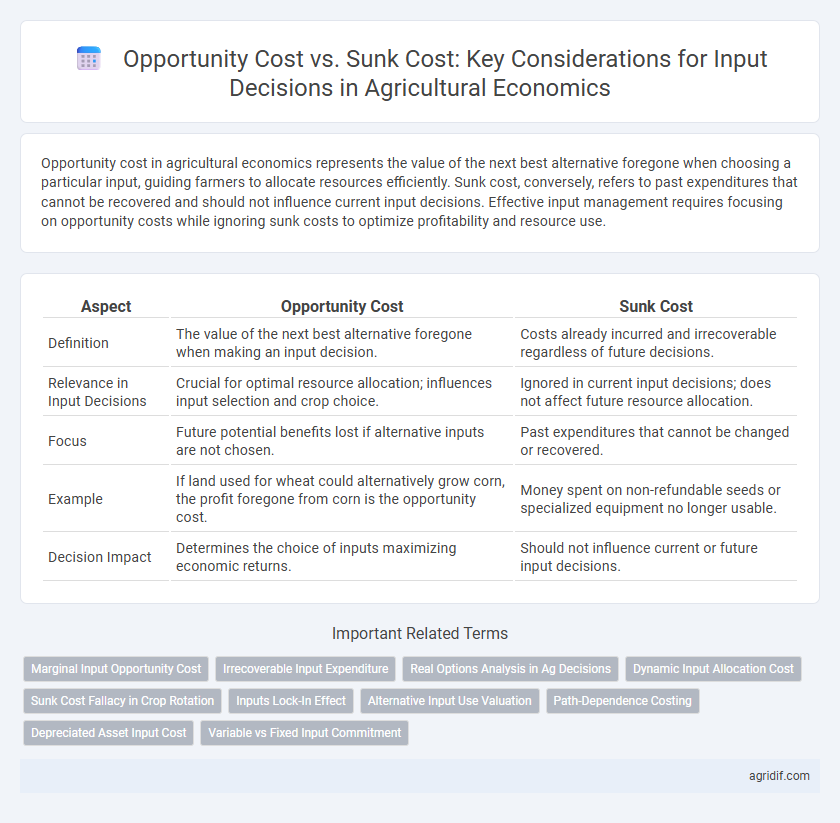

Opportunity cost in agricultural economics represents the value of the next best alternative foregone when choosing a particular input, guiding farmers to allocate resources efficiently. Sunk cost, conversely, refers to past expenditures that cannot be recovered and should not influence current input decisions. Effective input management requires focusing on opportunity costs while ignoring sunk costs to optimize profitability and resource use.

Table of Comparison

| Aspect | Opportunity Cost | Sunk Cost |

|---|---|---|

| Definition | The value of the next best alternative foregone when making an input decision. | Costs already incurred and irrecoverable regardless of future decisions. |

| Relevance in Input Decisions | Crucial for optimal resource allocation; influences input selection and crop choice. | Ignored in current input decisions; does not affect future resource allocation. |

| Focus | Future potential benefits lost if alternative inputs are not chosen. | Past expenditures that cannot be changed or recovered. |

| Example | If land used for wheat could alternatively grow corn, the profit foregone from corn is the opportunity cost. | Money spent on non-refundable seeds or specialized equipment no longer usable. |

| Decision Impact | Determines the choice of inputs maximizing economic returns. | Should not influence current or future input decisions. |

Defining Opportunity Cost in Agricultural Input Decisions

Opportunity cost in agricultural input decisions represents the value of the next best alternative foregone when allocating resources such as land, labor, or capital toward a specific crop or input usage. Unlike sunk costs, which are past expenses that cannot be recovered, opportunity costs focus on future benefits lost due to current input choices. Accurate assessment of opportunity costs enables farmers and agribusinesses to optimize input allocation for maximum economic returns and sustainable farm management.

Understanding Sunk Cost in Farm Management

Sunk costs in farm management represent past investments that cannot be recovered and should not influence current input decisions. Understanding the distinction between sunk costs and opportunity costs enables farmers to allocate resources efficiently by focusing on future benefits rather than irretrievable expenses. Effective input decisions maximize profit by prioritizing marginal returns over historical expenditures.

Key Differences Between Opportunity Cost and Sunk Cost

Opportunity cost in agricultural economics refers to the value of the next best alternative foregone when allocating resources such as land, labor, or capital, directly impacting input decisions. Sunk cost represents past expenditures on inputs that cannot be recovered and should not influence current or future investment choices in farming practices. Understanding this key difference ensures farmers allocate resources efficiently by considering future benefits rather than irretrievable past costs.

The Role of Opportunity Cost in Crop Selection

Opportunity cost in crop selection represents the potential returns forgone by choosing one crop over alternative options, guiding farmers toward maximizing land productivity and profit. Recognizing sunk costs, such as previous investments in machinery or land preparation, as irrelevant to current decisions prevents resource misallocation. Evaluating opportunity costs ensures optimal input allocation, aligning agricultural production with market demands and profitability.

Sunk Cost Fallacy and Its Impact on Agricultural Investments

The sunk cost fallacy leads farmers to continue investing in unprofitable agricultural inputs due to prior expenses that cannot be recovered, distorting rational decision-making in resource allocation. Ignoring opportunity cost in favor of sunk costs results in inefficient use of land, labor, and capital, reducing overall farm profitability and sustainability. Recognizing and overcoming this fallacy allows agricultural producers to optimize input choices, maximize returns, and improve long-term economic resilience.

Evaluating Input Alternatives: Considering Opportunity Costs

Evaluating input alternatives in agricultural economics requires focusing on opportunity costs, which represent the value of the next best alternative foregone when resources are allocated. Unlike sunk costs, which are past expenditures that cannot be recovered, opportunity costs influence current and future decision-making by highlighting potential gains from alternative uses of inputs such as land, labor, and capital. Accurate assessment of opportunity costs ensures optimal resource allocation, enhancing farm profitability and sustainability.

Avoiding Sunk Cost Trap in Farm Machinery Purchases

Farmers must distinguish opportunity costs from sunk costs when deciding on machinery investments to optimize resource allocation. Opportunity costs represent the potential returns from alternative uses of capital, while sunk costs are irreversible past expenditures that should not influence current decisions. Avoiding the sunk cost trap prevents farmers from holding onto outdated equipment, allowing for timely upgrades that enhance productivity and profitability.

Budgeting Farm Inputs: Balancing Past Expenditure and Future Gains

Budgeting farm inputs requires distinguishing opportunity cost, the potential returns from the best alternative use of resources, from sunk costs, which are past expenditures that cannot be recovered. Farmers must prioritize opportunity costs to allocate resources efficiently, ensuring future gains outweigh the benefits foregone by not choosing alternative input options. Ignoring sunk costs prevents biased decision-making, allowing for optimized input allocation that maximizes marginal returns within budget constraints.

Case Studies: Opportunity vs. Sunk Costs in Agricultural Practices

Case studies in agricultural economics highlight that opportunity costs represent the potential returns from the next best alternative input use, critical for optimizing resource allocation on farms. Sunk costs, such as previous investments in machinery or land preparation, do not influence current input decisions because they cannot be recovered. Understanding the distinction between opportunity cost and sunk cost allows farmers to make economically rational decisions that enhance profitability and sustainable resource management.

Strategies for Optimal Input Decisions in Agricultural Economics

Opportunity cost in agricultural input decisions represents the potential benefits lost when choosing one resource allocation over another, guiding farmers to prioritize inputs that maximize returns. Sunk costs, being past expenditures that cannot be recovered, should not influence current input strategies; focusing on marginal analysis ensures resources are allocated to inputs with the highest incremental productivity. Employing cost-benefit evaluation techniques and considering opportunity costs enable optimal input decisions that enhance farm profitability and resource efficiency.

Related Important Terms

Marginal Input Opportunity Cost

Marginal Input Opportunity Cost in agricultural economics refers to the value of the next best alternative use of an additional unit of input, guiding farmers to allocate resources efficiently by comparing potential returns. Unlike sunk costs, which are irrecoverable past expenses, opportunity costs directly influence input decisions by highlighting the trade-offs between different agricultural investments and their expected marginal benefits.

Irrecoverable Input Expenditure

Irrecoverable input expenditure represents sunk costs that should not influence current agricultural input decisions, as these costs cannot be recovered regardless of future actions. Opportunity cost, however, reflects the value of the best alternative use of resources, guiding farmers to allocate inputs efficiently for maximum economic return.

Real Options Analysis in Ag Decisions

Opportunity cost in agricultural input decisions reflects the potential benefits foregone by allocating resources to one option over another, while sunk costs represent irreversible past expenditures that should not influence current choices. Real Options Analysis enhances decision-making by quantifying the value of flexibility and timing in uncertain agricultural investments, allowing farmers to optimize input allocation by weighing future opportunity costs against fixed sunk costs.

Dynamic Input Allocation Cost

Opportunity cost in dynamic input allocation refers to the potential benefits lost when resources are allocated to one input over another, guiding optimal decision-making by forecasting future returns. Sunk costs, being irrecoverable past expenditures on inputs, should not influence current allocation decisions, as focusing on marginal costs and benefits ensures more efficient resource utilization in agricultural production.

Sunk Cost Fallacy in Crop Rotation

Farmers often fall prey to the sunk cost fallacy by continuing inefficient crop rotations due to prior investments in specific seeds or fertilizers, ignoring the opportunity cost of adopting more profitable alternatives. Recognizing sunk costs as irrelevant to future input decisions helps optimize resource allocation and enhances overall farm profitability in agricultural economics.

Inputs Lock-In Effect

Opportunity cost in agricultural input decisions reflects the value of foregone alternatives, driving farmers to allocate resources efficiently, while sunk costs represent irreversible expenditures that do not influence current choices. The Inputs Lock-In Effect occurs when past investments in specific inputs restrict flexibility, causing farmers to continue using inefficient resources despite better alternatives being available.

Alternative Input Use Valuation

Opportunity cost in agricultural input decisions reflects the value of the next best alternative use of resources, guiding farmers to allocate inputs where returns are maximized. Sunk cost, being irrecoverable past expenses, should not influence current input choices, as focusing on opportunity costs ensures efficient resource valuation and optimal production outcomes.

Path-Dependence Costing

Opportunity cost in agricultural input decisions represents the potential benefits foregone by selecting one resource allocation over another, reflecting the value of the next best alternative. In contrast, sunk costs are past expenditures that cannot be recovered and should not influence current or future input choices, emphasizing the importance of path-dependence costing to avoid inefficient resource allocation based on irrelevant historical costs.

Depreciated Asset Input Cost

Opportunity cost in agricultural input decisions reflects the value of the next best alternative use of a depreciated asset, guiding farmers to allocate resources efficiently for maximizing returns. Sunk costs, such as the original purchase price of equipment, should be excluded from decision-making since they do not affect future economic outcomes or input choices.

Variable vs Fixed Input Commitment

Opportunity cost in agricultural input decisions represents the potential benefits foregone by choosing variable inputs, which can be adjusted with seasonal flexibility, over fixed inputs that require long-term commitment and are non-recoverable, reflecting sunk costs. Understanding the distinction aids farmers in optimizing resource allocation by minimizing sunk cost impacts while leveraging the adaptability of variable inputs to respond to market fluctuations.

Opportunity cost vs Sunk cost for input decisions Infographic

agridif.com

agridif.com