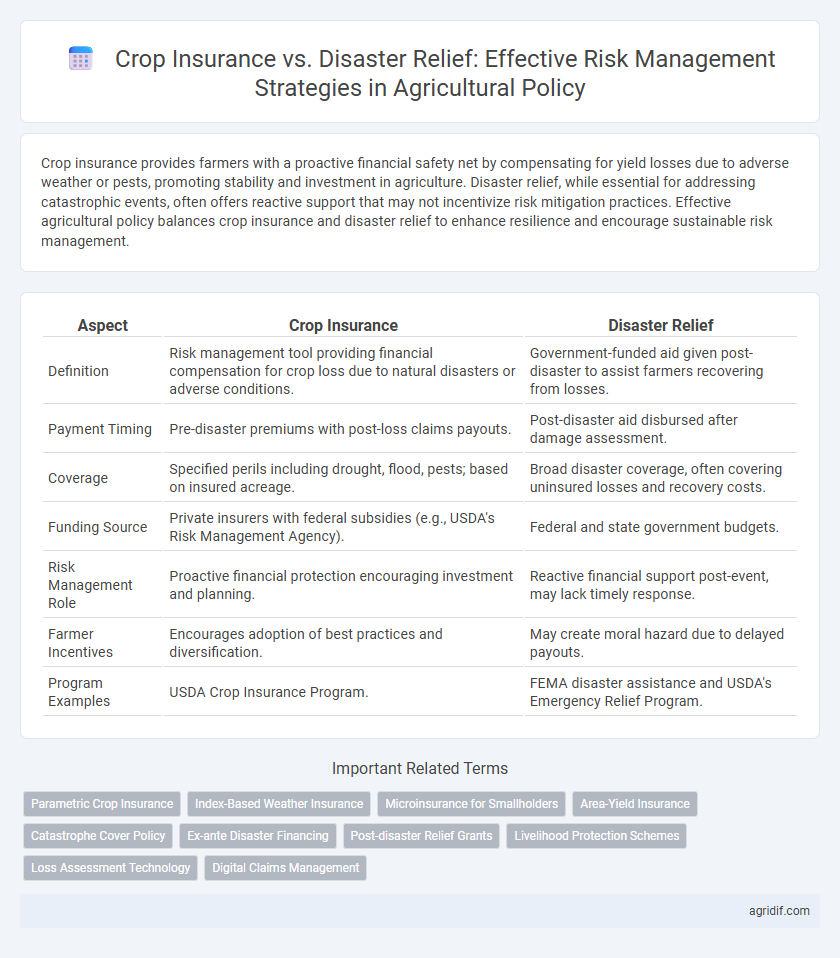

Crop insurance provides farmers with a proactive financial safety net by compensating for yield losses due to adverse weather or pests, promoting stability and investment in agriculture. Disaster relief, while essential for addressing catastrophic events, often offers reactive support that may not incentivize risk mitigation practices. Effective agricultural policy balances crop insurance and disaster relief to enhance resilience and encourage sustainable risk management.

Table of Comparison

| Aspect | Crop Insurance | Disaster Relief |

|---|---|---|

| Definition | Risk management tool providing financial compensation for crop loss due to natural disasters or adverse conditions. | Government-funded aid given post-disaster to assist farmers recovering from losses. |

| Payment Timing | Pre-disaster premiums with post-loss claims payouts. | Post-disaster aid disbursed after damage assessment. |

| Coverage | Specified perils including drought, flood, pests; based on insured acreage. | Broad disaster coverage, often covering uninsured losses and recovery costs. |

| Funding Source | Private insurers with federal subsidies (e.g., USDA's Risk Management Agency). | Federal and state government budgets. |

| Risk Management Role | Proactive financial protection encouraging investment and planning. | Reactive financial support post-event, may lack timely response. |

| Farmer Incentives | Encourages adoption of best practices and diversification. | May create moral hazard due to delayed payouts. |

| Program Examples | USDA Crop Insurance Program. | FEMA disaster assistance and USDA's Emergency Relief Program. |

Comparing Crop Insurance and Disaster Relief in Agricultural Risk Management

Crop insurance provides farmers with a proactive financial safety net by offering premiums-based coverage against specific losses, ensuring timely compensation after adverse weather events or pest outbreaks. Disaster relief programs are reactive, disbursing funds only after significant damage has occurred, often leading to delayed assistance and limited predictability for farmers. Analyzing crop insurance and disaster relief reveals that insurance promotes risk mitigation and fiscal responsibility, while disaster relief serves as an emergency fallback with variable funding and eligibility criteria.

Key Differences Between Crop Insurance and Disaster Relief Programs

Crop insurance provides farmers with pre-established financial protection against crop losses caused by weather events, pests, or disease, offering predictable indemnity based on acreage and yields. Disaster relief programs deliver emergency aid post-event, often funded by government appropriations, focusing on recovery rather than prevention and usually requiring separate application processes. Unlike disaster relief, crop insurance incentivizes risk management and planning through premium payments and risk assessment models integrated into agricultural policy frameworks.

Financial Stability: Crop Insurance vs. Disaster Relief

Crop insurance provides farmers with predictable financial protection by covering losses from yield reductions or price declines, promoting long-term financial stability. Disaster relief offers emergency funds after catastrophic events but lacks the consistency needed for effective risk management and can lead to budget uncertainties. Effective agricultural policies prioritize crop insurance to ensure reliable risk mitigation and sustained economic resilience in farming communities.

Efficiency and Timeliness of Payouts: Crop Insurance Versus Disaster Aid

Crop insurance offers efficient risk management through predetermined premiums and rapid payout mechanisms, ensuring timely financial support immediately after crop loss. Disaster relief programs often involve lengthy administrative processes and ad hoc funding, leading to delayed compensation that may hinder farmers' recovery efforts. Prioritizing crop insurance enhances the timeliness and reliability of payouts, promoting economic stability in agricultural communities.

Government Roles in Crop Insurance and Disaster Relief Policies

Government roles in crop insurance and disaster relief policies are pivotal for agricultural risk management, providing financial stability to farmers against unpredictable losses. Crop insurance programs, often subsidized and regulated by agencies like the USDA's Risk Management Agency, enable proactive risk mitigation by covering yield and revenue shortfalls. Disaster relief policies, administered through federal and state agencies, offer reactive financial assistance post-catastrophe, complementing insurance by addressing immediate recovery needs and supporting long-term resilience.

Impact on Farmer Behavior: Insurance Versus Disaster Support

Crop insurance encourages proactive risk management by providing farmers with financial incentives to invest in higher-yield practices and adopt advanced technologies, leading to increased productivity and sustainability. Disaster relief, often reactive and unpredictable, may reduce farmers' motivation to implement risk mitigation strategies, potentially fostering dependency and delayed recovery efforts. Empirical studies show that insurance schemes lead to more stable income streams, enabling better long-term planning compared to ad hoc disaster aid which primarily addresses immediate losses.

Accessibility and Eligibility: Barriers in Crop Insurance and Disaster Relief

Crop insurance often faces accessibility challenges due to complex eligibility criteria and high premium costs that deter small-scale farmers from participation, limiting its effectiveness as a risk management tool. Disaster relief programs, while more accessible in crisis moments, suffer from delayed disbursements and stringent eligibility requirements that exclude many vulnerable agricultural producers. Enhanced policy measures targeting simplified application processes and expanded eligibility can improve risk management outcomes for diverse farming communities.

Cost-Effectiveness for Agricultural Stakeholders

Crop insurance provides agricultural stakeholders with a cost-effective risk management tool by distributing risk and encouraging proactive loss prevention, often resulting in lower long-term expenses compared to unpredictable disaster relief funding. Disaster relief programs tend to be reactive and can lead to inefficient allocation of resources, creating fiscal uncertainty for farmers and policymakers alike. The consistent structure of crop insurance premiums enables better financial planning and stability for agricultural producers facing environmental risks.

Policy Innovations in Crop Insurance and Disaster Relief

Policy innovations in crop insurance and disaster relief enhance risk management by integrating index-based insurance models with real-time data analytics to provide faster, more accurate payouts. Leveraging satellite imagery and remote sensing technologies improves damage assessment, reducing claim disputes and administrative costs. Hybrid programs combining crop insurance with targeted disaster relief allocate resources efficiently, ensuring financial resilience for farmers affected by climate variability.

Recommendations for Integrating Crop Insurance and Disaster Relief

Integrating crop insurance and disaster relief programs enhances risk management by providing farmers with timely financial support while promoting long-term resilience. Policy recommendations emphasize streamlining application processes, increasing premium subsidies to encourage greater participation, and establishing clear criteria to differentiate between insurance payouts and disaster relief aid. Coordinated efforts between agencies can reduce duplication, improve resource allocation, and foster a more adaptive agricultural safety net.

Related Important Terms

Parametric Crop Insurance

Parametric crop insurance offers a data-driven approach to agricultural risk management by providing payouts based on predefined triggers such as rainfall levels or temperature thresholds, enabling faster compensation compared to traditional disaster relief programs. This method reduces administrative costs and enhances farmers' financial resilience by delivering timely funds linked directly to measurable weather events rather than actual yield losses.

Index-Based Weather Insurance

Index-Based Weather Insurance offers a proactive risk management tool by providing payouts triggered by predefined weather indices such as rainfall or temperature deviations, reducing the administrative burden and moral hazard associated with traditional crop insurance. Unlike disaster relief programs that activate post-loss and often involve lengthy claims processes, index-based insurance delivers timely compensation directly linked to measurable climate events, enhancing financial resilience for farmers in volatile agricultural environments.

Microinsurance for Smallholders

Microinsurance offers smallholder farmers affordable and tailored crop insurance solutions that mitigate financial losses from climate-related risks, enhancing their resilience compared to traditional disaster relief programs. By providing timely payouts and encouraging risk-reducing practices, microinsurance promotes sustainable agricultural productivity and reduces dependency on government aid during adverse events.

Area-Yield Insurance

Area-Yield Insurance provides farmers with compensation based on average regional crop yields rather than individual farm losses, offering more stable and predictable risk management compared to traditional disaster relief programs, which often rely on post-event assessments and can result in delayed aid. By linking payouts to area-wide yield shortfalls, this insurance type incentivizes collective risk reduction and helps stabilize farm incomes against fluctuations caused by adverse weather or pest outbreaks.

Catastrophe Cover Policy

Crop insurance provides farmers with predictable financial protection against yields and revenue losses due to natural disasters, while disaster relief offers ad hoc, often delayed assistance after catastrophic events. Catastrophe Cover Policy, a low-cost crop insurance option, specifically covers severe losses beyond a high deductible threshold, enhancing risk management by offering timely indemnities and reducing dependency on uncertain government disaster aid.

Ex-ante Disaster Financing

Ex-ante disaster financing, including crop insurance schemes, provides farmers with pre-arranged financial resources to mitigate risks, reducing dependence on post-disaster relief funds that often face delays and coverage gaps. Crop insurance enables proactive risk management by offering indemnity payments based on predefined losses, thereby enhancing agricultural resilience and stabilizing income compared to reactive disaster relief programs.

Post-disaster Relief Grants

Post-disaster relief grants provide immediate financial support to farmers after catastrophic events, facilitating quick recovery without the need for prepayment or premium costs inherent in crop insurance. These grants target severe losses and enable targeted assistance, complementing insurance programs by covering gaps that crop insurance may not fully address.

Livelihood Protection Schemes

Livelihood protection schemes in agricultural policy emphasize the importance of crop insurance as a proactive risk management tool, providing farmers with financial stability through indemnity payments for yield or revenue losses. Disaster relief programs serve as reactive measures offering emergency aid post-crisis but lack the preventative financial security that crop insurance delivers to safeguard farmers' income and sustain rural livelihoods.

Loss Assessment Technology

Crop insurance leverages advanced loss assessment technology such as remote sensing, satellite imagery, and drone surveillance to provide precise, timely compensation based on actual crop damage, enhancing risk management efficiency. Disaster relief programs often rely on broader, less frequent assessments that may delay aid distribution and lack the granular data accuracy offered by modern loss assessment tools used in crop insurance schemes.

Digital Claims Management

Crop insurance leverages digital claims management systems to streamline risk assessment, minimize processing times, and enhance claim accuracy, providing farmers with timely and reliable financial support. Disaster relief programs increasingly integrate digital platforms for efficient damage reporting and fund disbursement, yet crop insurance remains more proactive by offering continuous coverage and precise risk mitigation through data-driven analytics.

Crop insurance vs disaster relief for risk management Infographic

agridif.com

agridif.com