Direct payments provide farmers with predictable income support regardless of market fluctuations, ensuring financial stability during uncertain times. Crop insurance offers protection against specific risks such as weather-related crop failures, helping farmers manage agricultural hazards more effectively. Balancing these tools allows policymakers to enhance income security while promoting risk management for sustainable farm operations.

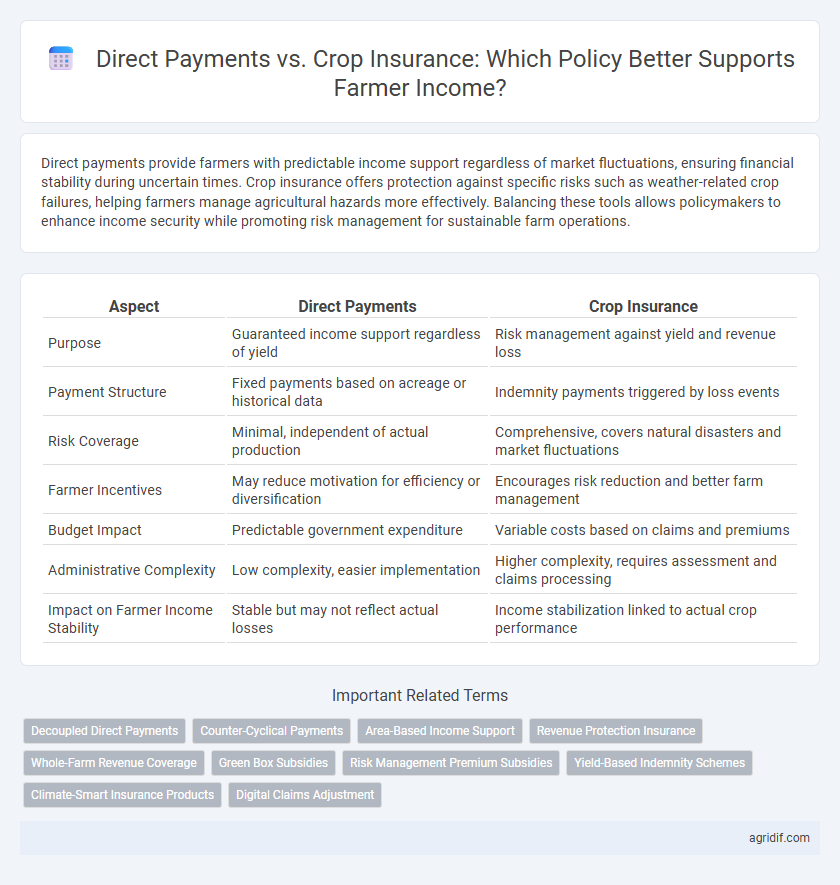

Table of Comparison

| Aspect | Direct Payments | Crop Insurance |

|---|---|---|

| Purpose | Guaranteed income support regardless of yield | Risk management against yield and revenue loss |

| Payment Structure | Fixed payments based on acreage or historical data | Indemnity payments triggered by loss events |

| Risk Coverage | Minimal, independent of actual production | Comprehensive, covers natural disasters and market fluctuations |

| Farmer Incentives | May reduce motivation for efficiency or diversification | Encourages risk reduction and better farm management |

| Budget Impact | Predictable government expenditure | Variable costs based on claims and premiums |

| Administrative Complexity | Low complexity, easier implementation | Higher complexity, requires assessment and claims processing |

| Impact on Farmer Income Stability | Stable but may not reflect actual losses | Income stabilization linked to actual crop performance |

Understanding Direct Payments in Agricultural Policy

Direct payments in agricultural policy provide farmers with fixed income support based on historical acreage or yields, stabilizing farm revenue regardless of market fluctuations or crop loss. These payments enhance predictability for farmers by reducing income volatility without tying compensation to actual production risks. Unlike crop insurance, which compensates for specific losses due to adverse events, direct payments offer a consistent financial safety net, promoting farm stability and investment planning.

The Role of Crop Insurance in Farmer Income Stability

Crop insurance plays a critical role in stabilizing farmer income by providing financial protection against unpredictable losses due to natural disasters, pests, or adverse weather conditions. Unlike direct payments that offer fixed subsidies regardless of yield outcomes, crop insurance aligns payouts with actual crop performance, mitigating risk through indemnity payments that cover shortfalls. This risk transfer mechanism encourages investment and sustainable farming practices by reducing income volatility and enhancing creditworthiness for agricultural producers.

Direct Payments: Advantages and Drawbacks

Direct payments provide farmers with a stable and predictable source of income, helping to mitigate market volatility and support farm viability during adverse conditions. These payments often target specific commodities and can be designed to incentivize sustainable practices, but they may contribute to market distortion and favor larger agribusinesses over small-scale farmers. While direct payments ensure short-term financial security, they risk reducing farmers' incentives to innovate or diversify, potentially affecting long-term agricultural resilience.

Crop Insurance: Benefits and Limitations

Crop insurance provides farmers with a risk management tool that compensates for losses due to natural disasters or market fluctuations, stabilizing farm income and promoting financial resilience. This mechanism encourages continued investment in agricultural production by mitigating the impact of unpredictable events such as droughts, floods, or pest outbreaks. However, limitations include potential moral hazard, high premium costs, and unequal access for small-scale or marginalized farmers, which can affect overall program effectiveness and equity.

Comparing Financial Security: Direct Payments vs Crop Insurance

Direct payments provide farmers with predictable and stable income by offering fixed financial support regardless of yield fluctuations or market changes. Crop insurance delivers risk-based protection, reimbursing losses only when adverse events reduce production or prices, creating variable income security tied to specific risks. Comparing financial security, direct payments ensure consistent cash flow while crop insurance offers targeted recovery, making their effectiveness dependent on individual risk exposure and farm management strategies.

Impact on Farm Management Decisions

Direct payments provide predictable income stability, allowing farmers to plan long-term investments and adopt sustainable practices with reduced financial risk. Crop insurance offers protection against yield losses and price fluctuations, influencing farmers to take calculated risks and adjust cropping patterns based on market demand and weather forecasts. The choice between these supports significantly shapes farm management decisions, balancing security with flexibility in operational strategies.

Government Spending and Budget Efficiency

Direct payments provide fixed income support to farmers regardless of production levels, often leading to budget inefficiencies and limited incentives for risk management. Crop insurance, funded through government subsidies, allocates resources more dynamically by compensating losses based on actual yield or revenue shortfalls, enhancing budgetary efficiency. Studies indicate that insurance mechanisms better target funds to farmers facing genuine financial risks, promoting more sustainable government spending in agricultural policy.

Influence on Crop Choices and Land Use

Direct Payments provide farmers with guaranteed income regardless of crop performance, encouraging the cultivation of traditional or high-demand crops without significant risk considerations. Crop Insurance promotes risk management by compensating for yield or revenue losses, influencing farmers to diversify crop choices and adopt resilient land-use practices to minimize potential claims. The interaction between these mechanisms shapes planting decisions and land allocation, impacting overall agricultural sustainability and economic stability.

Risk Mitigation Strategies for Farmers

Direct payments provide farmers with guaranteed income support regardless of yield fluctuations, ensuring financial stability during adverse conditions. Crop insurance transfers the risk of crop failure to insurers, allowing farmers to recover losses based on actual production shortfalls. Combining both strategies enhances risk mitigation by securing baseline income while protecting against variable yield and price risks in agricultural production.

Policy Recommendations for Sustainable Farmer Income

Direct payments ensure predictable income support for farmers, stabilizing earnings amid volatile markets, while crop insurance mitigates risks from adverse weather and price fluctuations by compensating losses. Policy recommendations emphasize integrating direct payments with subsidized crop insurance programs to balance income stability and risk management, promoting long-term sustainability. Enhancing targeted support for small and medium-sized farms through adaptive schemes can improve resilience and encourage sustainable agricultural practices.

Related Important Terms

Decoupled Direct Payments

Decoupled direct payments provide farmers with fixed income support independent of current production levels, stabilizing revenue without influencing planting decisions. Crop insurance, by contrast, offers risk management protection tied to yield losses and price fluctuations, directly mitigating income variability from adverse agricultural conditions.

Counter-Cyclical Payments

Counter-cyclical payments provide farmers with income support when market prices fall below a predetermined target, offering a safety net that complements crop insurance by stabilizing revenue during periods of low commodity prices. Unlike crop insurance, which indemnifies against yield losses due to adverse events, counter-cyclical payments specifically address price volatility, helping to maintain farm income and encourage consistent agricultural production.

Area-Based Income Support

Area-based direct payments provide farmers with predictable income support by distributing funds according to land area, ensuring stability regardless of yield fluctuations. Crop insurance compensates for losses due to adverse conditions but often involves complex claims processes and variable payouts, making direct payments a more reliable mechanism for income support in many agricultural policies.

Revenue Protection Insurance

Revenue Protection Insurance offers farmers a risk management tool by guaranteeing income based on projected revenue rather than solely on yield, providing more comprehensive coverage against price volatility and production loss compared to traditional Direct Payments. This insurance aligns more closely with actual market conditions, enhancing financial stability and encouraging sustainable agricultural practices.

Whole-Farm Revenue Coverage

Whole-Farm Revenue Protection (WFRP) offers comprehensive income risk management by covering all sources of farm revenue rather than individual crops, contrasting with traditional direct payments that provide fixed subsidies irrespective of market fluctuations. WFRP enhances financial stability for diversified farms by aligning compensation with actual revenue losses, thereby promoting adaptive farm management and resilience against adverse weather or market conditions.

Green Box Subsidies

Green Box subsidies under Agricultural Policy provide direct payments to farmers that are decoupled from production levels, promoting environmental sustainability without distorting market prices. Crop insurance, while offering risk management by compensating for yield losses, often leads to market distortions and higher government expenditures compared to the non-trade distorting Green Box support.

Risk Management Premium Subsidies

Risk management premium subsidies for crop insurance provide farmers with targeted financial protection against yield losses, offering a more flexible and risk-specific alternative compared to direct payments that often distribute fixed sums regardless of actual production risks. These subsidies enhance farmer income stability by reducing the cost of insurance premiums, thereby incentivizing the adoption of risk mitigation strategies aligned with fluctuating market and climatic conditions.

Yield-Based Indemnity Schemes

Yield-based indemnity schemes under crop insurance provide farmers with compensation tied directly to crop yield losses, offering a targeted safety net that reacts to actual production declines. In contrast, direct payments deliver fixed income support regardless of yield outcomes, potentially lacking the responsiveness to address specific yield shortfalls caused by adverse weather or pests.

Climate-Smart Insurance Products

Climate-smart insurance products, designed to mitigate climate risks, provide farmers with more resilient income support by compensating for extreme weather events and yield losses, making them a dynamic alternative to traditional direct payments. These insurance schemes leverage advanced climate data and remote sensing technology to tailor coverage, enhancing financial stability for farmers facing increasing climate variability.

Digital Claims Adjustment

Digital claims adjustment in crop insurance streamlines the verification process, reducing payout delays and enhancing financial stability for farmers. Direct payments offer predictable income support but lack the tailored risk management benefits provided by technology-driven insurance claims.

Direct Payments vs Crop Insurance for Farmer Income Infographic

agridif.com

agridif.com