Cash flow represents the actual inflow and outflow of money on a farm, ensuring that daily operations and expenses are covered without delay. Profit, on the other hand, measures the overall financial gain after accounting for all costs, including non-cash items like depreciation, providing a long-term view of farm viability. Maintaining positive cash flow is crucial for operational liquidity, while consistent profitability underpins sustainable growth and investment capacity in agriculture.

Table of Comparison

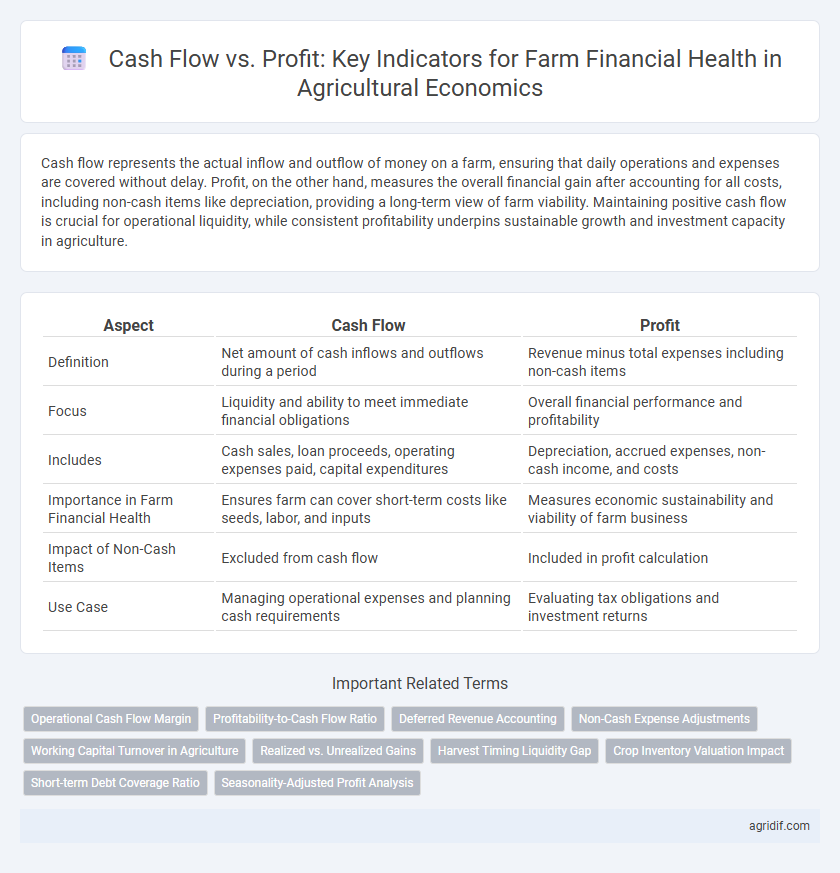

| Aspect | Cash Flow | Profit |

|---|---|---|

| Definition | Net amount of cash inflows and outflows during a period | Revenue minus total expenses including non-cash items |

| Focus | Liquidity and ability to meet immediate financial obligations | Overall financial performance and profitability |

| Includes | Cash sales, loan proceeds, operating expenses paid, capital expenditures | Depreciation, accrued expenses, non-cash income, and costs |

| Importance in Farm Financial Health | Ensures farm can cover short-term costs like seeds, labor, and inputs | Measures economic sustainability and viability of farm business |

| Impact of Non-Cash Items | Excluded from cash flow | Included in profit calculation |

| Use Case | Managing operational expenses and planning cash requirements | Evaluating tax obligations and investment returns |

Understanding Cash Flow in Agricultural Operations

Cash flow in agricultural operations represents the actual inflow and outflow of cash, crucial for managing day-to-day expenses such as seeds, labor, and equipment maintenance. Unlike profit, which accounts for total revenues minus expenses including non-cash items like depreciation, cash flow ensures liquidity to sustain farm activities and meet short-term obligations. Effective cash flow management supports timely payments, reduces financial stress, and maintains operational stability during fluctuating market conditions.

Defining Profit in Farm Financial Management

Profit in farm financial management represents the net income earned after subtracting all expenses from total revenue, reflecting the farm's overall profitability over a specific period. Unlike cash flow, which tracks the timing of cash inflows and outflows, profit measures true economic performance including non-cash items such as depreciation and inventory changes. Understanding profit is essential for making informed decisions about investment, sustainability, and long-term growth in agricultural operations.

Key Differences Between Cash Flow and Profit

Cash flow represents the actual inflow and outflow of money within a farm operation, reflecting liquidity and the ability to meet immediate expenses, while profit measures the overall financial performance by accounting for revenues minus all costs, including non-cash expenses like depreciation. Cash flow is crucial for managing day-to-day operations, ensuring timely payments for inputs, labor, and maintenance, whereas profit indicates long-term sustainability and the farm's capacity to generate surplus value. Understanding the differences between cash flow and profit enables better financial decision-making, investment planning, and risk management in agricultural enterprises.

Importance of Cash Flow for Farm Sustainability

Cash flow is critical for farm sustainability as it ensures the availability of liquid assets to cover daily operational expenses, debt repayments, and unexpected costs, unlike profit which reflects overall earnings after expenses. Positive cash flow enables timely investment in seeds, equipment, and labor, preventing disruptions in production cycles essential for long-term viability. Maintaining strong cash flow allows farms to adapt to market fluctuations and weather-related challenges, securing financial stability beyond reported profits.

How Profitability Impacts Long-Term Farm Growth

Profitability directly influences long-term farm growth by enabling reinvestment in technology, infrastructure, and crop diversification. Positive profit margins ensure sustained access to credit and improve resilience against market fluctuations or adverse weather conditions. Effective profit management supports strategic planning, fostering stability and expansion in agricultural enterprises over time.

Common Cash Flow Challenges in Farming

Common cash flow challenges in farming include seasonal income fluctuations, delayed payments from buyers, and high upfront costs for seeds, equipment, and labor. These cash flow constraints can strain a farm's ability to cover operational expenses despite showing profitability on paper. Effective cash flow management is essential for sustaining liquidity and avoiding insolvency during off-season periods or market downturns.

Strategies to Improve Farm Cash Flow

Improving farm cash flow involves effective management of receivables, timely collection of payments, and optimizing inventory turnover to ensure liquidity for operational needs. Implementing cost control measures and utilizing short-term financing solutions can help bridge cash shortages without compromising profitability. Strategic crop planning and diversification also enhance revenue streams, stabilizing cash inflows against market fluctuations and seasonal variability.

Monitoring Profit Margins in Agriculture

Monitoring profit margins in agriculture provides critical insight into the financial health of a farm by comparing cash inflows and outflows to net income. Cash flow reflects the liquidity necessary for day-to-day operations, while profit margins reveal the efficiency and long-term viability by measuring revenue minus production costs. Regular analysis of both metrics enables farm managers to make informed decisions on resource allocation and risk management to sustain profitability.

The Role of Cash Flow Statements in Farm Planning

Cash flow statements provide a detailed overview of cash inflows and outflows, enabling farmers to track liquidity essential for meeting short-term obligations and operational expenses. Unlike profit, which reflects net income over a period, cash flow emphasizes timing and availability of cash, crucial for managing seasonal fluctuations in agricultural revenue and expenses. Integrating cash flow analysis into farm planning supports informed decision-making on investments, debt management, and resource allocation to sustain financial stability and growth.

Balancing Cash Flow and Profit for Optimal Farm Health

Balancing cash flow and profit is essential for maintaining optimal farm financial health, as consistent cash flow ensures daily operations and short-term expenses are covered while profit reflects the long-term viability and growth potential of the farm. Effective management of cash flow involves timing income and expenses strategically to prevent liquidity shortages, whereas focusing solely on profit can overlook immediate financial stresses. Integrating cash flow analysis with profitability assessments enables farmers to make informed decisions that support sustainable farm operations and resilience against market fluctuations.

Related Important Terms

Operational Cash Flow Margin

Operational Cash Flow Margin measures the percentage of revenue remaining after operational expenses, providing insight into a farm's liquidity and ability to sustain day-to-day activities compared to net profit, which accounts for all revenues and expenses including non-cash items. Monitoring Operational Cash Flow Margin ensures that agricultural businesses maintain sufficient cash flow to cover operational costs, critical for long-term financial health and investment decisions.

Profitability-to-Cash Flow Ratio

The Profitability-to-Cash Flow Ratio is a critical metric in agricultural economics, measuring a farm's ability to convert net profit into actual cash inflows, essential for sustaining operational liquidity and long-term financial health. Monitoring this ratio helps farmers identify discrepancies between reported earnings and available cash, enabling proactive management of expenses, debt obligations, and investment strategies.

Deferred Revenue Accounting

Deferred revenue accounting in agricultural economics allows farms to accurately match income with expenses, ensuring cash flow timing does not distort profit figures. This approach improves farm financial health analysis by highlighting cash flow patterns separate from reported profits, aiding strategic decision-making.

Non-Cash Expense Adjustments

Non-cash expense adjustments, such as depreciation and amortization, play a crucial role in analyzing farm financial health by distinguishing cash flow from profit, as these expenses reduce accounting profit without impacting actual cash availability. Accurately adjusting for these non-cash expenses ensures better cash flow management, enabling farmers to make informed operational and investment decisions.

Working Capital Turnover in Agriculture

Working Capital Turnover in agriculture measures how efficiently a farm uses its short-term assets to generate revenue, directly impacting cash flow management and operational liquidity. Maintaining an optimal turnover ratio ensures sufficient cash flow to cover day-to-day expenses while sustaining profitability, critical for long-term farm financial health.

Realized vs. Unrealized Gains

Cash flow reflects the actual inflow and outflow of cash in farm operations, crucial for day-to-day financial health, while profit includes both realized gains from completed sales and unrealized gains or losses from changes in asset values, such as crop inventories or land appreciation. Understanding the difference between realized gains, which impact liquidity, and unrealized gains, which affect net worth but not immediate cash availability, is essential for managing sustainable farm financial performance.

Harvest Timing Liquidity Gap

Harvest timing influences the liquidity gap by creating periods when cash inflows from crop sales are delayed, causing cash flow challenges despite reported profits. Managing the cash flow effectively during this gap is crucial for maintaining farm financial health, ensuring operational expenses and debt obligations are met before profits are realized.

Crop Inventory Valuation Impact

Cash flow reflects the actual liquidity available for farm operations, while profit includes non-cash items like crop inventory valuation, which can inflate income without immediate cash benefits. Accurate crop inventory valuation is crucial in agricultural economics as it affects profitability assessments, tax obligations, and long-term financial health, influencing decisions on investment and resource allocation.

Short-term Debt Coverage Ratio

Short-term Debt Coverage Ratio measures a farm's ability to generate sufficient cash flow to cover immediate liabilities, highlighting liquidity rather than profitability. Monitoring this ratio ensures timely debt payments, safeguarding the farm's financial stability despite fluctuations in profit margins.

Seasonality-Adjusted Profit Analysis

Seasonality-adjusted profit analysis reveals fluctuations in farm profitability by accounting for revenue and expense timing, offering a more accurate measure than raw cash flow. Understanding these seasonal patterns is essential for managing liquidity, investment decisions, and sustaining long-term farm financial health.

Cash flow vs profit for farm financial health Infographic

agridif.com

agridif.com