The quota system limits the quantity of agricultural imports, directly controlling market supply and stabilizing domestic prices but potentially causing shortages and higher costs for consumers. The tariff system imposes taxes on imported goods, allowing more flexible import levels while generating government revenue and protecting domestic producers by making imports more expensive. Both systems aim to shield local farmers, yet tariffs provide market-driven price adjustments, whereas quotas enforce absolute import limits.

Table of Comparison

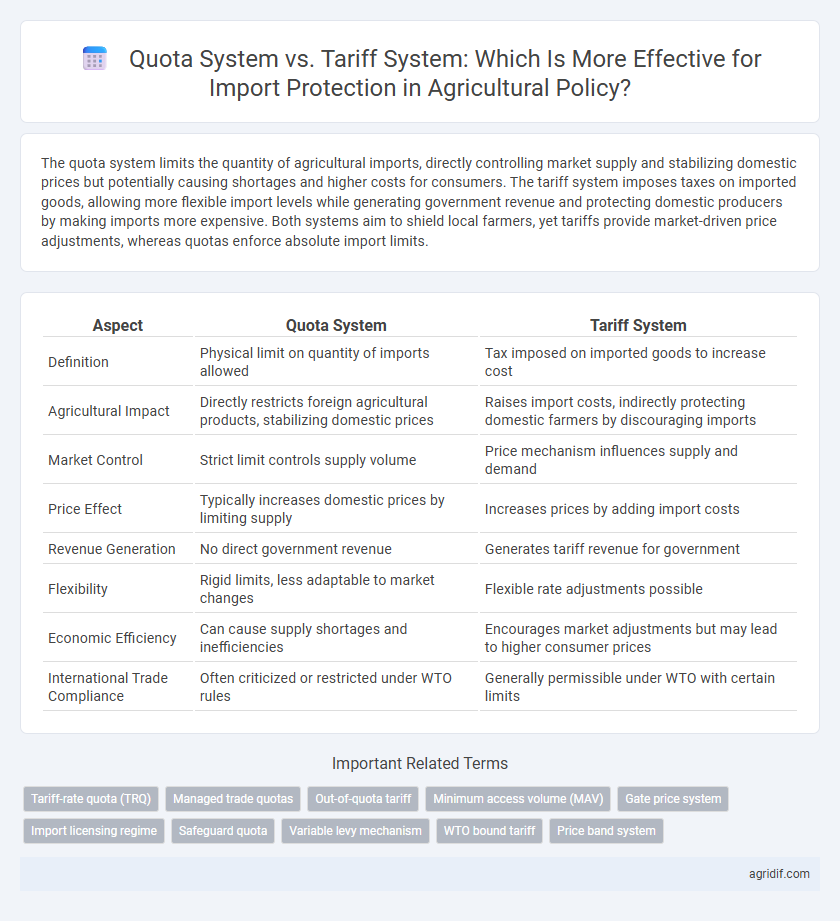

| Aspect | Quota System | Tariff System |

|---|---|---|

| Definition | Physical limit on quantity of imports allowed | Tax imposed on imported goods to increase cost |

| Agricultural Impact | Directly restricts foreign agricultural products, stabilizing domestic prices | Raises import costs, indirectly protecting domestic farmers by discouraging imports |

| Market Control | Strict limit controls supply volume | Price mechanism influences supply and demand |

| Price Effect | Typically increases domestic prices by limiting supply | Increases prices by adding import costs |

| Revenue Generation | No direct government revenue | Generates tariff revenue for government |

| Flexibility | Rigid limits, less adaptable to market changes | Flexible rate adjustments possible |

| Economic Efficiency | Can cause supply shortages and inefficiencies | Encourages market adjustments but may lead to higher consumer prices |

| International Trade Compliance | Often criticized or restricted under WTO rules | Generally permissible under WTO with certain limits |

Understanding Agricultural Import Protection

The quota system limits the quantity of agricultural imports, directly restricting market supply to protect domestic producers, often leading to higher domestic prices and potential shortages. The tariff system imposes a tax on imported agricultural goods, raising their prices and making local products more competitive without capping import volumes. Understanding these systems is crucial for evaluating their impact on domestic markets, trade relationships, and food security within agricultural policy frameworks.

Overview of Quota Systems in Agriculture

Quota systems in agriculture impose a strict quantitative limit on the volume of imported agricultural products, directly restricting market supply to protect domestic producers. These limits help stabilize domestic prices and shield local farmers from foreign competition but can lead to supply shortages and increased prices for consumers. Unlike tariff systems that tax imports, quotas enforce absolute import ceilings, making them a more rigid form of trade protection in agricultural markets.

Key Features of Tariff Systems

Tariff systems impose a specific tax on imported goods, raising their market price to protect domestic agriculture by reducing foreign competition. Unlike quota systems that limit quantity, tariffs generate government revenue and allow imports to fluctuate with market demand while maintaining competitive pressure on local producers. Key features include price adjustment based on tax rates, revenue generation, and flexibility in trade volume, making tariffs a preferred tool for managing agricultural import protection.

Economic Impacts of Quotas vs Tariffs

Quota systems restrict the quantity of agricultural imports, leading to supply limitations and potential price inflation in domestic markets, which can reduce consumer welfare and create inefficiencies. Tariff systems impose taxes on imports, generating government revenue while allowing market adjustments that typically result in less severe supply distortions and more predictable price effects. Compared to tariffs, quotas create greater market uncertainty and higher risks of rent-seeking behavior by importers, often causing larger economic deadweight losses and trade tensions.

Effects on Domestic Agricultural Producers

Quota systems restrict the quantity of imported agricultural goods, directly limiting competition and often leading to higher domestic prices and increased producer revenues. Tariff systems impose taxes on imports, which raise prices for foreign products but allow for flexible market adjustments without fixed limits on volume. Domestic producers benefit from quotas through predictable market shares, whereas tariffs provide protective price advantages while encouraging some level of import competition.

Consumer Implications: Quotas versus Tariffs

Quotas restrict the quantity of agricultural imports, often leading to higher consumer prices and limited product availability, causing potential welfare losses due to reduced choice and supply. Tariffs impose a tax on imported goods, which increases prices but allows consumers access to a broader range of products, enabling more flexibility in purchasing decisions. Both systems protect domestic producers but tariffs generally offer more predictable market signals and less distortion in consumer welfare compared to quotas.

Trade Relations and WTO Compliance

Quota systems impose quantitative limits on agricultural imports, often leading to trade distortions and challenges in WTO compliance due to their restrictive nature. Tariff systems, by applying specific import taxes, provide more transparent and flexible protection, aligning better with WTO rules and facilitating smoother trade relations. The WTO favors tariff bindings over quotas as tariffs are less trade-distorting and allow member countries to maintain predictability in agricultural market access.

Administrative Challenges of Quotas and Tariffs

Quota systems impose strict limits on import quantities, often requiring extensive government monitoring and enforcement, which can lead to high administrative costs and potential corruption. Tariff systems generate revenue and are easier to adjust but demand robust customs infrastructure to accurately assess and collect duties, complicating border operations. Both methods face challenges in transparency and efficiency, with quotas risking market distortions and tariffs necessitating detailed valuation processes to prevent evasion.

Case Studies: Quota and Tariff Policies in Action

Quota systems restrict the quantity of agricultural imports, effectively controlling supply and stabilizing domestic prices, as demonstrated by New Zealand's dairy sector where strict quotas have preserved local farm incomes. Tariff systems impose taxes on imported goods, making foreign products more expensive and less competitive, exemplified by the United States' corn tariffs that protect domestic producers while generating government revenue. Case studies reveal that quota policies provide direct quantity control but may lead to supply shortages, whereas tariffs offer flexible protection but can provoke trade disputes and price volatility.

Policy Recommendations for Sustainable Import Protection

Implementing a quota system restricts the volume of agricultural imports, directly limiting foreign competition but may lead to supply shortages and higher prices. Tariff systems impose taxes on imports, encouraging domestic production while generating government revenue that can fund agricultural innovation and sustainability programs. A hybrid approach combining moderate tariffs with flexible quotas can balance market stability, protect local farmers, and promote sustainable agricultural development through targeted policy incentives.

Related Important Terms

Tariff-rate quota (TRQ)

Tariff-rate quota (TRQ) combines tariff and quota systems by allowing a specified quantity of agricultural imports at a lower tariff rate, while quantities exceeding the quota face higher tariffs, effectively balancing market protection with import flexibility. TRQs enable governments to protect domestic producers from excessive foreign competition while ensuring stable supply and price levels in the agricultural sector.

Managed trade quotas

Managed trade quotas in agricultural policy restrict import volumes to stabilize domestic markets and protect local producers from price volatility and foreign competition. Unlike tariffs that impose a tax on imports, quota systems set explicit limits on quantity, providing more predictable market access control and potentially fostering negotiated trade agreements.

Out-of-quota tariff

Out-of-quota tariffs impose higher duties on agricultural imports exceeding set quotas, effectively limiting excess supply and protecting domestic producers without the strict quantity restrictions of quotas. This system balances market access with protectionism by allowing controlled import volumes while deterring surplus imports through penalizing tariffs.

Minimum access volume (MAV)

The quota system strictly limits agricultural imports to a fixed Minimum Access Volume (MAV), ensuring domestic producers' market share is protected by controlling the quantity allowed. In contrast, the tariff system allows unlimited imports but imposes a tax, which indirectly influences the MAV by affecting import volumes based on price sensitivity.

Gate price system

The gate price system under the quota framework sets a fixed import price, effectively controlling the volume and protecting domestic farmers by limiting competition from cheaper foreign goods. Unlike tariffs that fluctuate with market conditions, gate pricing ensures predictable import costs, stabilizing local agricultural markets and supporting farmer income sustainability.

Import licensing regime

The import licensing regime under a quota system restricts the quantity of agricultural products allowed, directly controlling supply and safeguarding domestic farmers from oversaturation. In contrast, a tariff system imposes fees on imports, influencing prices rather than quantities, allowing market forces greater flexibility while still providing protection to local agricultural industries.

Safeguard quota

Safeguard quotas limit the quantity of agricultural imports to protect domestic farmers from sudden market disruptions, offering a fixed volume restriction rather than varying price controls like tariffs. Unlike tariff systems which impose additional costs on imports, safeguard quotas provide direct import limits, ensuring more predictable protection levels for sensitive agricultural sectors.

Variable levy mechanism

The variable levy mechanism in agricultural import protection adjusts tariffs based on world market prices, ensuring domestic prices remain stable and producers are shielded from volatile global fluctuations. Unlike fixed quotas, the variable levy provides flexible protection by automatically changing import costs to maintain consistent support for local farmers.

WTO bound tariff

The quota system limits import quantities, directly controlling market supply, while the tariff system imposes duties that raise import costs, influencing prices rather than volumes. WTO bound tariffs establish maximum tariff rates that member countries cannot exceed, ensuring predictable trade barriers and allowing flexibility compared to rigid quota restrictions.

Price band system

The price band system combines elements of both quota and tariff systems by setting a range of prices that trigger additional duties to protect domestic agricultural markets from volatile import prices. This mechanism adjusts tariffs based on pre-established reference prices, stabilizing income for farmers while controlling import quantities without rigid quotas.

Quota system vs Tariff system for import protection Infographic

agridif.com

agridif.com