Gross margin measures the difference between total revenue and variable costs, highlighting the direct profitability of farm production activities. Net margin accounts for both variable and fixed costs, offering a comprehensive view of overall farm profitability and financial sustainability. Understanding the distinction between gross and net margins enables farmers to make informed decisions on resource allocation and cost management to optimize profitability.

Table of Comparison

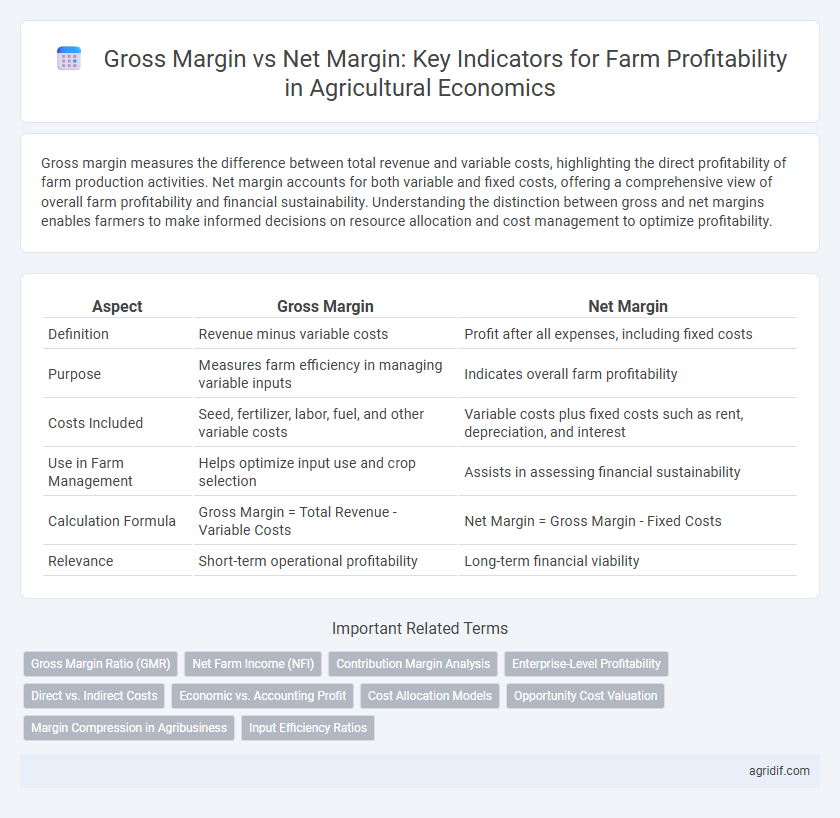

| Aspect | Gross Margin | Net Margin |

|---|---|---|

| Definition | Revenue minus variable costs | Profit after all expenses, including fixed costs |

| Purpose | Measures farm efficiency in managing variable inputs | Indicates overall farm profitability |

| Costs Included | Seed, fertilizer, labor, fuel, and other variable costs | Variable costs plus fixed costs such as rent, depreciation, and interest |

| Use in Farm Management | Helps optimize input use and crop selection | Assists in assessing financial sustainability |

| Calculation Formula | Gross Margin = Total Revenue - Variable Costs | Net Margin = Gross Margin - Fixed Costs |

| Relevance | Short-term operational profitability | Long-term financial viability |

Understanding Gross Margin in Agricultural Economics

Gross margin in agricultural economics measures the revenue from crop or livestock sales minus variable costs such as seeds, feed, and fertilizers, providing a clear indicator of the farm's operational efficiency before fixed costs. It helps farmers identify which enterprises generate the highest returns relative to variable inputs, essential for optimizing resource allocation and improving profitability. Tracking gross margin supports informed decisions on crop selection and input management, crucial for sustaining competitive farm operations.

Defining Net Margin for Farm Enterprises

Net margin for farm enterprises measures the profitability by subtracting total expenses, including operating costs, fixed costs, and interest, from total revenue generated by farm activities. Unlike gross margin, which only accounts for variable costs, net margin provides a comprehensive view of financial performance by reflecting the impact of all expenses on farm income. This metric enables farmers to assess overall efficiency, optimize resource allocation, and improve long-term sustainability in agricultural economics.

Key Differences Between Gross Margin and Net Margin

Gross margin in agricultural economics represents the difference between total farm revenue and variable costs, highlighting the direct profitability of farming operations without accounting for fixed expenses. Net margin, however, deducts both variable and fixed costs from total revenue, providing a comprehensive measure of overall farm profitability. Understanding the key differences between gross margin and net margin enables farmers to analyze operational efficiency separately from total financial performance.

Importance of Calculating Farm Gross Margin

Calculating farm gross margin is essential for assessing the core profitability of crop or livestock production by measuring revenue minus variable costs, excluding fixed expenses. This metric allows farmers to identify which enterprises generate the highest returns and optimize resource allocation, enhancing operational efficiency. Understanding gross margin helps in making informed decisions about crop selection, input use, and risk management, directly impacting farm profitability and sustainability.

How Net Margin Reflects Farm Profitability

Net margin in agricultural economics measures the actual profitability of a farm by accounting for all expenses, including fixed and variable costs, providing a clear picture of the farm's financial health. Unlike gross margin, which only considers the difference between total revenue and variable costs, net margin reflects the overall efficiency and sustainability of farm operations. A positive net margin indicates that a farm generates enough income to cover all costs and achieve profit, essential for long-term viability and investment decisions.

Common Errors in Margin Calculations on Farms

Common errors in farm margin calculations often involve confusing gross margin with net margin, leading to inaccurate profitability assessments. Gross margin calculates revenue minus variable costs, while net margin accounts for all expenses, including fixed costs and overheads, providing a clearer picture of true farm profitability. Ignoring fixed costs or misclassifying expenses can significantly distort financial analysis and decision-making in agricultural economics.

Factors Impacting Gross and Net Margins in Agriculture

Gross margin in agriculture measures the difference between revenue from crop or livestock sales and variable costs like seeds, fertilizers, and labor, reflecting operational efficiency. Net margin accounts for all costs, including fixed expenses such as equipment depreciation, land rent, and interest payments, providing a comprehensive view of farm profitability. Factors impacting these margins include fluctuating commodity prices, input cost volatility, weather conditions, yield variability, and farm management practices that influence both revenue generation and cost control.

Gross Margin vs Net Margin: Implications for Farm Decision Making

Gross margin represents total revenue minus variable costs, highlighting the farm's ability to cover operational expenses and generate profit before fixed costs. Net margin accounts for all expenses, including fixed costs like depreciation and interest, offering a comprehensive measure of farm profitability. Understanding the distinction between gross and net margins informs strategic decisions on resource allocation, cost management, and investment to enhance overall farm sustainability.

Maximizing Farm Profitability Through Margin Analysis

Gross margin measures the difference between farm revenue and variable costs, providing a clear indicator of operational efficiency, while net margin accounts for all expenses, including fixed costs, offering a comprehensive view of overall profitability. Maximizing farm profitability requires analyzing both margins to identify cost-saving opportunities and optimize resource allocation. Strategic decisions based on detailed margin analysis enhance financial resilience and sustainable growth in agricultural enterprises.

Case Studies: Gross Margin and Net Margin in Agricultural Operations

Case studies in agricultural economics reveal that gross margin highlights the revenue minus variable costs, crucial for assessing short-term farm profitability and operational efficiency. In contrast, net margin incorporates fixed costs, providing a comprehensive measure of long-term financial sustainability and overall farm viability. Analysis of diverse farm operations demonstrates that maximizing gross margin can boost immediate cash flow, while improving net margin supports strategic investment and growth decisions.

Related Important Terms

Gross Margin Ratio (GMR)

Gross Margin Ratio (GMR) is a key indicator in agricultural economics that measures a farm's efficiency by comparing gross margin to total revenue, highlighting the profitability before fixed costs are deducted. Unlike net margin, which accounts for all expenses, GMR emphasizes operational efficiency and provides critical insight into a farm's core income-generating capacity.

Net Farm Income (NFI)

Net Farm Income (NFI) captures the true profitability of a farm by accounting for all revenues minus variable and fixed costs, providing a comprehensive measure beyond the gross margin, which only considers variable production costs. Understanding NFI allows farmers and economists to evaluate the farm's financial sustainability and long-term economic viability, making it a critical indicator for strategic decision-making in agricultural economics.

Contribution Margin Analysis

Gross margin in agricultural economics represents total revenue minus variable costs, highlighting the contribution margin's role in assessing farm profitability by isolating the impact of fixed costs. Net margin further refines this analysis by deducting fixed costs, providing a comprehensive view of the farm's financial health and sustainability.

Enterprise-Level Profitability

Gross margin measures the difference between total revenue and variable costs, providing insight into the contribution of each agricultural enterprise to farm profitability, while net margin accounts for all expenses including fixed costs, offering a comprehensive view of overall financial performance. Enterprise-level profitability analysis leverages gross margin to identify high-performing crops or livestock, but net margin is crucial for evaluating the sustainability and long-term viability of farm operations.

Direct vs. Indirect Costs

Gross margin measures farm profitability by subtracting direct costs such as seeds, fertilizers, and labor directly tied to production, providing insight into operational efficiency. Net margin accounts for both direct and indirect costs, including overhead expenses like machinery depreciation and administrative fees, offering a comprehensive view of overall financial sustainability.

Economic vs. Accounting Profit

Gross margin in agricultural economics measures the difference between total revenue and variable costs, reflecting the economic profitability of farm operations by highlighting cash flow available for fixed costs and profit, whereas net margin considers all costs including fixed and non-cash expenses, emphasizing accounting profit that accounts for depreciation, interest, and opportunity costs. Understanding the distinction between gross margin and net margin is crucial for evaluating farm profitability, as gross margin offers insight into operational efficiency, while net margin provides a comprehensive view of overall financial health and sustainability.

Cost Allocation Models

Gross margin in agricultural economics highlights revenue minus variable costs, crucial for evaluating short-term farm profitability and operational efficiency, while net margin incorporates both fixed and variable costs, offering a comprehensive view of long-term financial sustainability. Accurate cost allocation models that distinguish between direct, indirect, fixed, and variable costs optimize profit analysis by enabling precise resource management and strategic decision-making in farm operations.

Opportunity Cost Valuation

Gross margin reflects farm profitability by measuring revenue minus variable costs, while net margin accounts for all costs including fixed and opportunity costs, providing a more comprehensive valuation of farm financial performance. Incorporating opportunity cost valuation reveals the true economic cost of resources, highlighting the trade-offs farmers face when allocating land, labor, and capital.

Margin Compression in Agribusiness

Gross margin reflects a farm's revenue minus variable costs, providing insight into operational efficiency, while net margin accounts for all expenses, revealing overall profitability. Margin compression in agribusiness, driven by rising input costs and volatile commodity prices, squeezes both gross and net margins, challenging the sustainability and competitive advantage of farming operations.

Input Efficiency Ratios

Gross margin highlights the revenue remaining after variable input costs, serving as a critical measure of input efficiency ratios in agricultural economics, while net margin accounts for all expenses, reflecting overall farm profitability. Emphasizing gross margin helps farmers optimize variable inputs like seeds and fertilizers to improve cost-effectiveness before fixed costs impact total profitability.

Gross margin vs net margin for farm profitability Infographic

agridif.com

agridif.com