Forward contracts provide customized agreements between buyers and sellers to lock in prices for agricultural commodities, reducing price risk but carrying counterparty risk due to lack of standardization and regulation. Futures contracts are standardized, exchange-traded agreements that offer liquidity and reduced counterparty risk through margin requirements and clearinghouses, facilitating price discovery and risk management for farmers and traders. Farmers must evaluate their risk tolerance, market access, and cost considerations when choosing between forward contracts and futures contracts for commodity marketing.

Table of Comparison

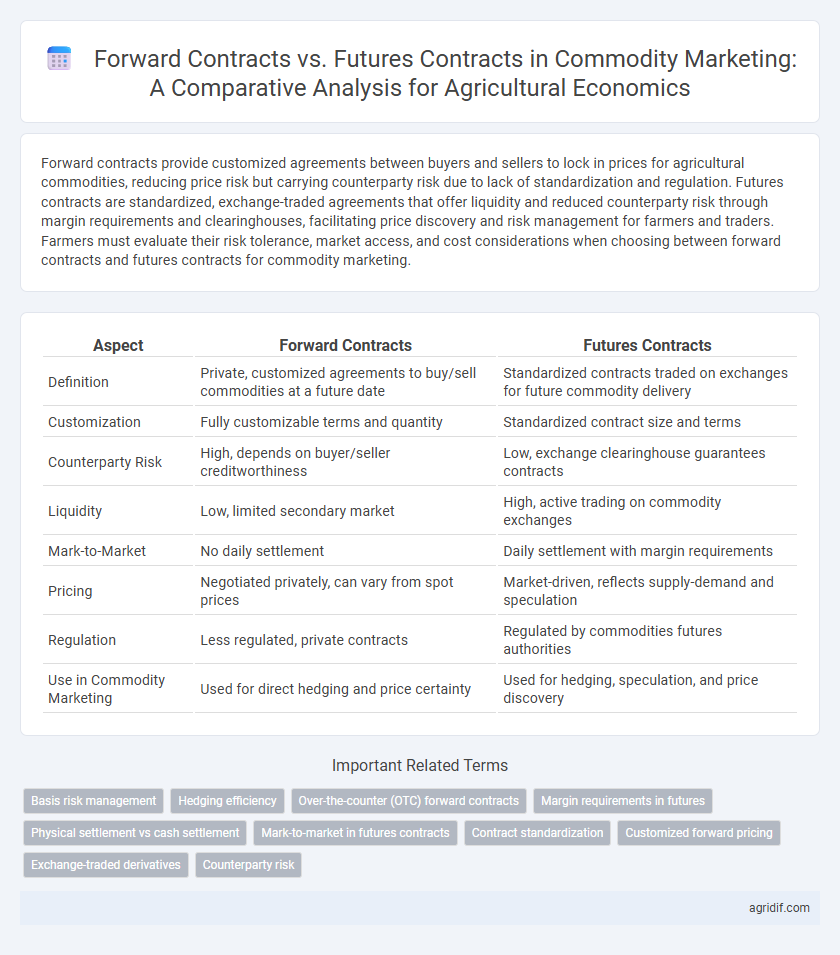

| Aspect | Forward Contracts | Futures Contracts |

|---|---|---|

| Definition | Private, customized agreements to buy/sell commodities at a future date | Standardized contracts traded on exchanges for future commodity delivery |

| Customization | Fully customizable terms and quantity | Standardized contract size and terms |

| Counterparty Risk | High, depends on buyer/seller creditworthiness | Low, exchange clearinghouse guarantees contracts |

| Liquidity | Low, limited secondary market | High, active trading on commodity exchanges |

| Mark-to-Market | No daily settlement | Daily settlement with margin requirements |

| Pricing | Negotiated privately, can vary from spot prices | Market-driven, reflects supply-demand and speculation |

| Regulation | Less regulated, private contracts | Regulated by commodities futures authorities |

| Use in Commodity Marketing | Used for direct hedging and price certainty | Used for hedging, speculation, and price discovery |

Introduction to Forward and Futures Contracts in Agricultural Markets

Forward contracts in agricultural markets involve direct agreements between buyers and sellers to exchange a specific quantity of a commodity at a predetermined price on a future date, offering tailored risk management and price certainty. Futures contracts, standardized and traded on organized exchanges like the Chicago Board of Trade, provide liquidity and reduce counterparty risk through daily settlement and margin requirements. Both instruments are essential for farmers and agribusinesses to hedge against price volatility, with forwards offering customization and futures delivering market transparency and ease of trading.

Key Features of Forward Contracts for Farmers

Forward contracts in agricultural commodity marketing enable farmers to lock in prices for their crops before harvest, reducing exposure to market price volatility. These contracts are privately negotiated, customizable agreements between farmers and buyers, offering flexibility in quantity, quality, and delivery terms. Unlike standardized futures contracts traded on exchanges, forward contracts carry counterparty risk but provide tailored solutions aligned with individual farm production and marketing needs.

Essential Characteristics of Futures Contracts in Agriculture

Futures contracts in agriculture are standardized agreements to buy or sell a specific quantity and quality of a commodity at a predetermined price and date, providing price transparency and risk management for farmers and buyers. These contracts are traded on regulated exchanges, ensuring liquidity and reducing counterparty risk through margin requirements and daily settlement procedures. Unlike forward contracts, futures contracts offer marked-to-market pricing and standardized terms, making them more accessible and efficient tools for hedging price fluctuations in agricultural markets.

Price Risk Management: Forward vs Futures Contracts

Forward contracts provide customized terms between buyers and sellers, allowing precise price risk management by locking in prices for agricultural commodities directly. Futures contracts offer standardized agreements traded on exchanges, enabling price risk mitigation through margin requirements and daily settlement, enhancing liquidity and reducing counterparty risk. Both tools are essential in agricultural economics for hedging against price volatility, but futures contracts facilitate greater market transparency and flexibility.

Customization and Flexibility: Which Contract Suits Agricultural Needs?

Forward contracts offer greater customization and flexibility, allowing farmers and buyers to tailor terms such as quantity, quality, and delivery schedules to specific agricultural production cycles and market demands. Futures contracts provide standardized terms and are traded on exchanges, facilitating greater liquidity and price transparency but less adaptability to individual farm requirements. For agricultural marketing, forward contracts often suit unique or speciality crops needing precise agreements, while futures contracts are preferable for bulk commodity producers seeking risk management through liquid markets.

Contract Settlement and Delivery Mechanisms in Agriculture

Forward contracts in agricultural commodity marketing involve bilateral agreements with customized terms and physical delivery at contract maturity, providing flexibility but higher counterparty risk. Futures contracts are standardized, exchange-traded agreements settled through clearinghouses with marked-to-market daily margining, often resulting in cash settlement or delivery through regulated warehouses. The delivery mechanism in futures contracts enhances market liquidity and reduces credit risk, whereas forward contracts offer tailored settlement options aligned with specific agricultural production schedules.

Counterparty Risk: Minimizing Defaults in Commodity Marketing

Forward contracts in agricultural commodity marketing carry higher counterparty risk due to their private, over-the-counter nature, increasing the chance of default. Futures contracts significantly reduce this risk through standardized terms and the involvement of clearinghouses that guarantee performance. Minimizing defaults in commodity trading is critical for market stability, with futures providing a more secure mechanism for risk transfer and price discovery.

Cost Implications and Margin Requirements

Forward contracts in agricultural commodity marketing typically involve lower upfront costs but carry higher credit risk due to lack of standardized margin requirements. Futures contracts demand margin deposits, ensuring daily settlement and reducing counterparty risk, but these margin calls can impact cash flow management for farmers. The cost implications of futures include potential margin calls and broker fees, whereas forwards may incur higher default risk costs despite lower initial financial commitment.

Market Accessibility and Liquidity Considerations

Forward contracts provide flexibility in commodity marketing with customizable terms directly between buyer and seller, but typically offer lower market accessibility and liquidity due to their over-the-counter nature. Futures contracts are standardized and traded on organized exchanges, significantly enhancing market accessibility and liquidity by allowing easy entry, exit, and price discovery for agricultural producers and buyers. High liquidity in futures markets facilitates efficient risk management and price transparency, crucial for effective commodity marketing strategies.

Practical Decision-Making: Choosing Between Forward and Futures Contracts

Forward contracts offer customizable terms and direct negotiation with buyers, providing price certainty and tailored delivery schedules essential for specific agricultural commodities. Futures contracts, traded on regulated exchanges, enhance liquidity and reduce counterparty risk through standardized terms and margin requirements, enabling easier price discovery and risk management. Practical decision-making involves assessing farm size, commodity type, market access, and risk tolerance to determine whether the flexibility of forwards or the standardized, transparent nature of futures aligns better with marketing goals.

Related Important Terms

Basis risk management

Forward contracts provide tailored price agreements between buyers and sellers, effectively managing basis risk by locking in specific prices for agricultural commodities. In contrast, futures contracts, traded on exchanges with standardized terms, offer greater liquidity while potentially exposing participants to basis risk due to price differences between the local cash market and the futures market.

Hedging efficiency

Futures contracts offer standardized terms and high liquidity, enhancing hedging efficiency by allowing precise price risk management in commodity marketing. Forward contracts provide customization tailored to specific producer needs but carry counterparty risk, potentially reducing hedging effectiveness compared to futures.

Over-the-counter (OTC) forward contracts

Over-the-counter (OTC) forward contracts in agricultural commodity marketing allow producers and buyers to customize terms such as price, quantity, and delivery date, reducing basis risk compared to standardized futures contracts traded on exchanges. These OTC forward contracts provide flexibility and direct counterparty negotiation but carry higher counterparty default risk than regulated futures markets, which offer greater liquidity and standardized price discovery.

Margin requirements in futures

Margin requirements in futures contracts serve as a financial safeguard, mandating traders to deposit an initial margin and maintain a minimum maintenance margin, which fluctuates with market prices and ensures contract performance. Forward contracts lack standardized margin requirements, exposing parties to higher counterparty risk but allowing for flexible customized terms.

Physical settlement vs cash settlement

Forward contracts in agricultural commodity marketing involve physical settlement where the actual product is delivered at contract maturity, providing farmers with certainty on price and delivery terms. Futures contracts typically settle in cash, allowing traders to hedge price risk without the need for physical commodity exchange, enhancing liquidity and ease of market participation.

Mark-to-market in futures contracts

Futures contracts in agricultural commodity marketing require daily mark-to-market adjustments, ensuring gains and losses are settled each trading day, which reduces credit risk but demands liquidity management from producers. Forward contracts lack this daily marking, providing price certainty at contract initiation but exposing parties to higher default risk due to settlement only at maturity.

Contract standardization

Forward contracts offer tailored terms agreed privately between buyer and seller, allowing flexibility in quantity, quality, and delivery dates, while futures contracts are standardized agreements traded on organized exchanges with fixed specifications for commodity type, quantity, and delivery time, enhancing market liquidity and price transparency. The standardization in futures contracts facilitates easier transferability and risk management through margin requirements, whereas forward contracts carry higher counterparty risk due to their customized nature and lack of centralized clearing.

Customized forward pricing

Customized forward pricing in agricultural commodity marketing allows producers and buyers to tailor contract terms such as quantity, quality, and delivery schedules, providing flexibility that futures contracts lack due to standardized terms and exchange-traded nature. Forward contracts mitigate price risk through personalized agreements directly between parties, while futures contracts offer liquidity and hedging advantages but with less customization.

Exchange-traded derivatives

Forward contracts are customized, over-the-counter agreements between two parties to buy or sell a specific quantity of an agricultural commodity at a predetermined price on a future date, lacking standardized terms and regulatory oversight. Futures contracts, traded on regulated exchanges like the Chicago Board of Trade (CBOT), offer standardized contract sizes and settlement dates, providing greater liquidity and price transparency in commodity marketing for agricultural producers and traders.

Counterparty risk

Forward contracts in agricultural commodity marketing expose parties to higher counterparty risk due to their private, over-the-counter nature lacking centralized clearing. Futures contracts mitigate counterparty risk through exchange clearinghouses that guarantee contract performance and provide daily mark-to-market settlements.

Forward contracts vs futures contracts for commodity marketing Infographic

agridif.com

agridif.com