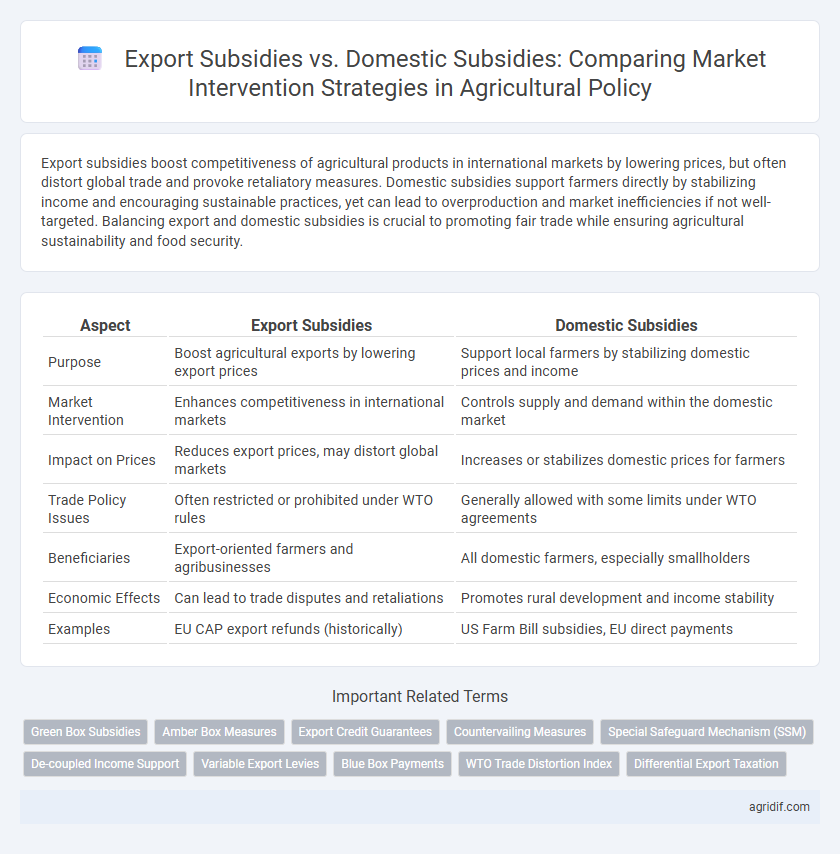

Export subsidies boost competitiveness of agricultural products in international markets by lowering prices, but often distort global trade and provoke retaliatory measures. Domestic subsidies support farmers directly by stabilizing income and encouraging sustainable practices, yet can lead to overproduction and market inefficiencies if not well-targeted. Balancing export and domestic subsidies is crucial to promoting fair trade while ensuring agricultural sustainability and food security.

Table of Comparison

| Aspect | Export Subsidies | Domestic Subsidies |

|---|---|---|

| Purpose | Boost agricultural exports by lowering export prices | Support local farmers by stabilizing domestic prices and income |

| Market Intervention | Enhances competitiveness in international markets | Controls supply and demand within the domestic market |

| Impact on Prices | Reduces export prices, may distort global markets | Increases or stabilizes domestic prices for farmers |

| Trade Policy Issues | Often restricted or prohibited under WTO rules | Generally allowed with some limits under WTO agreements |

| Beneficiaries | Export-oriented farmers and agribusinesses | All domestic farmers, especially smallholders |

| Economic Effects | Can lead to trade disputes and retaliations | Promotes rural development and income stability |

| Examples | EU CAP export refunds (historically) | US Farm Bill subsidies, EU direct payments |

Understanding Export Subsidies in Agricultural Policy

Export subsidies in agricultural policy are government financial supports aimed at reducing export prices to enhance competitiveness in global markets, often leading to trade distortions and international disputes. Unlike domestic subsidies, which primarily support internal production and stabilize farmer incomes, export subsidies directly influence trade flows by making agricultural products artificially cheaper abroad. Understanding the complexities of export subsidies is crucial for assessing their impact on global trade equity, market efficiency, and compliance with World Trade Organization (WTO) agreements.

The Role of Domestic Subsidies in Supporting Farmers

Domestic subsidies play a crucial role in stabilizing farmers' incomes by directly supporting production costs and mitigating market risks, enhancing agricultural sustainability. Unlike export subsidies that primarily encourage international competitiveness, domestic subsidies focus on ensuring food security and rural development within the country. These interventions help maintain stable supply chains and protect farmers from volatile global commodity prices, fostering long-term agricultural investment.

Comparative Effectiveness of Export vs Domestic Subsidies

Export subsidies directly reduce the international price of agricultural goods, enhancing competitiveness in global markets but often triggering trade disputes and retaliations. Domestic subsidies support farmers through income stabilization and input cost reduction without directly affecting world prices, preserving market stability within the country. Comparative studies indicate that while export subsidies boost short-term market share abroad, domestic subsidies provide more sustainable support by fostering long-term agricultural productivity and rural development.

Impact on Global Agricultural Trade Dynamics

Export subsidies distort global agricultural trade by artificially lowering prices, leading to trade imbalances and retaliatory measures from competing countries. Domestic subsidies, while supporting local farmers, can also shift production patterns and affect export competitiveness but tend to have a less direct impact on international market prices. The World Trade Organization regulations aim to limit export subsidies to promote fair competition, whereas domestic support is often subjected to stricter monitoring to prevent market distortions.

WTO Regulations on Agricultural Subsidies

WTO regulations impose stricter limits on export subsidies compared to domestic subsidies to prevent market distortion and promote fair trade in agriculture. Export subsidies are largely prohibited under the Agreement on Agriculture to reduce trade barriers and avoid undermining global market prices. Domestic subsidies are categorized into Amber, Blue, and Green Boxes, with Green Box subsidies allowed without limits as long as they cause minimal trade distortion.

Market Distortion: Export Subsidies vs Domestic Support

Export subsidies often lead to significant market distortion by artificially lowering prices of agricultural products in global markets, disadvantaging producers in countries without such support. Domestic subsidies, while also influencing production and consumption patterns, typically have a more limited impact on international trade competitiveness and global price signals. The World Trade Organization considers export subsidies more trade-distorting compared to domestic support measures under the Agreement on Agriculture due to their direct effect on international market dynamics.

Economic and Social Implications for Rural Communities

Export subsidies can distort global markets by artificially lowering prices, disadvantaging farmers in developing countries and leading to trade disputes. Domestic subsidies aimed at supporting rural communities help stabilize farm income, encourage sustainable agricultural practices, and promote local economic development. However, over-reliance on domestic support may create market inefficiencies and reduce competitiveness, impacting long-term economic resilience in rural areas.

Case Studies: Country Approaches to Subsidy Use

Export subsidies often distort international markets by artificially lowering prices, as seen in the European Union's Common Agricultural Policy reforms that gradually reduced such subsidies to comply with WTO rules. In contrast, domestic subsidies, like the United States' direct payments to farmers, aim to stabilize income and support rural development without directly influencing export competitiveness. Case studies from Brazil highlight how shifting from export subsidies to targeted domestic programs enhanced agricultural sustainability and market efficiency.

Sustainability Concerns in Subsidy-led Market Intervention

Export subsidies often distort international markets by encouraging overproduction and promoting unsustainable farming practices, which exacerbate environmental degradation and resource depletion. Domestic subsidies, when targeted towards sustainable agriculture such as agroecology, conservation farming, and renewable inputs, can incentivize farmers to adopt practices that enhance soil health and biodiversity. Prioritizing subsidies that support sustainable production methods reduces negative environmental impacts while improving long-term food security and rural livelihoods.

Policy Recommendations for Balanced Agricultural Markets

Export subsidies often distort international trade by artificially lowering prices, leading to retaliatory measures and market imbalances, while domestic subsidies directly support farmers without significantly impacting global trade dynamics. Policy recommendations emphasize shifting from export subsidies to targeted domestic support that promotes sustainable production, rural development, and market stability. Implementing transparent subsidy frameworks aligned with World Trade Organization (WTO) guidelines can enhance fair competition and ensure balanced agricultural markets.

Related Important Terms

Green Box Subsidies

Green Box subsidies under the WTO framework support agricultural market intervention by promoting environmentally sustainable practices without distorting trade or production, contrasting with export subsidies that often lead to market distortions and trade disputes. These subsidies help stabilize farm incomes and encourage eco-friendly farming techniques while complying with international trade rules, unlike domestic subsidies linked directly to production levels or price supports.

Amber Box Measures

Amber Box measures, classified by the WTO, include export and domestic subsidies that distort agricultural markets, with export subsidies directly affecting international trade by lowering prices abroad, while domestic subsidies primarily support internal production but can indirectly influence export competitiveness. Export subsidies are subject to stricter reduction commitments under the Uruguay Round Agreement due to their greater trade-distorting effects compared to domestic subsidies, which are often designed as market price support and production-linked payments within Amber Box constraints.

Export Credit Guarantees

Export Credit Guarantees serve as a vital export subsidy in agricultural policy by reducing the financial risk for exporters, thereby enhancing market access and competitiveness in international trade. Unlike domestic subsidies that support local producers through direct payments or price controls, Export Credit Guarantees specifically promote agricultural exports by securing credit and mitigating payment defaults from foreign buyers.

Countervailing Measures

Export subsidies distort global agricultural trade by artificially lowering prices, prompting affected countries to implement countervailing measures such as tariffs or quotas to protect domestic producers from unfair competition. Domestic subsidies promote local market stability without directly impacting international prices, making them less likely to trigger countervailing duties under World Trade Organization (WTO) rules.

Special Safeguard Mechanism (SSM)

Export subsidies distort international markets by artificially lowering prices, while domestic subsidies primarily aim to stabilize local farm incomes and production. The Special Safeguard Mechanism (SSM) allows developing countries to impose additional tariffs temporarily to protect domestic agriculture from import surges and price drops, balancing market intervention without resorting to export subsidies.

De-coupled Income Support

De-coupled income support, as a form of domestic subsidy, provides farmers with direct payments independent of production levels, minimizing market distortions compared to export subsidies that directly influence international prices and trade flows. This approach aligns with World Trade Organization commitments by reducing trade distortions while ensuring stable farmer income and preserving agricultural sustainability.

Variable Export Levies

Variable export levies, as a form of export subsidies, fluctuate based on international market prices to protect domestic agricultural producers by adjusting export costs and maintaining competitive pricing. Unlike fixed domestic subsidies, these levies respond dynamically to global price signals, helping stabilize farm incomes while influencing trade balances and market intervention policies.

Blue Box Payments

Export subsidies distort international markets by artificially lowering prices and prompting trade disputes, whereas domestic subsidies, including Blue Box Payments, aim to support farmers while complying with World Trade Organization rules by linking payments to production-limiting practices. Blue Box Payments serve as a middle ground in agricultural policy, allowing market intervention without encouraging overproduction or violating trade agreements.

WTO Trade Distortion Index

Export subsidies significantly increase the WTO Trade Distortion Index by artificially lowering prices and encouraging excess production for foreign markets, leading to greater market imbalances. In contrast, domestic subsidies tend to have a lower distortion impact as they primarily support internal production without directly influencing international trade prices.

Differential Export Taxation

Differential export taxation in agricultural policy influences market intervention by imposing varied tax rates on exported commodities, which contrasts with uniform domestic subsidies aimed at stabilizing internal prices and supporting farmers' incomes. This targeted taxation can discourage exports of specific products to protect local supply or adjust trade balances, while domestic subsidies primarily sustain production levels and market stability within the country.

Export subsidies vs domestic subsidies for market intervention Infographic

agridif.com

agridif.com