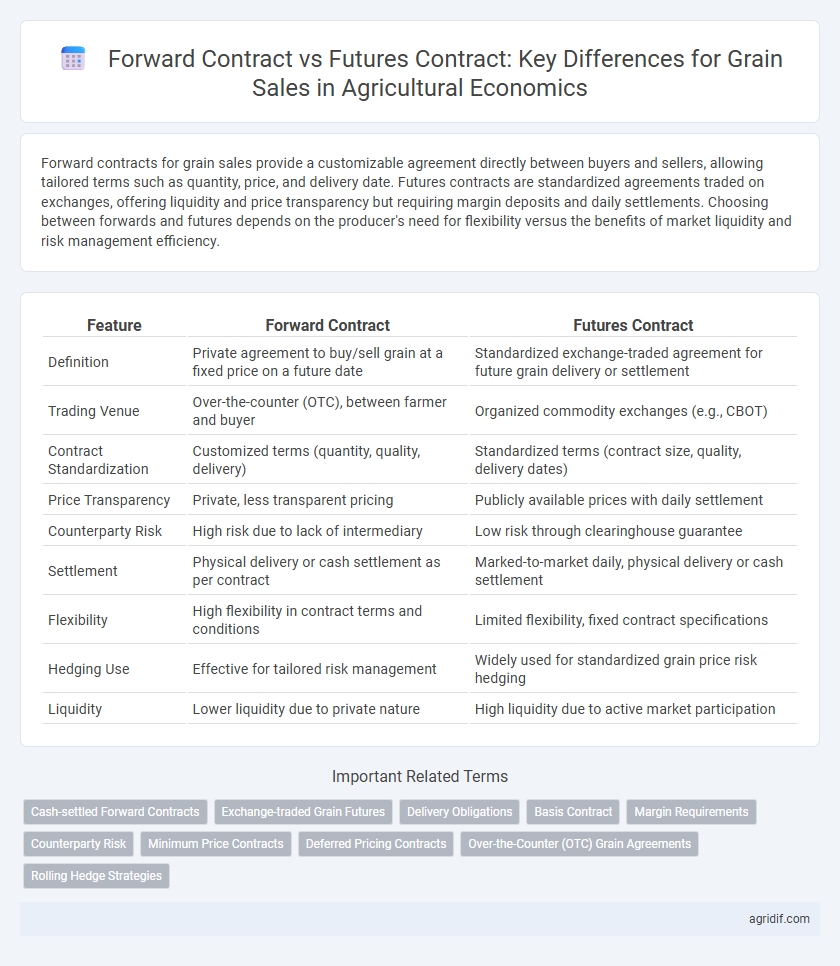

Forward contracts for grain sales provide a customizable agreement directly between buyers and sellers, allowing tailored terms such as quantity, price, and delivery date. Futures contracts are standardized agreements traded on exchanges, offering liquidity and price transparency but requiring margin deposits and daily settlements. Choosing between forwards and futures depends on the producer's need for flexibility versus the benefits of market liquidity and risk management efficiency.

Table of Comparison

| Feature | Forward Contract | Futures Contract |

|---|---|---|

| Definition | Private agreement to buy/sell grain at a fixed price on a future date | Standardized exchange-traded agreement for future grain delivery or settlement |

| Trading Venue | Over-the-counter (OTC), between farmer and buyer | Organized commodity exchanges (e.g., CBOT) |

| Contract Standardization | Customized terms (quantity, quality, delivery) | Standardized terms (contract size, quality, delivery dates) |

| Price Transparency | Private, less transparent pricing | Publicly available prices with daily settlement |

| Counterparty Risk | High risk due to lack of intermediary | Low risk through clearinghouse guarantee |

| Settlement | Physical delivery or cash settlement as per contract | Marked-to-market daily, physical delivery or cash settlement |

| Flexibility | High flexibility in contract terms and conditions | Limited flexibility, fixed contract specifications |

| Hedging Use | Effective for tailored risk management | Widely used for standardized grain price risk hedging |

| Liquidity | Lower liquidity due to private nature | High liquidity due to active market participation |

Introduction to Forward and Futures Contracts in Grain Sales

Forward contracts in grain sales are customized agreements between buyers and sellers to deliver a specified quantity of grain at a predetermined price and date, offering flexibility but carrying counterparty risk. Futures contracts are standardized, exchange-traded agreements for buying or selling grain at a future date, providing liquidity and price transparency while requiring margin deposits. Both instruments help farmers and grain buyers manage price volatility, but futures contracts allow easier exit and hedging due to their standardized nature and centralized clearing.

Key Differences Between Forward and Futures Contracts

Forward contracts in grain sales are customized agreements between two parties to buy or sell a specific quantity of grain at a predetermined price on a future date, often settled at contract maturity with counterparty risk. Futures contracts are standardized, exchange-traded instruments with regulated terms, marked-to-market daily, reducing default risk through a clearinghouse and providing greater liquidity. Key differences include customization flexibility, counterparty risk exposure, standardization level, and settlement processes critical for managing price risk in agricultural economics.

Advantages of Forward Contracts for Grain Producers

Forward contracts for grain sales offer producers the advantage of tailored agreements that specify exact quantities, delivery dates, and prices, providing certainty and reducing market risk. These contracts eliminate the need for margin payments or daily settlement, preserving cash flow and lowering transaction costs for farmers. Moreover, forward contracts allow flexibility in negotiation terms, aligning closely with individual production schedules and storage capacities.

Benefits of Using Futures Contracts in Grain Marketing

Futures contracts in grain marketing provide standardized terms and are traded on regulated exchanges, offering enhanced liquidity and easier price discovery compared to forward contracts. They reduce counterparty risk through margin requirements and clearinghouses, allowing farmers to hedge price volatility effectively. These contracts also enable greater flexibility to offset positions before delivery, facilitating better risk management in volatile grain markets.

Risk Management: How Contracts Mitigate Price Volatility

Forward contracts in grain sales provide customized agreements between farmers and buyers, reducing price volatility risk by locking in prices tailored to specific quantities and delivery dates. Futures contracts, traded on exchanges, offer standardized terms and daily settlement, enabling farmers to hedge against adverse price movements through margin adjustments. Both contracts serve as effective risk management tools, with forwards providing flexibility and futures ensuring liquidity and price transparency in volatile grain markets.

Flexibility and Customization: Forward vs Futures Contracts

Forward contracts offer greater flexibility and customization for grain sales, allowing farmers and buyers to negotiate specific terms such as quantity, quality, delivery date, and price tailored to their unique needs. Futures contracts provide standardized terms traded on exchanges, which limits customization but enhances liquidity and price transparency. This trade-off makes forwards preferable for personalized risk management, while futures suit those seeking market-driven price discovery and ease of transfer.

Market Participation: Who Uses Each Contract Type?

Farmers and grain producers commonly use forward contracts to lock in prices directly with buyers, ensuring price certainty and tailored terms specific to their production schedules. Futures contracts attract speculative traders, hedgers, and larger agribusinesses seeking liquidity and the ability to trade standardized contracts on regulated exchanges. Market participation in futures involves a broader range of actors, including commercial hedgers and financial investors, whereas forward contracts typically involve bilateral agreements between producers and end-users.

Cost Structures and Margin Requirements Explained

Forward contracts for grain sales typically involve fixed pricing with no initial margin requirements, reducing upfront costs but increasing counterparty risk. Futures contracts require traders to post margin deposits and maintain variation margins, ensuring liquidity and reducing default risk, but entail ongoing margin calls and associated costs. The cost structure of forwards is generally simpler and less expensive initially, whereas futures contracts impose dynamic margin requirements impacting cash flow and risk management strategies.

Real-world Case Studies: Grain Sales with Forwards and Futures

Grain producers using forward contracts can lock in prices directly with buyers, enabling tailored agreements that minimize basis risk but may lack liquidity. Futures contracts trade on regulated exchanges like the Chicago Board of Trade, offering standardized terms and greater market transparency, which enhances price discovery and risk management through margin requirements. Case studies show that farmers employing futures contracts combined with cash sales often achieve better price stabilization, while forward contracts provide flexibility essential in niche grain markets.

Choosing the Right Contract for Your Grain Marketing Strategy

Selecting the appropriate contract between forward and futures contracts hinges on risk tolerance, pricing flexibility, and market timing in grain marketing strategies. Forward contracts provide personalized terms with fixed prices, mitigating price volatility but limiting profit from favorable price movements. Futures contracts offer standardized agreements traded on exchanges, allowing for price hedging and potential gains but with margin requirements and less customization.

Related Important Terms

Cash-settled Forward Contracts

Cash-settled forward contracts in grain sales offer tailored agreements between buyers and sellers to lock in prices without the need for physical delivery, reducing risks related to price volatility in agricultural economics. Unlike standardized futures contracts traded on exchanges, these over-the-counter contracts provide flexibility in terms and settlement, facilitating effective risk management for grain producers and buyers.

Exchange-traded Grain Futures

Exchange-traded grain futures contracts offer standardized terms, liquidity, and reduced counterparty risk compared to forward contracts, facilitating efficient price discovery and risk management for agricultural producers. Unlike customized forward contracts, futures are marked-to-market daily, ensuring transparency and enabling farmers to hedge grain price volatility effectively on regulated exchanges.

Delivery Obligations

Forward contracts for grain sales involve a private agreement with specific delivery terms negotiated between buyer and seller, allowing customization of quantity, quality, and delivery date, but carry higher counterparty risk. Futures contracts are standardized exchange-traded agreements with specified delivery months and quality grades, minimizing counterparty risk through margin requirements and clearinghouses, and allowing physical delivery or cash settlement at contract expiration.

Basis Contract

Basis contracts in grain sales offer farmers a forward pricing mechanism by locking in the basis--the difference between local cash prices and futures prices--while allowing the futures price to be determined later, reducing price risk without immediate futures market commitment. Unlike standard futures contracts, basis contracts provide flexibility and specificity to local market conditions, enhancing risk management and marketing strategies in agricultural economics.

Margin Requirements

Forward contracts in grain sales typically require no margin payments, allowing farmers and buyers to settle the contract at harvest without upfront financial commitments, whereas futures contracts demand initial and maintenance margin deposits to mitigate counterparty risk and ensure market liquidity. Margin requirements for futures contracts fluctuates with market volatility, compelling participants to monitor margin calls closely to avoid liquidation, contrasting the more flexible but less regulated credit risk exposure in forward contracts.

Counterparty Risk

Forward contracts in grain sales carry higher counterparty risk due to their over-the-counter nature and lack of standardized clearinghouses, increasing the likelihood of default. Futures contracts mitigate counterparty risk through centralized exchanges and margin requirements, providing greater security and liquidity for agricultural producers and buyers.

Minimum Price Contracts

Minimum price contracts in grain sales guarantee farmers a baseline revenue by setting a floor price, contrasting with futures contracts that lock in specific prices but lack downside price protection. Forward contracts provide customized terms between the buyer and seller, while futures contracts are standardized and traded on exchanges, offering liquidity and transparency but less flexibility.

Deferred Pricing Contracts

Forward contracts for grain sales offer customized terms and deferred pricing that locks in a price for future delivery without standardized exchange requirements, allowing farmers flexibility in timing and quantity. Futures contracts, traded on organized exchanges, provide standardized terms and price transparency but require margin deposits and daily settlement, which can limit farmers' ability to defer pricing until closer to harvest.

Over-the-Counter (OTC) Grain Agreements

Over-the-counter (OTC) grain agreements allow farmers and buyers to negotiate customized forward contracts that specify quantities, prices, and delivery terms, providing flexibility absent in standardized futures contracts traded on exchanges. Unlike futures contracts, OTC forward contracts avoid margin requirements and daily settlement, reducing liquidity risk but increasing counterparty risk in grain sales.

Rolling Hedge Strategies

Rolling hedge strategies in grain sales involve continuously closing out expiring futures contracts and opening new ones to maintain price protection over an extended period, contrasting with forward contracts that lock in prices without flexibility for adjustment. Futures contracts offer greater liquidity and mark-to-market accounting, enabling more effective risk management through rolling hedges compared to the fixed, bilateral nature of forward contracts.

Forward contract vs Futures contract for grain sales Infographic

agridif.com

agridif.com