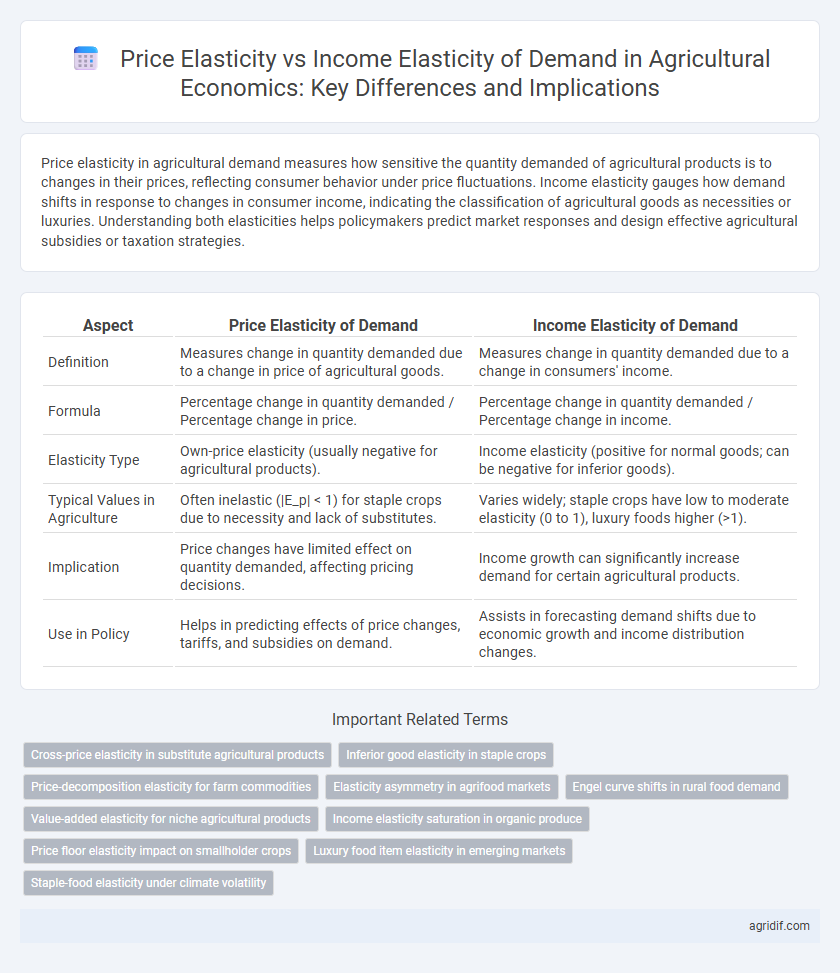

Price elasticity in agricultural demand measures how sensitive the quantity demanded of agricultural products is to changes in their prices, reflecting consumer behavior under price fluctuations. Income elasticity gauges how demand shifts in response to changes in consumer income, indicating the classification of agricultural goods as necessities or luxuries. Understanding both elasticities helps policymakers predict market responses and design effective agricultural subsidies or taxation strategies.

Table of Comparison

| Aspect | Price Elasticity of Demand | Income Elasticity of Demand |

|---|---|---|

| Definition | Measures change in quantity demanded due to a change in price of agricultural goods. | Measures change in quantity demanded due to a change in consumers' income. |

| Formula | Percentage change in quantity demanded / Percentage change in price. | Percentage change in quantity demanded / Percentage change in income. |

| Elasticity Type | Own-price elasticity (usually negative for agricultural products). | Income elasticity (positive for normal goods; can be negative for inferior goods). |

| Typical Values in Agriculture | Often inelastic (|E_p| < 1) for staple crops due to necessity and lack of substitutes. | Varies widely; staple crops have low to moderate elasticity (0 to 1), luxury foods higher (>1). |

| Implication | Price changes have limited effect on quantity demanded, affecting pricing decisions. | Income growth can significantly increase demand for certain agricultural products. |

| Use in Policy | Helps in predicting effects of price changes, tariffs, and subsidies on demand. | Assists in forecasting demand shifts due to economic growth and income distribution changes. |

Understanding Price Elasticity in Agricultural Markets

Price elasticity in agricultural markets measures the responsiveness of the quantity demanded to changes in the price of agricultural products, reflecting consumers' sensitivity to price fluctuations. Understanding price elasticity helps predict how shifts in market prices impact demand for crops and livestock, which is essential for farmers and policymakers in setting production levels and price supports. Unlike income elasticity, which gauges demand changes relative to income variations, price elasticity directly addresses the effect of price changes on agricultural commodity consumption patterns.

Exploring Income Elasticity of Demand for Agricultural Products

Income elasticity of demand for agricultural products measures how consumer demand changes with variations in income, reflecting essential consumption patterns in agricultural economics. Agricultural products typically exhibit positive income elasticity, indicating that as income rises, demand for these goods increases, especially for higher-value or non-staple items such as fruits and vegetables. Understanding income elasticity helps policymakers and producers anticipate shifts in market demand related to economic growth and transitions in consumer preferences.

Key Differences Between Price and Income Elasticity in Agriculture

Price elasticity of demand in agriculture measures the responsiveness of quantity demanded to changes in the price of agricultural products, often reflecting short-term consumer adjustments. Income elasticity assesses how demand for agricultural goods shifts with changes in consumers' income, highlighting long-term consumption patterns and the classification of goods as necessities or luxuries. Key differences lie in their sensitivity drivers: price elasticity is influenced by product substitutes and urgency, whereas income elasticity depends on economic growth trends and income distribution among consumers.

Factors Influencing Price Elasticity in Agricultural Demand

Price elasticity of demand in agriculture is influenced by factors such as the availability of substitutes, the proportion of income spent on agricultural goods, and the time period considered for adjustment. The necessity of agricultural products often results in lower price elasticity compared to other goods, as consumers cannot easily reduce consumption despite price changes. Seasonal variations and perishability also affect price responsiveness, making short-term demand generally more inelastic.

Determinants of Income Elasticity in Agricultural Goods

Income elasticity for agricultural goods depends on factors such as the type of commodity, consumer income levels, and the good's perishability, with staple foods typically showing lower income elasticity compared to luxury agricultural products. Higher income levels generally increase demand for higher-quality or processed agricultural goods, reflecting a positive income elasticity that influences market demand patterns. Seasonal variations and cultural preferences also affect income elasticity, as they shape consumption habits and willingness to spend more on certain agricultural products.

Price Elasticity and Its Impact on Farm Revenues

Price elasticity of demand in agriculture measures how the quantity demanded responds to price changes, crucially affecting farm revenues since inelastic demand can stabilize income despite price fluctuations. Crops with low price elasticity, such as staple grains, tend to maintain steady revenue streams for farmers, whereas highly elastic products like fresh fruits or vegetables may cause significant income variability when prices shift. Understanding price elasticity enables agricultural economists to forecast revenue impacts and design policies that mitigate risks from volatile market prices.

Income Growth and Shifts in Agricultural Demand

Income elasticity of demand for agricultural products measures the responsiveness of quantity demanded to changes in consumer income, often exceeding price elasticity in importance during periods of income growth. As incomes rise, demand shifts toward higher-quality and diverse agricultural goods, influencing market structures and production decisions significantly. Understanding income elasticity enables policymakers and producers to anticipate demand shifts and optimize supply in evolving agricultural markets.

Implications for Agricultural Policy and Market Strategies

Price elasticity of demand in agriculture indicates how sensitive the quantity demanded is to changes in price, often showing inelastic behavior due to the necessity of staple crops. Income elasticity reflects how demand varies with consumer income levels, revealing higher sensitivity for non-essential or luxury agricultural products. Understanding these elasticities allows policymakers to design targeted subsidies and market interventions that stabilize income for farmers while adjusting supply strategies to consumer income trends, optimizing overall agricultural sector performance.

Case Studies: Price vs. Income Elasticity in Crop and Livestock Sectors

Studies in agricultural economics reveal that price elasticity of demand for crops like wheat and maize is generally higher than income elasticity, indicating that price changes significantly influence consumption patterns more than income variations. In the livestock sector, case studies from India and Brazil show moderate price elasticity but higher income elasticity, reflecting that rising incomes drive greater demand for meat and dairy products. These contrasting elasticity behaviors highlight the necessity for tailored policy interventions to stabilize markets and improve farmer incomes across crop and livestock sectors.

Future Trends: Elasticity Measures and Sustainable Agricultural Development

Price elasticity of demand in agriculture is expected to remain relatively inelastic due to essential food product characteristics, while income elasticity may increase as rising incomes drive demand for higher-value and sustainably produced goods. Advanced econometric models and big data analytics will enhance the precision of elasticity measures, aiding policymakers in designing adaptive pricing and subsidy frameworks. Integrating dynamic elasticity insights with sustainable agricultural development strategies supports resource-efficient production and market stability amid climate change and evolving consumer preferences.

Related Important Terms

Cross-price elasticity in substitute agricultural products

Cross-price elasticity measures the responsiveness of demand for an agricultural product when the price of a substitute changes, revealing substitution effects critical for market analysis. High positive cross-price elasticity between substitute crops like corn and wheat indicates that price shifts in one significantly influence the demand for the other, guiding producers and policymakers in resource allocation.

Inferior good elasticity in staple crops

Price elasticity of demand for staple crops tends to be relatively low, reflecting inelastic consumer response to price changes due to their necessity in diets. Income elasticity of demand for these inferior staple goods often exhibits negative values, indicating that as consumer income rises, demand shifts away from these staples toward higher-quality substitutes.

Price-decomposition elasticity for farm commodities

Price elasticity of demand for agricultural commodities measures the responsiveness of quantity demanded to changes in market prices, reflecting short-term consumption adjustments. Income elasticity, by contrast, captures how demand shifts with variations in consumer income, often showing that staple farm commodities have low income elasticity while higher-value products exhibit greater sensitivity.

Elasticity asymmetry in agrifood markets

Price elasticity of demand in agricultural markets often exhibits higher responsiveness to price changes for staple crops than luxury food items, reflecting inelastic demand for essential goods. Income elasticity shows asymmetric behavior where increased consumer income significantly boosts demand for high-value agrifood products, while staple food demand remains relatively stable, demonstrating income inelasticity.

Engel curve shifts in rural food demand

Price elasticity of agricultural demand measures sensitivity to price changes, while income elasticity captures responsiveness to income variations, with Engel curve shifts reflecting evolving consumption patterns in rural households; increases in income typically lead to higher demand for diverse and higher-quality food products, altering the shape and position of Engel curves in rural economies. Understanding these elasticities helps predict agricultural market dynamics and guides policy interventions to enhance food security and rural welfare.

Value-added elasticity for niche agricultural products

Value-added elasticity measures the sensitivity of demand for niche agricultural products to changes in their value addition, often exceeding traditional price and income elasticity due to the unique qualities and branding involved. Understanding value-added elasticity helps producers optimize pricing and marketing strategies, capturing consumer willingness to pay premiums for specialty goods beyond basic price or income fluctuations.

Income elasticity saturation in organic produce

Income elasticity of demand for organic produce tends to saturate as consumer income rises, reflecting a plateau in demand growth despite higher earnings. Price elasticity remains relatively higher, indicating that organic produce consumption is still sensitive to price changes even when income-driven demand stabilizes.

Price floor elasticity impact on smallholder crops

Price elasticity in agricultural demand measures how sensitive smallholder crop quantities are to price changes, often showing inelastic responses due to limited substitutes and income constraints. Implementing a price floor can reduce price elasticity by stabilizing income for farmers, encouraging consistent production but potentially leading to surplus and market distortions in smallholder crop markets.

Luxury food item elasticity in emerging markets

Luxury food items in emerging markets exhibit higher income elasticity compared to price elasticity, reflecting strong demand sensitivity to rising incomes as disposable income grows. In contrast, price elasticity remains relatively low, indicating that changes in price have a smaller effect on the quantity demanded for these premium agricultural products.

Staple-food elasticity under climate volatility

Staple-food demand in agricultural economics exhibits low price elasticity due to its essential nature, remaining relatively inelastic even under climate volatility-driven supply shocks. Income elasticity for staple foods tends to be lower compared to non-staple foods, reflecting limited demand responsiveness to income changes amid climate-induced livelihood uncertainties.

Price elasticity vs Income elasticity for agricultural demand Infographic

agridif.com

agridif.com