Subsidies provide direct financial support to farmers, encouraging crop protection by reducing the costs of pesticides and sustainable farming practices. Tariffs impose taxes on imported agricultural products, protecting domestic crops from foreign competition and promoting local agricultural stability. Balancing subsidies and tariffs is crucial for creating effective agricultural policies that safeguard crop yields while fostering market competitiveness.

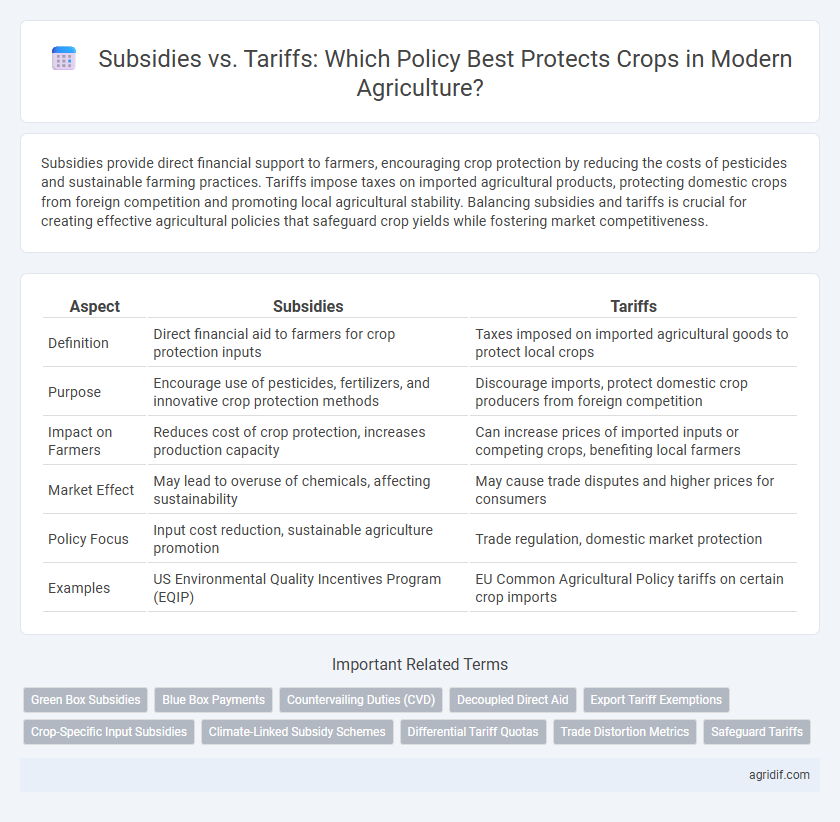

Table of Comparison

| Aspect | Subsidies | Tariffs |

|---|---|---|

| Definition | Direct financial aid to farmers for crop protection inputs | Taxes imposed on imported agricultural goods to protect local crops |

| Purpose | Encourage use of pesticides, fertilizers, and innovative crop protection methods | Discourage imports, protect domestic crop producers from foreign competition |

| Impact on Farmers | Reduces cost of crop protection, increases production capacity | Can increase prices of imported inputs or competing crops, benefiting local farmers |

| Market Effect | May lead to overuse of chemicals, affecting sustainability | May cause trade disputes and higher prices for consumers |

| Policy Focus | Input cost reduction, sustainable agriculture promotion | Trade regulation, domestic market protection |

| Examples | US Environmental Quality Incentives Program (EQIP) | EU Common Agricultural Policy tariffs on certain crop imports |

Introduction to Crop Protection in Agricultural Policy

Crop protection in agricultural policy involves measures to prevent crop losses due to pests, diseases, and environmental factors, essential for ensuring food security and farm income stability. Subsidies provide direct financial support to farmers for purchasing pesticides, resistant seeds, and adopting integrated pest management, encouraging sustainable practices and innovation. Tariffs on imported agricultural inputs or produce can regulate market competition, protect domestic farmers from unfair trade practices, and influence crop protection costs and availability.

Understanding Subsidies: Types and Objectives

Subsidies for crop protection typically include direct payments, input subsidies, and insurance support aimed at stabilizing farmer incomes and encouraging sustainable practices. These financial aids reduce the cost burden of pesticides, fertilizers, and advanced technologies, thereby enhancing crop yields and food security. Key objectives focus on promoting environmental sustainability, boosting agricultural productivity, and safeguarding farmers against market volatility.

The Role of Tariffs in Crop Protection

Tariffs play a critical role in crop protection by imposing taxes on imported agricultural products, thereby discouraging the influx of potentially harmful pests and diseases from foreign crops. These trade barriers help domestic farmers maintain competitive advantages and ensure local crop safety, supporting food security and sustainable agriculture. By regulating import volume, tariffs serve as a preventive measure against biosecurity risks, complementing other agricultural policies focused on crop health.

Economic Impacts of Subsidies on Farmers

Subsidies in agricultural policy provide direct financial support to farmers, enhancing their capacity to invest in crop protection technologies and reduce production risks. These payments stabilize farm incomes, encouraging sustainable practices and increasing overall agricultural productivity. Economic impacts include improved market competitiveness and reduced vulnerability to price fluctuations, fostering long-term sector resilience.

Tariffs and Their Effects on Agricultural Markets

Tariffs on imported agricultural products raise prices, shielding domestic farmers from foreign competition while potentially increasing costs for consumers and downstream industries. These trade barriers can reduce market efficiency by distorting supply and demand, leading to higher prices and decreased export opportunities for the imposing country. Tariff policies often trigger retaliatory measures from trading partners, escalating trade tensions and disrupting global agricultural supply chains.

Comparing Subsidies and Tariffs: Pros and Cons

Subsidies for crop protection reduce production costs and encourage farmers to adopt advanced technologies, boosting agricultural productivity and food security. Tariffs protect domestic agriculture by imposing taxes on imported crops, which can safeguard local farmers from foreign competition but may increase consumer prices and invite trade disputes. While subsidies promote innovation and market stability, tariffs provide immediate protection but risk market inefficiencies and retaliation from trade partners.

Global Trade Implications of Crop Protection Measures

Subsidies for crop protection can distort global agricultural markets by encouraging overproduction, leading to price drops that harm farmers in non-subsidizing countries. Tariffs on imported agricultural goods serve as protective barriers that can restrict market access and provoke trade disputes under World Trade Organization rules. Balancing subsidies and tariffs is critical to maintaining fair competition and ensuring sustainable crop protection practices within the global trade framework.

Environmental Consequences of Subsidies and Tariffs

Subsidies for crop protection often lead to overuse of chemical pesticides and fertilizers, resulting in soil degradation, water contamination, and loss of biodiversity. Tariffs may protect domestic markets but can encourage intensified farming practices abroad with less stringent environmental regulations, exacerbating global ecological damage. Both policies require careful design to balance agricultural productivity with sustainable environmental stewardship.

Policy Recommendations for Effective Crop Protection

Policy recommendations for effective crop protection emphasize targeted subsidies over tariffs to enhance farmer resilience and encourage sustainable agricultural practices. Subsidies aimed at promoting integrated pest management and the adoption of resistant crop varieties provide direct financial support while minimizing market distortions. Implementing smart subsidy programs can foster innovation, reduce dependency on chemical pesticides, and improve long-term crop productivity and environmental outcomes.

Future Trends in Agricultural Subsidies and Tariffs

Future trends in agricultural subsidies indicate a shift towards more targeted financial support aimed at promoting sustainable farming practices and advancing climate-resilient crop protection technologies. Tariffs are expected to become more strategically applied, balancing international trade dynamics with domestic agricultural stability, while encouraging innovation in pest management and environmentally-friendly crop protection solutions. Data from global trade organizations suggest an increasing emphasis on integrating subsidies and tariffs to enhance food security and reduce environmental impact in the agricultural sector.

Related Important Terms

Green Box Subsidies

Green Box subsidies in agricultural policy are designed to support crop protection without distorting trade, as they include government-funded programs for research, environmental protection, and pest management that do not directly influence production levels or market prices. Unlike tariffs, which impose taxes on imports to protect domestic crops, Green Box subsidies promote sustainable farming practices and innovation while complying with World Trade Organization rules.

Blue Box Payments

Blue Box payments under the Agricultural Policy framework provide targeted subsidies that support farmers in adopting environmentally sustainable crop protection methods while maintaining production levels. These payments are designed to be compatible with World Trade Organization (WTO) rules, offering a strategic alternative to tariffs by minimizing trade distortions and encouraging eco-friendly agricultural practices.

Countervailing Duties (CVD)

Countervailing Duties (CVD) serve as a critical trade remedy in agricultural policy to offset subsidies granted by foreign governments that unfairly lower crop prices, protecting domestic farmers from market distortions. Unlike tariffs, CVD specifically target subsidized imports, ensuring a level playing field by neutralizing the price advantage caused by government support in competing countries.

Decoupled Direct Aid

Decoupled direct aid provides farmers with income support independent of production levels, reducing market distortions often caused by tariffs aimed at crop protection. This approach encourages sustainable agricultural practices by minimizing incentives to overproduce, aligning with modern policies that prioritize environmental stewardship over trade barriers.

Export Tariff Exemptions

Export tariff exemptions encourage international competitiveness of agricultural products by reducing costs and promoting market access. These exemptions support crop protection efforts by enabling farmers to invest more in sustainable practices without the financial burden of additional tariffs.

Crop-Specific Input Subsidies

Crop-specific input subsidies enhance farmers' ability to invest in targeted fertilizers and pesticides, directly improving crop yields and resilience against pests and diseases. These subsidies often result in more efficient resource allocation compared to tariffs, which can distort market prices and limit the competitiveness of agricultural exports.

Climate-Linked Subsidy Schemes

Climate-linked subsidy schemes in agricultural policy prioritize financial incentives for farmers adopting sustainable practices that enhance crop resilience to climate change, outperforming tariffs which primarily serve as trade barriers rather than direct climate mitigation tools. These subsidies target drought-resistant crop varieties, advanced irrigation technologies, and soil conservation methods, promoting long-term productivity and environmental sustainability.

Differential Tariff Quotas

Differential tariff quotas strategically balance crop protection by imposing variable tariff rates within set import limits, incentivizing domestic production while allowing controlled access to foreign crops. These quotas optimize market stability and food security by protecting local farmers from global price volatility without completely restricting international trade.

Trade Distortion Metrics

Subsidies for crop protection often lead to higher trade distortion metrics by artificially lowering domestic production costs, while tariffs impose direct price barriers affecting import competitiveness. Measuring these trade distortions involves analyzing changes in market prices, production volumes, and export-import imbalances to assess policy impacts on global agricultural trade dynamics.

Safeguard Tariffs

Safeguard tariffs serve as a protective measure by temporarily increasing import duties on specific crops to shield domestic farmers from sudden surges in foreign competition, thereby maintaining market stability. Unlike subsidies, which directly provide financial support to producers, safeguard tariffs aim to regulate trade flows and prevent market distortions without significant fiscal expenditure.

Subsidies vs Tariffs for Crop Protection Infographic

agridif.com

agridif.com