Import quotas restrict the quantity of agricultural products entering a country, directly limiting supply and often leading to higher domestic prices and potential shortages. Tariffs impose a tax on imported agricultural goods, raising their cost and providing revenue for the government while allowing market forces to adjust supply more flexibly. Both tools protect domestic farmers but differ in economic impact, with tariffs generally offering more predictability and import quotas creating greater market distortions.

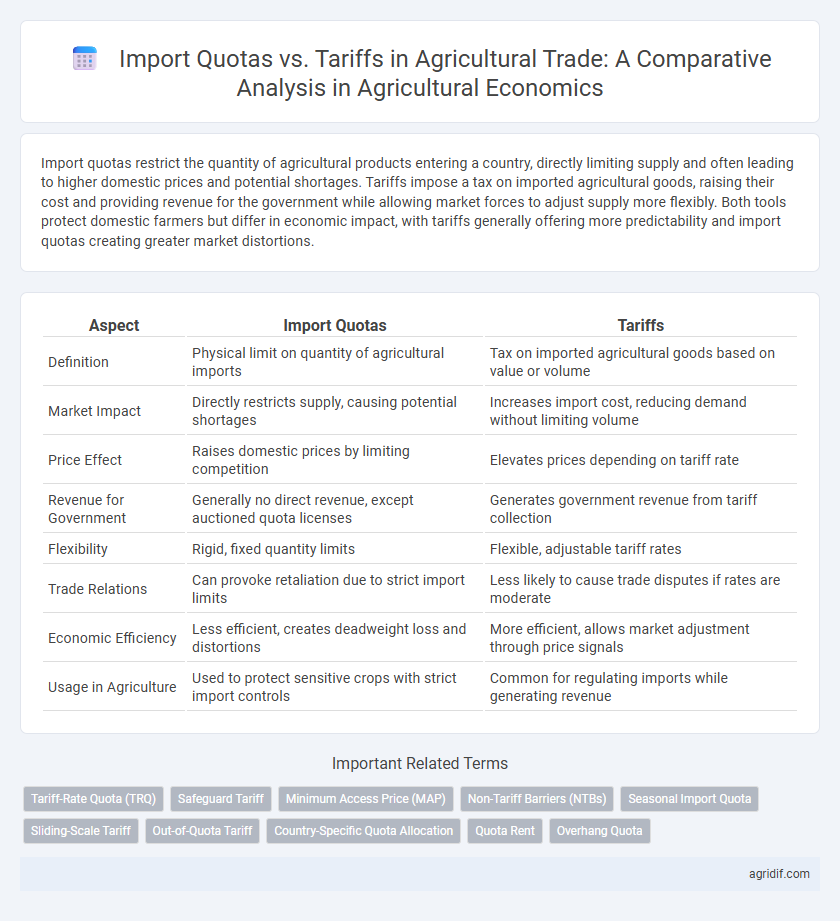

Table of Comparison

| Aspect | Import Quotas | Tariffs |

|---|---|---|

| Definition | Physical limit on quantity of agricultural imports | Tax on imported agricultural goods based on value or volume |

| Market Impact | Directly restricts supply, causing potential shortages | Increases import cost, reducing demand without limiting volume |

| Price Effect | Raises domestic prices by limiting competition | Elevates prices depending on tariff rate |

| Revenue for Government | Generally no direct revenue, except auctioned quota licenses | Generates government revenue from tariff collection |

| Flexibility | Rigid, fixed quantity limits | Flexible, adjustable tariff rates |

| Trade Relations | Can provoke retaliation due to strict import limits | Less likely to cause trade disputes if rates are moderate |

| Economic Efficiency | Less efficient, creates deadweight loss and distortions | More efficient, allows market adjustment through price signals |

| Usage in Agriculture | Used to protect sensitive crops with strict import controls | Common for regulating imports while generating revenue |

Understanding Import Quotas in Agricultural Trade

Import quotas in agricultural trade limit the quantity of specific agricultural products that can be imported during a set period, directly controlling market supply and protecting domestic producers from foreign competition. These quotas create scarcity, often driving up prices for imported goods and benefiting local farmers, but may lead to retaliatory trade measures. Unlike tariffs, which impose a tax on imports, import quotas restrict volume, making them a more rigid form of trade protection in agricultural economics.

The Mechanisms of Tariffs in Agriculture

Tariffs in agricultural trade function as taxes imposed on imported goods, raising their market price to protect domestic producers from foreign competition. These mechanisms influence supply and demand by making imported agricultural products less competitive, leading to increased domestic production and potentially higher prices for consumers. Tariffs generate government revenue and can be adjusted to respond to changing market conditions or trade policies, contrasting with the fixed quantity limits imposed by import quotas.

Economic Impacts of Import Quotas on Farmers

Import quotas restrict the quantity of agricultural products that can be imported, often leading to higher domestic prices and increased revenue for local farmers by reducing foreign competition. These quotas can create scarcity in the market, encouraging farmers to expand production and potentially raising their incomes. However, import quotas may also distort market signals, causing inefficiencies and higher costs for consumers and industries relying on agricultural inputs.

Tariffs and Domestic Agricultural Market Stability

Tariffs on agricultural imports serve as a crucial tool for stabilizing domestic markets by protecting local farmers from sudden price fluctuations and foreign competition. They generate government revenue that can be reinvested into agricultural development, enhancing productivity and sustainability. By maintaining controlled import costs, tariffs help preserve local market equilibrium and support long-term economic resilience in the agricultural sector.

Price Effects: Quotas vs. Tariffs in Agriculture

Import quotas in agricultural trade create rigid limits on quantity, driving domestic prices higher by restricting supply more sharply than tariffs, which impose a per-unit tax allowing market quantities to adjust more flexibly. Tariffs generate government revenue while causing smaller price increases, whereas quotas can lead to greater price volatility and potential rent-seeking by import license holders. Empirical studies in agricultural economics show that tariffs tend to moderate price spikes compared to quotas, supporting more stable market conditions for producers and consumers.

Trade Policy Objectives in Agricultural Economics

Import quotas restrict the quantity of agricultural products that can be imported, directly limiting supply to protect domestic farmers and stabilize prices. Tariffs impose taxes on imported goods, generating government revenue while increasing the cost of foreign agricultural products to encourage consumption of domestic alternatives. Both policies aim to balance trade protection, food security, and price stability within agricultural markets to support rural incomes and national economic goals.

Import Quotas and Global Agricultural Competitiveness

Import quotas limit the quantity of agricultural products that can be imported, directly restricting supply and often leading to higher domestic prices and reduced market efficiency. These restrictions disrupt global agricultural competitiveness by protecting domestic producers from international competition, potentially reducing incentives for innovation and productivity improvements. Contrastingly, tariffs generate revenue for governments while allowing more flexibility in import volumes, but quotas impose rigid constraints that can distort trade dynamics more severely.

Tariffs, Revenue Generation, and Agricultural Trade

Tariffs on agricultural imports serve as a direct source of government revenue by imposing specific taxes on imported goods, encouraging domestic production and generating funds for public investment. Unlike import quotas that restrict physical quantities, tariffs adjust the cost structure, influencing trade flows and market prices without capping volume. Effective tariff policies balance protection for local farmers with international trade competitiveness, impacting agricultural market stability and economic growth.

WTO Regulations on Agricultural Quotas and Tariffs

WTO regulations on agricultural trade impose strict guidelines on the use of import quotas and tariffs to ensure fair competition and market access. Import quotas limit the quantity of agricultural products entering a country, often disrupting market balance, whereas tariffs impose a fixed charge per unit or value, allowing for more predictable trade flows. The Agreement on Agriculture under the WTO mandates transparency and reduction of tariff levels while generally discouraging non-tariff barriers like import quotas to promote freer agricultural trade.

Comparative Analysis: Quotas vs. Tariffs for Food Security

Import quotas restrict the physical quantity of agricultural goods entering a country, directly limiting supply and potentially causing price volatility, while tariffs impose a tax on imports, influencing trade by raising prices but allowing flexible quantities. Quotas often lead to supply shortages and reduced market competition, which can threaten food security by increasing dependency on domestic production and limiting consumer choice. Tariffs provide revenue for governments and can be adjusted to stabilize markets without fixed supply caps, making them more adaptable for managing food security in fluctuating international trade conditions.

Related Important Terms

Tariff-Rate Quota (TRQ)

Tariff-rate quotas (TRQs) in agricultural trade combine import quotas with tariffs by allowing a specified quantity of imports at a lower tariff rate, with higher tariffs applied to quantities exceeding the quota. This mechanism balances trade liberalization and protectionism, supporting domestic farmers while managing import competition and market stability.

Safeguard Tariff

Safeguard tariffs in agricultural trade serve as temporary protective measures allowing countries to restrict imports that cause or threaten serious injury to domestic producers, offering flexibility compared to rigid import quotas. These tariffs enable adjustment to sudden import surges while maintaining some market predictability and compliance with World Trade Organization (WTO) rules.

Minimum Access Price (MAP)

Minimum Access Price (MAP) in agricultural trade serves as a protective measure ensuring that imported goods do not undercut domestic producers by setting a price floor, often used alongside import quotas to regulate supply without distorting market prices excessively. Unlike tariffs, which increase the cost of imports directly through taxes, MAP stabilizes domestic markets by guaranteeing minimum returns for growers, thus maintaining farmer income and agricultural sustainability.

Non-Tariff Barriers (NTBs)

Import quotas restrict the quantity of agricultural products allowed into a country, directly limiting market supply and often leading to higher domestic prices, whereas tariffs impose a tax on imports, influencing trade flows through price adjustments. Non-tariff barriers (NTBs) such as import quotas can create more rigid trade distortions than tariffs by imposing fixed limits rather than variable costs, impacting domestic producers, exporters, and global agricultural market dynamics.

Seasonal Import Quota

Seasonal import quotas restrict the quantity of agricultural products allowed during specific periods, stabilizing domestic prices and protecting farmers from market volatility caused by harvest cycles. Unlike tariffs, which increase costs across all imports, seasonal quotas precisely control supply timing, aligning with peak domestic production to balance trade competitiveness and food security.

Sliding-Scale Tariff

Sliding-scale tariffs in agricultural trade adjust import duties based on the volume of imports, effectively regulating supply without imposing fixed quantitative limits like import quotas. This approach allows for more flexible market responses, stabilizes domestic prices, and reduces the market distortions typically caused by rigid quota systems.

Out-of-Quota Tariff

Out-of-quota tariffs in agricultural trade impose higher duties on imports exceeding established quotas, effectively limiting the volume of foreign agricultural goods entering the market. These tariffs protect domestic farmers by stabilizing prices and controlling supply, contrasting with import quotas that set strict quantitative limits without price adjustments.

Country-Specific Quota Allocation

Country-specific quota allocation in import quotas restricts the quantity of agricultural goods that each exporting country can sell, directly influencing trade flows and prices by limiting supply from specific sources. Unlike tariffs, which impose a uniform tax on all imports, quota allocations create exclusive access rights that can lead to preferential treatment and trade distortions among trading partners.

Quota Rent

Import quotas restrict the quantity of agricultural products allowed into a country, generating quota rent that benefits domestic producers or license holders by creating scarcity and driving up prices. Tariffs impose taxes on imported goods, providing government revenue but typically resulting in less direct economic gain for producers compared to the quota rent captured under import quotas.

Overhang Quota

Overhang quotas create a surplus of import licenses beyond the established quota, distorting agricultural trade by allowing greater imports than intended under tariff-rate quotas. This practice undermines tariff effectiveness by inflating import volumes, disrupting market stability, and disadvantaging domestic producers in agricultural economics.

Import Quotas vs Tariffs for agricultural trade Infographic

agridif.com

agridif.com