Subsidies in agricultural exports lower production costs and enhance competitiveness by directly supporting farmers, increasing export volumes and stabilizing income. Tariffs, on the other hand, protect domestic markets from foreign competition by imposing taxes on imports but can provoke retaliatory measures that hinder export growth. Balancing subsidies and tariffs is crucial for agricultural economies to maintain export profitability while avoiding trade disputes.

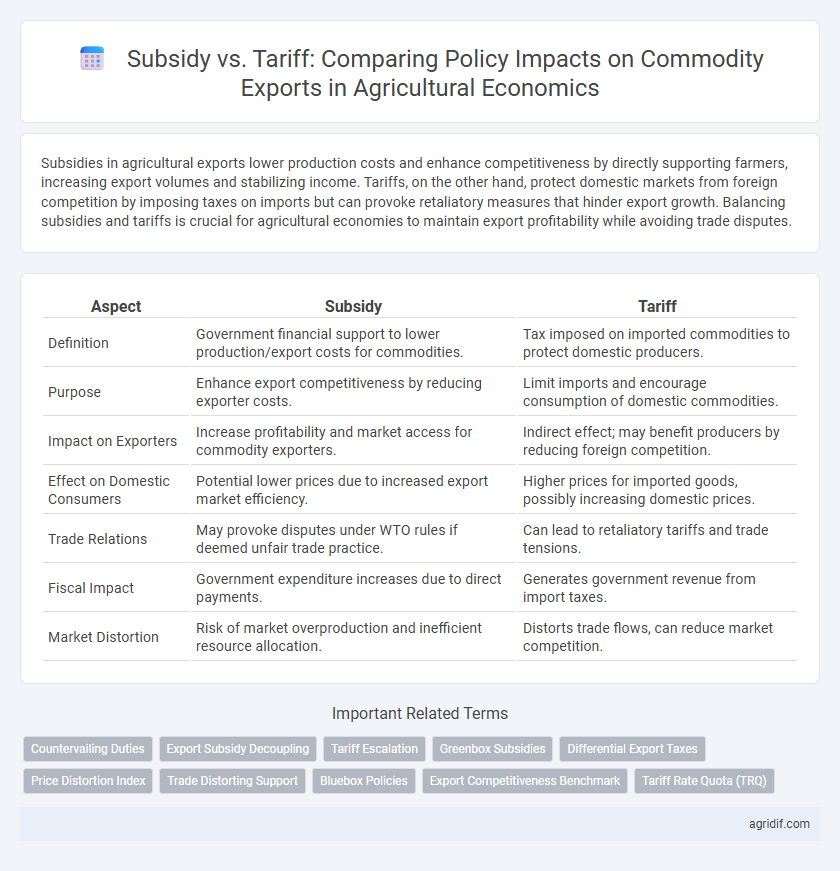

Table of Comparison

| Aspect | Subsidy | Tariff |

|---|---|---|

| Definition | Government financial support to lower production/export costs for commodities. | Tax imposed on imported commodities to protect domestic producers. |

| Purpose | Enhance export competitiveness by reducing exporter costs. | Limit imports and encourage consumption of domestic commodities. |

| Impact on Exporters | Increase profitability and market access for commodity exporters. | Indirect effect; may benefit producers by reducing foreign competition. |

| Effect on Domestic Consumers | Potential lower prices due to increased export market efficiency. | Higher prices for imported goods, possibly increasing domestic prices. |

| Trade Relations | May provoke disputes under WTO rules if deemed unfair trade practice. | Can lead to retaliatory tariffs and trade tensions. |

| Fiscal Impact | Government expenditure increases due to direct payments. | Generates government revenue from import taxes. |

| Market Distortion | Risk of market overproduction and inefficient resource allocation. | Distorts trade flows, can reduce market competition. |

Understanding Agricultural Subsidies and Tariffs

Agricultural subsidies directly lower production costs for farmers, boosting commodity exports by making products more competitive in international markets. Tariffs impose taxes on imported goods, often sparking trade disputes but providing domestic producers with protection against foreign competition. Understanding the economic impact of subsidies versus tariffs is crucial for formulating trade policies that balance market efficiency and farmer support in agricultural economics.

Historical Perspective on Subsidies and Tariffs in Agriculture

Subsidies in agriculture have historically aimed to stabilize farmer incomes and ensure food security, often leading to overproduction and market distortions. Tariffs on agricultural commodity exports were traditionally used to protect domestic markets from foreign competition but often resulted in retaliatory trade measures. Over time, international trade agreements have increasingly limited the use of both subsidies and tariffs, promoting more open and competitive global agricultural markets.

Economic Rationale Behind Subsidies for Commodity Exports

Subsidies for commodity exports are economically justified as they enhance the competitiveness of domestic producers by lowering production costs, enabling access to international markets, and stabilizing income in volatile agricultural sectors. These government financial supports help mitigate risks associated with price fluctuations and global demand shifts, promoting export growth and rural development. In contrast to tariffs, which protect domestic markets by restricting imports, subsidies actively encourage export expansion to boost national trade balances.

Tariffs as a Tool for Protecting Domestic Agricultural Producers

Tariffs serve as a critical instrument in agricultural economics to safeguard domestic producers by imposing import taxes that increase the cost of foreign commodities, thereby enhancing the competitiveness of locally grown products. Unlike subsidies, which directly lower production costs, tariffs indirectly protect domestic agriculture by reducing market access for international exporters and encouraging local consumption. Empirical studies reveal that countries applying tariffs on commodities like grains and dairy often experience bolstered farm incomes and stabilized rural economies.

Comparative Analysis: Impact of Subsidies vs Tariffs on Export Competitiveness

Subsidies directly lower production costs for exporters, enhancing competitiveness by enabling lower prices or higher profit margins in international markets. Tariffs impose additional costs on foreign competitors' goods, indirectly boosting domestic exporters by reducing import competition but potentially provoking retaliatory measures. Comparative analysis shows subsidies often provide more immediate gains in export volume and global market share, while tariffs can protect certain sectors but risk escalating trade tensions that may harm long-term competitiveness.

Effects on Global Commodity Prices and Market Access

Subsidies on commodity exports typically lower production costs, boosting supply and often leading to decreased global commodity prices, which benefits importing countries but can distort fair competition. Tariffs imposed by importing nations raise the cost of foreign commodities, restricting market access and potentially driving up global prices by limiting supply sources. Both policies significantly influence international trade dynamics, with subsidies encouraging overproduction and tariffs protecting domestic industries at the expense of global market efficiency.

Subsidies, Tariffs, and Trade Agreements: Navigating WTO Rules

Subsidies and tariffs play critical roles in shaping commodity export markets within the framework of WTO rules, with subsidies often subject to stringent disciplines to prevent trade distortions. Export subsidies for agricultural commodities are heavily regulated under the Agreement on Agriculture, aiming to reduce market imbalances and promote fair competition. Trade agreements increasingly emphasize the reduction or elimination of export subsidies while allowing tariffs to protect domestic producers, balancing economic interests and compliance with international trade obligations.

Implications for Developing vs Developed Agricultural Economies

Subsidies in developing agricultural economies often enhance export competitiveness by lowering production costs, enabling small-scale farmers to access international markets and improve their income levels, whereas tariffs imposed by developed countries can restrict such market access and distort global trade flows. Developed economies tend to use tariffs to protect high-value agricultural sectors, maintaining domestic price stability and safeguarding employment, which can disadvantage exporters from developing nations by limiting their competitive edge. The interplay between subsidies in developing countries and tariffs in developed regions shapes global commodity prices and influences trade policy negotiations within international agricultural markets.

Environmental and Social Consequences of Subsidies and Tariffs

Subsidies on commodity exports often encourage overproduction, leading to negative environmental impacts such as soil degradation, water depletion, and increased greenhouse gas emissions. Tariffs, while potentially reducing export volumes, can protect local ecosystems by discouraging intensive farming practices and promoting sustainable land use. Socially, subsidies may exacerbate inequality by disproportionately benefiting large agribusinesses, whereas tariffs can support small-scale farmers but risk trade conflicts that affect overall economic stability.

Policy Recommendations for Balanced Export Growth

Subsidies for agricultural commodity exports can enhance competitiveness by lowering production costs but risk market distortions and international disputes under WTO rules. Tariffs, while protecting domestic markets, may reduce export volumes and provoke retaliation, hindering balanced growth. Policy recommendations emphasize a calibrated blend of targeted subsidies with minimal export tariffs, complemented by capacity-building measures and trade facilitation to sustain competitive and inclusive export expansion.

Related Important Terms

Countervailing Duties

Countervailing duties are imposed by importing countries to offset subsidies granted by exporting governments that unfairly lower commodity prices, protecting domestic producers from distorted competition. Unlike tariffs, which are general taxes on imports, countervailing duties specifically target subsidized exports to restore market equilibrium and promote fair trade in agricultural commodities.

Export Subsidy Decoupling

Export subsidy decoupling in agricultural economics refers to shifting financial support from direct price incentives to payments independent of current export decisions, reducing market distortions and promoting fair trade. Unlike tariffs that impose barriers on imports, decoupled export subsidies aim to enhance commodity competitiveness without influencing export volumes, aligning with World Trade Organization regulations.

Tariff Escalation

Tariff escalation occurs when higher tariffs are imposed on processed agricultural exports compared to raw commodities, discouraging value addition in developing countries and distorting global trade patterns. Subsidies support domestic producers by lowering production costs, while tariff escalation protects domestic processing industries but often undermines competitiveness of agricultural exporters in global markets.

Greenbox Subsidies

Greenbox subsidies in agricultural economics provide direct payments to farmers without distorting production or trade, supporting commodity exports while complying with WTO rules. Unlike tariffs, which impose taxes on imports and can provoke trade disputes, Greenbox subsidies enhance competitiveness with minimal market distortion and maintain export stability.

Differential Export Taxes

Differential export taxes create economic distortions by imposing varied tax rates on commodity exports, often discouraging producers and skewing market signals compared to direct subsidies that financially support exporters to enhance competitiveness. While subsidies can boost export volumes by lowering production costs and encouraging supply, export taxes reduce exporter revenues, leading to reduced incentives for production and inefficiencies in global commodity markets.

Price Distortion Index

Subsidies create a positive Price Distortion Index by artificially lowering domestic production costs for commodity exports, leading to overproduction and global market price depressions; tariffs, conversely, increase the Price Distortion Index by raising import costs, protecting domestic producers but risking retaliatory trade barriers. Measuring the Price Distortion Index helps quantify the extent to which these trade policies distort commodity prices, influencing international competitiveness and resource allocation in agricultural economics.

Trade Distorting Support

Trade-distorting support in agricultural economics manifests through subsidies and tariffs, with subsidies directly lowering export costs to boost competitiveness, while tariffs impose barriers that protect domestic markets but restrict trade flows. Both mechanisms alter market signals and resource allocation, often leading to inefficiencies and distorted global commodity prices.

Bluebox Policies

Blue Box policies in agricultural economics provide subsidies that support commodity exports by compensating farmers for production limitations, contrasting with tariffs that impose taxes on imported goods to protect domestic markets. These subsidies aim to stabilize agricultural income and trade competitiveness without directly restricting market flows, aligning with World Trade Organization regulations to reduce trade distortions.

Export Competitiveness Benchmark

Subsidies directly reduce production costs, enabling exporters to price commodities more competitively in international markets and improve export competitiveness benchmarks. Tariffs on imports, while protective for domestic industries, can provoke retaliatory measures that undermine export competitiveness by increasing market entry barriers and reducing trade volumes.

Tariff Rate Quota (TRQ)

Tariff Rate Quota (TRQ) offers a hybrid trade policy by allowing a set quantity of commodity exports at a lower tariff rate while imposing higher tariffs on quantities exceeding the quota, balancing trade protection with market access. This mechanism supports domestic producers by controlling export volumes and stabilizing prices, contrasting with subsidies that directly reduce production costs but may lead to market distortions.

Subsidy vs Tariff for commodity exports Infographic

agridif.com

agridif.com