed varieties under perfect competition drive innovation through numerous suppliers offering genetically similar seeds, resulting in lower prices and increased farmer choice. Conversely, monopoly power in seed suppliers limits access and inflates prices by controlling proprietary genetic traits, reducing competition and farmer bargaining power in agricultural markets.

Supply-Side Oligopsony

Seed suppliers operate in a supply-side oligopsony where a few dominant buyers exert considerable market power, contrasting with the idealized conditions of perfect competition. This oligopsony structure enables these buyers to influence prices and terms, limiting seed suppliers' profitability and market access compared to a perfectly competitive market scenario.

Seed Price Fixation

In agricultural economics, perfect competition among seed suppliers leads to seed price fixation determined by market equilibrium where numerous firms sell homogeneous seeds, resulting in prices reflecting marginal costs. Conversely, monopoly power allows a single seed supplier to set higher seed prices above marginal cost, reducing farmer surplus and potentially limiting seed accessibility.

Intellectual Property Rights in Seeds

Perfect competition in seed markets is rare due to strong intellectual property rights, which grant monopoly power to certain suppliers by protecting patented seed varieties and genetically modified traits. These protections limit competition by restricting access to patented seeds, allowing firms to set higher prices and control market supply, impacting agricultural input costs and innovation incentives.

Technology Use Agreements (TUAs)

Technology Use Agreements (TUAs) in seed supply systems illustrate the contrast between perfect competition and monopoly power, as monopolistic firms leverage TUAs to restrict farmers' seed-saving practices and maintain proprietary control over biotechnology innovations. These agreements reduce market competition by limiting seed reuse and promoting repeated purchases, thereby shaping pricing dynamics and farmer dependency within agricultural supply chains.

Entry Barriers in Seed Distribution

Entry barriers in seed distribution significantly differ between perfect competition and monopoly markets, where perfect competition features low barriers enabling numerous suppliers to enter freely, while monopolies maintain high entry barriers through patent protections and exclusive distribution agreements. These barriers limit new entrants' ability to compete, consolidating market power and enabling monopolists to control prices and seed availability, impacting agricultural economics by restricting farmer access to diverse seed varieties.

Farmer-Seed Supplier Bargaining Power

In agricultural economics, perfect competition among seed suppliers ensures farmers can negotiate prices effectively due to numerous competing firms, whereas monopoly power restricts farmer bargaining power by limiting seed availability and inflating costs. Seed monopolies often leverage patented genetically modified seeds, reducing farmers' choices and increasing dependence on single suppliers.

Vertical Integration in Seed Supply Chains

Vertical integration in seed supply chains allows monopoly power to consolidate control over production, distribution, and pricing, reducing competition and creating barriers to entry for smaller producers. Perfect competition in this sector is disrupted as integrated firms exploit economies of scale and proprietary technology, limiting seed variety availability and driving higher prices for farmers.

Perfect competition vs monopoly power for seed suppliers Infographic

agridif.com

agridif.com