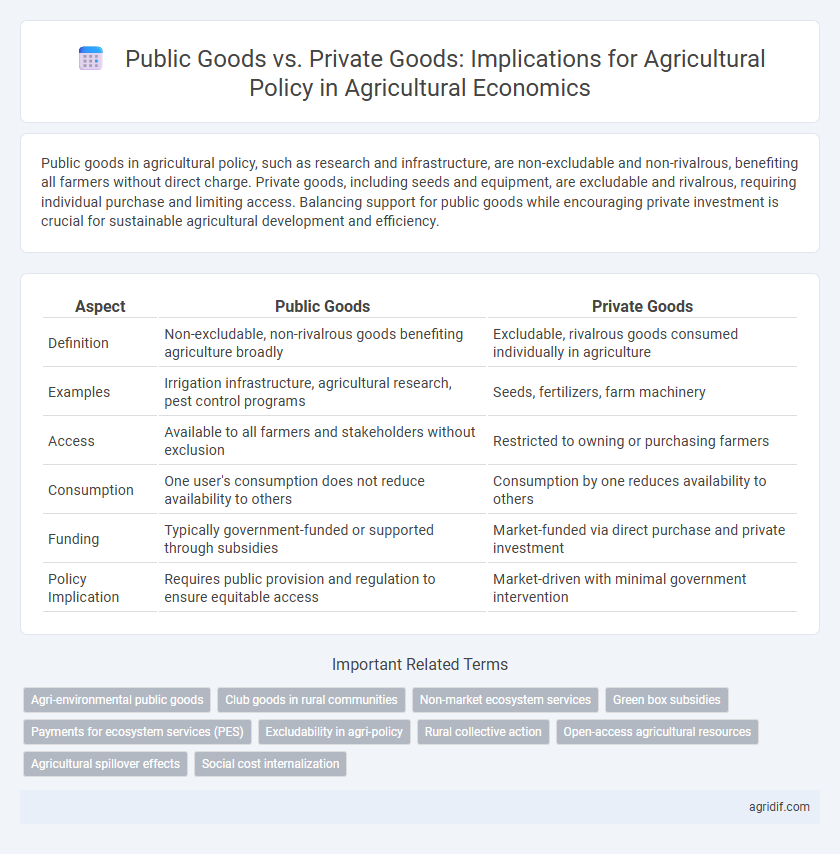

Public goods in agricultural policy, such as research and infrastructure, are non-excludable and non-rivalrous, benefiting all farmers without direct charge. Private goods, including seeds and equipment, are excludable and rivalrous, requiring individual purchase and limiting access. Balancing support for public goods while encouraging private investment is crucial for sustainable agricultural development and efficiency.

Table of Comparison

| Aspect | Public Goods | Private Goods |

|---|---|---|

| Definition | Non-excludable, non-rivalrous goods benefiting agriculture broadly | Excludable, rivalrous goods consumed individually in agriculture |

| Examples | Irrigation infrastructure, agricultural research, pest control programs | Seeds, fertilizers, farm machinery |

| Access | Available to all farmers and stakeholders without exclusion | Restricted to owning or purchasing farmers |

| Consumption | One user's consumption does not reduce availability to others | Consumption by one reduces availability to others |

| Funding | Typically government-funded or supported through subsidies | Market-funded via direct purchase and private investment |

| Policy Implication | Requires public provision and regulation to ensure equitable access | Market-driven with minimal government intervention |

Defining Public Goods and Private Goods in Agriculture

Public goods in agriculture refer to resources or services that are non-excludable and non-rivalrous, such as agricultural research, rural infrastructure, and environmental conservation efforts. Private goods are characterized by excludability and rivalry, including crops, livestock, and farm machinery, which can be owned and traded by individual farmers. Agricultural policy must distinguish between these to effectively allocate resources and design interventions that promote both public welfare and private enterprise growth.

Key Characteristics Differentiating Public and Private Goods

Public goods in agricultural policy are characterized by non-excludability and non-rivalry, meaning that farmers and communities benefit from resources like irrigation systems and pest control services without reducing availability to others. Private goods, such as seeds and fertilizers, exhibit excludability and rivalry, allowing producers to control access and consumption by individual farmers. Understanding these distinctions is crucial for designing effective agricultural policies that balance resource allocation and promote sustainable development.

Importance of Public Goods in Agricultural Policy

Public goods such as irrigation infrastructure, research and development in crop resilience, and pest control programs play a critical role in agricultural policy by enabling sustainable productivity and food security. Unlike private goods, these resources are non-excludable and non-rivalrous, ensuring that benefits extend widely across farming communities without exclusion. Investing in public goods addresses market failures and encourages innovation, risk reduction, and equitable access vital for rural development and economic stability in agriculture.

Private Goods and Market Mechanisms in Agriculture

Private goods in agriculture, characterized by rivalry and excludability, are primarily produced and exchanged through market mechanisms that allocate resources efficiently based on supply and demand. Market mechanisms incentivize farmers to optimize production, reduce costs, and respond to price signals, enhancing sector productivity and competitiveness. Such dynamics promote innovation and investment in agricultural inputs and technologies, crucial for sustainable agricultural development within a capitalist economy.

Challenges in Providing Agricultural Public Goods

Agricultural public goods, such as soil conservation and pest control, face significant challenges in provision due to their non-excludable and non-rivalrous nature, leading to underinvestment by private actors. Market failures arise because private goods incentives do not align with long-term sustainability and environmental goals essential for agricultural policy. Effective agricultural policy must address these challenges through targeted subsidies, regulation, and public-private partnerships to ensure the provision and maintenance of vital public goods.

Policy Tools for Supporting Public Goods in Agriculture

Policy tools for supporting public goods in agriculture include subsidies, grants, and conservation programs designed to promote sustainable farming practices that benefit the environment and society. These instruments incentivize farmers to deliver ecosystem services such as biodiversity preservation, soil health, and water quality, which are typically underprovided by private markets. Effective agricultural policy balances these interventions to enhance food security while maintaining ecological resilience.

Balancing Public and Private Goods in Policy Design

Effective agricultural policy design requires balancing public goods such as environmental sustainability, biodiversity, and infrastructure with private goods like crop yields and farm income. Public goods generate widespread benefits including soil conservation and water quality, while private goods drive individual farm profitability and innovation. Integrating incentives that encourage sustainable practices ensures long-term productivity while addressing market failures inherent in public good provision.

Economic Impacts of Public Goods Provision in Agriculture

Public goods in agriculture, such as clean water, biodiversity, and research on sustainable farming techniques, generate positive externalities that enhance overall economic welfare and long-term productivity. Unlike private goods, their non-excludable and non-rivalrous nature leads to under-provision by markets, necessitating government intervention and policy support. Effective investment in public goods provision increases agricultural resilience, reduces environmental degradation, and promotes rural development, thereby creating significant economic benefits beyond individual producers.

Case Studies: Public vs Private Goods in Agricultural Systems

Public goods in agricultural systems, such as irrigation infrastructure and research on pest-resistant crops, yield widespread benefits without exclusive ownership, promoting sustainable farming practices and food security. Private goods, including seeds and fertilizers, are rivalrous and excludable, encouraging innovation through market incentives but sometimes limiting access for small-scale farmers. Comparative case studies in regions like India and Brazil reveal that integrating public goods investment with private sector efficiency maximizes productivity and equitable resource distribution in agricultural policy.

Recommendations for Integrating Public and Private Goods in Agricultural Policy

Effective agricultural policy should promote the integration of public goods, such as ecosystem services and research innovation, with private goods like crop production and market access. Encouraging public-private partnerships and investment in sustainable technologies can enhance productivity while preserving environmental quality. Policy frameworks must balance incentives to ensure equitable resource distribution and long-term agricultural resilience.

Related Important Terms

Agri-environmental public goods

Agri-environmental public goods, such as biodiversity conservation, soil preservation, and water quality, provide non-excludable and non-rival benefits essential for sustainable agricultural systems. Agricultural policies must prioritize funding and incentives for these public goods to address market failures and enhance long-term ecosystem services supporting productivity and rural livelihoods.

Club goods in rural communities

Club goods in rural agricultural communities exhibit characteristics of excludability and non-rivalrous consumption, making them vital for shared resources like irrigation systems and community storage facilities. Agricultural policies targeting club goods can enhance cooperative management, reduce individual costs, and improve collective access to essential infrastructure, fostering sustainable rural development.

Non-market ecosystem services

Non-market ecosystem services, such as soil fertility, pollination, and water regulation, represent public goods in agricultural economics because they are non-excludable and non-rivalrous, benefiting all farmers and communities without direct market transactions. Agricultural policies must prioritize the preservation and enhancement of these public goods through subsidies, regulation, and incentives to ensure sustainable farming practices and long-term ecological resilience.

Green box subsidies

Green box subsidies, classified under WTO rules as non-trade distorting, support public goods in agriculture by promoting environmental sustainability, research, and rural development without directly affecting market prices or production levels. In contrast, private goods subsidies target individual producers and often lead to market distortions, making green box policies critical for balancing agricultural productivity with ecological conservation.

Payments for ecosystem services (PES)

Payments for ecosystem services (PES) incentivize farmers to provide public goods such as biodiversity conservation, carbon sequestration, and water quality improvement, which are typically underprovided in traditional markets. Agricultural policies integrating PES address market failures by compensating landowners for maintaining ecosystem services essential for sustainable agriculture and rural development.

Excludability in agri-policy

Excludability in agricultural policy differentiates public goods, such as pest control services and research, which are non-excludable and benefit all farmers regardless of payment, from private goods like seeds and fertilizers that are excludable and sold to specific users. Effective agri-policy must address the challenge of financing non-excludable public goods since markets tend to underprovide them due to free-rider problems.

Rural collective action

Public goods in agricultural policy, such as irrigation systems and rural infrastructure, benefit entire communities and require collective action to manage and sustain. Private goods, including individual crop outputs and livestock, emphasize personal ownership and market transactions, highlighting the need for policies that balance communal resource management with farmers' economic incentives.

Open-access agricultural resources

Open-access agricultural resources such as grazing lands and water are classic examples of public goods that lack excludability and are subject to overuse and depletion without effective regulation. Agricultural policy must address the "tragedy of the commons" by implementing sustainable management strategies and property rights to prevent resource degradation and ensure long-term productivity.

Agricultural spillover effects

Agricultural spillover effects highlight the critical distinction between public goods, such as soil conservation and pollination services, which benefit multiple stakeholders without excluding anyone, and private goods like individual crop yields that are rivalrous and excludable. Effective agricultural policy must account for these externalities to enhance rural welfare, promote sustainable practices, and maximize economic efficiency by internalizing the positive spillovers inherent in public goods.

Social cost internalization

Public goods in agricultural policy, such as biodiversity conservation and clean water provision, experience challenges in social cost internalization due to their non-excludable and non-rivalrous nature, leading to potential underinvestment. In contrast, private goods, like individual crops and livestock, allow clearer attribution of social costs and benefits, facilitating targeted policies that promote efficient resource allocation and sustainable farming practices.

Public goods vs private goods for agricultural policy Infographic

agridif.com

agridif.com