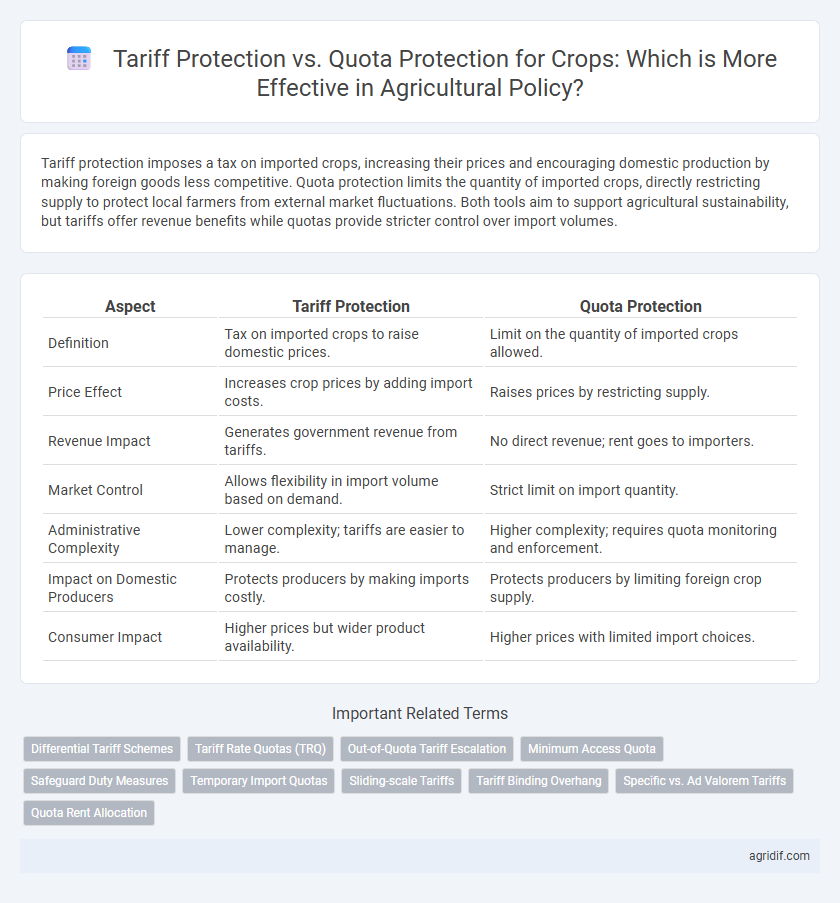

Tariff protection imposes a tax on imported crops, increasing their prices and encouraging domestic production by making foreign goods less competitive. Quota protection limits the quantity of imported crops, directly restricting supply to protect local farmers from external market fluctuations. Both tools aim to support agricultural sustainability, but tariffs offer revenue benefits while quotas provide stricter control over import volumes.

Table of Comparison

| Aspect | Tariff Protection | Quota Protection |

|---|---|---|

| Definition | Tax on imported crops to raise domestic prices. | Limit on the quantity of imported crops allowed. |

| Price Effect | Increases crop prices by adding import costs. | Raises prices by restricting supply. |

| Revenue Impact | Generates government revenue from tariffs. | No direct revenue; rent goes to importers. |

| Market Control | Allows flexibility in import volume based on demand. | Strict limit on import quantity. |

| Administrative Complexity | Lower complexity; tariffs are easier to manage. | Higher complexity; requires quota monitoring and enforcement. |

| Impact on Domestic Producers | Protects producers by making imports costly. | Protects producers by limiting foreign crop supply. |

| Consumer Impact | Higher prices but wider product availability. | Higher prices with limited import choices. |

Understanding Tariff and Quota Protection in Agriculture

Tariff protection in agriculture imposes taxes on imported crops, raising their market prices to shield domestic producers and encourage local farming. Quota protection limits the quantity of imported crops, directly restricting foreign supply to maintain higher domestic prices and secure local market share. Both tools influence market access, crop diversity, and food security, but tariffs generate government revenue while quotas often create supply shortages and market distortions.

Historical Evolution of Crop Protection Policies

Tariff protection for crops historically allowed gradual adjustment of domestic markets by imposing taxes on imported agricultural goods, encouraging local production while maintaining trade flexibility. Quota protection emerged as a more rigid measure, directly limiting the volume of crop imports to stabilize domestic prices and protect farmers from foreign competition. Over time, many countries shifted from quotas to tariffs due to WTO trade agreements promoting transparency and reducing trade barriers in agricultural policy frameworks.

Tariff Protection: Mechanisms and Impacts

Tariff protection in agricultural policy involves imposing taxes on imported crops to increase their prices, making domestic produce more competitive in local markets. This mechanism generates government revenue while allowing producers to maintain market share without quantity restrictions. However, tariffs can lead to higher food prices and potential trade disputes, affecting both consumers and international relations.

Quota Protection: Mechanisms and Impacts

Quota protection in agricultural policy restricts the quantity of specific crops that can be imported, effectively limiting foreign competition and stabilizing domestic prices. By imposing fixed limits on import volumes, quota protection controls supply, supports farmers' incomes, and encourages local production. However, this mechanism can reduce market efficiency, increase consumer prices, and provoke trade disputes among international partners.

Comparative Analysis: Tariffs vs Quotas for Farmers

Tariff protection allows farmers to benefit from price stability by imposing taxes on imported crops, promoting domestic production without restricting quantities. Quota protection sets physical limits on the amount of imported crops, providing farmers with guaranteed market shares but potentially leading to higher prices for consumers. Tariffs offer more flexible market adjustment, while quotas create rigid supply constraints, impacting farmers' competitiveness and long-term agricultural sustainability.

Trade Implications of Tariff and Quota Systems

Tariff protection on crops imposes a tax on imported agricultural goods, allowing domestic producers to compete by raising foreign product prices, which can generate government revenue but may lead to higher consumer costs and trade retaliation. Quota protection limits the physical quantity of imports, directly restricting supply and often creating scarcity-driven price increases without generating tariff revenue, potentially causing market distortions and supply chain inefficiencies. Trade implications of these systems include altered import volumes, shifts in global market dynamics, and the possibility of trade disputes under international agreements like the WTO.

Effects on Domestic Crop Prices and Supply

Tariff protection raises domestic crop prices by imposing taxes on imported goods, making them more expensive and encouraging local production, which can stabilize or increase the domestic supply. Quota protection limits the quantity of imports directly, often causing sharper price increases and supply restrictions as domestic producers face less competition but consumers encounter scarcity. While tariffs generate government revenue and allow market adjustments, quotas tend to create more rigid price controls and potential shortages in the domestic agricultural market.

Consumer Welfare: Price and Quality Considerations

Tariff protection on crops generally leads to higher prices for consumers by imposing a tax on imported goods, which can reduce consumer welfare through increased costs and limited access to diverse products. Quota protection restricts the quantity of imports, often causing price volatility and reduced quality variety, as limited supply reduces competitive pressure on domestic producers. Consumer welfare is more negatively impacted under quota systems due to constrained choice and potential quality degradation compared to the more transparent price signals under tariffs.

Policy Challenges in Balancing Protection and Trade

Tariff protection imposes a fixed tax on imported crops, allowing predictable revenue but potentially causing market distortions and higher consumer prices. Quota protection restricts the quantity of imports, offering stronger supply control but risking trade disputes and market inefficiencies. Policymakers face challenges in balancing these tools to safeguard domestic farmers while maintaining international trade commitments under agreements like the WTO.

Future Directions for Crop Protection in Agricultural Policy

Tariff protection allows for flexible adjustment of import taxes to stabilize domestic crop prices, promoting farmer income security and market competitiveness. Quota protection restricts the quantity of crop imports, ensuring limited market disruption but potentially causing supply shortages and price volatility. Future agricultural policies should balance tariff and quota mechanisms, integrating digital monitoring and climate-adaptive frameworks to enhance crop protection while supporting sustainable trade practices.

Related Important Terms

Differential Tariff Schemes

Differential tariff schemes offer targeted tariff rates based on crop type and market conditions, allowing for nuanced protection compared to rigid quota systems that limit import quantities. This approach enhances agricultural policy by balancing domestic crop competitiveness with import flexibility, reducing market distortions and encouraging efficient resource allocation.

Tariff Rate Quotas (TRQ)

Tariff Rate Quotas (TRQ) combine tariff protection and quota limits by allowing a specified quantity of crops to be imported at a lower tariff rate while applying higher tariffs to quantities exceeding the quota, effectively balancing trade liberalization and domestic market protection. TRQs are widely used in agricultural policy to regulate import volumes, stabilize domestic prices, and support local farmers by controlling external competition within defined thresholds.

Out-of-Quota Tariff Escalation

Out-of-quota tariff escalation imposes higher tariffs on agricultural imports exceeding predetermined quota limits, effectively restricting supply and protecting domestic crop markets from foreign competition. This mechanism often leads to increased price volatility and trade distortions compared to quota protection, which fixedly limits import volumes but typically maintains stable tariff rates within quotas.

Minimum Access Quota

Minimum Access Quotas (MAQs) provide a defined quantity of crop imports allowed under tariff protection schemes, ensuring market stability while protecting domestic producers from excessive foreign competition. Compared to quota protection, MAQs balance trade liberalization with supply assurance by maintaining controlled import volumes subject to tariffs rather than outright limits.

Safeguard Duty Measures

Tariff protection involves imposing taxes on imported crops to stabilize domestic prices and shield local farmers, while quota protection restricts the volume of imports through fixed limits to control market supply. Safeguard duty measures are temporary tariffs applied to agricultural imports when sudden surges threaten domestic producers, providing a flexible tool within tariff protection to prevent market disruptions and ensure crop sector resilience.

Temporary Import Quotas

Temporary import quotas in agricultural policy provide targeted protection by limiting crop quantities entering a market to support domestic producers without imposing high tariff barriers. This approach allows flexibility in adjusting supply while mitigating price volatility and encouraging domestic crop production sustainability.

Sliding-scale Tariffs

Sliding-scale tariffs in agricultural policy adjust tariff rates based on the volume or price of crop imports, providing flexible protection that balances market stability and competitiveness. This mechanism offers more precision compared to quota protection by allowing controlled import quantities without the rigid limits set by fixed quotas, thereby supporting domestic farmers while minimizing market distortions.

Tariff Binding Overhang

Tariff binding overhang occurs when a country's applied tariff rates on crops are lower than the bound rates set in trade agreements, creating a gap that limits the use of tariff protection compared to quota protection. This overhang reduces the flexibility of tariff adjustments, often making quota protection a more immediate tool for controlling crop imports and stabilizing domestic markets.

Specific vs. Ad Valorem Tariffs

Specific tariffs impose a fixed fee per unit of crop imported, providing predictable protection levels regardless of price fluctuations, while ad valorem tariffs charge a percentage of the crop's value, adjusting protection dynamically with market prices. Quota protection limits the quantity of crop imports, which can create scarcity and higher prices, but lacks the price sensitivity inherent in ad valorem tariffs and the simplicity of specific tariffs in agricultural policy enforcement.

Quota Rent Allocation

Quota protection in agricultural policy restricts crop imports by setting quantity limits, generating quota rents that create economic value for those holding import licenses, unlike tariff protection which imposes taxes on imports. Efficient quota rent allocation can influence market outcomes by benefiting domestic producers or license holders, potentially leading to rent-seeking behavior and distorted trade incentives.

Tariff protection vs quota protection for crops Infographic

agridif.com

agridif.com