Direct payments provide farmers with a guaranteed income, stabilizing cash flow regardless of yield or market fluctuations. Crop insurance offers targeted risk management by compensating for specific losses due to weather, pests, or price drops. Balancing direct payments and crop insurance enhances resilience by combining income support with protection against unpredictable agricultural risks.

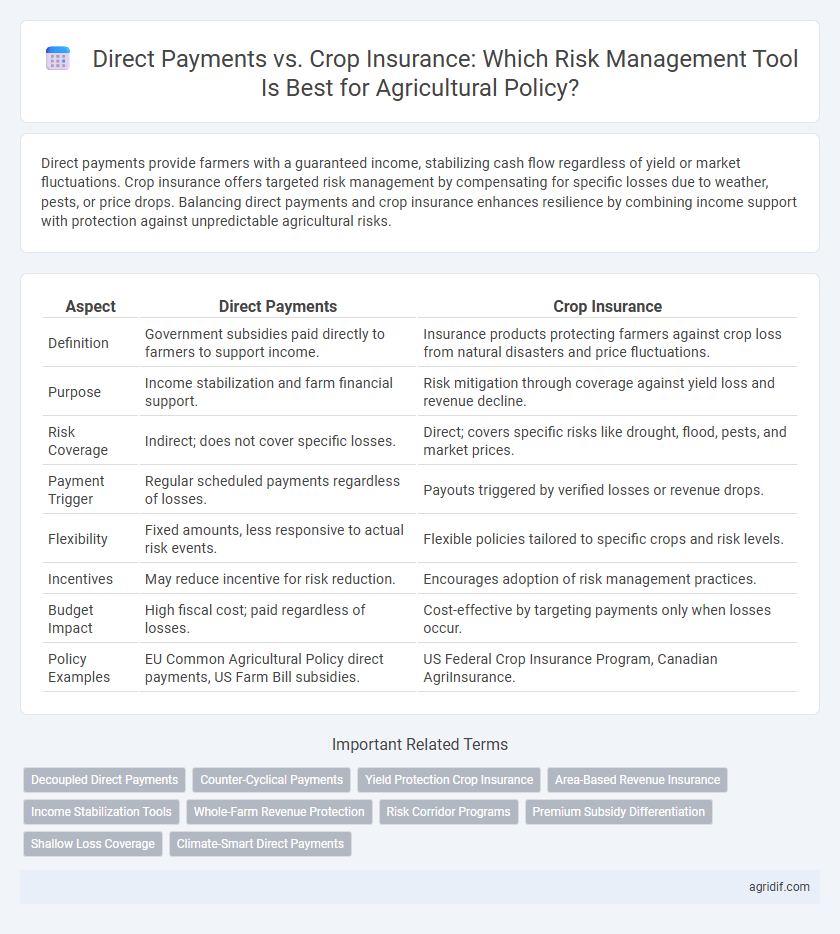

Table of Comparison

| Aspect | Direct Payments | Crop Insurance |

|---|---|---|

| Definition | Government subsidies paid directly to farmers to support income. | Insurance products protecting farmers against crop loss from natural disasters and price fluctuations. |

| Purpose | Income stabilization and farm financial support. | Risk mitigation through coverage against yield loss and revenue decline. |

| Risk Coverage | Indirect; does not cover specific losses. | Direct; covers specific risks like drought, flood, pests, and market prices. |

| Payment Trigger | Regular scheduled payments regardless of losses. | Payouts triggered by verified losses or revenue drops. |

| Flexibility | Fixed amounts, less responsive to actual risk events. | Flexible policies tailored to specific crops and risk levels. |

| Incentives | May reduce incentive for risk reduction. | Encourages adoption of risk management practices. |

| Budget Impact | High fiscal cost; paid regardless of losses. | Cost-effective by targeting payments only when losses occur. |

| Policy Examples | EU Common Agricultural Policy direct payments, US Farm Bill subsidies. | US Federal Crop Insurance Program, Canadian AgriInsurance. |

Understanding Agricultural Risk Management Strategies

Direct payments provide farmers with fixed subsidies regardless of yield fluctuations, offering predictable income but limited responsiveness to actual risks. Crop insurance compensates for specific losses caused by adverse events such as drought, pests, or price drops, aligning payouts more closely with risk exposure. Effective agricultural risk management often combines these tools to balance income stability and risk mitigation, optimizing farm resilience against market and environmental uncertainties.

Overview of Direct Payments in Agriculture

Direct payments in agriculture provide farmers with fixed financial support to stabilize income and reduce market volatility impact. These payments are based on historical acreage or yields rather than current production, offering a predictable revenue stream regardless of weather or market fluctuations. Unlike crop insurance, direct payments do not require farmers to demonstrate losses, simplifying risk management but offering less targeted protection against specific disasters.

Fundamentals of Crop Insurance Programs

Crop insurance programs provide a foundational risk management tool by offering financial protection against yield losses and revenue declines caused by natural disasters and price fluctuations. Unlike direct payments, which provide fixed subsidies regardless of individual risk exposure, crop insurance aligns indemnities with actual losses, promoting more efficient risk mitigation. Key components include multi-peril coverage, government-subsidized premiums, and indemnity calculations based on historical yield data and market prices.

Comparing Risk Reduction: Direct Payments vs Crop Insurance

Direct payments provide predictable income support regardless of yield fluctuations, offering limited risk reduction against adverse weather or market volatility. Crop insurance directly mitigates financial losses by compensating farmers for actual yield or revenue shortfalls, aligning payouts with specific risk events. Empirical studies indicate crop insurance more effectively stabilizes farm income under variable conditions, whereas direct payments function primarily as baseline income support.

Financial Impacts on Farmers: Which Policy Delivers More Stability?

Direct payments provide farmers with predictable income by offering fixed subsidies regardless of yield fluctuations, ensuring baseline financial stability during adverse conditions. Crop insurance mitigates risks by compensating for actual losses, but premiums and claim processes can introduce uncertainty in cash flow. Evaluating financial impacts reveals that while direct payments deliver consistent stability, crop insurance offers tailored risk coverage, making the optimal choice dependent on individual farm risk profiles and market volatility.

Incentives and Farmer Behavior: Direct Payments versus Insurance

Direct payments provide guaranteed income support regardless of production outcomes, which may reduce farmers' incentives to adopt risk-reducing practices or invest in resilient technologies. In contrast, crop insurance aligns incentives by compensating losses only when adverse events occur, encouraging farmers to engage in improved risk management and crop diversification strategies. Empirical studies indicate that insurance programs promote more adaptive behavior, whereas direct payments can inadvertently lead to moral hazard and overproduction.

Policy Costs: Government Expenditure and Efficiency

Direct payments in agricultural policy often lead to higher government expenditure with limited risk targeting, whereas crop insurance programs allocate funds more efficiently by directly compensating for production losses. Crop insurance reduces moral hazard by linking payments to actual yield reductions, enhancing policy efficiency and minimizing fiscal waste. Consequently, prioritizing crop insurance over direct payments can optimize government spending and improve risk management outcomes in agriculture.

International Approaches to Agricultural Support

International agricultural policies balance direct payments and crop insurance to enhance risk management for farmers. Direct payments provide predictable income support, stabilizing farm revenue amid market volatility, while crop insurance mitigates specific risks from adverse weather and pest outbreaks. Countries like the United States emphasize subsidized crop insurance programs, whereas the European Union favors coupled direct payments under the Common Agricultural Policy, reflecting diverse strategies tailored to regional agricultural risk profiles.

Long-term Sustainability of Risk Management Tools

Direct payments provide immediate financial stability but may discourage adaptive risk management practices, undermining long-term agricultural resilience. Crop insurance incentivizes farmers to engage in proactive risk reduction measures, fostering sustainable risk mitigation strategies over time. Sustainable agricultural policy balances both tools to enhance farmers' ability to withstand climate variability and market fluctuations while promoting environmental stewardship.

Policy Recommendations for Future Agricultural Risk Management

Policy recommendations for future agricultural risk management emphasize a balanced integration of direct payments and crop insurance to enhance farm income stability and promote sustainable farming practices. Direct payments provide immediate financial support, while crop insurance incentivizes risk mitigation through diversified coverage and premium subsidies, reducing reliance on ad hoc disaster aid. A policy framework prioritizing data-driven risk assessment, enhanced coverage options, and targeted support for vulnerable crops can optimize resource allocation and strengthen resilience against climate variability and market fluctuations.

Related Important Terms

Decoupled Direct Payments

Decoupled direct payments provide stable income support to farmers without linking payments to current crop production or prices, reducing market distortion while supporting farm revenue. Crop insurance, by contrast, offers risk management protection directly tied to yield or revenue losses, but may lead to moral hazard and higher government expenditures compared to decoupled payments.

Counter-Cyclical Payments

Counter-cyclical payments provide targeted income support when crop prices fall below a predetermined target, offering farmers risk mitigation against market volatility without the need for premium payments associated with crop insurance. Unlike direct payments, which are fixed regardless of market conditions, counter-cyclical payments adjust with commodity prices, enhancing financial stability and incentivizing continued production during price downturns.

Yield Protection Crop Insurance

Yield Protection Crop Insurance offers targeted risk mitigation by compensating farmers for revenue losses caused by declining crop yields due to natural disasters, providing a flexible alternative to direct payments that are often fixed and less responsive to actual production variability. This insurance mechanism incentivizes improved farm management and resilience, aligning risk management more closely with real-time agricultural conditions compared to the static nature of traditional direct payment programs.

Area-Based Revenue Insurance

Area-Based Revenue Insurance offers farmers risk management by linking compensation to regional yield and revenue indices, reducing individual acreage reporting complexities unlike traditional direct payments. This insurance approach incentivizes productivity while providing tailored protection against regional weather and market fluctuations, enhancing financial stability within agricultural policy frameworks.

Income Stabilization Tools

Direct payments provide predictable income support by offering fixed subsidies regardless of market fluctuations, ensuring baseline farm revenue. Crop insurance mitigates financial losses from yield or price volatility by reimbursing farmers based on actual damages, enhancing risk management through reactive compensation.

Whole-Farm Revenue Protection

Whole-Farm Revenue Protection (WFRP) offers comprehensive risk management by insuring total farm revenue, providing broader coverage compared to traditional direct payments that often target specific commodities. WFRP mitigates income variability across diverse agricultural enterprises, complementing or substituting for direct payments and conventional crop insurance policies by addressing whole-farm financial stability.

Risk Corridor Programs

Direct payments provide fixed income support regardless of yield fluctuations, whereas risk corridor programs under crop insurance limit overall losses by sharing risk between farmers and insurers, enhancing financial stability during adverse conditions. Risk corridor programs effectively reduce premium volatility, allowing producers to manage severe losses while promoting crop diversification and sustainable agricultural practices.

Premium Subsidy Differentiation

Direct payments provide fixed income support regardless of production risk, while crop insurance offers tailored risk management with premium subsidies adjusted based on coverage level and crop risk profile. Differentiation in premium subsidies incentivizes farmers to adopt higher coverage levels, enhancing resilience to yield variability and adverse weather events within agricultural policy frameworks.

Shallow Loss Coverage

Shallow Loss Coverage compensates farmers for moderate yield or revenue declines, bridging gaps left by traditional crop insurance by covering losses below catastrophic thresholds. Direct payments provide fixed income support but lack responsiveness to actual crop performance, making Shallow Loss Coverage a targeted risk management tool that enhances financial resilience for small to mid-sized farms.

Climate-Smart Direct Payments

Climate-Smart Direct Payments offer targeted financial support to farmers adopting sustainable practices that enhance resilience to climate variability, contrasting with traditional crop insurance that primarily compensates for yield losses post-event. By incentivizing proactive risk management through carbon sequestration, soil health improvement, and water conservation, these payments align agricultural policy with long-term environmental and economic sustainability goals.

Direct payments vs crop insurance for risk management Infographic

agridif.com

agridif.com