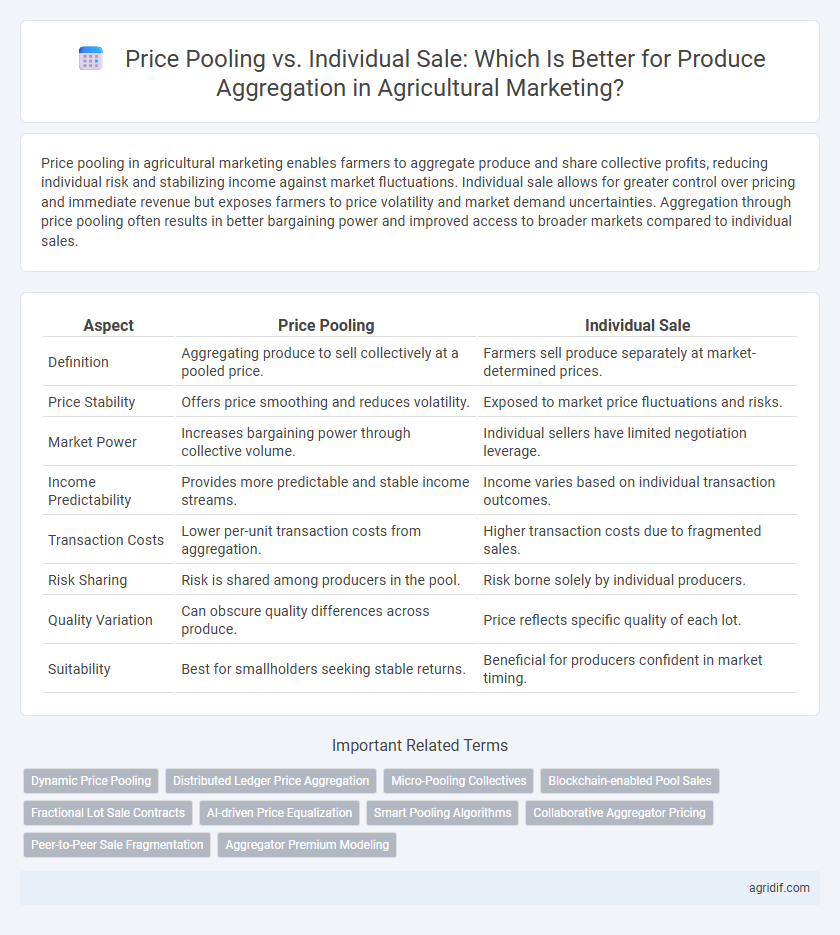

Price pooling in agricultural marketing enables farmers to aggregate produce and share collective profits, reducing individual risk and stabilizing income against market fluctuations. Individual sale allows for greater control over pricing and immediate revenue but exposes farmers to price volatility and market demand uncertainties. Aggregation through price pooling often results in better bargaining power and improved access to broader markets compared to individual sales.

Table of Comparison

| Aspect | Price Pooling | Individual Sale |

|---|---|---|

| Definition | Aggregating produce to sell collectively at a pooled price. | Farmers sell produce separately at market-determined prices. |

| Price Stability | Offers price smoothing and reduces volatility. | Exposed to market price fluctuations and risks. |

| Market Power | Increases bargaining power through collective volume. | Individual sellers have limited negotiation leverage. |

| Income Predictability | Provides more predictable and stable income streams. | Income varies based on individual transaction outcomes. |

| Transaction Costs | Lower per-unit transaction costs from aggregation. | Higher transaction costs due to fragmented sales. |

| Risk Sharing | Risk is shared among producers in the pool. | Risk borne solely by individual producers. |

| Quality Variation | Can obscure quality differences across produce. | Price reflects specific quality of each lot. |

| Suitability | Best for smallholders seeking stable returns. | Beneficial for producers confident in market timing. |

Introduction to Produce Aggregation in Agriculture

Produce aggregation in agriculture involves collecting smaller quantities of crops from multiple farmers to create a larger, marketable volume, enhancing bargaining power and reducing transaction costs. Price pooling combines revenues from aggregated sales, distributing earnings based on agreed formulas, which lowers price risk for individual farmers compared to direct individual sales. This method improves market access and stabilizes farmer incomes while enabling efficient logistics and consistent product quality for buyers.

Understanding Price Pooling Mechanisms

Price pooling mechanisms aggregate revenue from multiple producers, distributing earnings based on collective output rather than individual sales, which mitigates price volatility risks. This system enhances market stability and bargaining power for farmers, especially in sectors with fluctuating commodity prices like grains and fruits. Understanding the formulas and timing of pool settlements is critical to optimizing returns compared to individual sale strategies.

Overview of Individual Sale Systems

Individual sale systems in agricultural marketing involve farmers selling their produce directly to buyers without aggregating with others, allowing for personalized pricing based on quality and demand. This approach often results in variable income, as farmers negotiate prices independently, which can lead to higher profits during peak demand but increased risk during market downturns. Direct sales enhance transparency and traceability but require farmers to have strong market knowledge and negotiation skills.

Benefits of Price Pooling for Farmers

Price pooling enhances farmers' income stability by averaging prices over the entire season, minimizing the impact of market fluctuations on individual sales. It reduces transaction costs and bargaining power disparities, enabling small-scale farmers to access larger markets more effectively. Collective price pooling also fosters cooperative marketing efforts, improving overall market access and fostering sustainable agricultural development.

Advantages of Individual Sale Approaches

Individual sale approaches in agricultural marketing enable farmers to retain full control over pricing, often leading to higher profits by negotiating directly with buyers. This method allows for flexible marketing strategies tailored to specific produce quality and market demand, promoting competitive pricing dynamics. Individual sales also facilitate quicker transactions and reduce dependency on collective decision-making, improving responsiveness to market changes.

Challenges and Risks in Price Pooling

Price pooling in agricultural marketing centralizes revenue distribution but faces challenges such as price volatility impacting collective returns and potential disputes over individual contribution fairness. Risks include reduced incentives for producers to improve quality and timing, leading to inefficiencies and market mismatches. These factors complicate trust and transparency, often hindering the scalability of pooling arrangements compared to individual sales.

Limitations of Individual Sale in Agricultural Marketing

Individual sale in agricultural marketing often limits farmers' bargaining power due to fragmented supply and inconsistent quality, resulting in lower prices and higher transaction costs. Limited access to market information and smaller volumes per farmer reduce competitiveness against larger buyers and intermediaries. This approach restricts economies of scale, making it difficult to invest in quality improvements and efficient logistics, ultimately hindering farmers' income growth.

Impact of Aggregation Models on Market Access

Price pooling enhances market access by stabilizing income for farmers through collective negotiation and risk-sharing, leading to improved bargaining power and better price realization in agricultural markets. Individual sales offer immediate payment but expose producers to price volatility and limited access to larger buyers, restricting market opportunities. Aggregation models that utilize price pooling often result in stronger market linkages and increased participation in formal supply chains, boosting farmers' competitiveness and income stability.

Case Studies: Success Stories and Failures

Price pooling in agricultural produce aggregation often leads to stabilized farmer incomes by averaging out price fluctuations, as demonstrated in the successful case study of Australian wheat cooperatives. Conversely, individual sale strategies can result in higher short-term profits but expose farmers to greater market volatility, exemplified by failed attempts in small-scale vegetable markets in India. These case studies highlight the trade-off between risk management and profit maximization in agricultural marketing models.

Choosing the Right Sales Approach for Farmer Collectives

Price pooling stabilizes income for farmer collectives by aggregating produce and distributing revenue based on collective performance, reducing market price volatility risks. Individual sale allows farmers to capitalize on higher market prices per unit but exposes them to price fluctuations and inconsistent earnings. Choosing the right sales approach depends on factors like risk tolerance, market access, and collective negotiation power to maximize overall profitability and sustainability.

Related Important Terms

Dynamic Price Pooling

Dynamic price pooling enhances revenue stability for farmers by aggregating produce sales and adjusting payouts based on real-time market demand and supply fluctuations, contrasting with individual sales where farmers face price volatility and lower bargaining power. This mechanism leverages collective market intelligence to optimize price realization, reduce transaction costs, and improve overall market efficiency in agricultural marketing.

Distributed Ledger Price Aggregation

Distributed ledger technology enhances price pooling for agricultural produce by ensuring transparent, immutable records of aggregated prices, reducing information asymmetry compared to individual sales. This decentralized approach increases trust among producers, facilitating fairer price discovery and higher market efficiency.

Micro-Pooling Collectives

Micro-pooling collectives in agricultural marketing enhance farmers' bargaining power by aggregating produce for pooled sales, resulting in better price stability and reduced transaction costs compared to individual sales. This approach optimizes market access and income by leveraging collective volume to negotiate superior prices and minimize market volatility.

Blockchain-enabled Pool Sales

Blockchain-enabled price pooling for agricultural produce enhances transparency and trust by securely aggregating farmer sales data, reducing price volatility compared to individual sales where farmers sell produce independently. This decentralized ledger technology optimizes aggregate pricing strategies, promotes fair revenue distribution, and strengthens market access for smallholder farmers through real-time data verification.

Fractional Lot Sale Contracts

Price pooling in agricultural marketing enables producers to collectively aggregate produce and share revenue based on total sales, offering risk mitigation and stable returns, whereas individual sale requires farmers to sell independently, often facing price volatility. Fractional Lot Sale Contracts facilitate partial pooling by allowing producers to commit specified portions of their harvest to collective contracts, balancing individual flexibility with collective bargaining power.

AI-driven Price Equalization

AI-driven price equalization in agricultural marketing enhances price pooling by analyzing market data to set uniform prices for aggregated produce, reducing volatility for farmers. Individual sales lack this optimization, often resulting in fragmented pricing and lower overall revenue stability for producers.

Smart Pooling Algorithms

Smart pooling algorithms enhance price pooling by aggregating produce from multiple farmers, optimizing supply volumes to secure better market prices and reduce transaction costs. These algorithms use real-time data analytics and demand forecasting to dynamically adjust pooling strategies, outperforming traditional individual sales in maximizing revenue and minimizing market risks.

Collaborative Aggregator Pricing

Collaborative aggregator pricing leverages price pooling to stabilize farmers' income by combining produce from multiple growers, enhancing bargaining power and reducing market volatility. This method contrasts with individual sale, where single farmers face fluctuating prices and limited negotiation strength, often leading to lower returns despite higher risks.

Peer-to-Peer Sale Fragmentation

Price pooling aggregates produce to stabilize earnings by minimizing price volatility, whereas individual sales in peer-to-peer networks often lead to market fragmentation, reducing collective bargaining power and causing inconsistent revenue streams for farmers. Peer-to-peer sale fragmentation complicates market access and weakens price signals, hindering efficient aggregation and limiting smallholder farmers' ability to compete effectively.

Aggregator Premium Modeling

Price pooling consolidates multiple farmers' produce sales to stabilize prices and maximize collective revenue, while individual sales expose farmers to market volatility but allow for personalized pricing strategies. Aggregator premium modeling leverages pooled data to optimize price premiums by analyzing supply fluctuations, demand patterns, and quality variations across aggregated produce batches.

Price pooling vs Individual sale for produce aggregation Infographic

agridif.com

agridif.com