Agricultural insurance provides farmers with financial protection against losses caused by natural disasters, pests, and market fluctuations, ensuring income stability. Crop diversification reduces risk by spreading investments across different crops, minimizing the impact of failure in any single crop. Combining both strategies enhances resilience by balancing predictable financial support with adaptive farming practices.

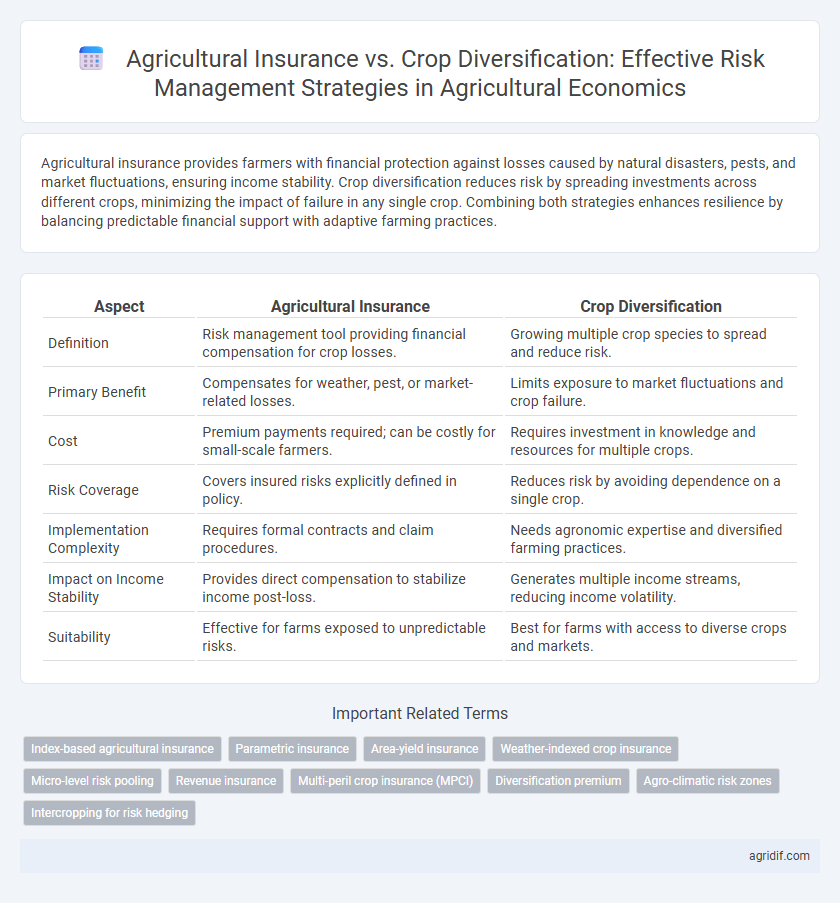

Table of Comparison

| Aspect | Agricultural Insurance | Crop Diversification |

|---|---|---|

| Definition | Risk management tool providing financial compensation for crop losses. | Growing multiple crop species to spread and reduce risk. |

| Primary Benefit | Compensates for weather, pest, or market-related losses. | Limits exposure to market fluctuations and crop failure. |

| Cost | Premium payments required; can be costly for small-scale farmers. | Requires investment in knowledge and resources for multiple crops. |

| Risk Coverage | Covers insured risks explicitly defined in policy. | Reduces risk by avoiding dependence on a single crop. |

| Implementation Complexity | Requires formal contracts and claim procedures. | Needs agronomic expertise and diversified farming practices. |

| Impact on Income Stability | Provides direct compensation to stabilize income post-loss. | Generates multiple income streams, reducing income volatility. |

| Suitability | Effective for farms exposed to unpredictable risks. | Best for farms with access to diverse crops and markets. |

Understanding Agricultural Risks: An Overview

Agricultural insurance provides a financial safety net against unpredictable events like weather extremes, pests, and market price fluctuations, securing farmers' income. Crop diversification reduces risk exposure by cultivating multiple crop species, thus mitigating the impact of a single crop failure. Both strategies are essential in managing agricultural risks, balancing immediate financial protection with long-term resilience in farm production systems.

The Role of Agricultural Insurance in Risk Mitigation

Agricultural insurance plays a critical role in risk mitigation by providing financial protection against crop failures caused by adverse weather conditions, pests, and diseases, ensuring farmers' income stability. Unlike crop diversification, which reduces risk through spreading production across multiple crops, agricultural insurance offers direct compensation, enabling farmers to manage unforeseen losses more effectively. This risk transfer mechanism supports credit access and investment in modern farming technologies, fostering resilience in agricultural economies.

Crop Diversification: A Traditional Risk Management Strategy

Crop diversification remains a fundamental risk management strategy in agricultural economics, reducing exposure to market price fluctuations and adverse weather conditions by cultivating a variety of crops. This approach enhances farm income stability through spatial and temporal diversification, mitigating the risk of total crop failure. Empirical studies demonstrate that diversified portfolios often outperform reliance on agricultural insurance alone, especially in regions with limited insurance coverage or high premium costs.

Comparative Effectiveness: Insurance vs Crop Diversification

Agricultural insurance provides financial compensation against crop failures, directly mitigating economic losses from adverse weather or pest outbreaks, while crop diversification reduces overall risk by spreading income sources across multiple crops. Studies indicate insurance offers more immediate liquidity and targeted protection, whereas diversification enhances long-term resilience by stabilizing farm income and improving soil health. Effective risk management often combines both strategies, balancing the predictability of insurance payouts with the ecological and economic benefits of diversified cropping systems.

Economic Impacts of Agricultural Insurance

Agricultural insurance provides farmers with financial protection against crop losses due to adverse weather events, pests, or diseases, stabilizing farm income and encouraging investment in higher-yield technologies. Unlike crop diversification, which spreads risk across multiple crops but may reduce specialization benefits, insurance directly mitigates revenue variability, supporting credit access and long-term economic sustainability. Empirical studies demonstrate that regions with higher insurance coverage exhibit increased agricultural productivity and reduced income volatility, enhancing rural economic resilience.

Financial Benefits of Crop Diversification

Crop diversification enhances financial resilience by spreading income sources across multiple crops, reducing dependency on a single market or yield. This strategy lowers the economic impact of adverse weather or pest outbreaks, stabilizing farm revenue year-round. Compared to agricultural insurance, diversification often involves lower costs and provides ongoing risk mitigation without reliance on claims or premium payments.

Policy Implications for Risk Management in Agriculture

Agricultural insurance provides a safety net by mitigating financial losses from adverse weather events, pest infestations, and price volatility, making it a critical tool for risk management in farming. Crop diversification reduces dependency on a single crop, enhancing resilience against market fluctuations and environmental stressors. Policymakers should integrate insurance schemes with incentives for diversification to optimize risk reduction and promote sustainable agricultural development.

Challenges of Implementing Agricultural Insurance

Implementing agricultural insurance faces challenges such as high administrative costs, adverse selection, and moral hazard that hinder widespread adoption among smallholder farmers. Limited data availability and unreliable weather predictions complicate accurate premium setting and claim verification, reducing insurer confidence. In contrast, crop diversification directly mitigates risk by spreading potential losses but lacks the financial protection and scalability offered by insurance schemes.

Barriers to Crop Diversification Adoption

High initial costs and lack of access to information significantly impede farmers' ability to adopt crop diversification as an effective risk management strategy. Limited availability of diverse seed varieties and inadequate infrastructure for market access further restrict diversification efforts. These barriers often make agricultural insurance a more immediately feasible option despite its own limitations.

Toward Integrated Risk Management: Combining Insurance and Diversification

Combining agricultural insurance with crop diversification enhances risk management by mitigating both market and climate-related uncertainties. Insurance provides financial protection against catastrophic losses while diversification spreads risk across multiple crops, reducing dependency on a single source of income. Integrated strategies improve farmer resilience and stabilize income streams, promoting sustainable agricultural economics.

Related Important Terms

Index-based agricultural insurance

Index-based agricultural insurance provides targeted financial protection against specific weather events or yield losses, minimizing basis risk and reducing administrative costs compared to traditional insurance. Crop diversification spreads risk across different crops, but index-based insurance offers more precise indemnity triggers, enhancing farmer resilience to climate variability and market fluctuations in agricultural risk management.

Parametric insurance

Parametric insurance in agricultural economics offers precise risk management by providing payouts based on predefined weather indexes, reducing the lag and dispute typical in traditional indemnity-based insurance. Crop diversification spreads risk across various crops, but parametric insurance uniquely addresses correlated risks like drought or excessive rainfall by triggering automatic compensation linked to measurable parameters, enhancing financial stability for farmers.

Area-yield insurance

Area-yield insurance provides targeted financial protection by compensating farmers based on average regional crop yields, minimizing individual farm losses due to localized adverse weather events. Compared to crop diversification, this insurance option effectively mitigates systemic risks linked to climatic variability without requiring changes in farming practices or crop selection.

Weather-indexed crop insurance

Weather-indexed crop insurance offers precise, data-driven protection against weather-related risks by linking payouts to measurable parameters like rainfall or temperature, minimizing moral hazard and basis risk. Crop diversification spreads risk across multiple crops and ecosystems, but weather-indexed insurance provides targeted financial stability, enhancing resilience to climate variability in agricultural economics.

Micro-level risk pooling

Agricultural insurance provides farmers with financial compensation against yield losses, enabling effective micro-level risk pooling by distributing individual risks across a broader base. Crop diversification mitigates risk by reducing dependency on a single crop, but lacks the structured risk-sharing mechanisms inherent in insurance schemes at the micro-level.

Revenue insurance

Revenue insurance offers targeted financial protection against losses in agricultural income caused by price fluctuations and yield reductions, ensuring stable revenue streams for farmers. Crop diversification spreads risk across multiple crops but may dilute potential earnings and requires more complex management compared to the focused coverage and indemnity structure provided by revenue insurance.

Multi-peril crop insurance (MPCI)

Multi-peril crop insurance (MPCI) provides comprehensive coverage against a variety of risks such as drought, flood, pests, and disease, offering farmers direct financial protection that crop diversification alone cannot guarantee. While crop diversification reduces exposure to specific threats by spreading risk across different crops, MPCI more effectively mitigates income volatility associated with multi-hazard events, enhancing overall farm resilience.

Diversification premium

Crop diversification offers a significant diversification premium by spreading production risks across multiple crops, reducing vulnerability to price volatility and climate shocks compared to agricultural insurance, which primarily compensates for specific losses. Economic studies highlight that integrating diverse crop portfolios can enhance overall farm income stability and lower dependency on costly insurance premiums.

Agro-climatic risk zones

Agricultural insurance provides financial protection against losses caused by adverse agro-climatic conditions such as droughts and floods, offering a safety net in high-risk zones. Crop diversification mitigates risk by spreading production across multiple crops, reducing dependency on any single crop vulnerable to specific climatic stresses within agro-climatic risk zones.

Intercropping for risk hedging

Agricultural insurance provides financial compensation against crop failures, but intercropping as a crop diversification strategy enhances risk hedging by reducing dependency on a single crop and improving overall farm resilience. Research in agricultural economics shows intercropping systems increase yield stability and mitigate economic losses by spreading risk across multiple crop species under varying environmental conditions.

Agricultural insurance vs crop diversification for risk management Infographic

agridif.com

agridif.com